Earn Season 1: APR Incentive Update

July 05, 2023 ・ 4 min read

NFTfi Rewards Earn Season 1 went live on May 15th, designed to reward borrower-friendly loan terms and a responsible lending market.

After 6 weeks post-launch, the average loan APRs on NFTfi continue to drop and NFTfi is (at the time of writing) the leading NFT lending protocol by outstanding debt.

Today we’re making Earn Season 1 more inclusive.

More Earn Points for more users

Our Earn Season 1 announcement describes how Earn Points are currently calculated.

We are proud to have become the go-to NFT lending platform for long-term loans against high value assets such as CryptoPunks, Autoglyphs and Chromie Squiggles - these (typically low APR) loans maximally benefit from the current Earn Point reward structure.

One other strength of NFTfi is that we offer the widest selection of collateral of all NFT lending platforms (almost 500 collections). Following community feedback, we recognize the need to make Earn Season 1 more inclusive for more users and collateral types.

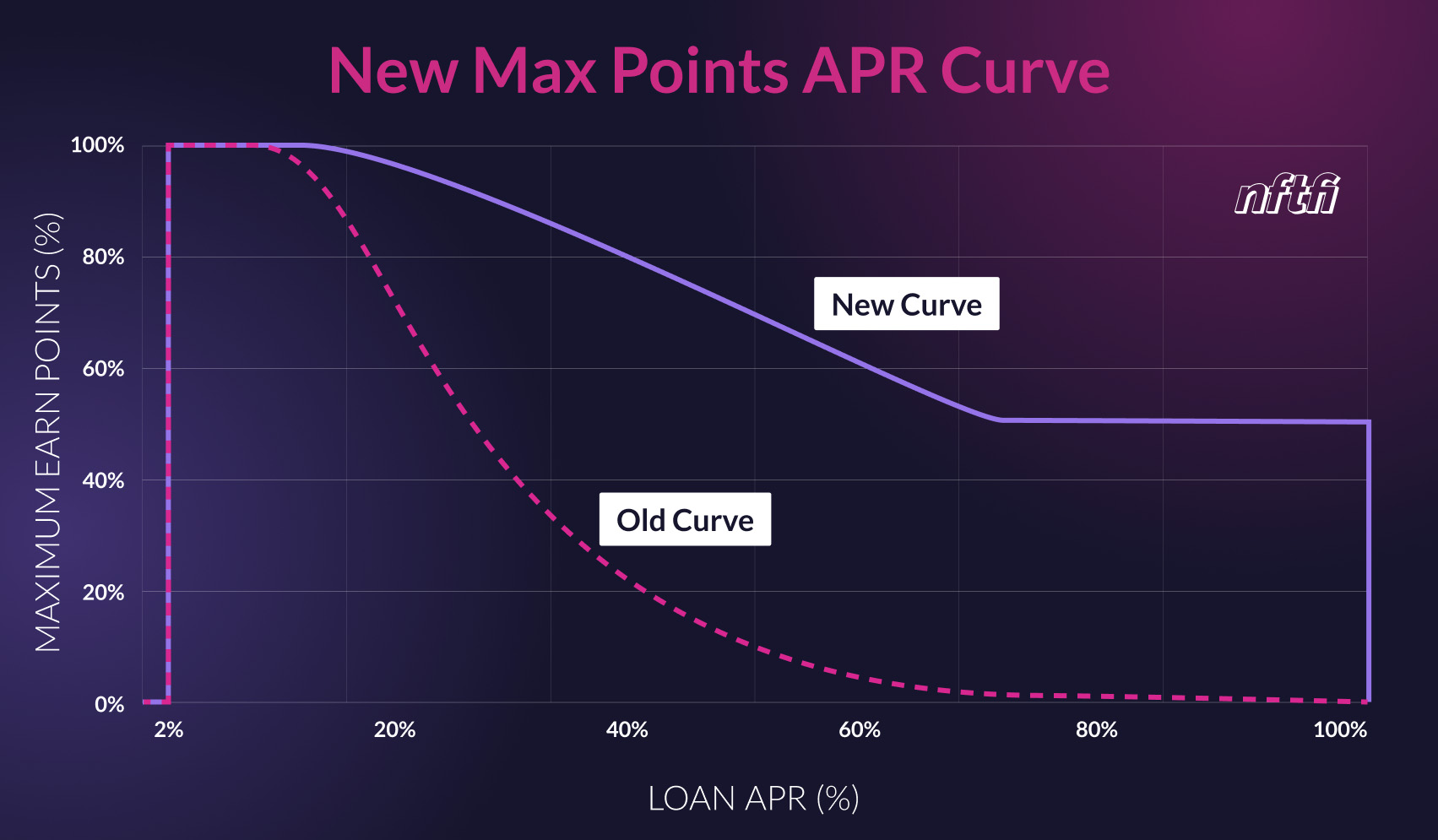

New Max Point APR Curve

Today we are changing the points formula to more generously reward more users with Earn Points. The maximum points a given loan can receive now drop off much slower and plateau at 50% of max points for loans between 70-100% APR. Loans with APRs over 100% do not earn points.

The new Max Point APR Curve will be activated today at 2 PM CET / 8 AM ET / 5 AM PT and only applies to loans initiated thereafter. Any loans initiated before this time and still ongoing will receive points according to the previous curve.

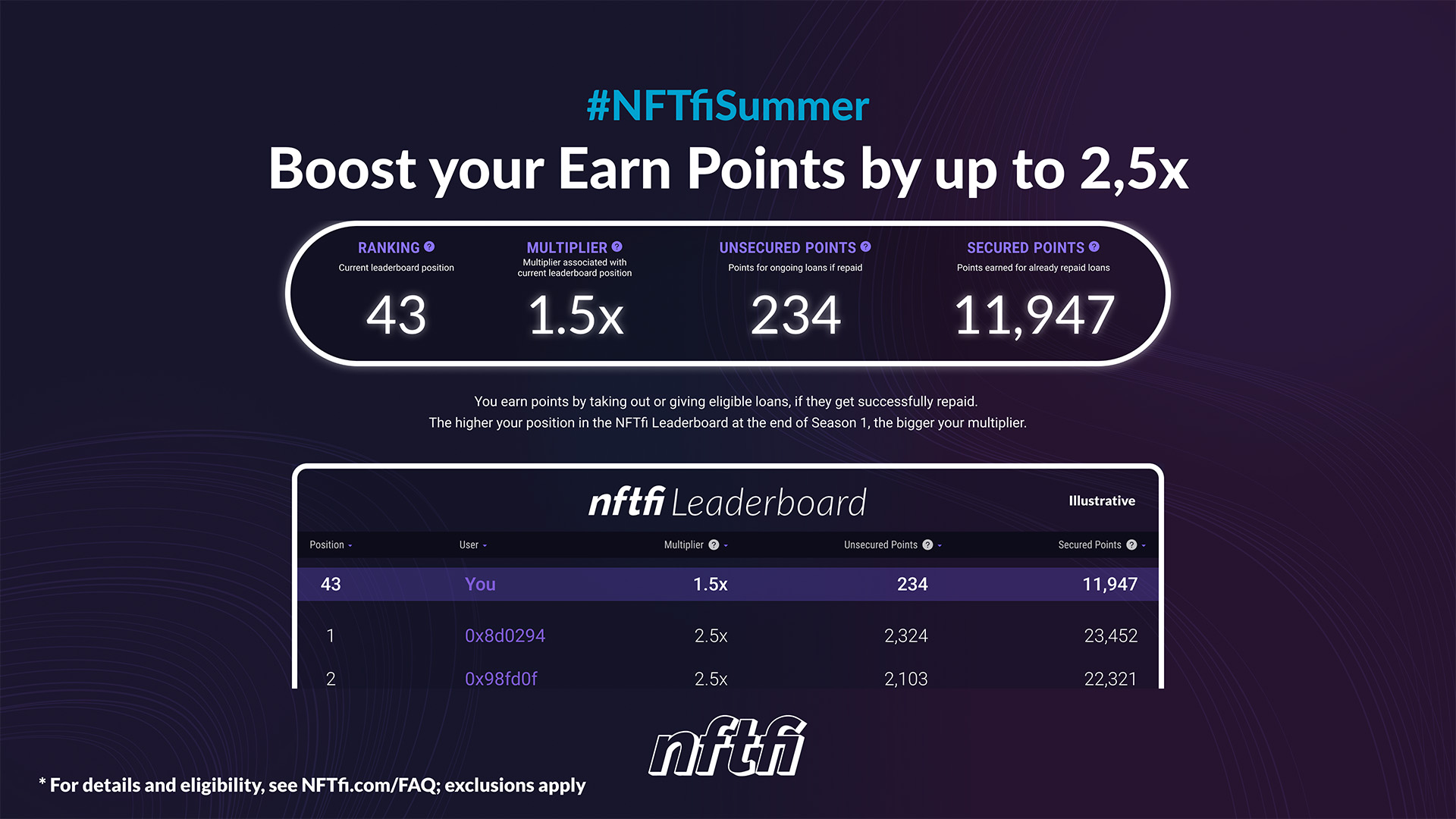

Boost your Earn Points by up to 2,5x

Remember that the 500 wallets with most secured points by the end of Season 1 will get a multiplier of up to 2.5x on their final balance. Earn Season 1 is currently planned to end in 3-4 months. The new Max Point APR Curve will make it much easier for more users to break into the top 500 and secure their multipliers still in time.

This incentive update will contribute to more borrower-friendly loan terms for a much larger range of collections than before, and more fairly reward more users with Earn Points.

We remain committed to making any necessary changes in the future to further promote responsible lending, and keep NFTfi the most borrower-friendly NFT lending platform.

This is not an offer of tokens or securities. Currently, reward points are not redeemable and simply show the loyalty level of a user. However, they are planned to become redeemable for benefits at a later point in time for eligible persons. U.S. residents, other U.S. persons, UK residents, other UK persons, and residents of countries or regions subject to sanctions, embargoes, or other restrictions imposed by the United States government or other applicable international authorities as well as persons subject to sanctions imposed by applicable international authorities are not eligible persons, and their points will not be redeemable. The eligibility of non-U.S. persons is at NFTfi's sole discretion and may take into account regulatory circumstances per jurisdiction. NFTfi makes no guarantees or promises regarding the issuance of any blockchain tokens. The timeline for a token issuance, whether or not an issuance occurs, and the conversion rate between reward points and tokens are all at NFTfi's sole discretion.

This blog post is for informational purposes only and should not be construed as financial or investment advice. Investments in loans carry inherent risks, and the value of NFTs can be highly volatile. Users should carefully consider their risk tolerance and investment objectives before taking out loans. Refer to the NFTfi Rewards FAQ and the NFTfi Terms and Conditions for more details before participating in the loyalty program.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >