Introducing Loan Renegotiations

August 30, 2022 ・ 3 min read

We’re thrilled to announce the launch of one of the most requested features by our community. Starting today, NFTfi borrowers and lenders can renegotiate their loan terms anytime before the loan has been foreclosed.

NFTfi’s loan renegotiation feature enables and improves true peer-to-peer interactions among borrowers and lenders. It also provides flexibility, as a lot can change during a loan period (market conditions, life circumstances, lending/borrowing strategies, etc.). We would like our users to have more options and choices when that happens.

Currently, NFTfi users are mainly engaging with each other on our Discord server. A trustless option within the dapp is more secure, faster, more convenient, and ensures a better user experience.

How does loan renegotiation work?

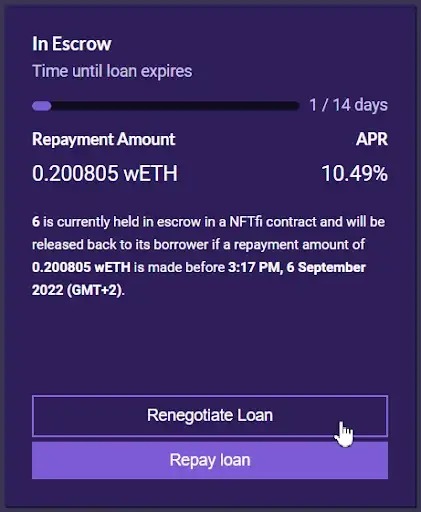

The renegotiation process can be initiated either by the borrower or the lender from the asset page by clicking the “Renegotiate Loan” button (see image below). It can be triggered any time during an active loan (while the NFT is in escrow) or after the loan has expired — but it must be initiated before the lender forecloses the loan.

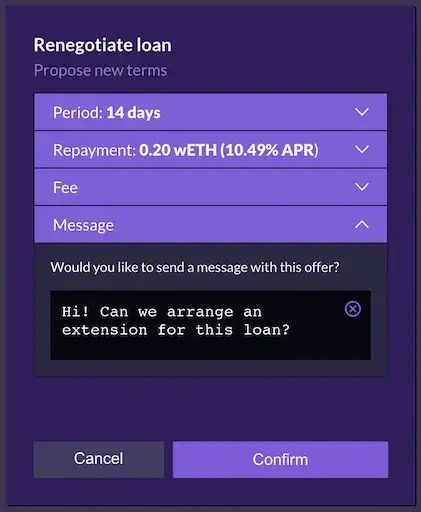

Whoever starts the renegotiation can change the loan period and repayment amount. You could also offer the other party an incentive (a payable fee) to accept the new terms. Alongside the new loan terms, you have the option to send a customized message to provide more context.

You can review, modify or cancel your renegotiation offer anytime before the other party responds (signs the message in MetaMask).

The other party always has a choice. They can refuse to renegotiate and leave the loan terms as they are, accept the new loan terms or make a counter-offer. Their counter-offers can also be reviewed, modified, or canceled anytime before receiving a response.

NFTfi users can keep making counter-offers until everyone is happy. The borrower always accepts the final offer (even if the lender already agreed to initial renegotiation terms). The renegotiation fee is always paid from borrower to lender (when the borrower accepts the renegotiation). Fees (both loan and renegotiation) are in the same currency as the loan principal.

Once accepted by the borrower, the loan terms will be updated accordingly.

If you have any questions or feedback about our new loan renegotiations feature, please join our Discord, where our community, NFTfi Ambassadors, and team members will be happy to help you out!

About NFTfi

NFTfi is the leading liquidity protocol for NFTs. It allows NFT holders to receive secured ETH and DAI loans from liquidity providers peer-to-peer. NFTfi’s vision is to build a decentralized, permissionless, user-owned public utility, supporting the seamless financialization of NFT-based economies through innovative mechanisms and highly user-friendly applications.

Discord | Twitter | Join the Ambassador program

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >