Use your NFTs to get a loan

Use your NFT as collateral to borrow crypto from lenders. Repay your loan, and you get your NFT back.

Total loan volume

Total number of loans

Average loan size

How it works

What is NFTfi?

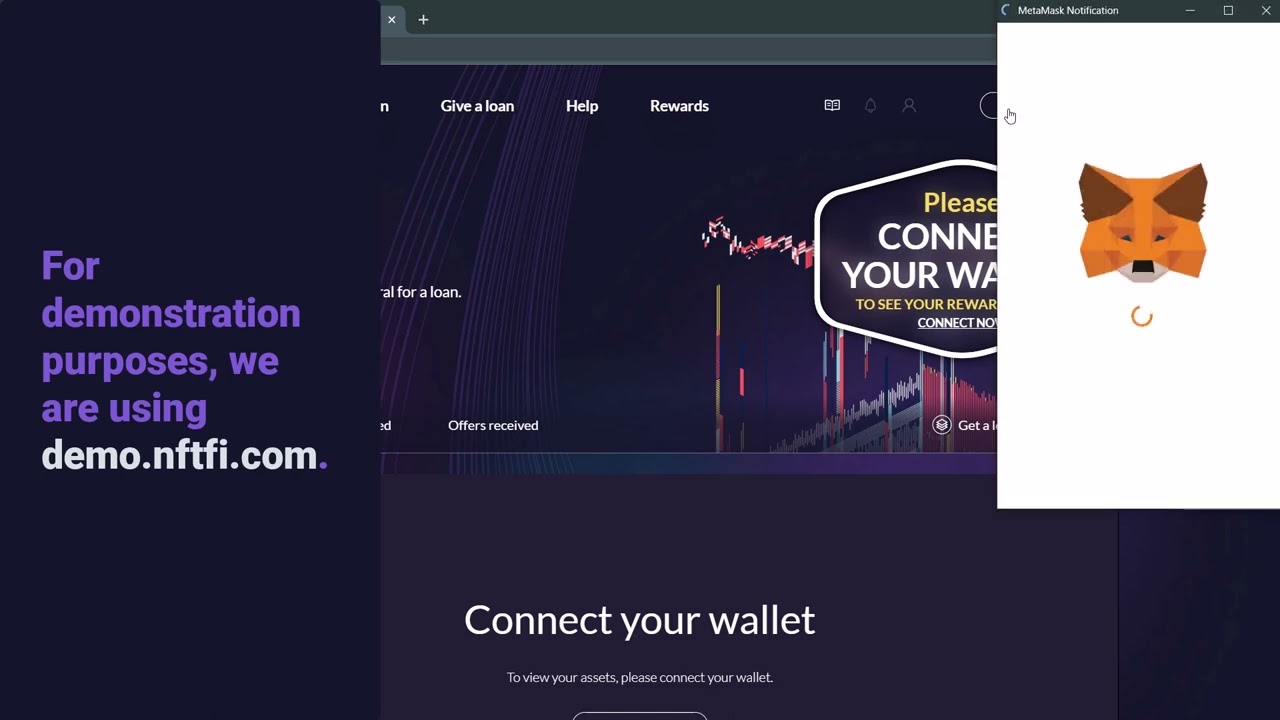

Connecting your wallet

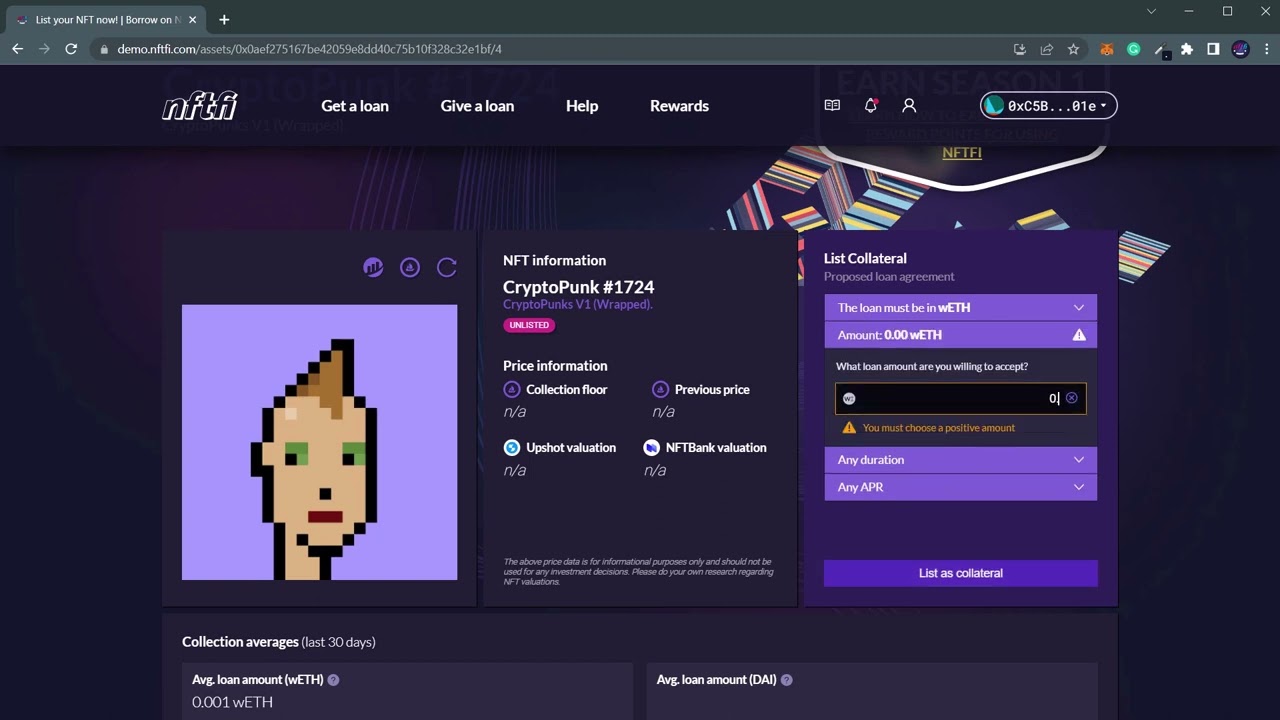

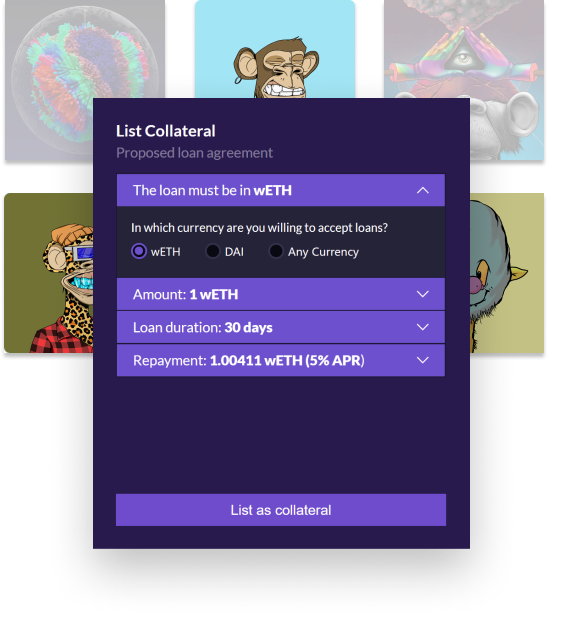

Listing your NFT

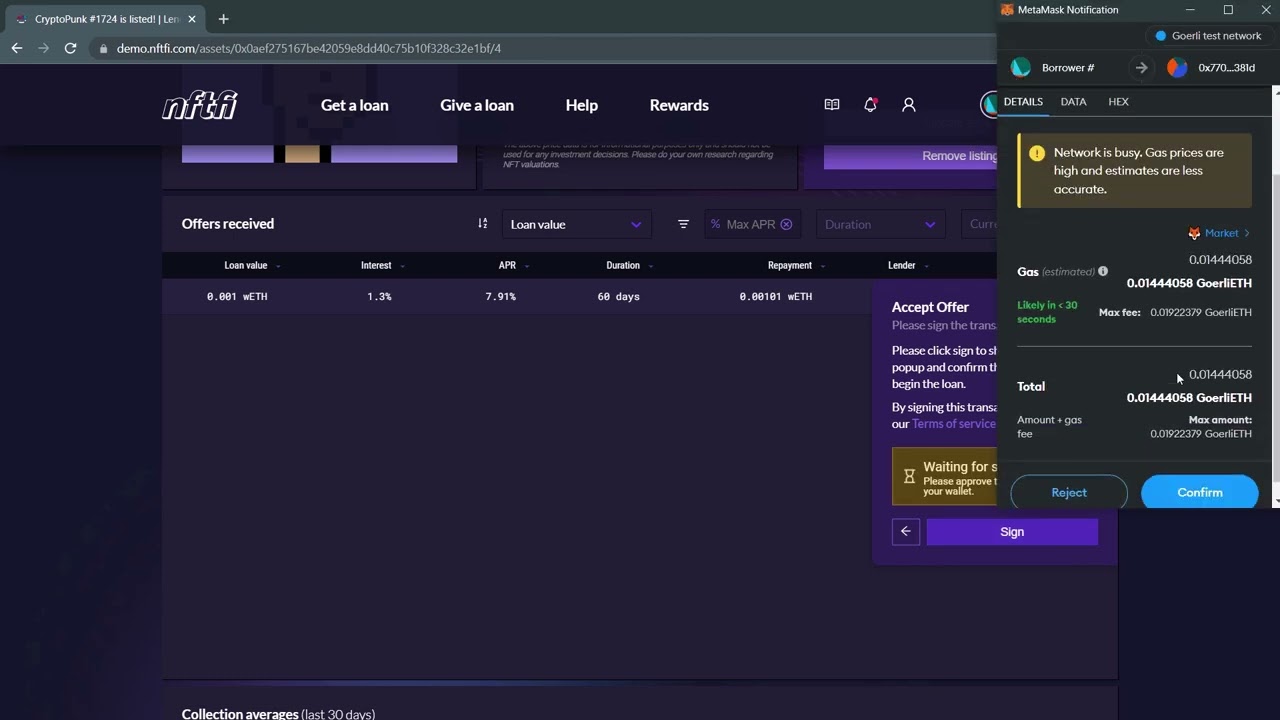

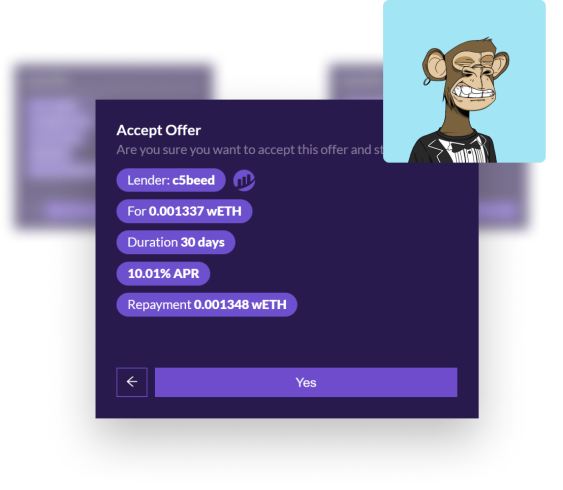

Accepting a loan offer

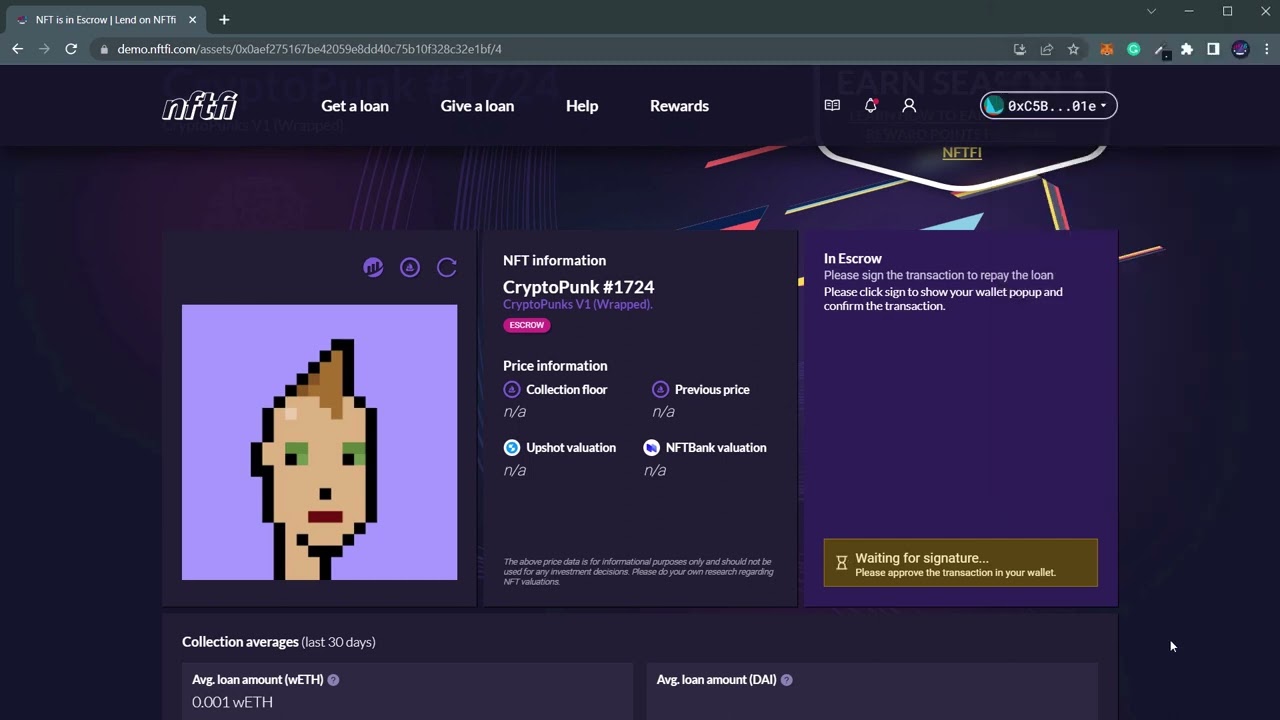

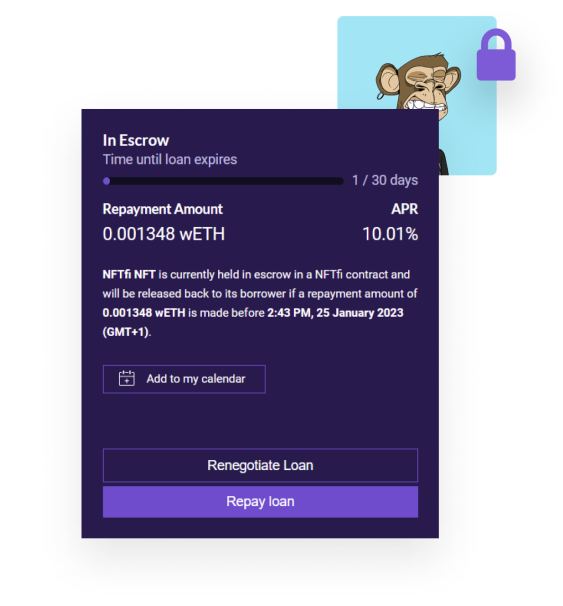

Repaying the loan

NFTfi is the leading liquidity protocol for NFTs. NFTfi allows NFT holders to borrow cryptocurrency from lenders by using their NFTs as collateral.

- Borrowers

- Lenders

- Institutions

List your NFT & start getting loan offers

First, you need to list your NFT and set the desired terms of the loan. After you list your NFT, other users will give you loan offers.

Receive loan offers & accept the best one

When you accept a loan offer, your NFT goes into a secure escrow smart contract, and you receive the wETH, DAI, or USDC from the lender directly to your wallet!

Repay the loan & get your NFT back

If you repay your loan in time, you will automatically receive your NFT back in your wallet!

Why NFTfi?

Our mission is to give NFT owners the financial flexibility they deserve. NFTfi was designed to provide the most secure, fair, and transparent way to unlock opportunities from your valuable NFTs.

Transparent & open

The NFTfi dApp runs on Ethereum and is non-custodial, decentralized, and permissionless. All you need is a digital wallet to interact.

Secure & double-audited

All core and periphery smart contracts have been double-audited by ChainSecurity & Halborn.

No auto-liquidations

Every loan is facilitated in a peer-to-peer manner under fixed terms. This means no risk of liquidation should floor prices go down.

0% borrower fees

NFTfi is a peer-to-peer protocol, and all loan terms are fixed between a lender and a borrower. Borrowers pay a 0% fee.

Latest blog posts

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >Top collections

Ways to join our community

Join our Discord, follow us on Twitter, and subscribe to our newsletter. That's all the alpha you need!

Got questions?

Peer-to-peer NFT lending is a pretty simple concept, and you can quickly learn the basics by scrolling through our FAQ section.

The ability to access liquidity against their NFTs without selling the asset gives unprecedented financial flexibility to NFT holders, especially if they have a large percentage of their portfolio locked up in these illiquid assets.

A few examples of what the liquidity obtained via NFTfi can be used for include:

- Serving immediate liquidity needs (e.g. covering margin positions)

- Taking advantage of short-term investment opportunities (e.g. high-yield liquidity mining or NFT flips)

- Taking advantage of long-term investment opportunities (e.g. buying real estate; long-term loans is now supported in NFTfi V2)

- Delaying a planned sale of an NFT for more opportune market conditions

- Delaying a planned sale of an NFT to defer potential capital gains tax

- Financing ‘real life’ needs without having to sell valuable assets

There are no fees for borrowers and lenders on NFTfi.

NFTfi is a peer-to-peer platform connecting NFT holders and liquidity providers directly via permissionless smart contract infrastructure. The NFTfi team at no point has access to any asset or is involved in any way in the negotiation of terms between Lenders and Borrowers. Since NFTfi’s first loan in May 2020, we have done over $400m in loan volume spread over more than 40,000 loans, and no borrower has ever had an asset stolen.

The NFTfi V2 smart contract system has been double-audited by two industry-leading firms (Chainsecurity, Halborn).

Here are all Halborn security audit reports:

Yes, loan renegotiation can be initiated both by the borrower and lender on any active loan that is not yet foreclosed by the lender. To read more about loan renegotiations and how they work, please read this blog post.