Art Blocks on NFTfi: A community-first approach to liquidity

April 28, 2023 ・ 5 min read

The generative art field has seen explosive growth and recognition since the establishment of Art Blocks, the premier generative art platform, in 2020. Since then, Art Blocks has hosted and nurtured the most celebrated generative art projects, from Tyler Hobbs’ Fidenza to Dmitri Cherniak’s Ringers and Snowfro (aka Erick Calderon)’s iconic Chromie Squiggle.

An incredible Art Blocks community of creators, collectors and enthusiasts has developed and continues to strengthen as OG projects receive increasing critical acclaim, while new projects push the boundaries and possibilities of the medium. In a remarkably positive deviation from the traditional art world, Art Blocks has enabled a culture in which artists and collectors are building together, with innovative organizations such as SquiggleDAO working to establish generative art’s rightful place in the canon.

This passionate ethos among Art Blocks collectors lends itself to long-term holds, especially as for generative art, future utility is not even part of the conversation (as opposed to PFP collections). These artworks have inherent value derived from their aesthetics, innovation, provenance, and a wide range of other creative factors. It is therefore unsurprising to see Art Blocks firmly in the top 3 all-time collections on NFTfi! Please note that this is the cumulative volume of different Art Blocks projects, as they are hosted on the same contract.

Art Blocks surpass $36M in total loan volume on NFTfi

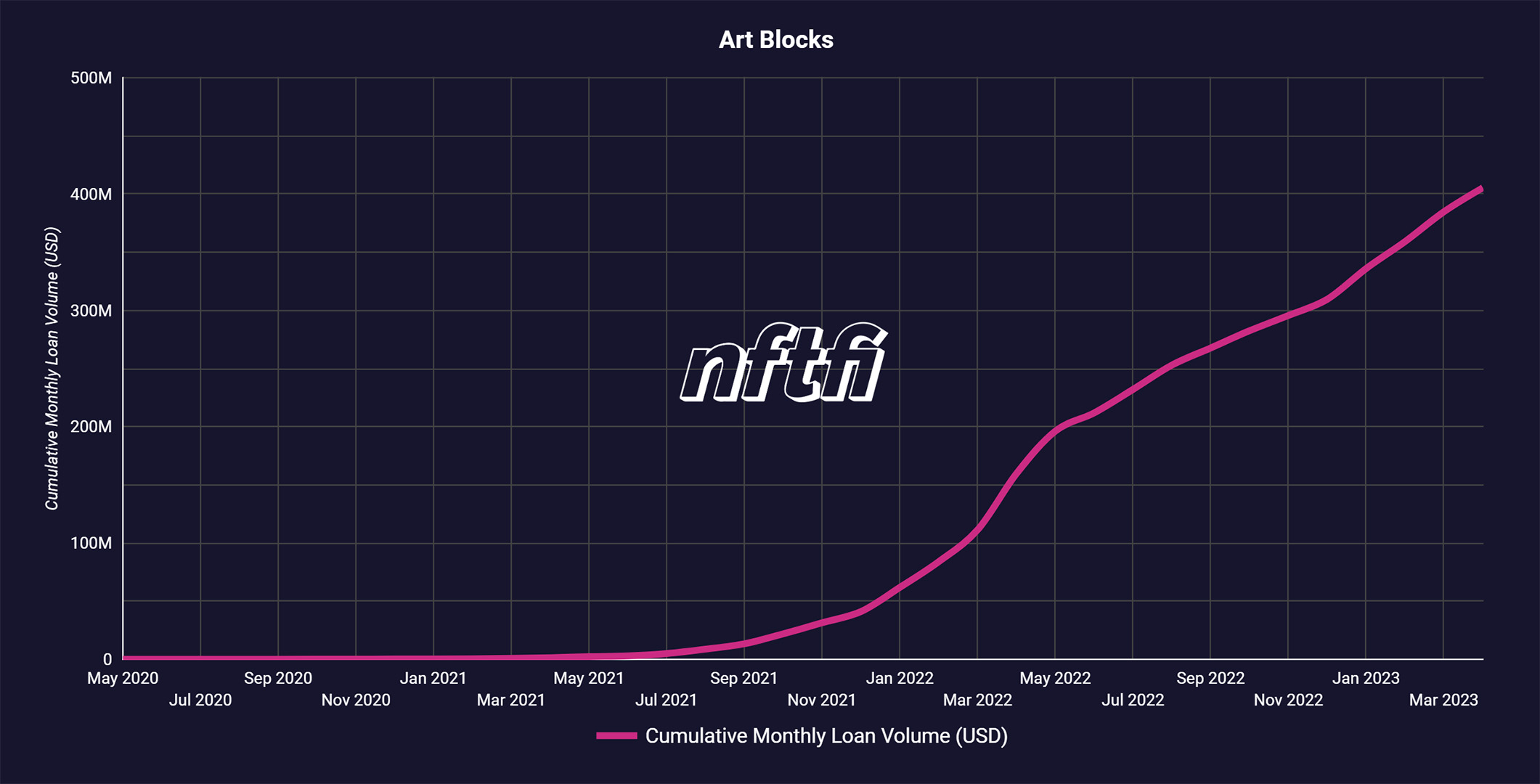

As the chart below shows, Art Blocks holders have been trusting NFTfi since February 2021. The cumulative monthly loan volume has steadily increased ever since, and the total loan volume has now surpassed an impressive $36M.

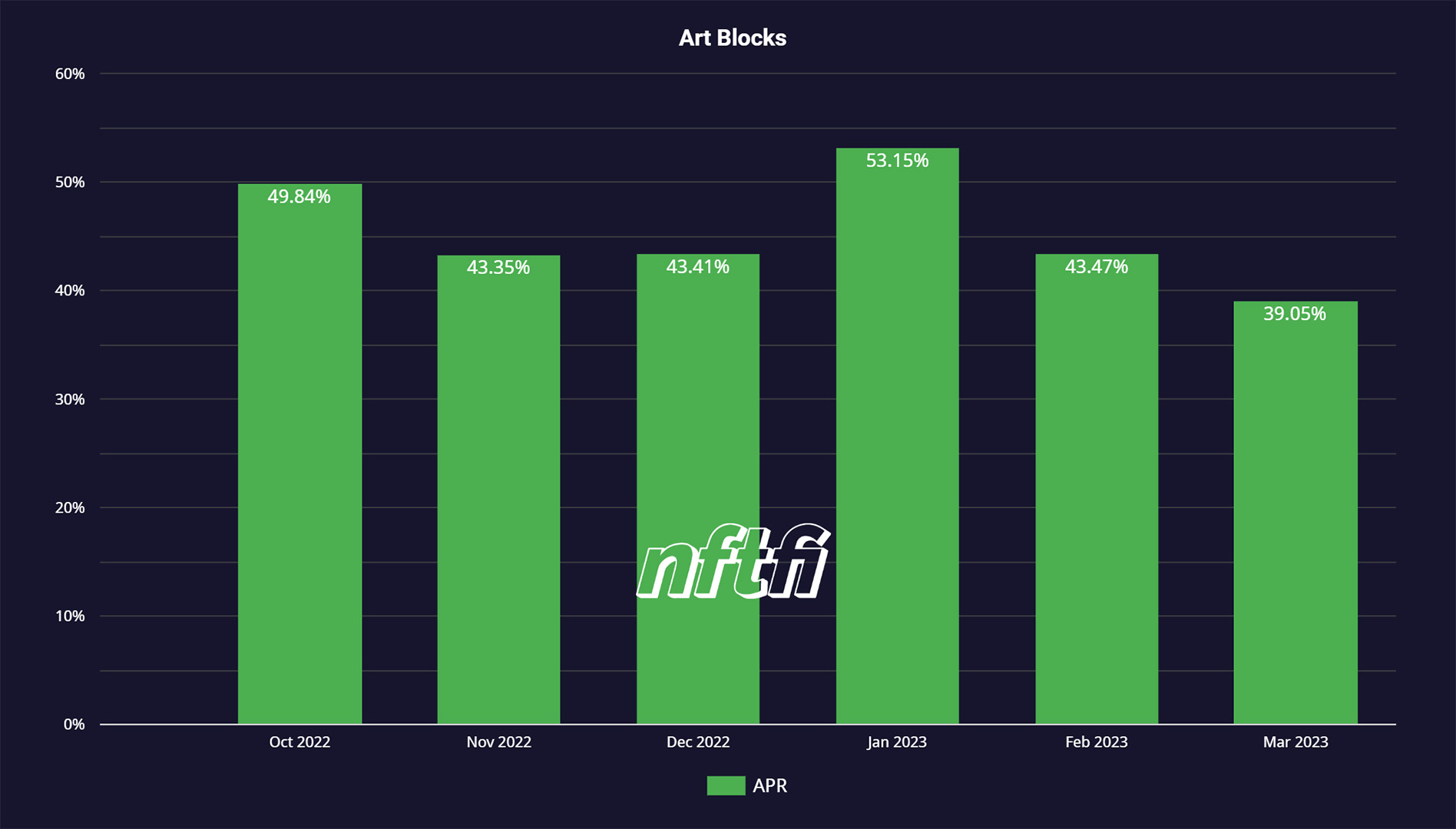

Art Blocks are at the forefront of NFT finance adoption, with the highest number of unique borrowers (447) compared to any other project or collection on NFTfi. Over 6450 loans collateralized by Art Blocks NFTs have been taken out to date, with an average duration of 34 days. As demonstrated in the chart below, the average APR (annual percentage rate) fell significantly in Q1 of 2023, from 53.15% down to 39.13% (please note that individual collection APRs will vary, as this is an average figure across all Art Blocks projects). This means borrowers are paying less interest. For a full guide to understanding APR and true loan cost, see our blog post.

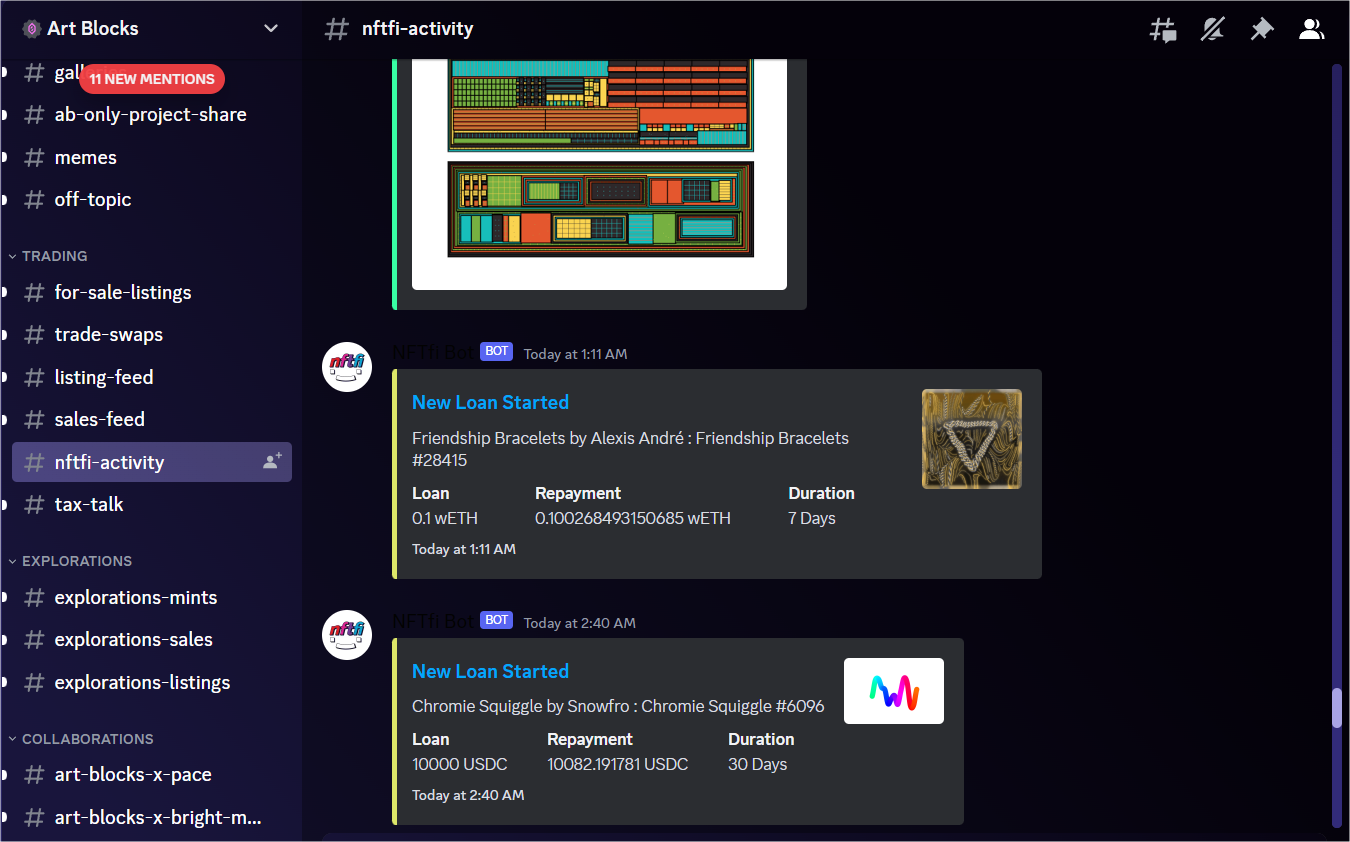

Track the latest loan activity with NFTfi’s Art Blocks Discord bot

NFTfi has a liquidity bot directly integrated into the Art Blocks Discord, enabling the whole community to keep track of loans. Key data is provided about each loan, including the loan volume, duration and how much interest the borrower will pay. To find it, visit the “Trading” menu and select “NFTfi-activity”.

How the Art Blocks community is making the most of lending and borrowing on NFTfi

Beyond the data, there are many reasons why an Art Blocks holder or enthusiast might use NFTfi. We spoke to homerfan33, a keen lender and borrower, who told us:

“I have used NFTfi since 2021 and have been both borrowing and lending on the platform with my Art Blocks collection. I’ve taken out loans on Squiggles, Memories of Qilin, Contractions by Loie Hollowell, and Friendship Bracelets. I see borrowing as a form of insurance - these are high-value pieces, so I’m happy to pay the APR for peace of mind. I also like using NFTfi because it’s peer-to-peer, so you get an actual person on the other side who can properly value your piece and give you a fair loan value.”

As this quote demonstrates, taking out a loan can be a hedging tool against potential price fluctuations. It is also a reliable way to access liquidity for taking advantage of market opportunities or meeting IRL needs, without having to sell your prized generative piece. Given the rapid ascent of generative art in recent years that has seen major traditional museums acquiring notable Art Blocks works and prices skyrocketing, NFTfi can be a valuable tool that offers long-term collectors more flexibility.

While NFTfi is peer-to-peer, it is not just individual collectors who can get involved, but organizations too…

How SquiggleDAO found a home for lending and borrowing on NFTfi

We heard from NiftyFifty of SquiggleDAO about their loan activities, and how NFTfi helps them to support Squiggles, Art Blocks, and the entire generative art ecosystem.

SquiggleDAO has been lending on Squiggles for more than a year as it aligns with our mission of acquiring more Squiggles (if the loan defaults), or generate some yield on our -otherwise idle- ETH if the loan is repaid. Additionally, lending increases the liquidity of Squiggles, making them more valuable and benefits the community by having liquidity available at reasonable rates.

We decided to expand the lending activity to other Art Blocks Curated collections, as Art Blocks and Squiggles are joined at the hip and their success is inexorably linked. So supporting the wider Art Blocks ecosystem was an obvious next step for us.

We focused our efforts on NFTfi as most of the Art Blocks borrowers and the lending activity was happening already there and we followed our community to support them.

The development of sophisticated NFT finance tools, such as art-collateralized loans on NFTfi, reflects a maturing industry, particularly as art lending is a specialty service already offered in the traditional art & finance markets by leading players such as Sotheby’s and Christie’s.

I’m ready! How can I start borrowing and lending on NFTfi?

You can check out this video for a quick overview, and read our beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

Interested in exploring the incredible range of generative art on Art Blocks? Check out their website, Twitter and Discord!

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >