Doodles: Coloring the world with joy, one loan at a time

May 09, 2023 ・ 4 min read

It’s no surprise that Doodles, with the joyful, whimsical and instantly iconic designs of Burnt Toast, have become one of the most beloved NFT collections of all time. Behind those PFPs’ sweet exteriors, however, Doodles mean business.

Doodles’ cultural influence across both web2 and web3 is truly unique and they have demonstrated their prowess in brand-building through iconic IRL events and establishing an unrivaled team - most notably signing Pharrell Williams as Chief Brand Officer. In fact, an exclusive Pharrell x Doodles capsule clothing collection just dropped at the artist’s Something in the Water festival and 300 sets of digital wearables by brands linked to Pharrell will also be airdropped to eligible Doodles soon.

These major moves have made headlines alongside the hyped release of Doodles 2: a whole new world (“The Stoodio”) in which anyone can create a character in Burnt Toast’s iconic style and customize it with wearables, collectibles and more - now live.

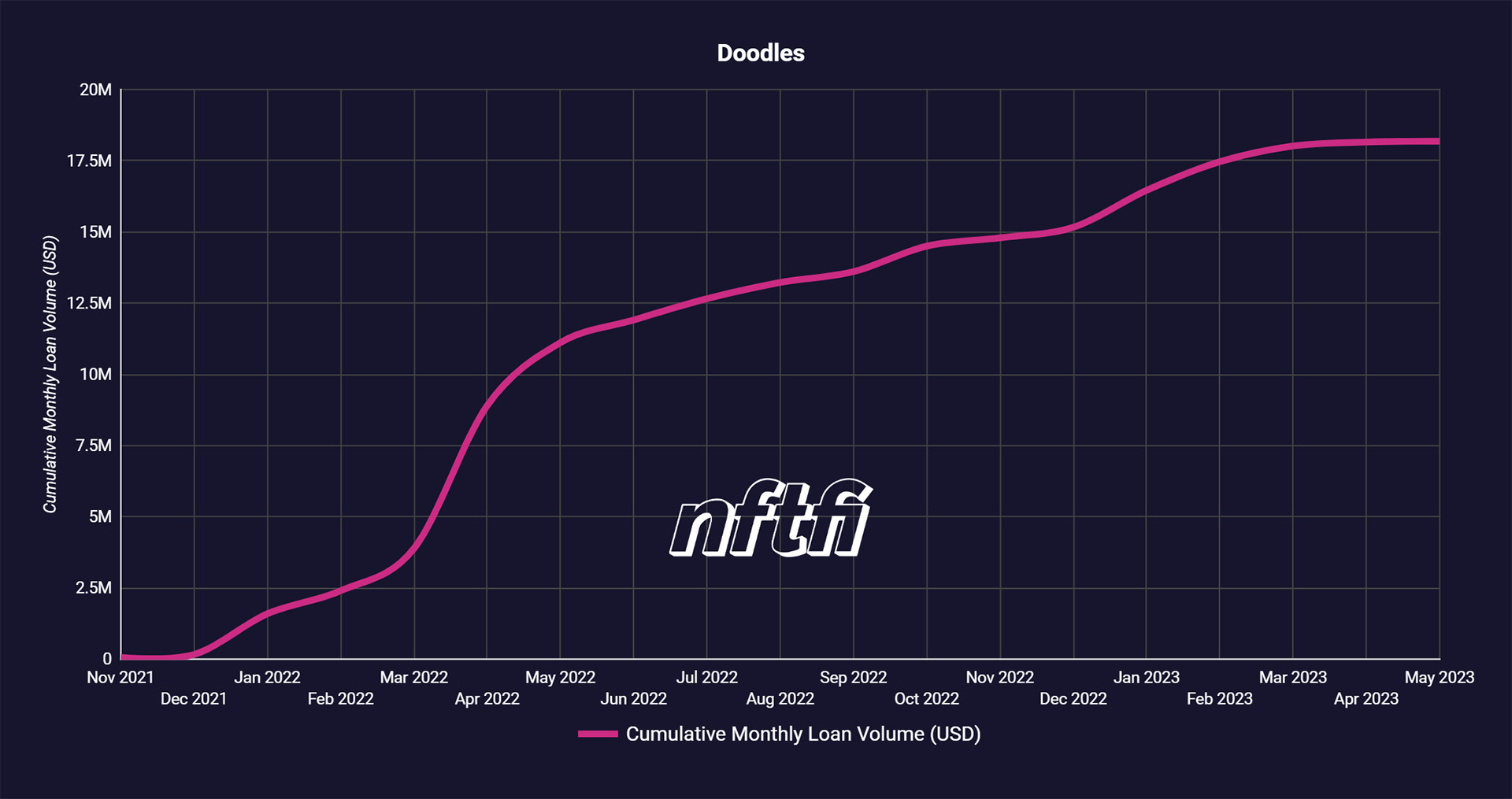

In the meantime, the Doodles community has been highly active in another area: NFT finance! In particular, peer-to-peer lending & borrowing on NFTfi. In fact, having powered through over $18M in loan volume to date, Doodles are proudly placed in NFTfi’s top 5 collections of all time.

Why is the Doodles community accessing liquidity on NFTfi?

There are many reasons why a Doodles holder might want to take out a loan, from spotting opportunities in the wider NFT market, to hedging against floor price drops, to simply meeting temporary liquidity needs. By using NFTfi, Doodles holders are able to unlock this liquidity without selling their NFTs, which for many Doodles holders have become far more than financial assets and are at the heart of their web3 identities.

We chatted to some Doodles about their activities on NFTfi to learn more, and heard from Mike Damazo about why he’s bullish on both lending and borrowing:

"When lending against NFTs, selecting what you truly vibe with and would not mind owning in case of a default is key. Choosing to provide liquidity to Doodles as a lender was a no-brainer for me therefore. I have also used NFTfi on the other side as a borrower, and unlocked liquidity at great rates to have more financial flexibility".

A deep dive into Doodles’ borrowing and lending data on NFTfi

As the chart above demonstrates, Doodles’ total loan volume on NFTfi has surpassed $18M. To date, there have been 250 unique borrowers and 221 unique lenders. So far, a total of 1274 loans have been successfully completed. An additional $600k+ of loan volume has taken place for Space Doodles.

The average loan amount is $14k, although the largest loan to date was for an impressive $234k! Across all loans, the overwhelming majority (96.2%) have been conducted in ETH.

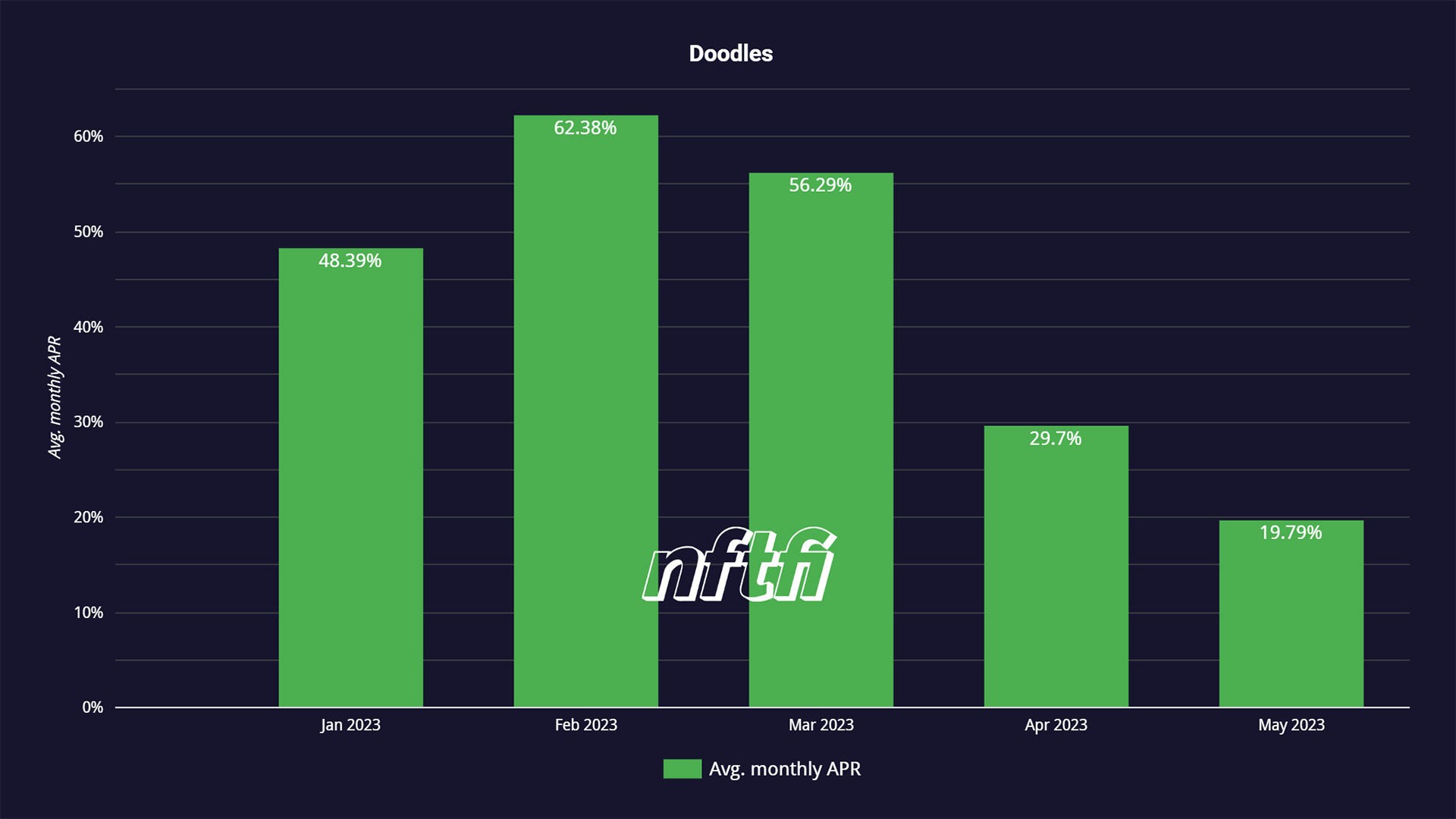

Decreasing APR: Borrowing with Doodles is becoming more affordable on NFTfi

The average APR (annual percentage rate) to date has been 46%, but in recent months it has been trending downward significantly, as the chart above shows. This means that borrowers are paying less interest when they borrow USDC, ETH or DAI with Doodles as collateral.

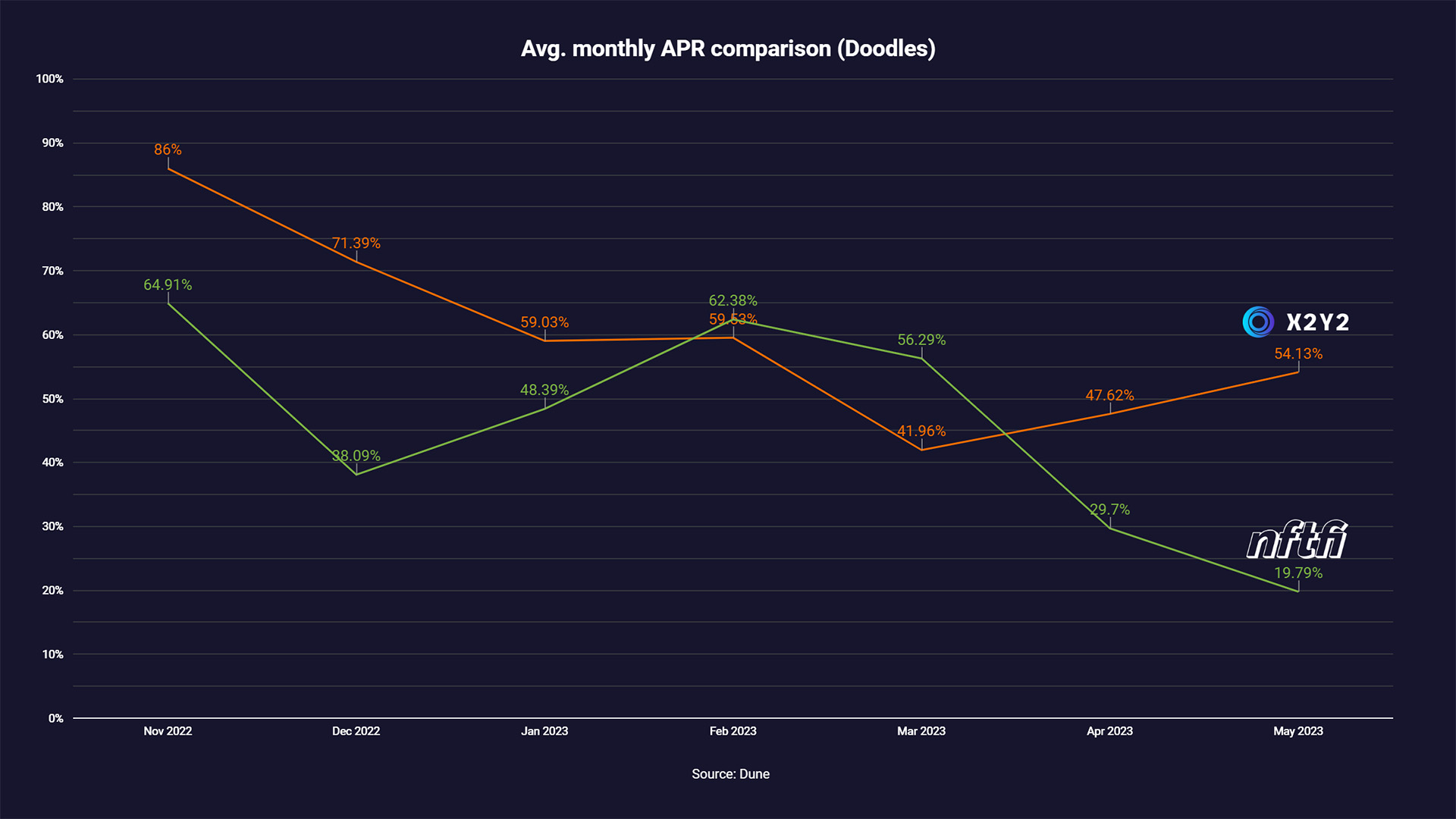

The chart below compares the average monthly APRs of Doodles loans on NFTfi (Dune source) and X2Y2 (Dune source). It shows that currently, borrowing on NFTfi is comparatively more affordable.

It is also important to note that APR can be misleading, as the length of NFT-collateralized loans tend to be much less than one year. The average duration of Doodles loans on NFTfi, for example, is 31 days. This means that the true loan cost (the interest the borrower actually pays at the end of the loan) is lower than the APR. For a guide to understanding both, see our blog post.

Benefit from NFTfi Rewards, the loyalty program for NFT lovers!

Our brand new loyalty program rewards lenders and borrowers with exclusive Earn Points. Click here to learn more!

If you are new to NFTfi, you can check out this video for a quick overview, and read our beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

To dive into the delightful world of Doodles, explore their website, Twitter and Discord!

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >