Azuki: Meteoric rise into the top 5 NFT collections on NFTfi!

April 14, 2023 ・ 3 min read

Azukis: First, you took the red bean. Next, you entered the garden. And then? You became liquidity masters and smashed into the top 5 collections on NFTfi!

March 2023 saw a huge $1.2M in loan volume on Azuki assets, a 64% increase on the previous month. This placed Azuki firmly in the #5 spot out of all collections on NFTfi in March. As the chart below shows, monthly loan volumes have been steadily increasing, and have now shot up to cross the $1M mark!

Borrowing with Azuki NFTs on NFTfi is becoming more accessible

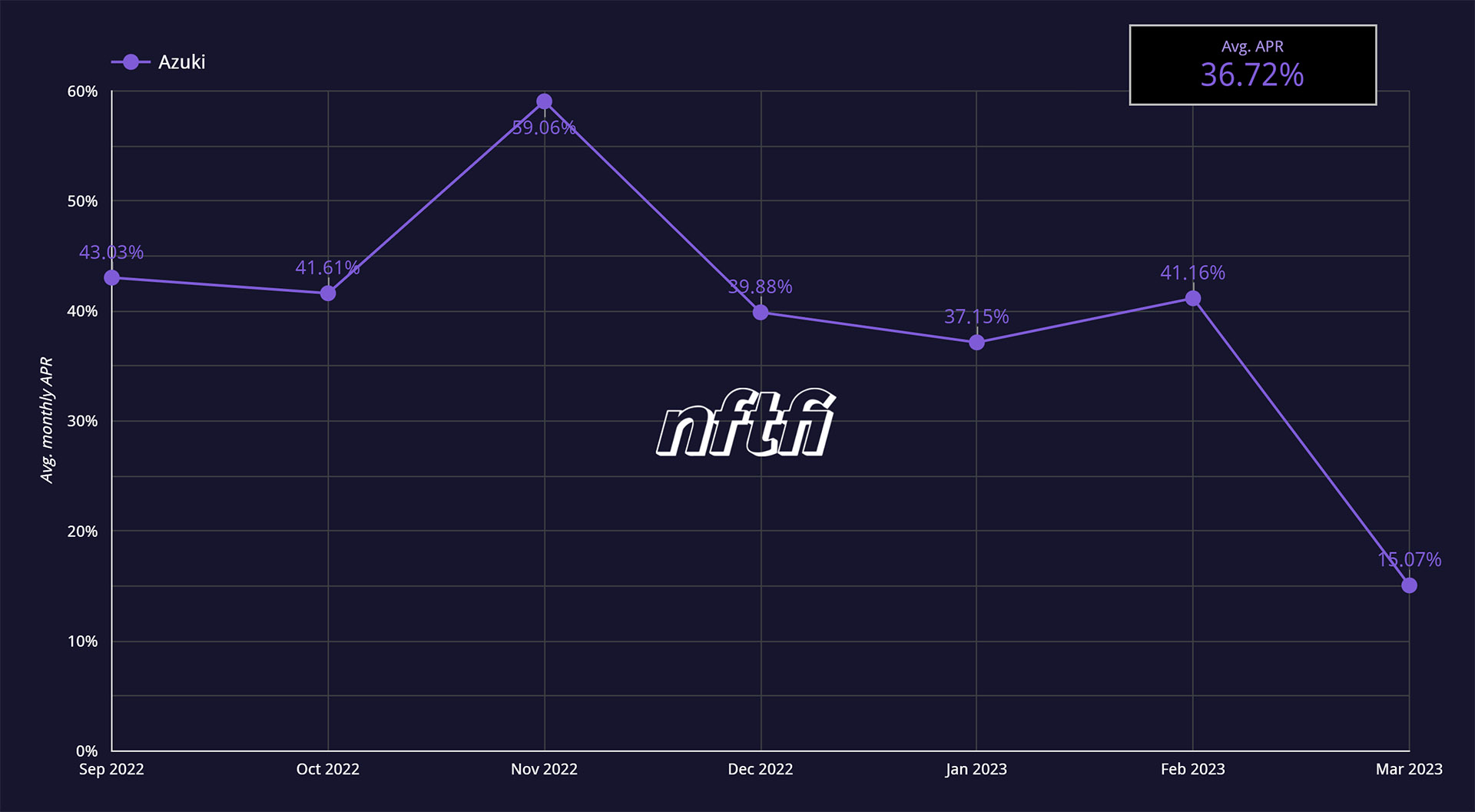

Alongside the major increase in loan activity was a significant drop in the average APR (annual percentage rate) down to 15.07% (see below). This means that borrowing ETH, DAI and USDC with your Azuki NFT as collateral costs less interest and becomes more affordable! For a helpful guide to APR and true loan cost, see our recent blog post.

Why the Azuki community is turning to NFT lending on NFTfi

To date, Azuki’s total loan volume has crossed $3.6M with 245 individual loans. The average loan amount is $15k, while the largest single loan was for $107k. The default ratio is 3.39%, meaning over 96% of holders who have taken out loans with their Azuki NFTs as collateral have repaid them.

The rise in loan activity on NFTfi has gone hand in hand with Azuki’s rising floor price - defying the bear market. This suggests that when Azuki holders need liquidity, they turn to borrowing on NFTfi as it enables them to temporarily unlock and access their NFTs’ value without selling them. Meanwhile, the decreasing APR on Azuki-collateralized loans shows that there is a competitive market among lenders to deploy capital.

We went straight to the community to find out why people choose to lend and borrow on NFTfi. We heard from Chris Scott, the founder & CEO of GMI Capital:

“I love using NFTfi because the concept is simple and they’ve proven they know how to operate a safe marketplace throughout the years. No confusing contracts or puzzling ponzinomics here; just a simple, non-custodial escrow system.

Azuki holders have demonstrated the value in their community through many ups and downs. With NFTfi they can tap into the value of those assets while remaining holders. Borrowing against their assets also doubles as insurance in the event of a market decline.”

I’m ready! How can I start borrowing or lending on NFTfi?

You can check out this video for a quick overview, and read our beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

Ready to take the red bean? Check out Azuki’s website, Twitter, Discord and Instagram!

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >