DigiDaigaku: Explosive Q1 Loan Activity on NFTfi

April 04, 2023 ・ 3 min read

Not many NFT collections can obtain and hold that elusive blue chip status, but one community is making it look easy…

Since launching the DigiDaigaku Genesis NFT collection via a free stealth mint in August 2022, Limit Break (the blockchain gaming company pioneered by Gabriel Leydon) has gone from strength to strength, including the recent acquisition of FreeNFT and the Baby Dragons drop.

The DigiDaigaku community is fully behind Leydon’s vision, to the extent that an official DigiCult has formed! We chatted to the cult’s co-founder Degen about how this vibrant group has grown to around 400 members, with such a powerful draw in terms of vibes and partnerships that it’s enticing new people to join DigiDaigaku just for access 👀

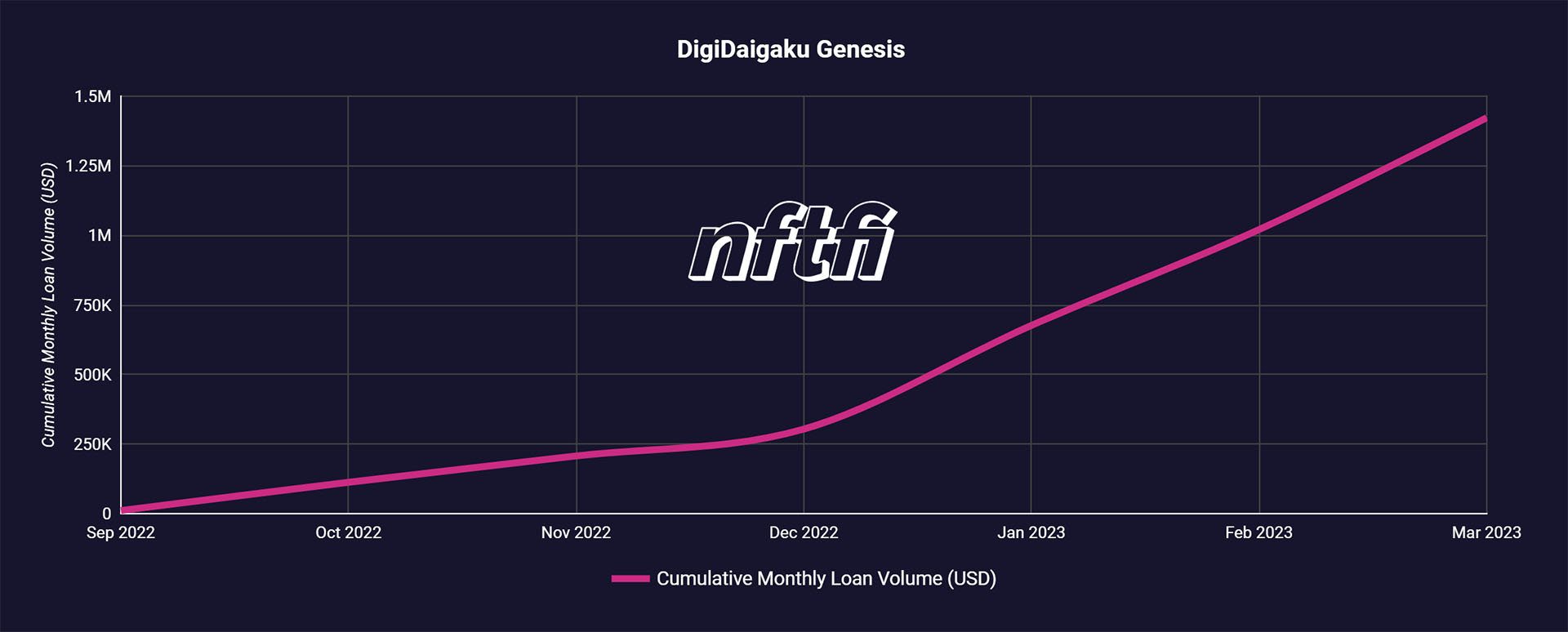

While 99% of projects are busy under-delivering, the irresistible DigiDaigaku Genesis characters kicked off 2023 in style: lighting up the Superbowl! But that’s not all the Digi community has been up to this year... There has also been a huge uptick in activity on NFTfi: loan volume on DigiDaigaku assets increased 275% in Q1 2023 compared to Q4 2022 - one of the highest growth spikes out of all listed blue chip collections.

DigiDaigaku achieve record-breaking NFT loan volumes on NFTfi

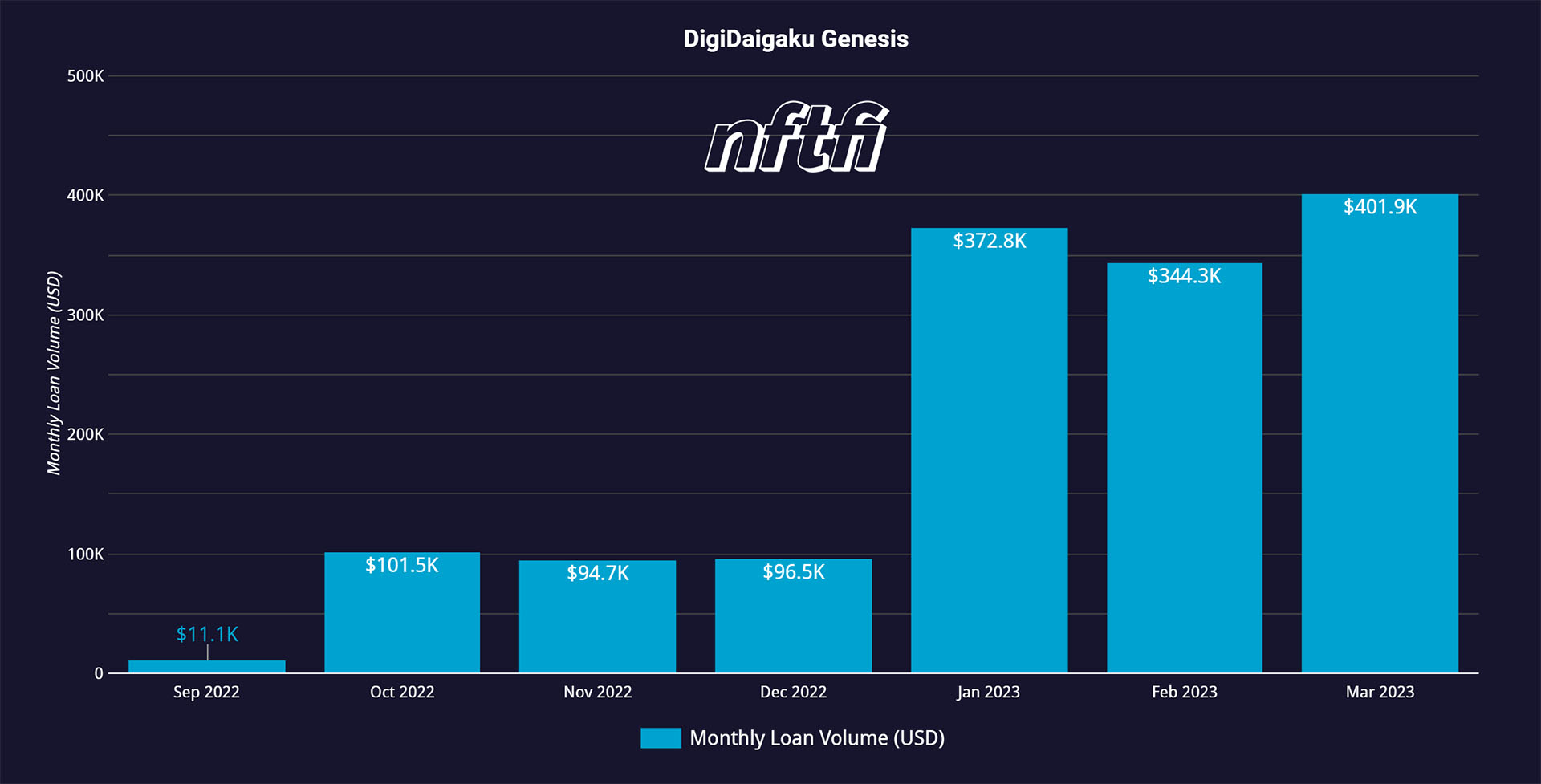

As the chart below shows, DigiDaigaku’s monthly loan volume has sky-rocketted since January. March 2023 was officially the collection’s best month to date, with an impressive $401.9k in loan volume.

The largest individual loan was for $50k and so far 32 unique borrowers and 46 unique lenders have amassed an incredible $1.42m in total loan volume - cementing NFTfi power-user status!

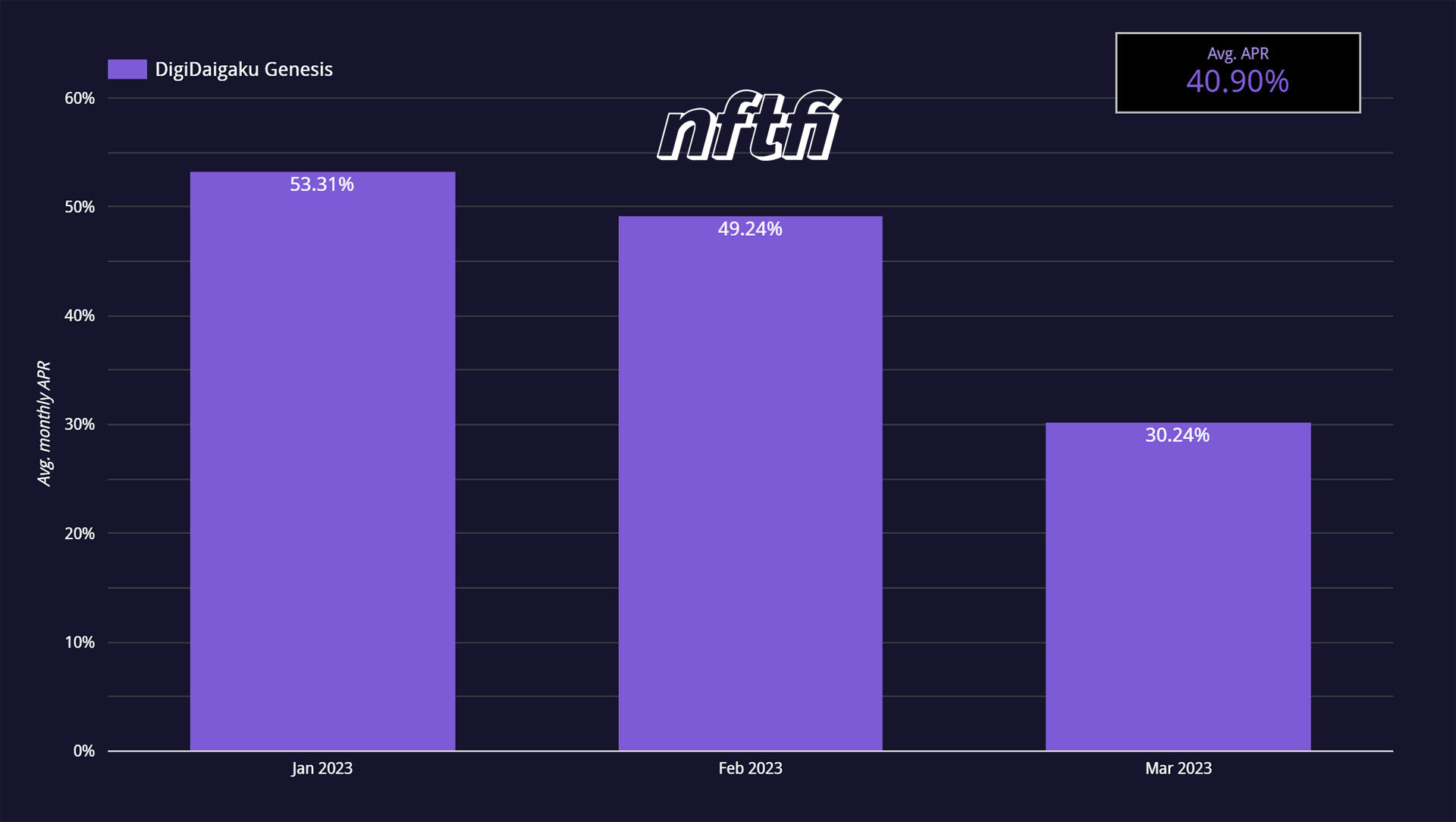

So how does NFTfi actually benefit DigiDaigaku holders? For starters, the repayment rate for loans that use DigiDaigaku NFTs as collateral is 95.52%! This means that almost all holders are accessing liquidity, making moves (in the market or IRL!), and reclaiming their assets - a potential win-win for borrowers and lenders alike. On average, loan duration is just over two weeks and APR (see chart below) has been declining for the past few months, meaning that the true loan cost for DigiDaigaku assets in March was just under 0.75%!

Tempted to join this credit-loving crew? You might have a few questions about security ⤵️

What makes NFTfi the most trusted NFT lending platform?

NFTfi has enabled over $380M in loan volume to date and unlike other protocols in the NFT finance industry, NFTfi is peer-to-peer. This means borrowers and lenders negotiate directly with each other and there are no auto-liquidations as in peer-to-pool protocols.

I’m ready! How can I start borrowing or lending on NFTfi?

You can check out NFTfi’s beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter and chat with experienced users by joining our thriving Discord community.

You can also follow DigiDaigaku’s Twitter, website and Discord. For exciting insights into the future of the collection and its fast-expanding universe, visit Limit Break’s Twitter and website. Last but not least, for a comprehensive overview of DigiDaigaku’s history and the alluring characters in its ecosystem, as well as recommendations of top-tier content related to Digi and Limit Break, check out the Book of Digi created by community star Moonlyght.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >