Demystifying NFT Lending: APR vs. True Loan Cost on NFTfi

April 11, 2023 ・ 5 min read

In this article, we explain the difference between “APR” and “true loan cost” on NFTfi, two critical components to consider when participating in the NFT lending ecosystem, either as a borrower or a lender.

What is APR in NFT finance?

Just like in traditional finance, when it comes to lending and borrowing, APR is often the first metric you will encounter - but what does it mean? APR (Annual Percentage Rate) is a standardized way to express the yearly interest rate charged on a loan.

For example, if you use your NFT as collateral and borrow $1000 at 25% APR for 12 months, then at the end of 12 months you owe $1250 in total. This is made up of $1000 (the amount borrowed, also known as the loan principal) + $250 in interest.

In short, APR gives borrowers a sense of how costly the loan is going to be and enables them to effectively compare different loan offers. For lenders, it indicates how much interest they will earn on their capital.

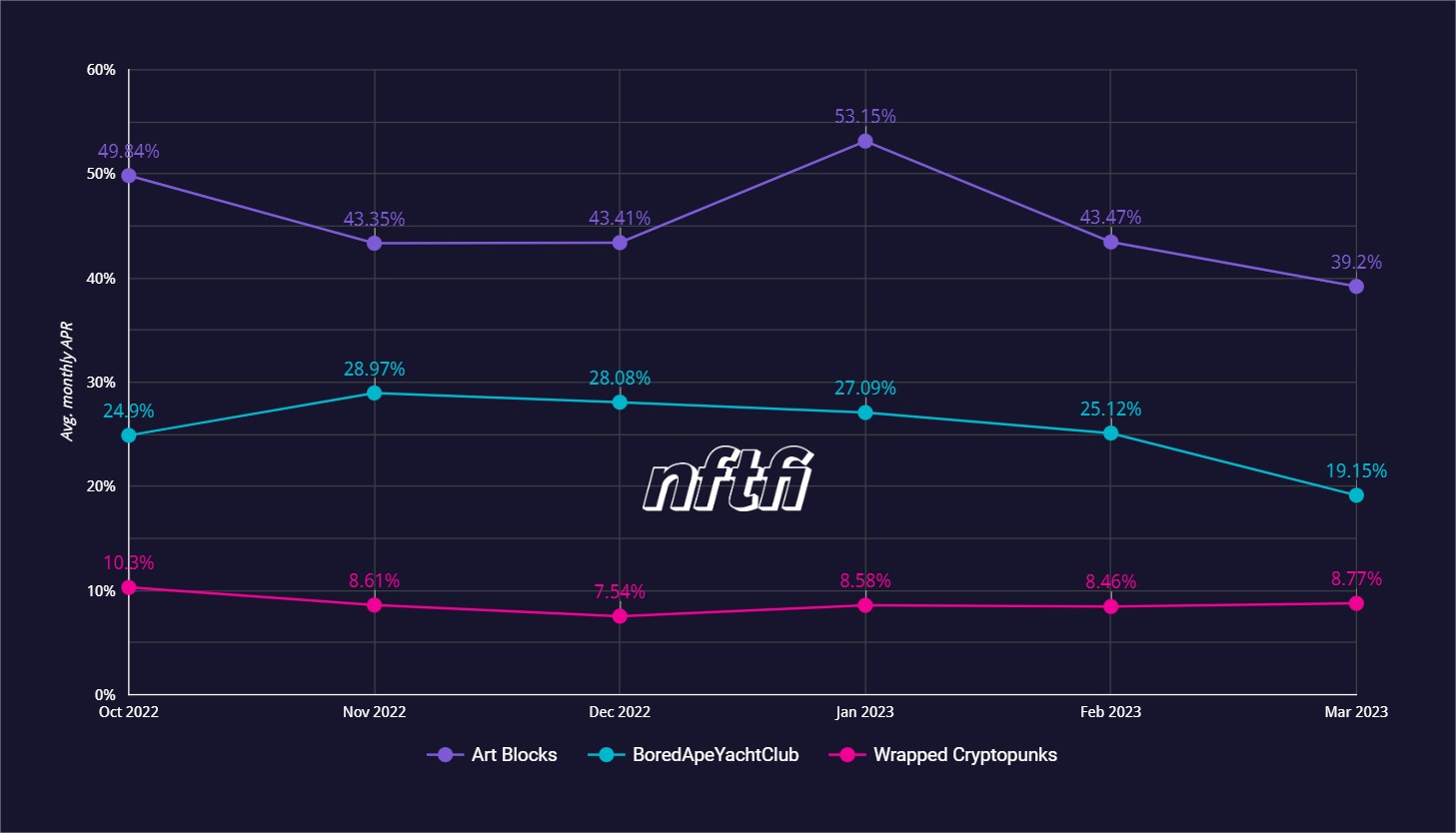

Average APR on NFTfi in the last 6 months

Let’s explore the APR in the Q4 2022 - Q1 2023 period for some of our listed blue chip collections.

The chart above compares the monthly average APRs over the last six months for Wrapped CryptoPunks, BAYC and Art Blocks (please note that the Art Blocks contract represents many different collections with varying APRs).

The chart reveals a number of interesting trends. For example, the APR on Wrapped CryptoPunks has been particularly stable. One reason for this could be that Punks are one of the most valuable and least volatile assets in the NFT space, so lenders are prepared to offer lower APRs to borrowers since the loan values are high and defaults are unlikely. The APRs are higher for Bored Apes and Art Blocks, although they have been notably trending down in Q1 of 2023. This means that borrowing with these assets as collateral is getting cheaper, as we will explore in the final section of this article.

In March, the average APR for a BAYC loan was 19.15%. Does that mean that someone taking a 30 day loan on his BAYC will pay almost 20% in interest? 😱 Not exactly!

While APR is a useful figure for comparing multiple loan offers, it can also be misleading in the context of NFT lending. This is because the average loan durations on NFT assets are much shorter than a year, so the interest you pay is far less than the APR implies. This is why calculating the true loan cost is crucial.

True loan cost on NFTfi: what is it and how do I calculate it?

The true loan cost is an accurate representation of the expense borrowers will incur when taking out a loan. For lenders, it is an accurate representation of the interest they will earn. To calculate it, you need to factor in the loan principal, the APR, and the length of the loan.

Let’s revisit the same example of borrowing $1000 at 25% APR, but this time for a period of 31 days (the average duration across all 38k+ loans to date on NFTfi).

Since APR is expressed annually, we can convert the annual rate to a daily rate by dividing it by 365 (the number of days in a year). In this case, the daily interest rate is approximately 0.0685% (25% / 365).

Next, we can calculate the total interest for the 31-day loan by multiplying the daily interest rate by the number of days and the principal amount:

0.0685% * 31 * $1,000 = $21.24

Therefore, after 31 days, you would owe a total of $1,021.24, which includes the $1,000 loan principal and $21.24 in interest.

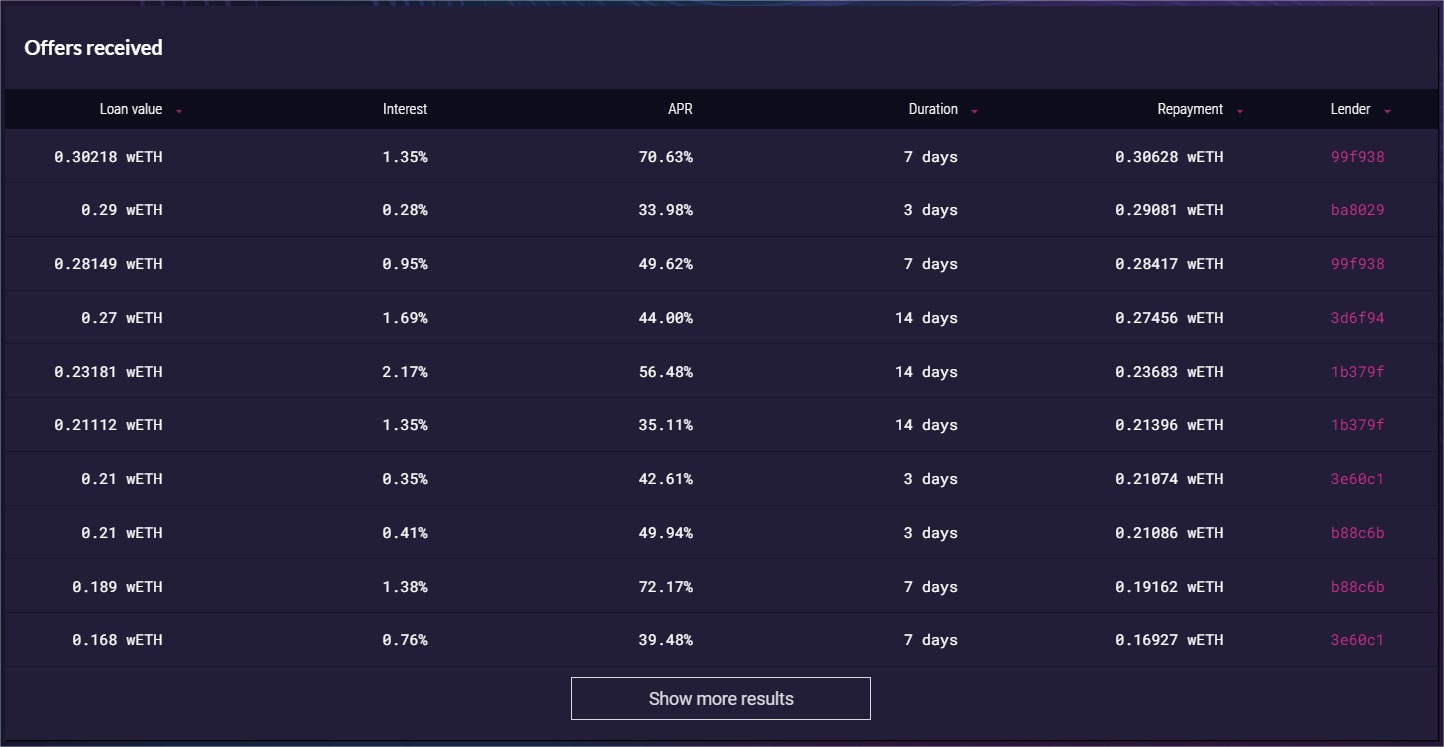

To make this simple to understand and help borrowers compare different loan offers, the NFTfi UI displays both the APR and true loan cost (as ‘Interest’ in the offers table) on every asset page. 👇

I want to take out an NFT-collateralized loan on NFTfi. What will the APR and True Loan Cost be?

NFTfi, unlike some other lending protocols, is peer-to-peer, and borrowers can set their preferred terms and choose which loan offer to accept.

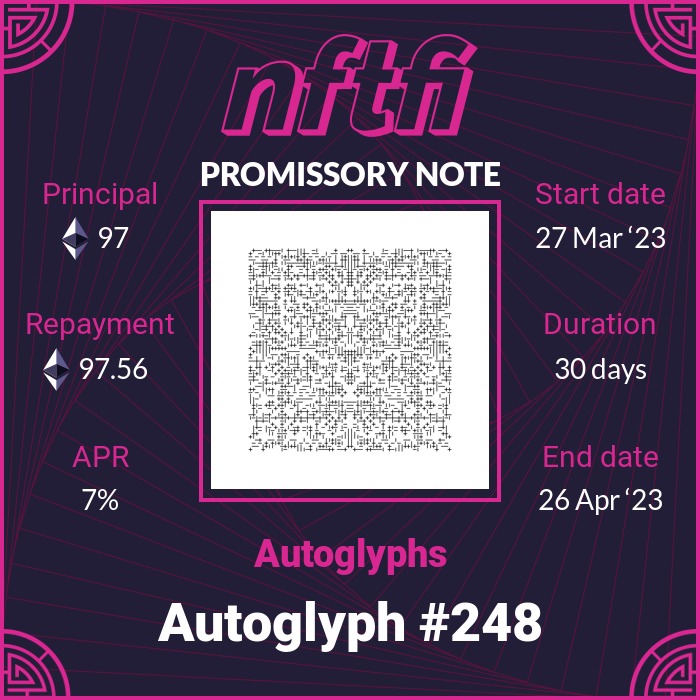

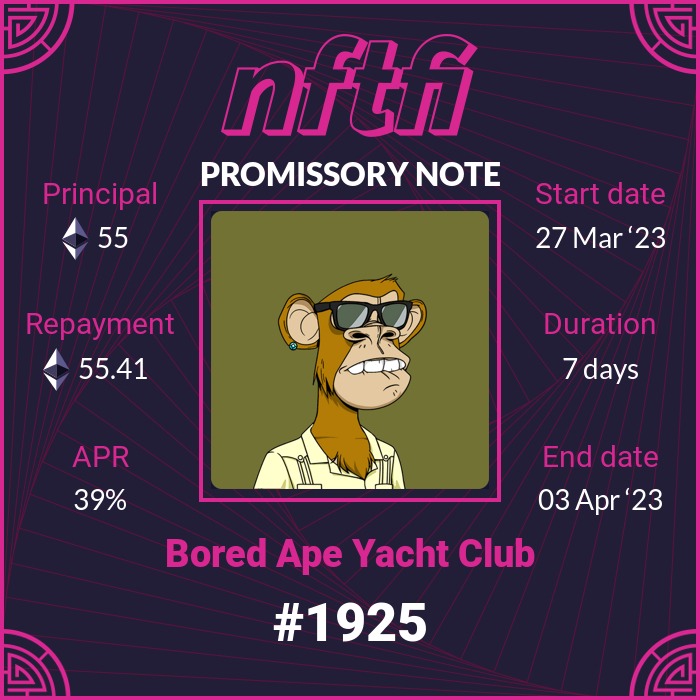

Let’s look at two recent examples of loans on blue-chip NFTs:

In this example, the borrower has taken out a loan for 97 ETH with Autoglyph #248 as collateral. While the APR is 7%, the true loan cost (i.e. the interest the borrower must pay) is only 0.56 ETH.

In this example, the borrower has taken out a loan for 57 ETH with BAYC #1925 as collateral. While the APR is 39%, the true loan cost (i.e. the interest the borrower must pay) is only 0.41 ETH.

If you want to explore historical APR and true loan cost data for different collections, you can check out our Dune dashboard.

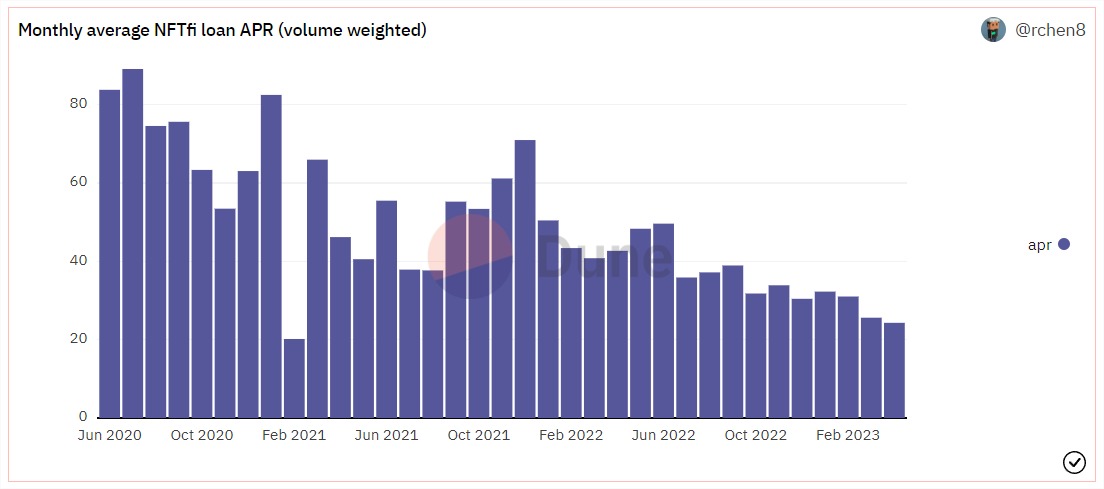

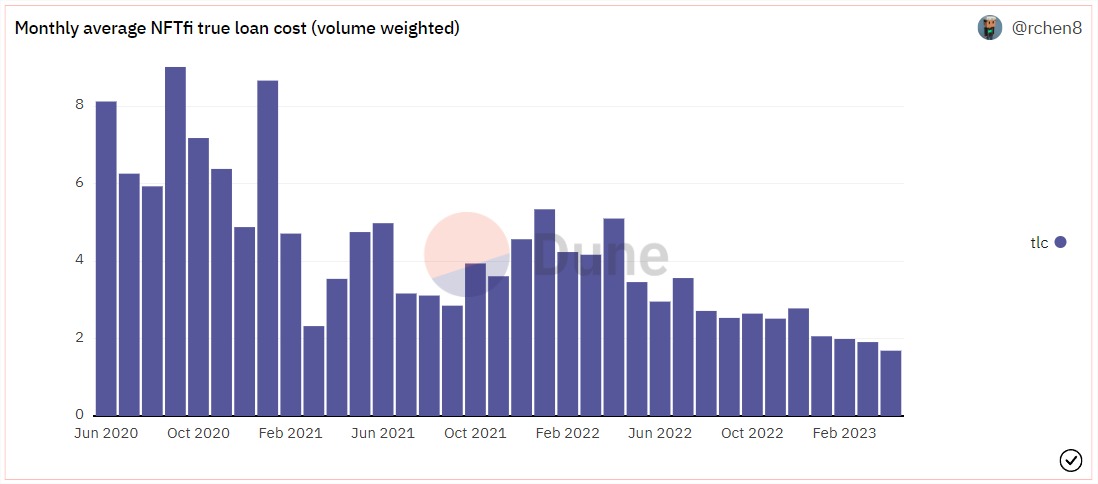

As shown in the charts above, APRs and, consequently, the true loan costs of loans have been decreasing for several months now. This indicates that obtaining loans through NFTfi is getting more affordable and is close to the lowest all-time low levels.

If you are considering taking out a loan on your NFT, we suggest reading our beginner-friendly guide to borrowing on NFTfi. To stay up to date follow us on Twitter and chat with experienced users by joining our thriving Discord community.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >