Discover Refinancing: A Faster and More Efficient Way to Extend Loans

January 31, 2024 ・ 3 min read

Instantly renew an existing loan and bypass the burden of upfront repayment.

We have completely streamlined the process of extending a loan.

Before refinancing, extending a loan was a hassle. Users had to jump into time-consuming, capital-intensive, and sometimes stressful loops:

- Repaying their original loan.

- Relisting their assets and waiting for new offers.

Now, borrowers can quickly extend the maturity of their loan with just a few clicks and without having to repay the previous loan in full.

At any point, a borrower has the opportunity to accept new offers from lenders to extend their active loan or just seize an opportunity for better terms.

To extend a loan, borrowers only need to pay (or in the case of a surplus, receive) the difference between the new principal and the old principal plus interest.

The refinancing feature will also create plenty of new opportunities for lenders. Previously, they had to wait for assets to be listed in order to provide bids or send standing collection offers.

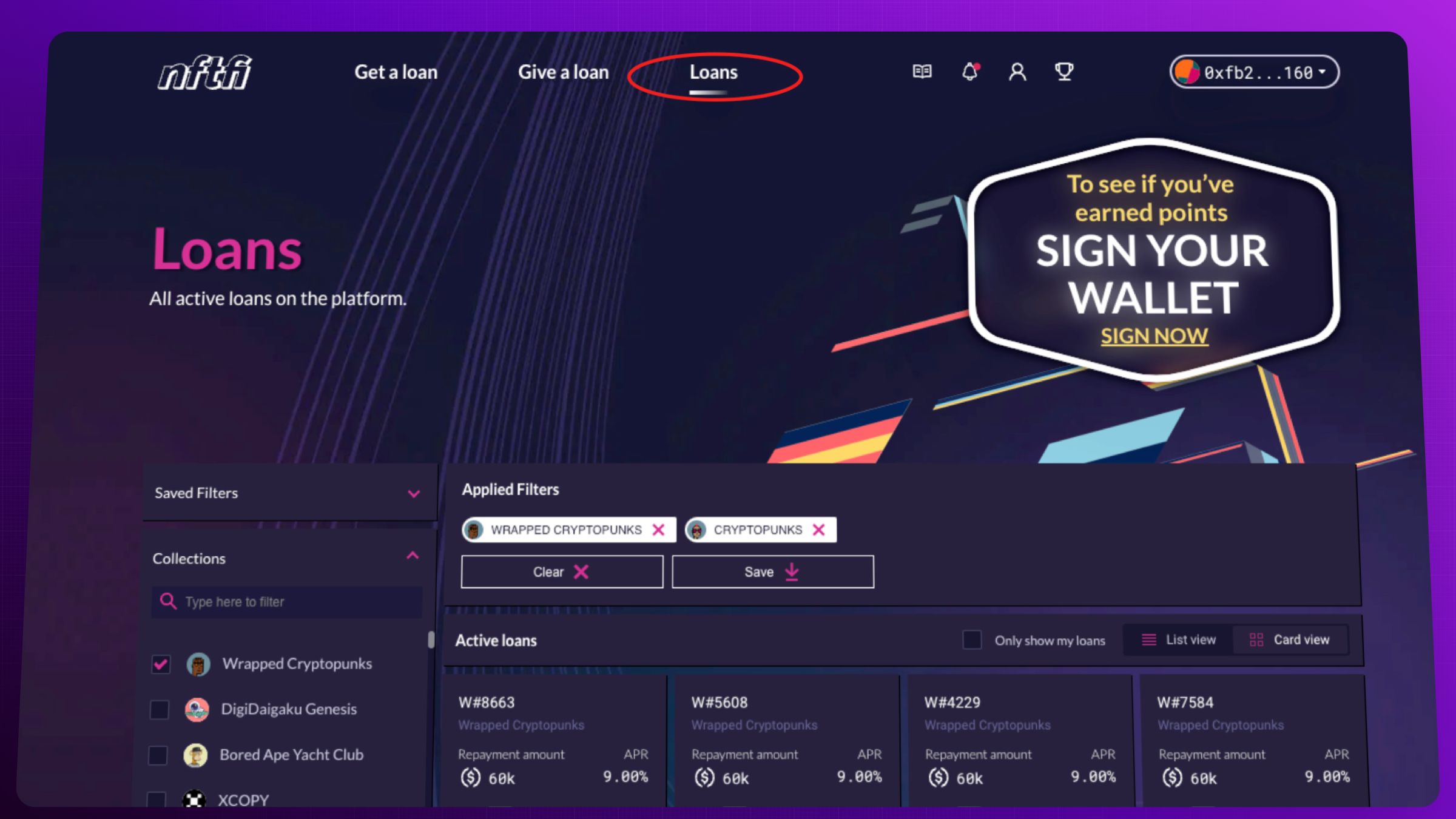

Now, they can bid on assets while still in escrow. Lenders can now browse existing loans and send refinancing offers to borrowers through the new Loans page.

Refinancing in two simple steps

Step 1 - Receiving new offers on an active loan

From now on, borrowers will receive offers on their active loans, these offers might be from the original lender or competing lenders.

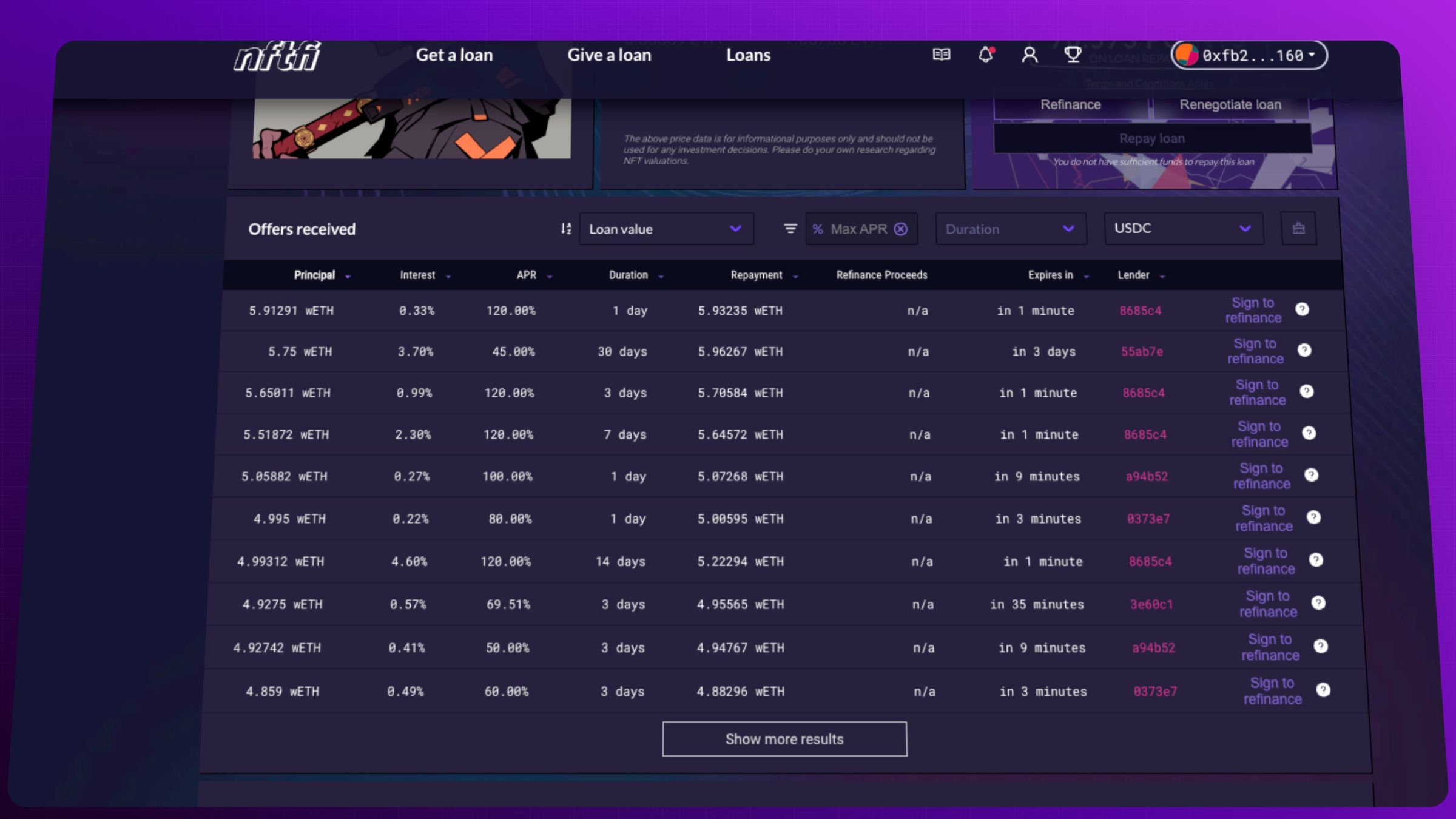

These offers will be displayed in the "Offers Received" panel. Each offer will come with the usual terms

- Principal Amount;

- Interest Rate;

- APR (Annual Percentage Rate);

- Duration;

- Repayment Cost;

- Expiry Date; and

- and Lender's Wallet Address.

Importantly, the "Refinance Proceeds," section is introduced.

The statement will display the difference between the total value of the old loan (principal + interest) and the value of the new loan's principal.

- If positive, this indicates that the borrower will receive the surplus.

- If negative, it signifies that the borrower must cover the difference before finalizing a new loan.

Step 2 - Refinance a loan

The borrower initiates the refinancing process by clicking on the "Refinance" button next to the offer. A prompt summarizing the terms about to be accepted will appear. Then, a series of on-chain interactions with the Refinancing Smart Contract begin.

Depending on the balance between the total value of the old loan and the value of the new loan's principal the Refinancing contract will either:

- withdraw the deficit from the borrower's wallet

- or transfer a surplus to the borrower's wallet.

Additional Note - Loan extensions must be in the same token as the existing loan - for example, if the existing loan is in USDC - the extension must also be in USDC.

First time learning about NFTfi?

If you're just discovering NFTfi, watch the video below for a quick overview and check our beginner’s guide to borrowing.

Stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >