CryptoPunks: The first collection to hit $100M milestone on NFTfi

June 07, 2023 ・ 5 min read

CryptoPunks are the undisputed OGs of the NFT world, uniting a formidable community of early adopters, innovators, and crypto art enthusiasts since 2017.

CryptoPunks’ historical, artistic and cultural importance is now globally recognised far beyond the NFT space, and thanks to a number of landmark donations and acquisitions in recent years, Punks now grace the halls of major museums such as the Centre Pompidou in Paris, LACMA and the ICA Miami.

Their cultural importance has unsurprisingly resulted in significant financial value and top tier asset status, including on NFTfi, where CryptoPunks lead all other NFT collections in lending and borrowing activity.

CryptoPunks dominate the no.1 position in all-time loan volume on NFTfi

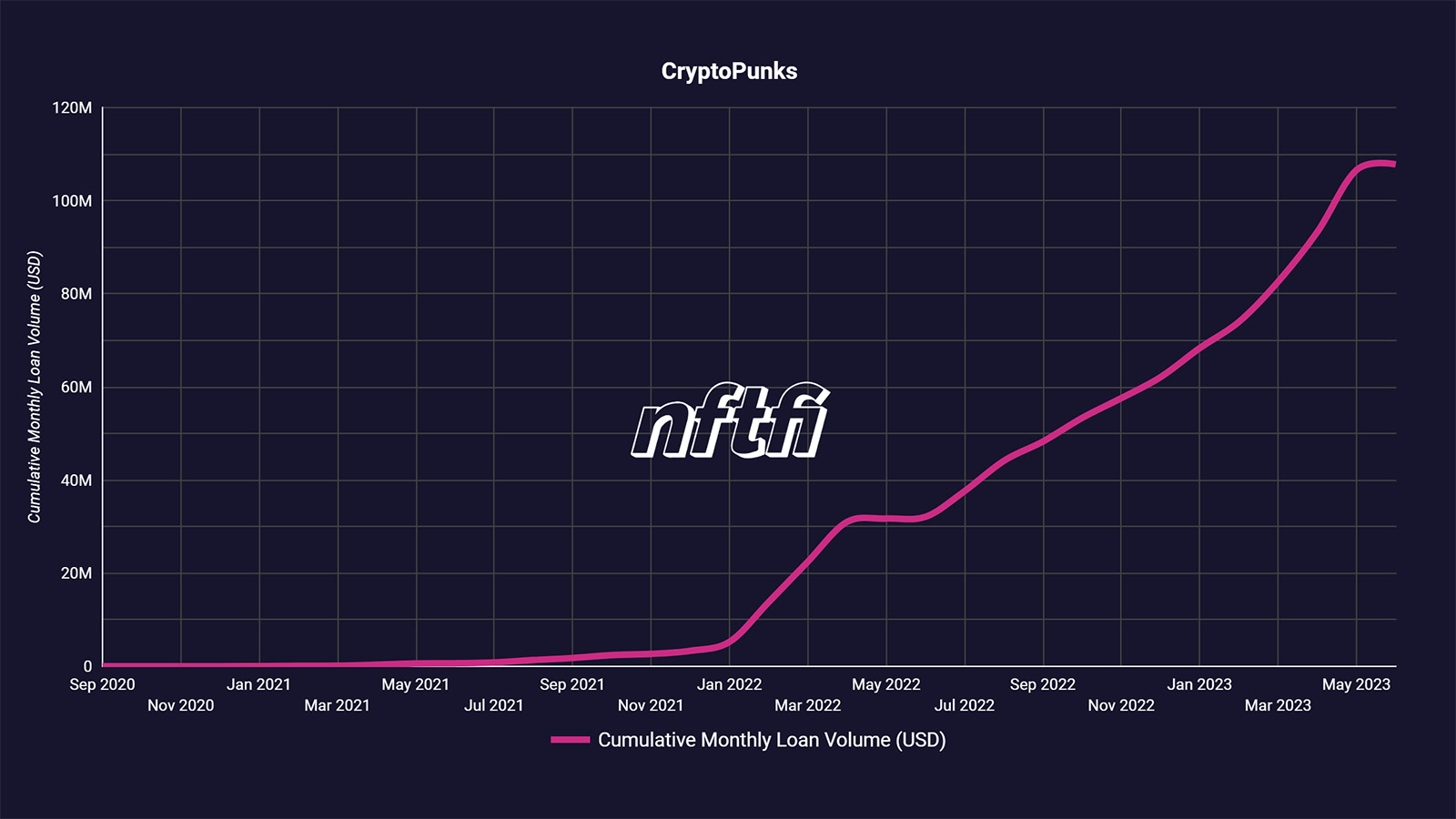

As the chart above shows, CryptoPunks reached a monumental milestone in May 2023, becoming the first collection to surpass $100M in total loan volume on NFTfi.

This achievement reflects Punks’ early adoption of NFT finance tools as well as their long-term belief in the value of their assets. The default ratio across CryptoPunks NFTs on NFTfi is a mere 1.73%, indicating that over 98% of loans against Punks have been repaid.

Over 2,000 individual loans have been executed to date, with an average loan duration of 41.71 days, and an average loan size of $53,143.

So, what are the strategies and motivations behind these impressive statistics? We talked to Punks active on NFTfi to find out.

How CryptoPunks are maximizing NFT lending & borrowing opportunities on NFTfi

We often hear stories of holders successfully leveraging their ‘Forever Punk’ to access liquidity. We spoke with Brownie, a keen lender and borrower, who told us:

“When I acquired my hoodie punk in 2021, I had plans to never sell it but I also wanted to figure out a way to leverage my punk and continue to grow my ETH. I came across NFTfi and was reassured by my research, so I decided to wrap my punk and take out my first loan. The whole experience was very smooth, and the rates over time became increasingly attractive, making using NFTfi a no-brainer!

His typical strategy was:

1. Provide loans to other borrowers using the WETH from my punk loan

2. Use NFTButler to get deals on NFTs & flip

3. Trade crypto by setting buy orders at support levels

This is one of many potential strategies that lenders and borrowers can pursue on NFTfi. We also heard from Red how he refines his NFT collection over time by staying liquid:

“Some people (like me), when they have full conviction in a project, spend all their liquidity buying in. Then, once you get to know that collection’s traits and quirks, you are able to spot deals. However, without liquidity, you can’t jump on the opportunity!

So, I keep my eligible NFTs listed on NFTfi, accrue offers, and I’m then able to unlock that liquidity right when I need it without selling any of my NFTs. I can then flip my purchase for profit and repay the loan, or keep it, perhaps even take out a new loan, and decide which NFT compliments my collection best."

Portfolio management is key for both traders and collectors, as longtime NFTfi user Lutherin confirmed:

“NFTfi has been instrumental in facilitating NFT trading, offering ample liquidity during crucial moments, whether for buying the dips or leveraging positions. I greatly appreciate the fixed-term and interest-based loans, as they enable me to strategically manage my liquidity without encountering any unexpected surprises.”

In addition, some Punks have even achieved lifelong IRL ambitions, including Tony Herrera:

“Through NFTfi, I was able to attain my real estate goals. I had tried to get a loan from an ETH whale and offered a number of Punks as collateral, but it didn’t work out. Then, I looked into borrowing on NFTfi and after discussing it with @sergitosergito, I decided to aggressively borrow against my NFTs in order to attain that property.

Fortunately my strategy worked, even though the price of Punks trended lower month after month, and I attained two commercial properties and a dream house, one that I could only fantasize about buying when I first saw it some 20+ years ago.”

As these community insights demonstrate, Punks have been maximizing the potential of both lending and borrowing on NFTfi for years. Their participation is now being additionally rewarded.

CryptoPunk loan volumes are rising during Earn Season 1

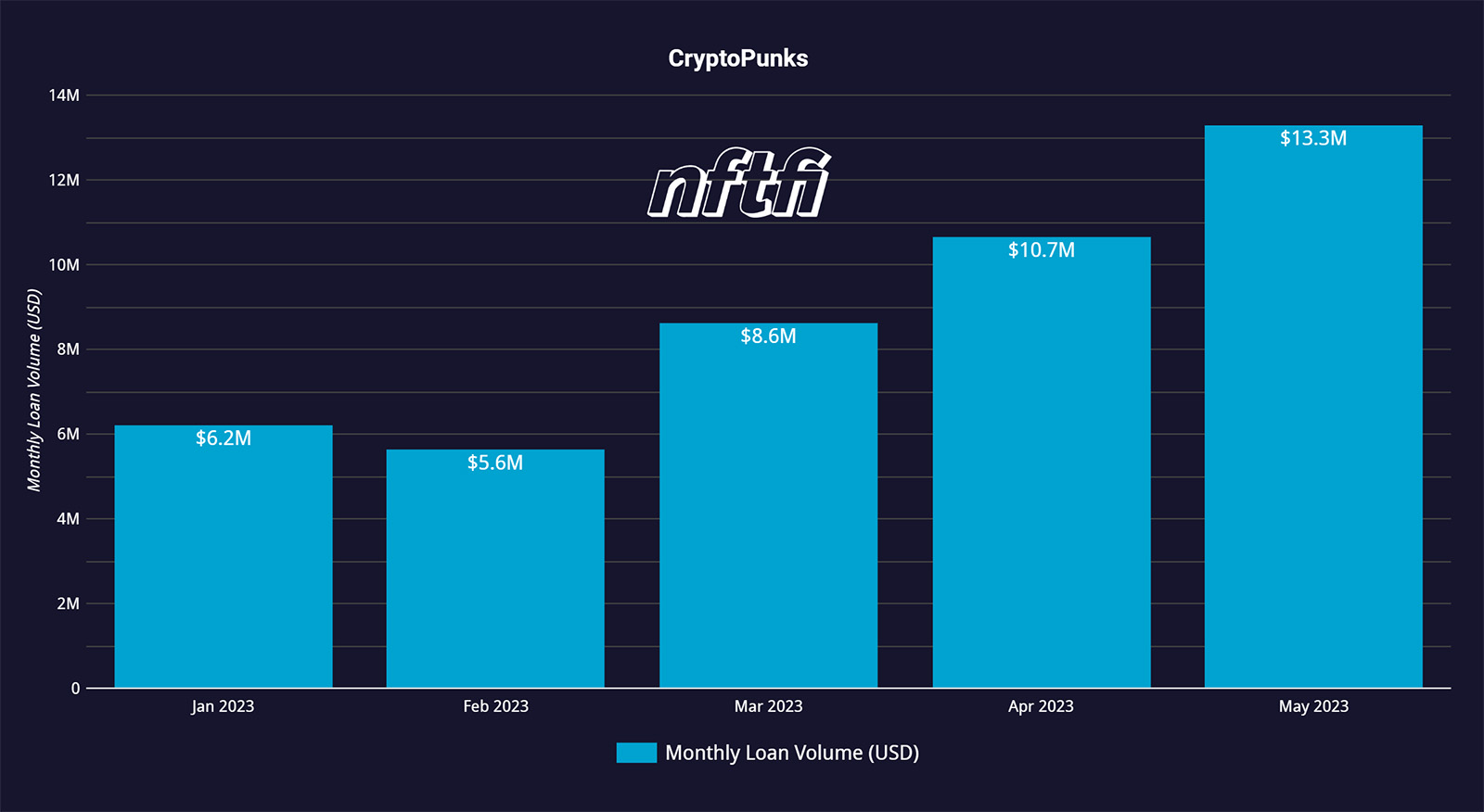

In May, NFTfi launched NFTfi Rewards with Earn Season 1: a program to reward NFT lovers for borrower-friendly loan terms and encourage responsible lending behavior. Learn more here.

As the chart below shows, this has accelerated the upward trend in CryptoPunks’ monthly loan volume, leading to a significant $13.3M in May alone.

Benefit from NFTfi Rewards, the loyalty program for NFT lovers!

Our brand new loyalty program rewards lenders and borrowers with exclusive Earn Points. Click here to learn more!

If you are new to NFTfi, you can check out this video for a quick overview, and read our beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

To dive into the delightful world of CryptoPunks, explore their website, and Twitter.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >