How to start lending on NFTfi?

August 28, 2022 ・ 4 min read

Lenders offer wETH or DAI to borrowers. Borrowers offer their NFTs as collateral for the loans that lenders make possible.

As a lender, you can earn interest for your lending services.

If a borrower defaults on his loan, you can foreclose the loan and get their NFT.

PLEASE NOTE!

This lending guide is made using the Ethereum testnet. Testnet is used for testing purposes only, the tokens have no monetary value, but the testnet works the same as the mainnet.

Please make sure that you have connected your Metamask and are on the Ethereum Mainnet network before you start using NFTfi.

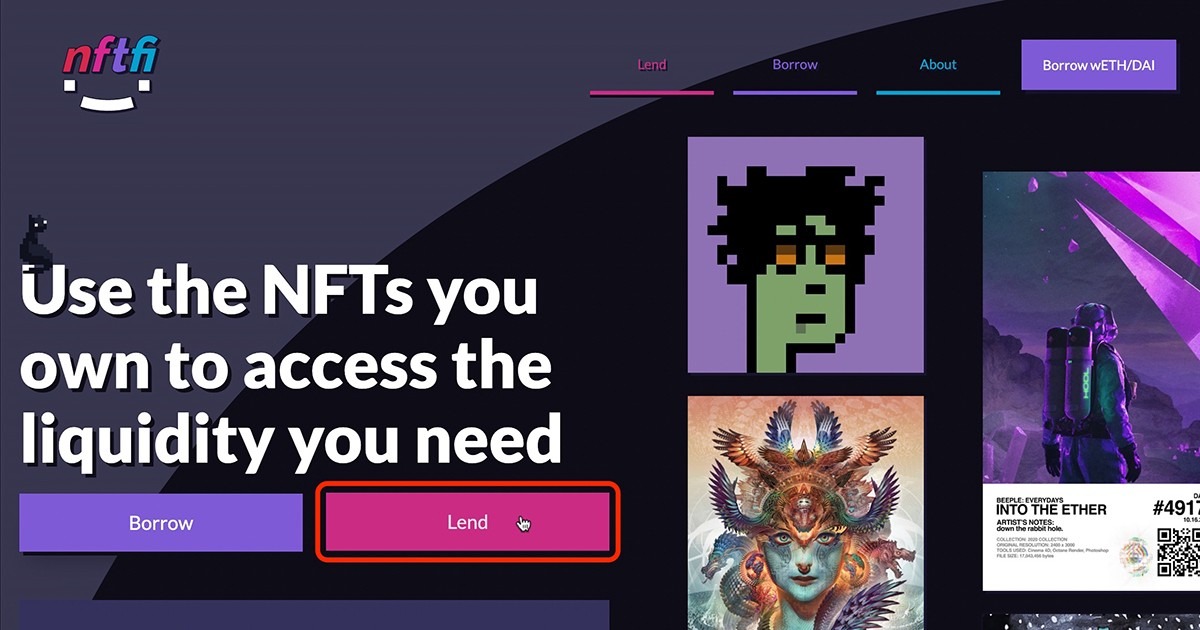

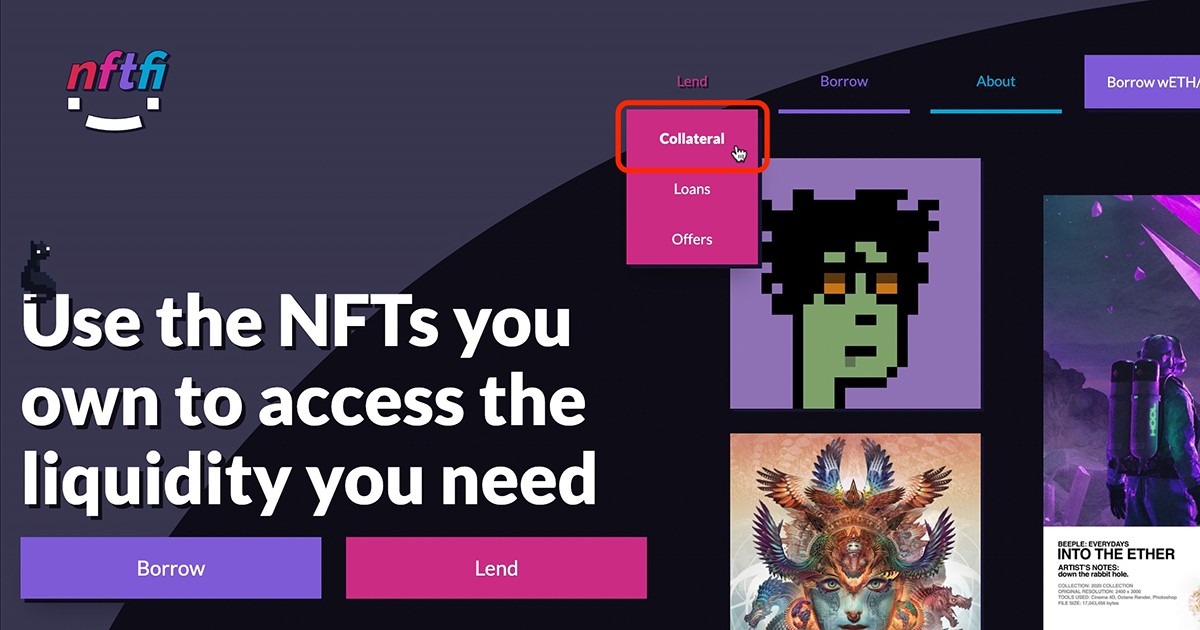

Making an offer

Step 1

In order to make a loan offer on NFTfi, you need to click the Lend button on the homepage.

You can also click Collateral in the Lend main navigation menu.

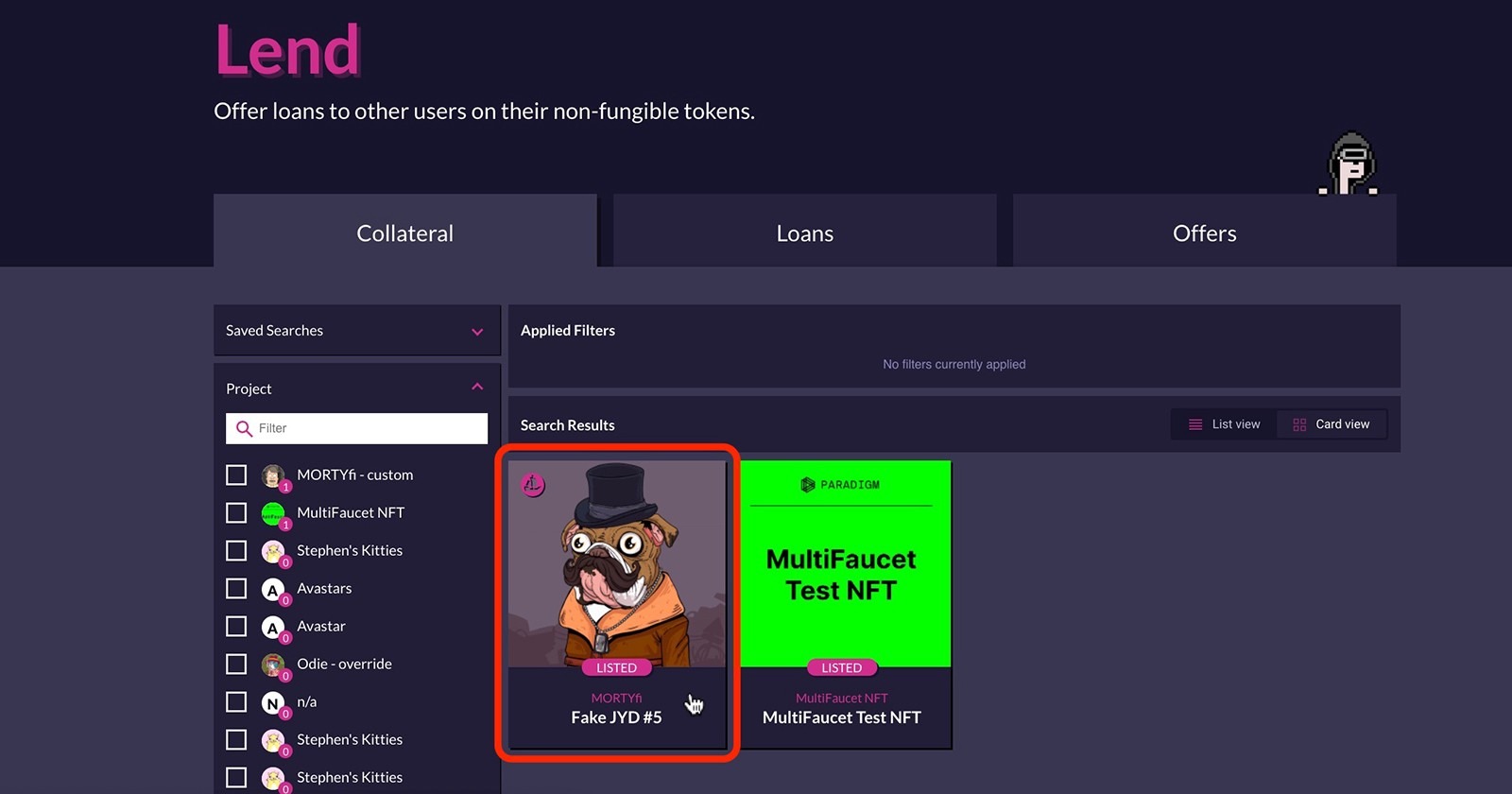

Step 2

Here you can browse different collections and NFT assets. Choose and click on the NFT that you would like to lend against.

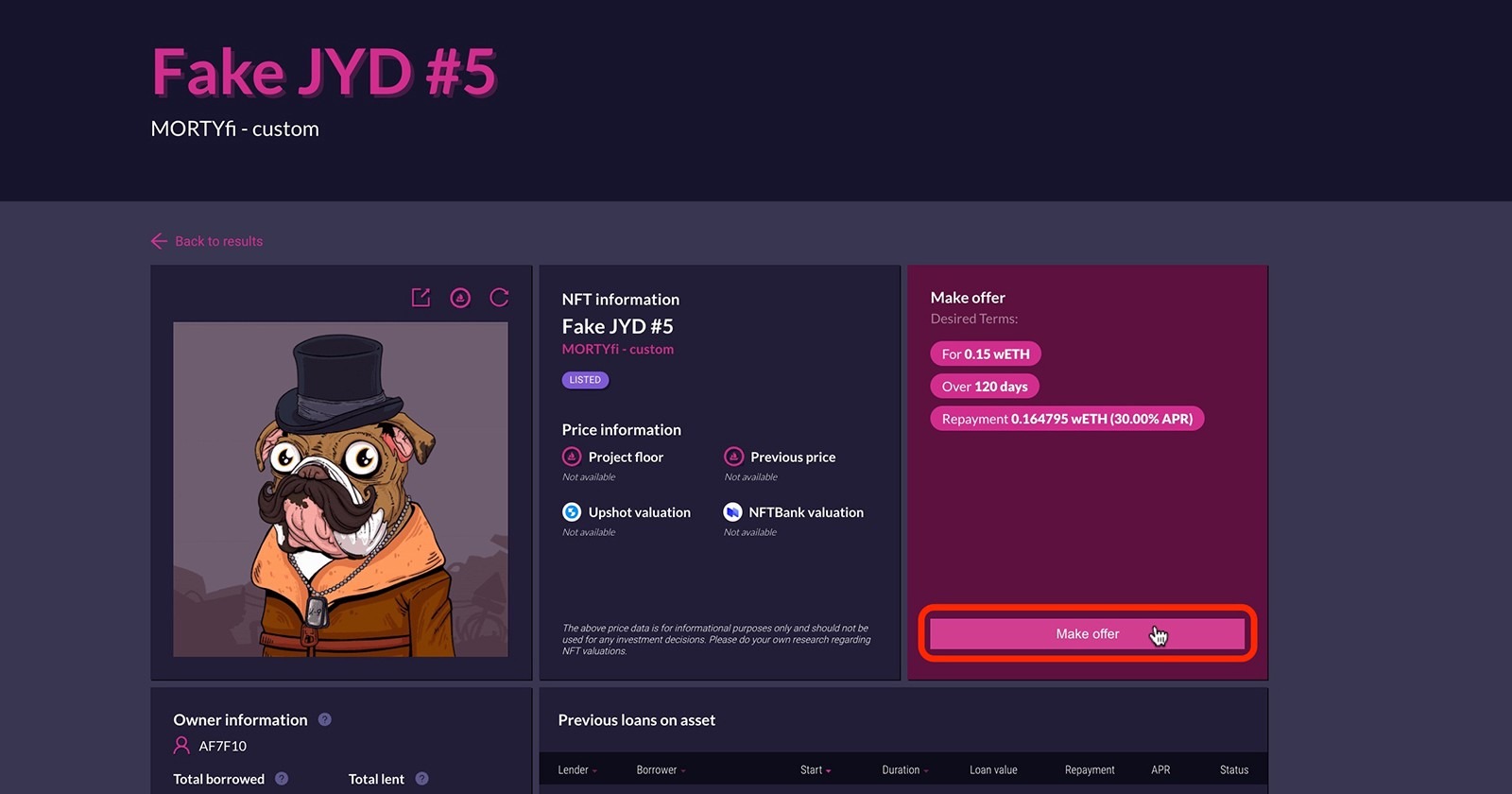

Step 3

To place an offer for the NFT asset, click Make offer.

Step 4

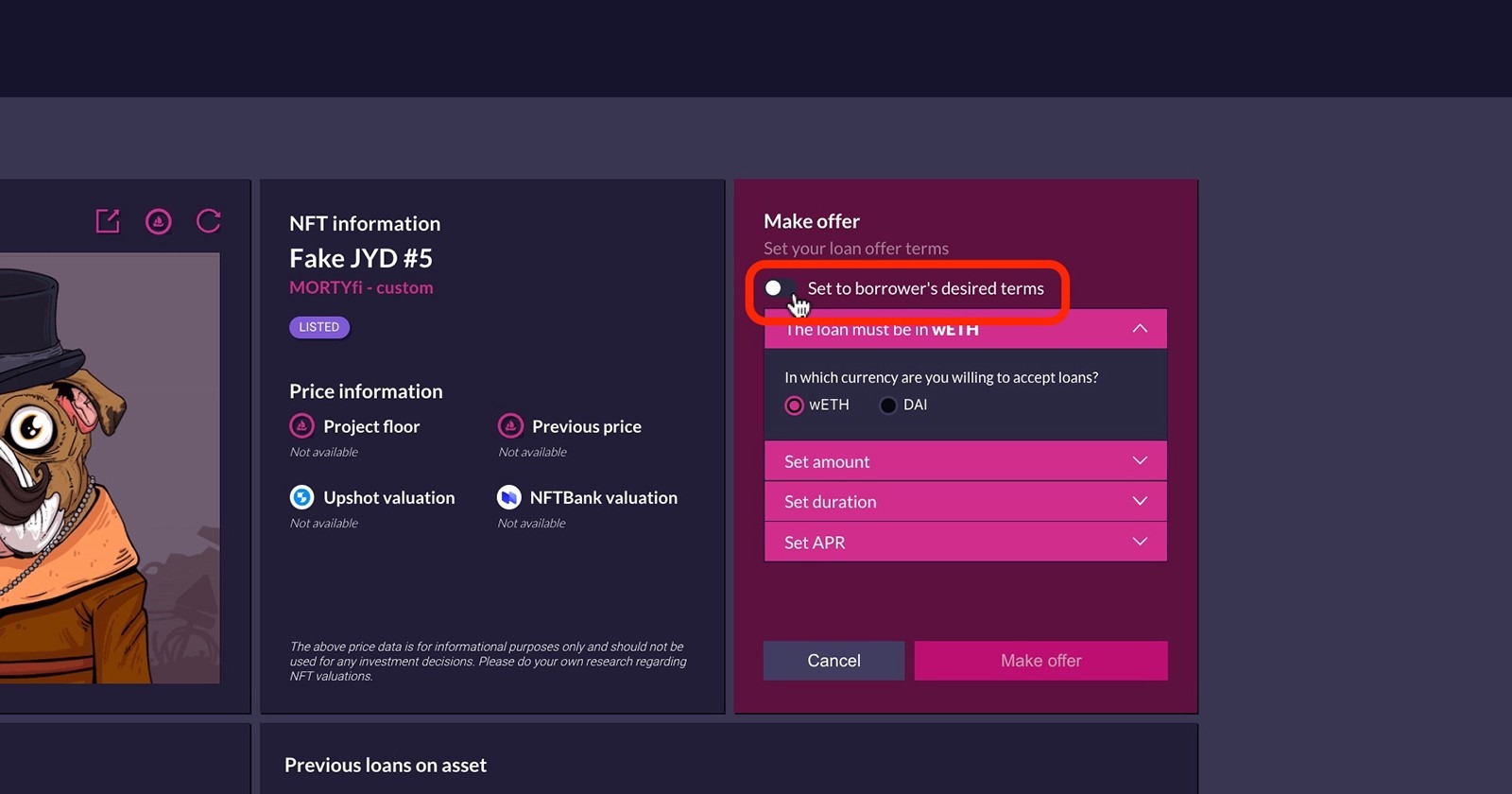

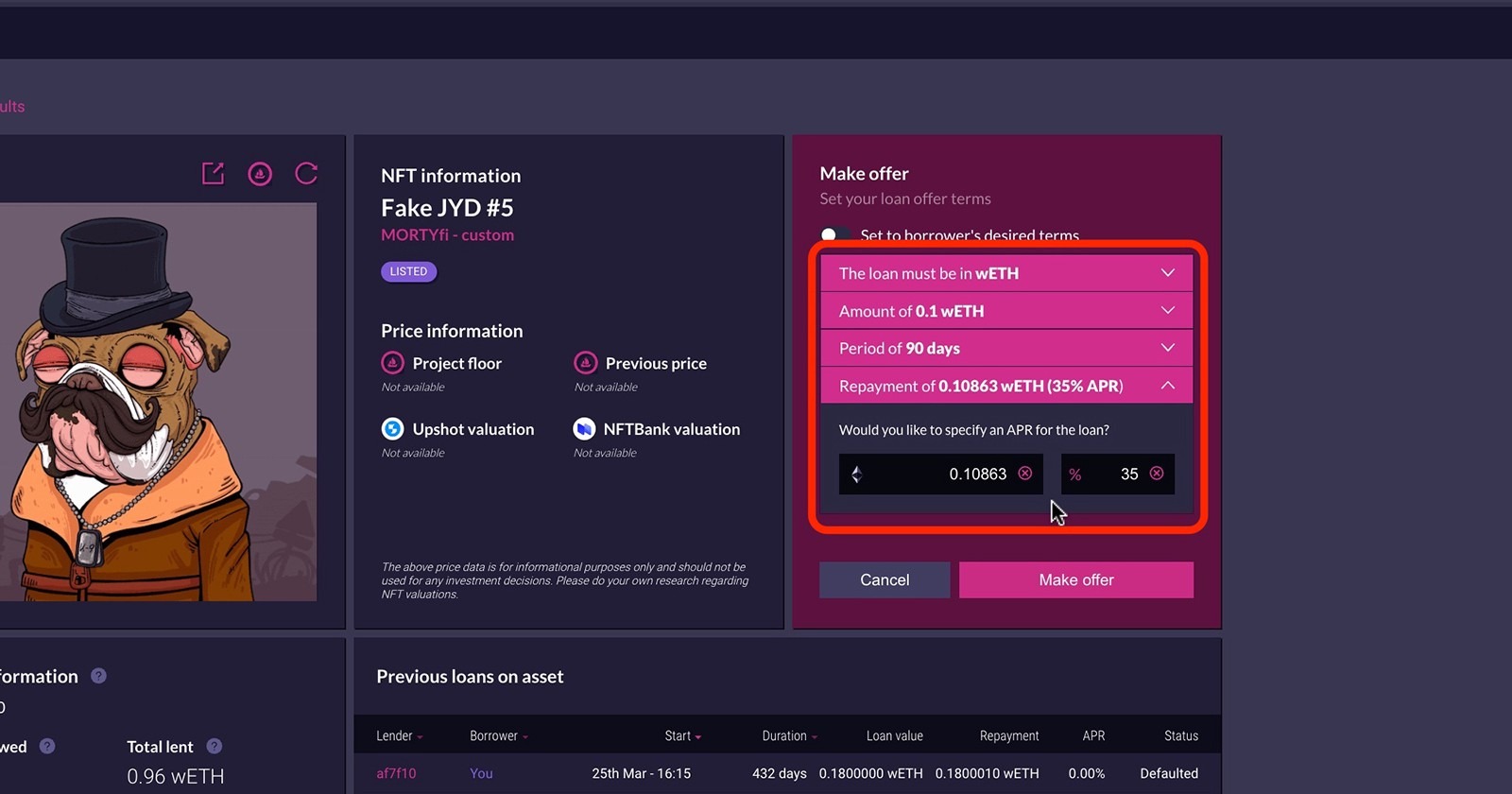

If you toggle the Set to borrower’s desired terms, you can prefill the loan terms accordingly.

If you’d like to offer terms different from the borrower’s, you can set your loan terms in this section.

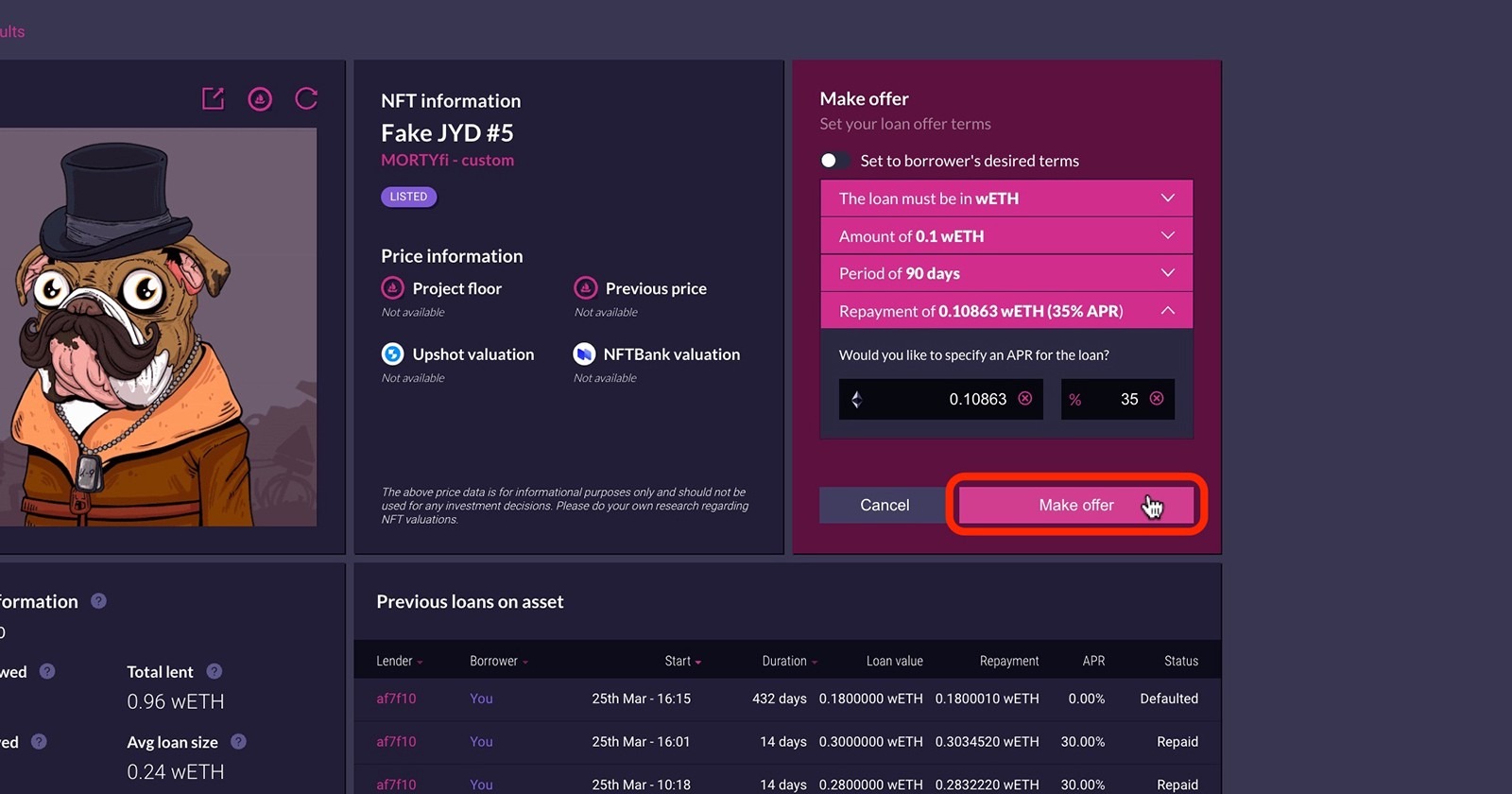

Once you are happy with the loan terms you’d like to offer, click Make offer.

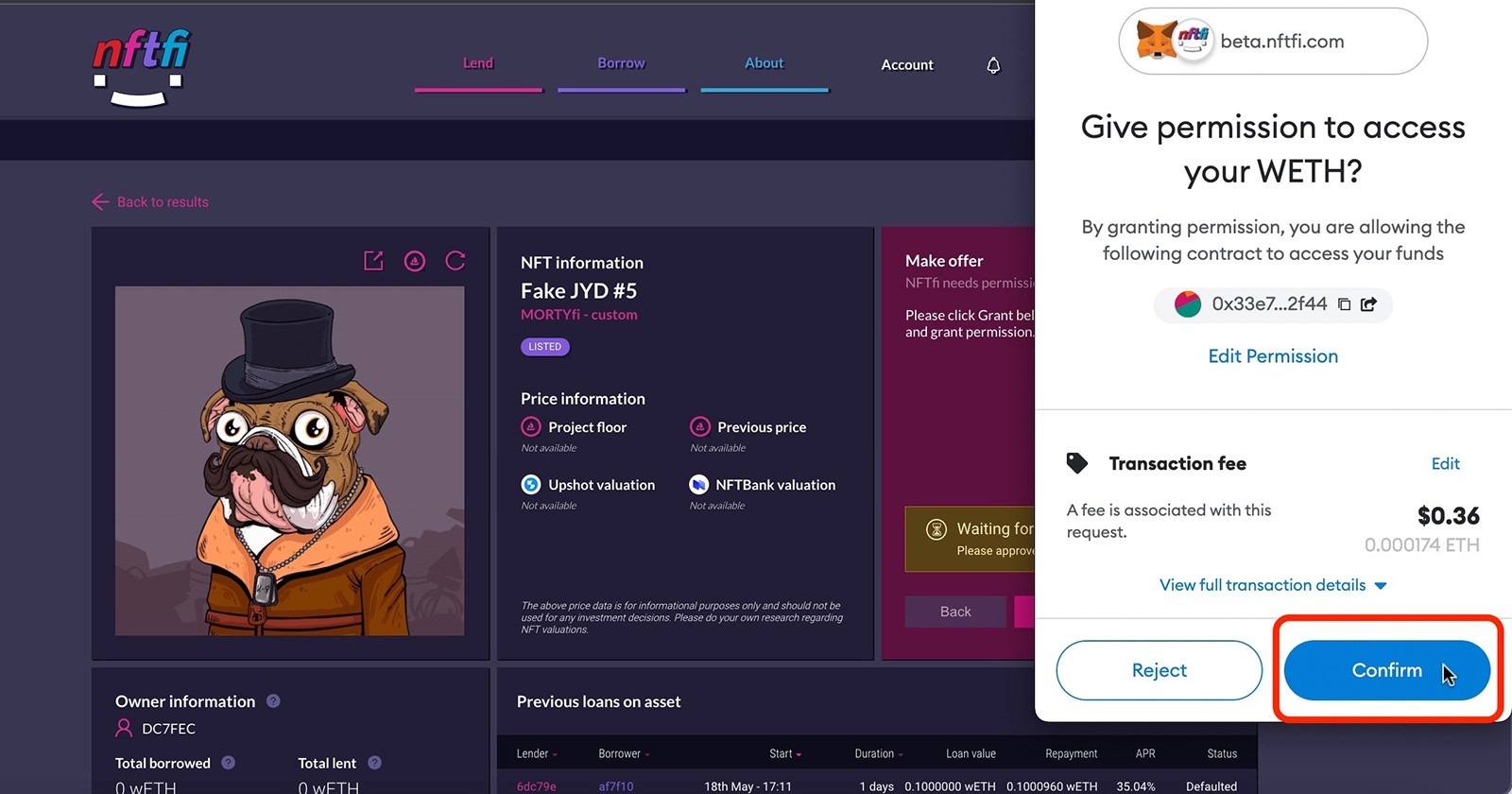

Step 5

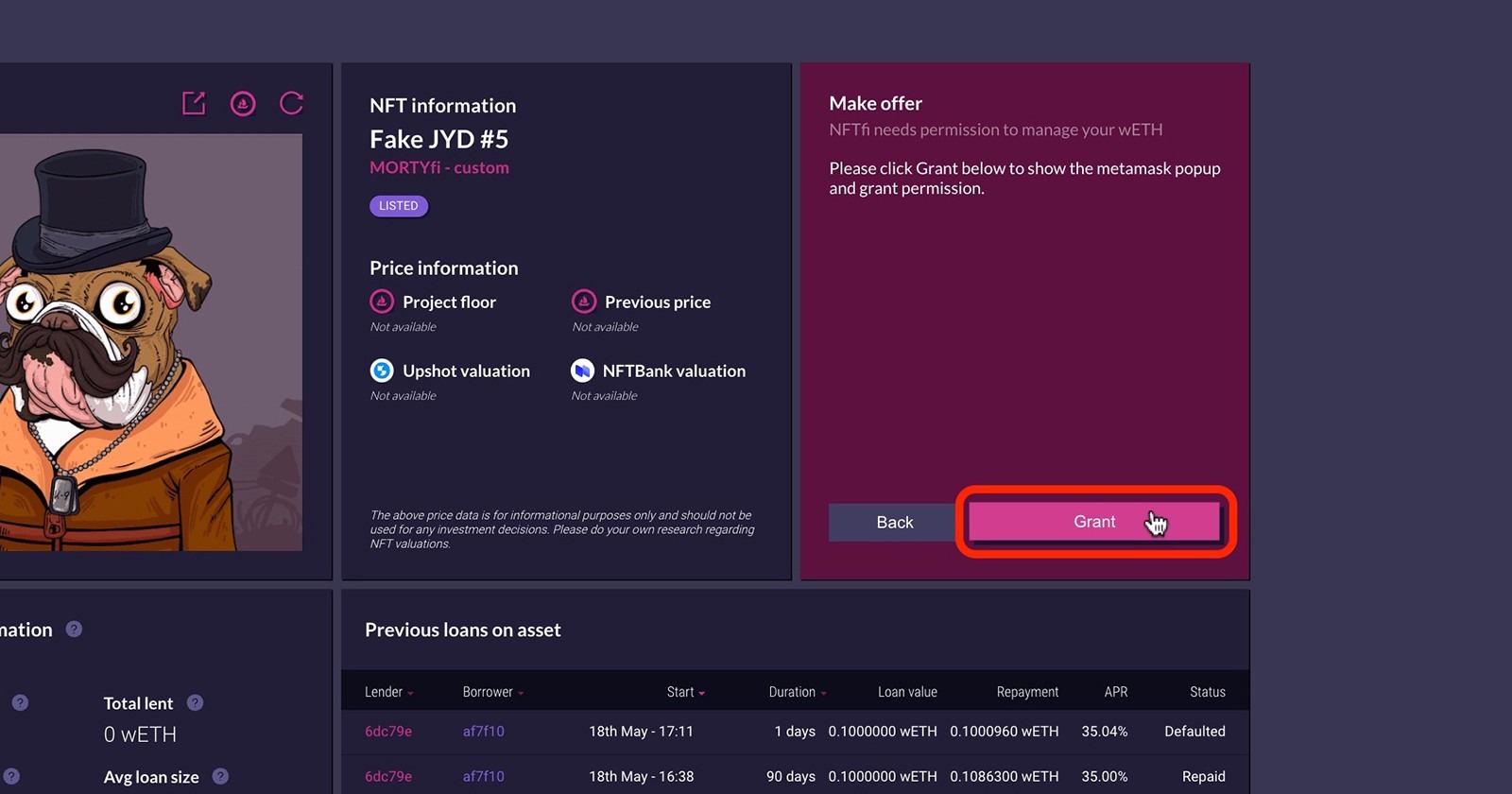

If you are a new user and this is your first offer on NFTfi, you will need to grant permission to access wETH (or DAI) from your wallet. You will need to grant that permission only once, and you will no longer see this request for your next offers.

Click Grant.

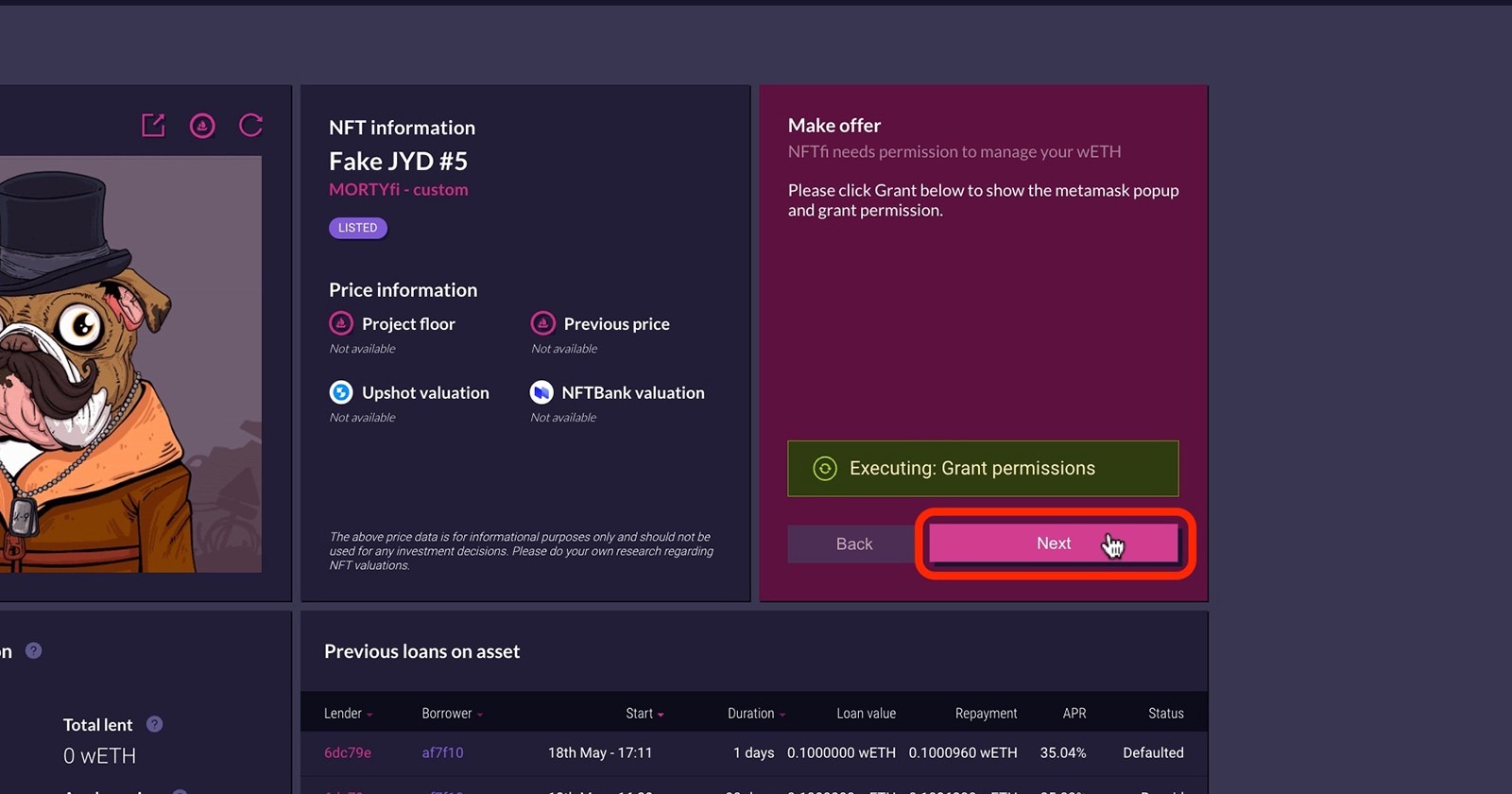

Step 6

Confirm granting permission in your Metamask by clicking Confirm. Please note that you will need to pay a gas fee for that transaction.

Click Next to proceed.

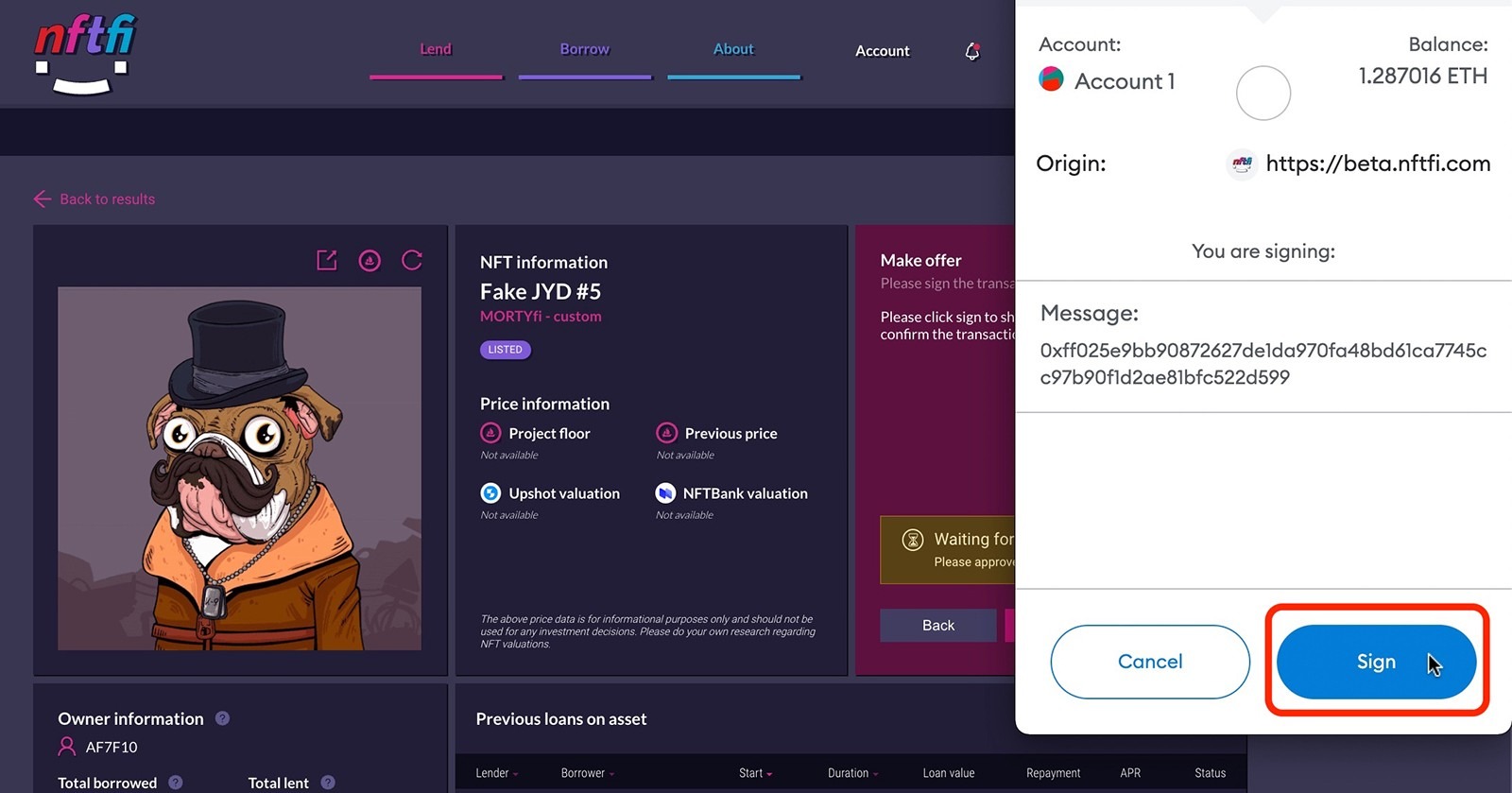

Step 7

At this point, you will need to sign the transaction in your Metamask wallet by clicking Sign.

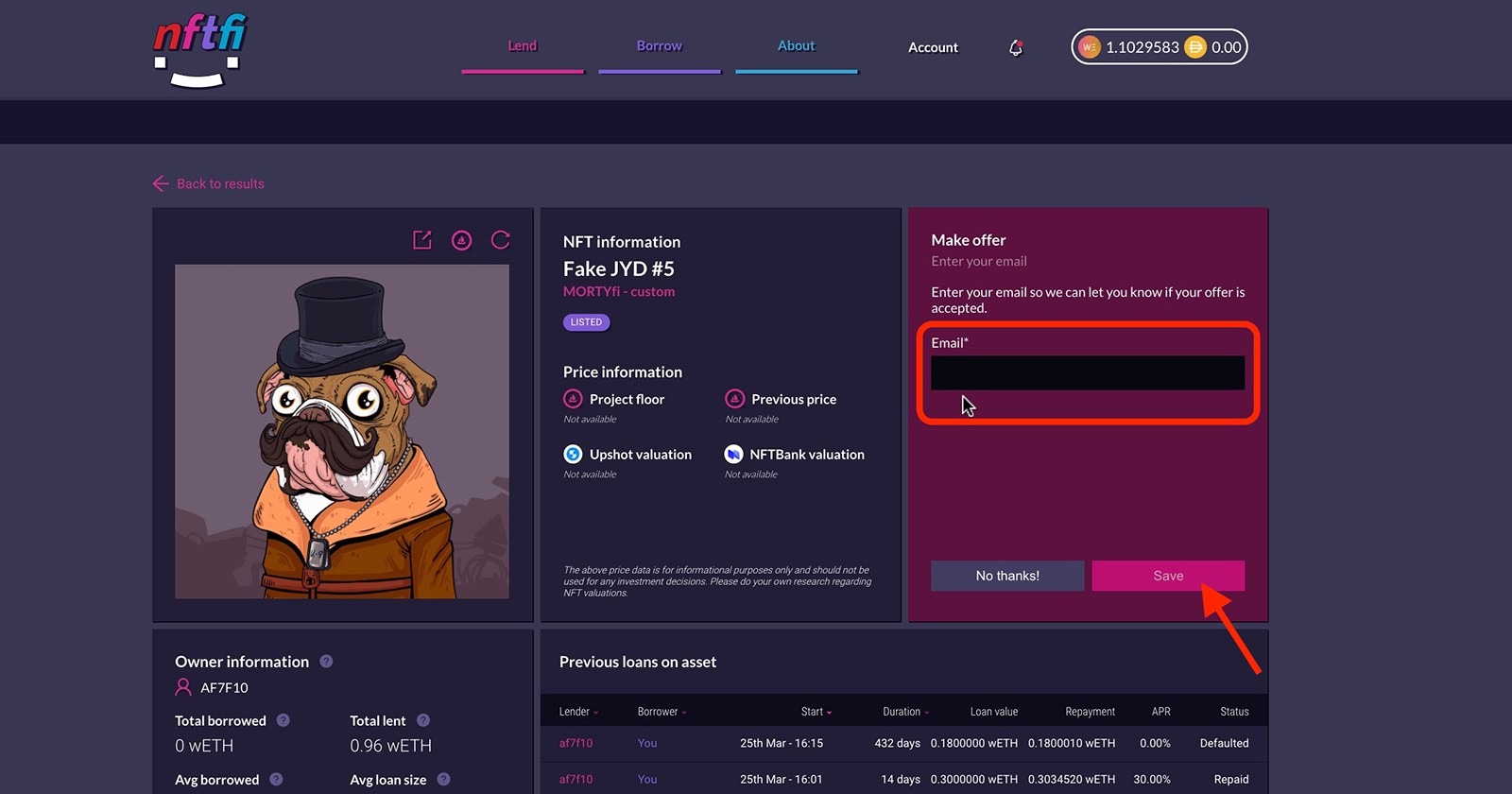

Step 8

If you’d like NFTfi to send you an email notification when your offer is accepted, please fill out the email field and click Save.

You can also see notifications on your NFTfi account under the bell icon next to Account.

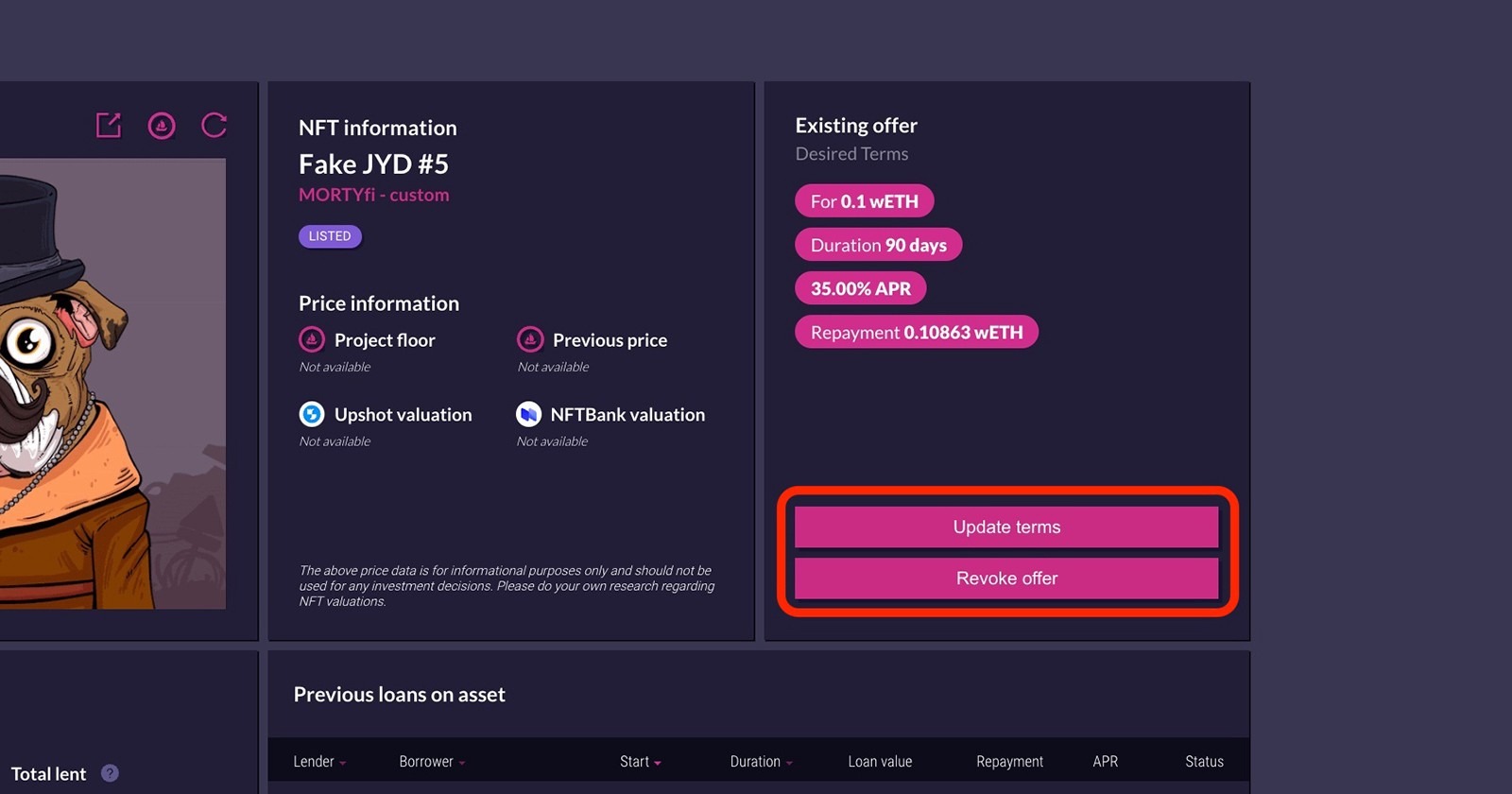

Step 9

Congratulations, you just made your first loan offer! The borrower will be able to see your loan offer, and if accepted, his NFT will enter an escrow smart contract, and he will receive your funds (as agreed in the loan offer).

Please note that you can update the terms or revoke your offer at any time until it’s accepted.

If the borrower repays your loan, you will get the funds immediately. No further action is required.

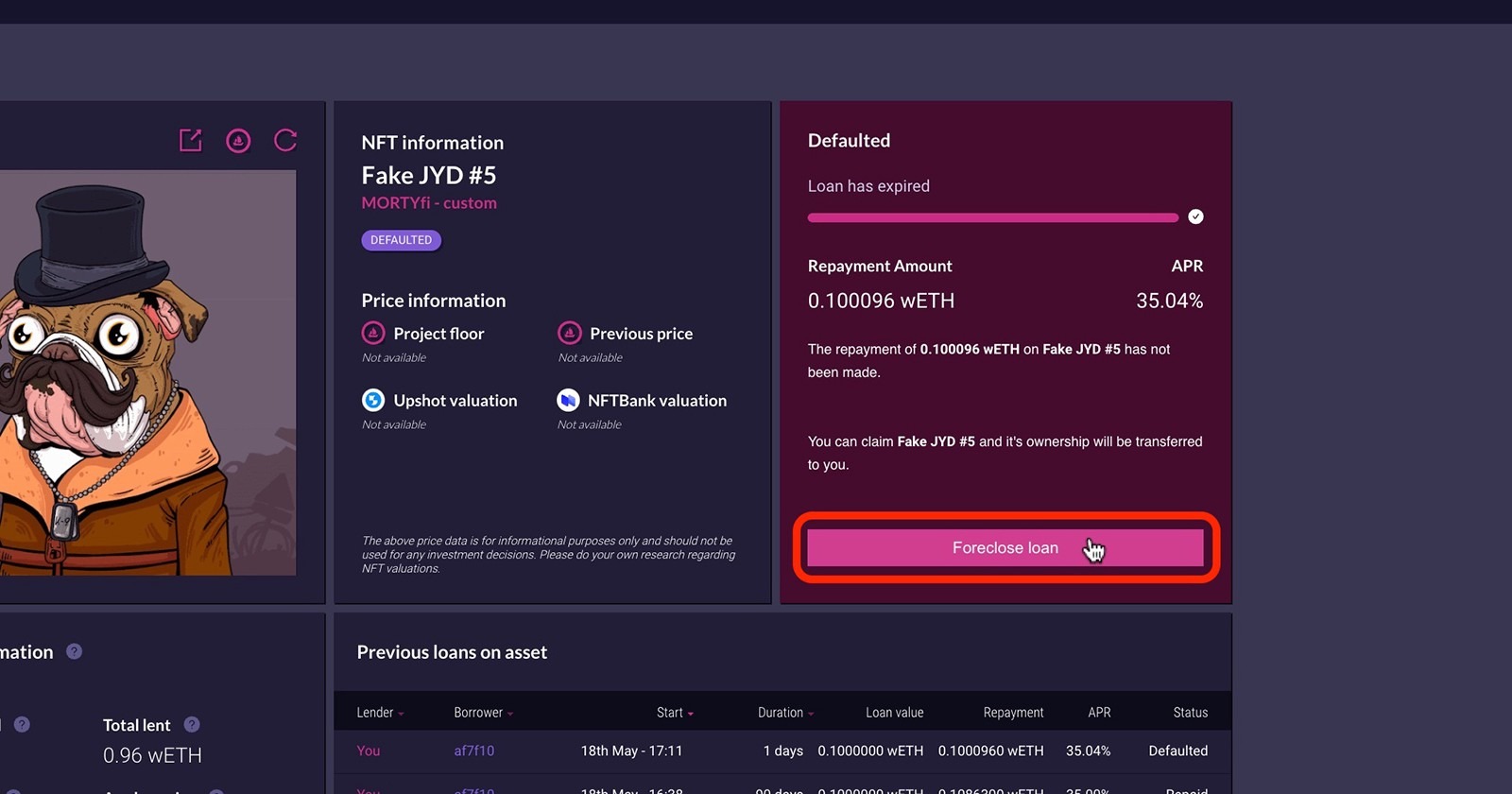

If the borrower defaults (does not repay the loan on time), you have the option to foreclose the loan and get the NFT that was placed as collateral.

Foreclosing a loan

Step 1

If the repayment has not been made by the borrower by the loan due date, then you can claim the NFT, and its ownership will be transferred to you.

Go to the asset page, and click the Foreclose loan button.

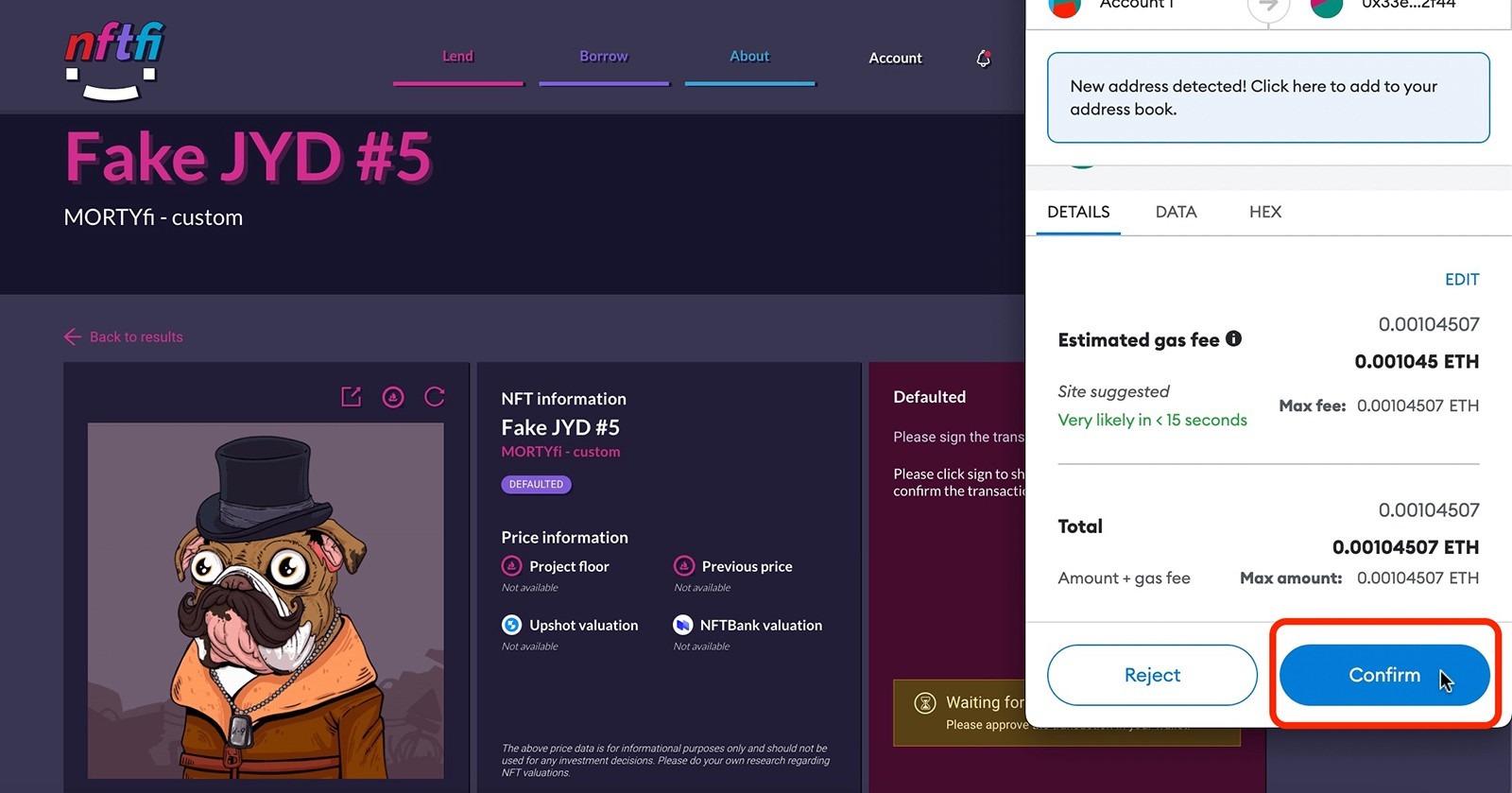

Step 2

You need to confirm the transaction in your Metamask (please note that you will need to pay a gas fee). Click Confirm.

Once confirmed, the NFT will be sent to your wallet.

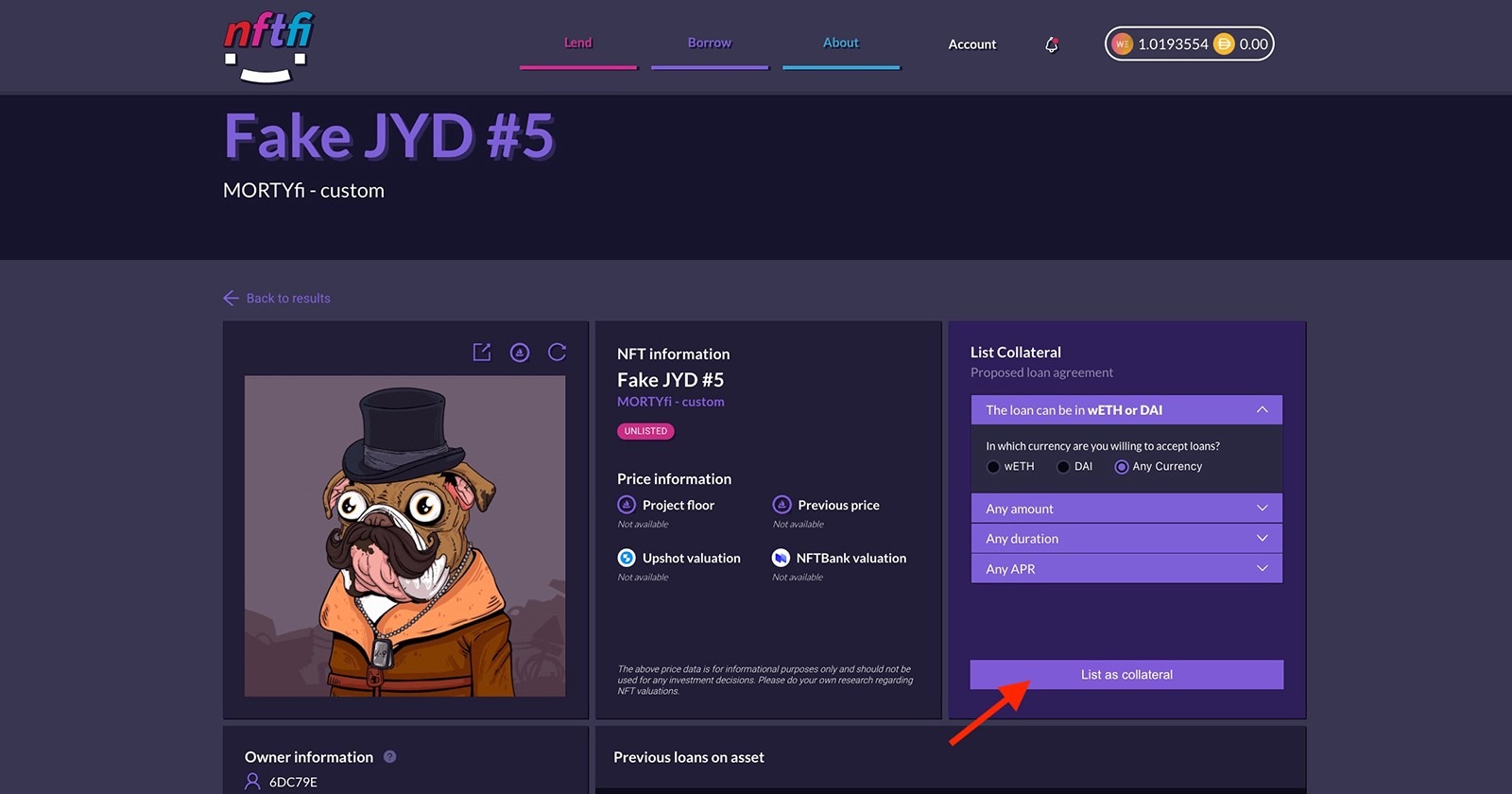

It will also show in your NFTfi account, and you will be able to list it as collateral yourself at any point if you wish to do so.

Follow us on Twitter and join our awesome Discord community if you need more help with lending on NFTfi.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >