A complete guide to allowances on NFTfi

August 03, 2023 ・ 4 min read

NFTfi is the most trusted NFT lending protocol, where you can use your NFTs to take out wETH, DAI, and USDC loans. In this article, we explain everything borrowers and lenders need to know about allowances on NFTfi.

What are allowances, and why do I need them?

Allowances are a tool for borrowers and lenders to manage permissions on NFTfi. Why is this tool necessary? In order to fund or repay loans on NFTfi, our smart contracts need permission to move the ERC-20 tokens you are using.

As a borrower, when the time comes to repay your loan, the contract must have permission to spend the required amount (per currency). As a lender, allowances enable you to cap the amount you loan. This is particularly useful for lenders that use collection offers (see our blog post for more information on these).

How do I manage allowances on NFTfi?

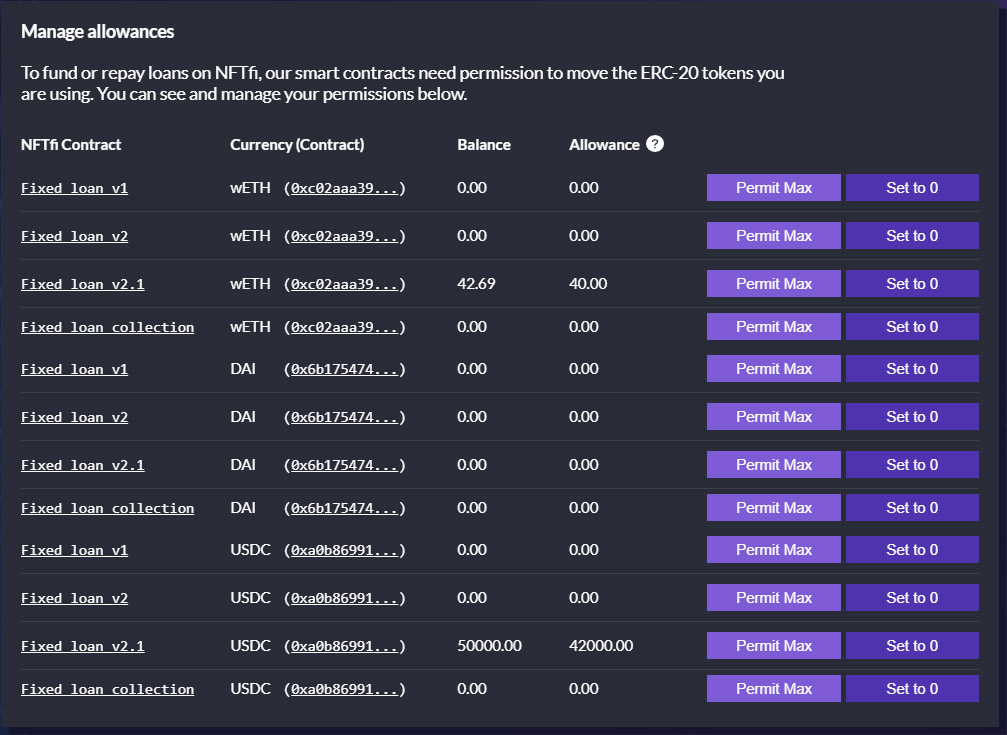

In order to manage allowances, visit the NFTfi dApp, connect your wallet (make sure it is the correct one for the loans or offers in question!), and visit the “Account” section. Here, you will see the “Manage Allowances” table pictured below.

- The “NFTfi Contract” column specifies which NFTfi Contract you are setting allowances for. The v1 and v2 contracts are no longer in use except for a number of long-term loans that remain active (loans from before October 2022). The majority of existing loans and all new loans are on the v2.1 contract. The “Fixed loan collection” sets permissions for the contract that enables standing collection offers. If in doubt, you can use Etherscan to confirm which loan contract you are using, or ask in our official Discord server.

- The “Currency (Contract)” column specifies which currency you are setting allowances for: wETH, DAI, or USDC.

- The “Balance” column displays the amount of that currency that you have in the connected wallet.

- The “Allowance” column displays the amount of that currency that the NFTfi smart contract has permission to move.

- If you select “Permit Max”, you are giving the NFTfi smart contract permission to move the maximum amount of that currency. Metamask window will open, and you will have to specify the custom spending cap (see image below).

Due to recent updates in MetaMask, it's no longer possible to set an infinite allowance for spending ERC20 tokens. The spending cap set is the total amount allowed for a specific smart contract and not per transaction, so the allowance decreases with each transaction. Amounts spent in transactions will be deducted from the previously set cap. Setting the allowance at a high enough number, while understanding the risks, can be a solution. Please note that the "Max" button in MetaMask sets the allowance to your wallet's current token balance.

- If you select “Set to 0”, the allowance is set to 0, and no currency can be moved.

If you are a borrower and you need to repay your loan, make sure your spending cap is higher than the loan repayment amount.

Finally, please note that a gas fee is required for setting and changing allowances on NFTfi.

Benefit from NFTfi Rewards, the loyalty program for NFT lovers!

Our brand new loyalty program rewards lenders and borrowers with exclusive Earn Points. Click here to learn more!

If you are new to NFTfi, you can check out this video for a quick overview, read our beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >