How to use Private Offers?

September 28, 2022 ・ 3 min read

What are private offers?

Lenders can use private offers to make a loan offer to potential borrowers for assets that are not publicly listed.

Private offers can also be used by friends or parties who know each other but would like to facilitate a loan without listing an asset on NFTfi.

Please note that for this feature, although the NFT can be owned by people who have not used NFTfi before, the NFT still has to be from a collection already listed on the platform.

How to use private offers on NFTfi?

First, we will cover private offers from the lender’s perspective and then from the borrower's perspective.

Private offers from the lender’s perspective

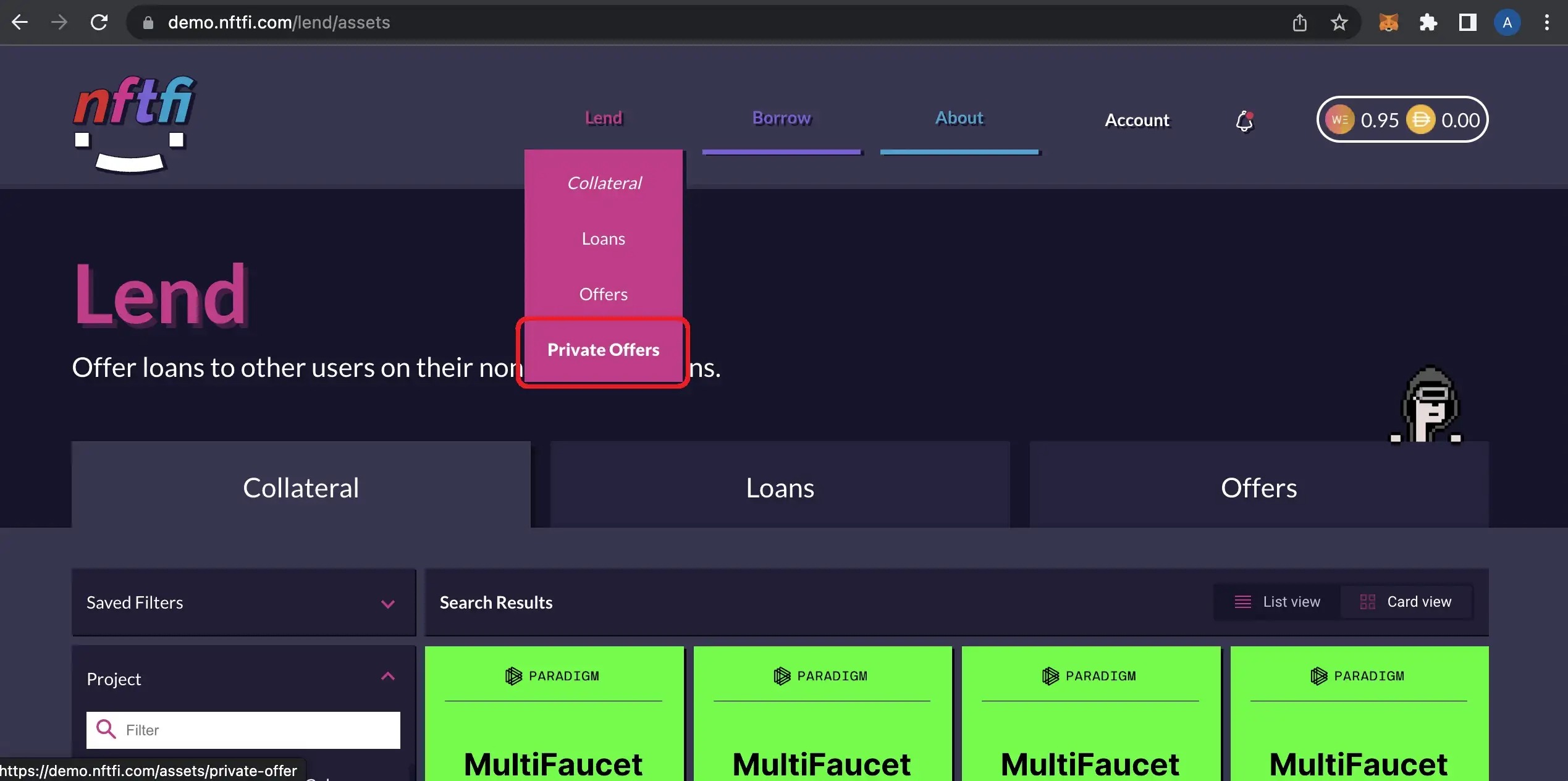

Click “Lend” and then “Private Offers.”

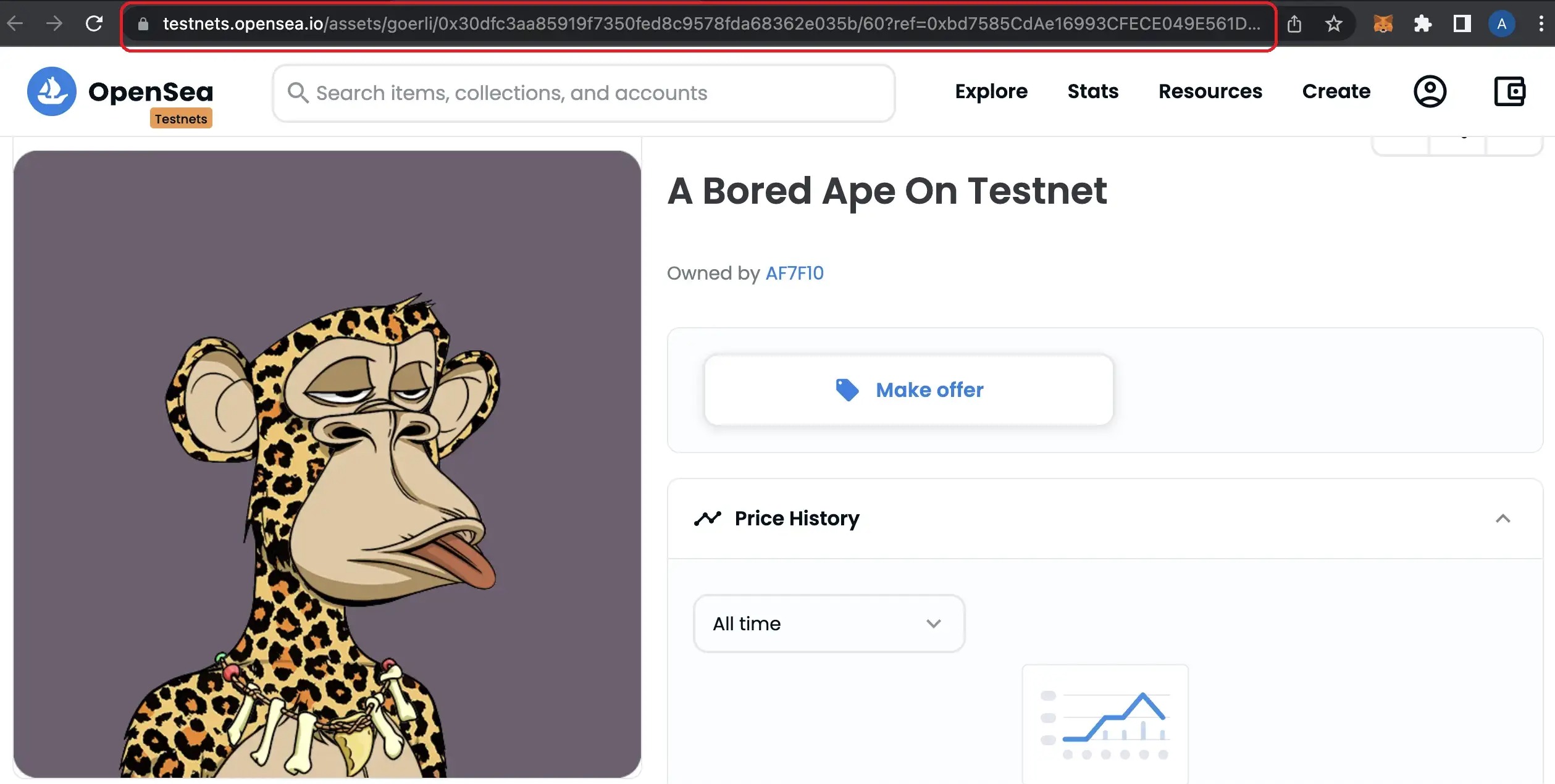

Now you will need to get the URL of the asset for which you want to make a loan offer on opensea.io and copy it.

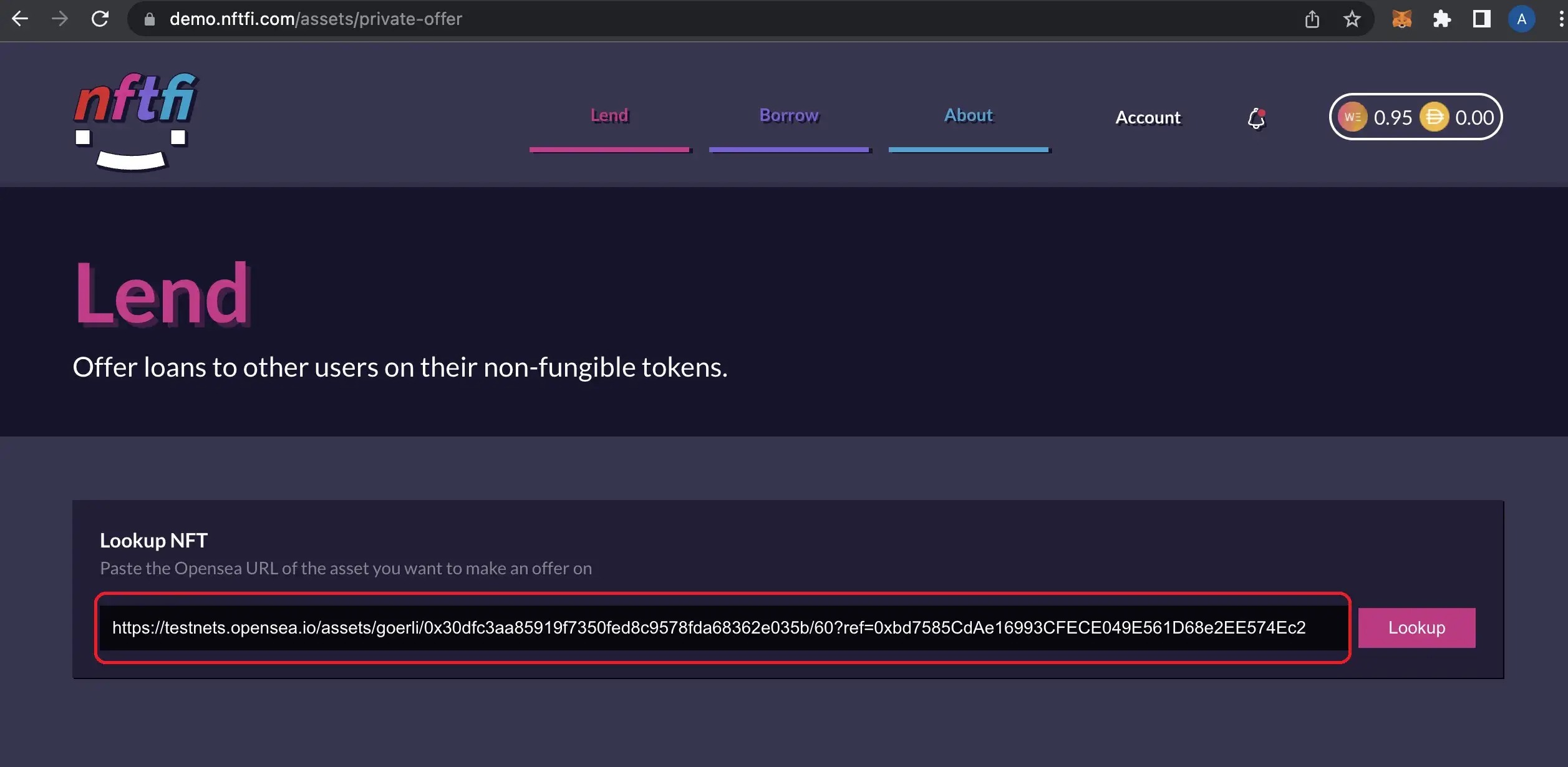

Paste the URL in the field and press the “Lookup” button.

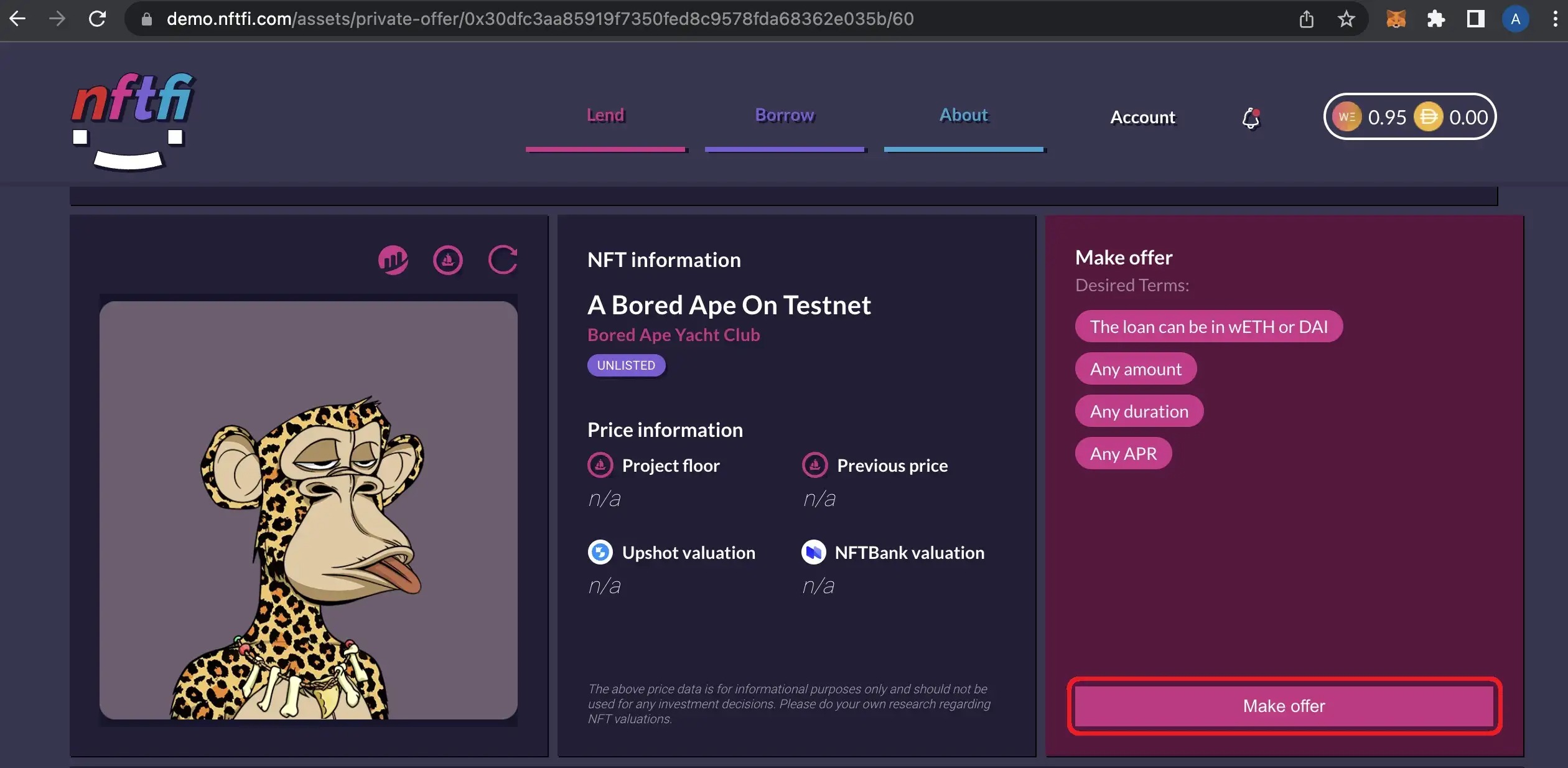

You will see the asset’s page, which will show the NFT as unlisted (if the asset happens to be listed already, please note that other lenders can make offers). Click “Make offer.”

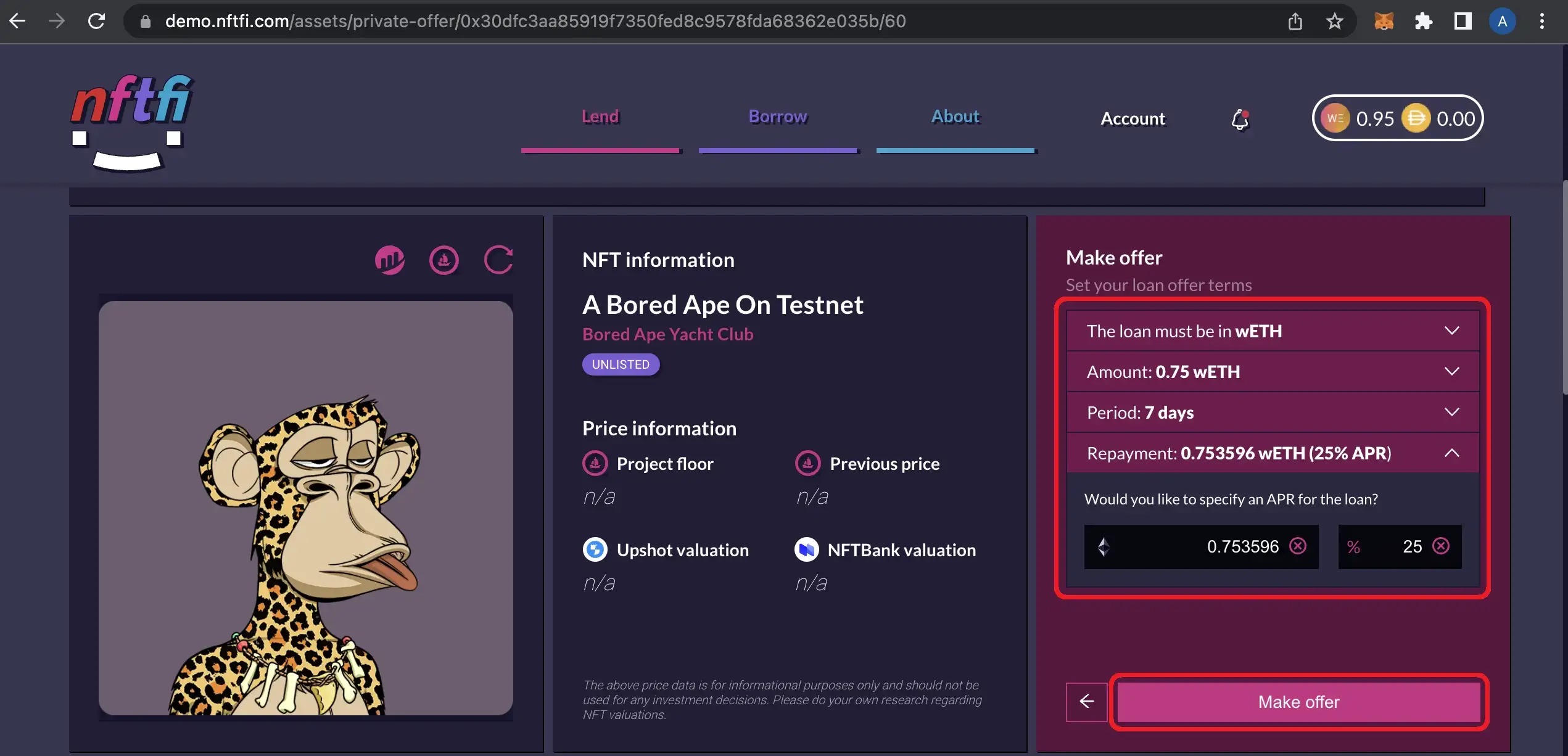

Fill out the loan offer terms and click “Make offer.”

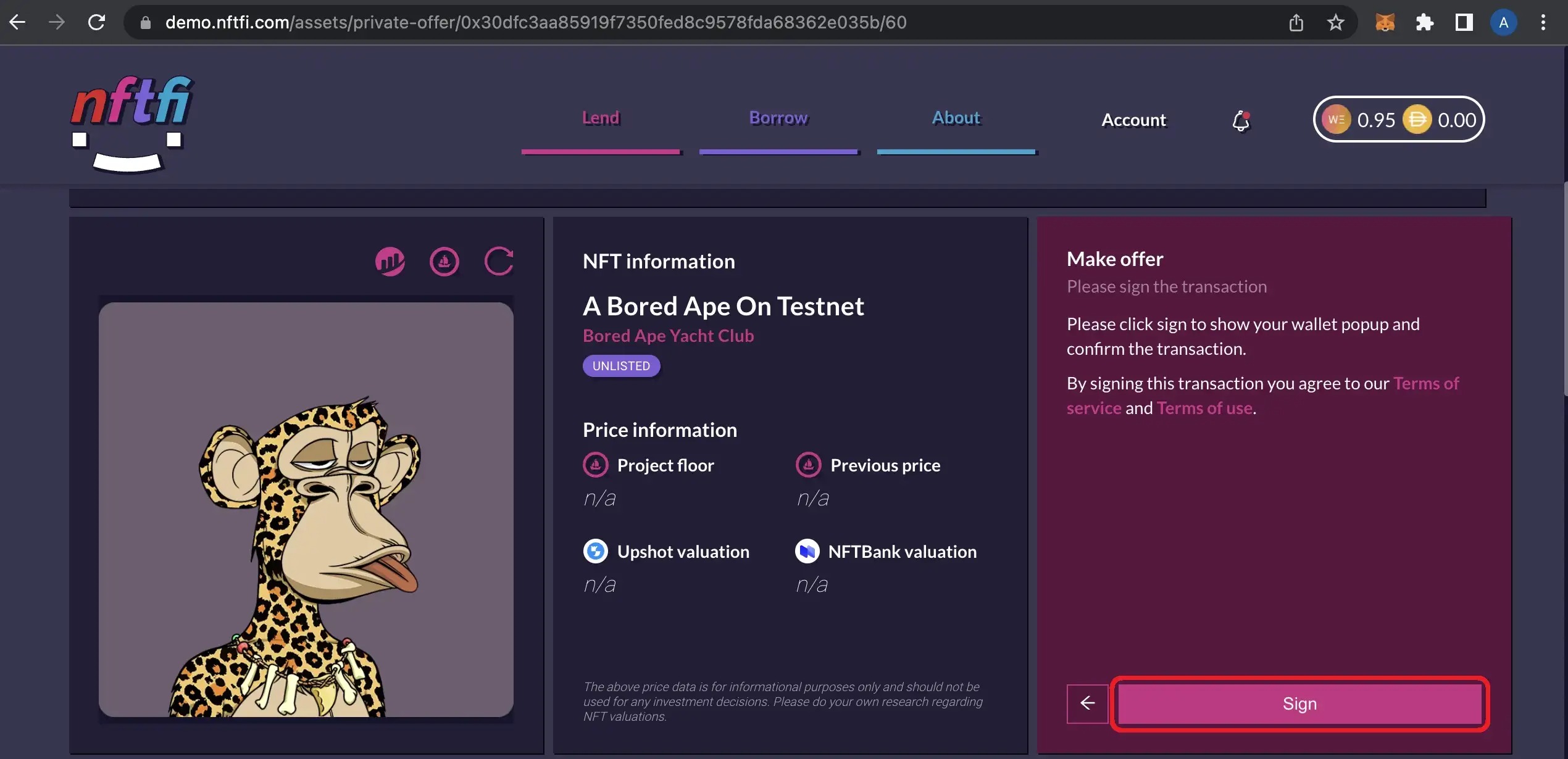

Sign the transaction to confirm the offer.

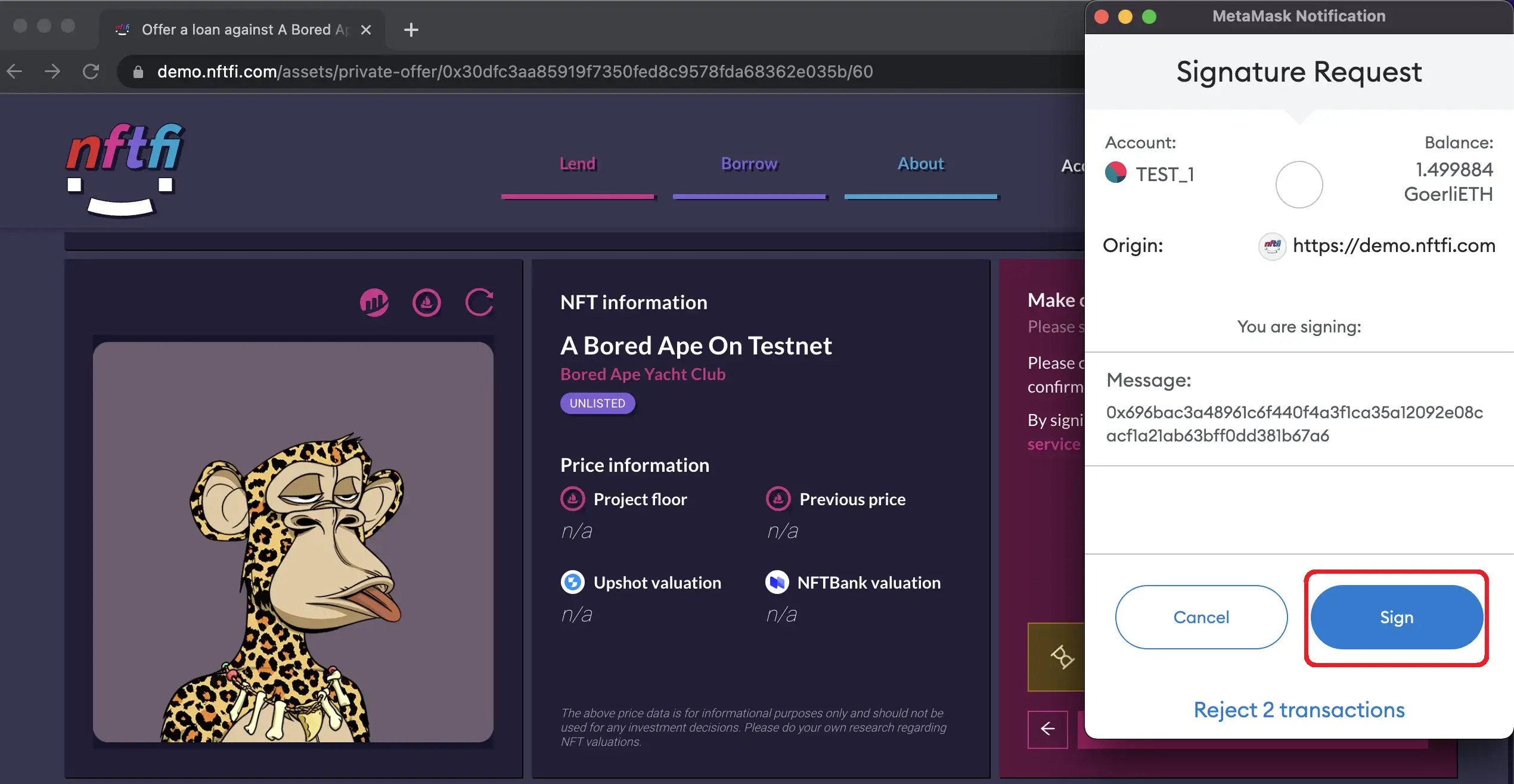

Once the wallet popup opens, click “Sign.”

Your offer has been created, and you can now share its URL with the asset owner. You can also update the terms or revoke the offer before it has been accepted.

Private offers from the borrower’s perspective

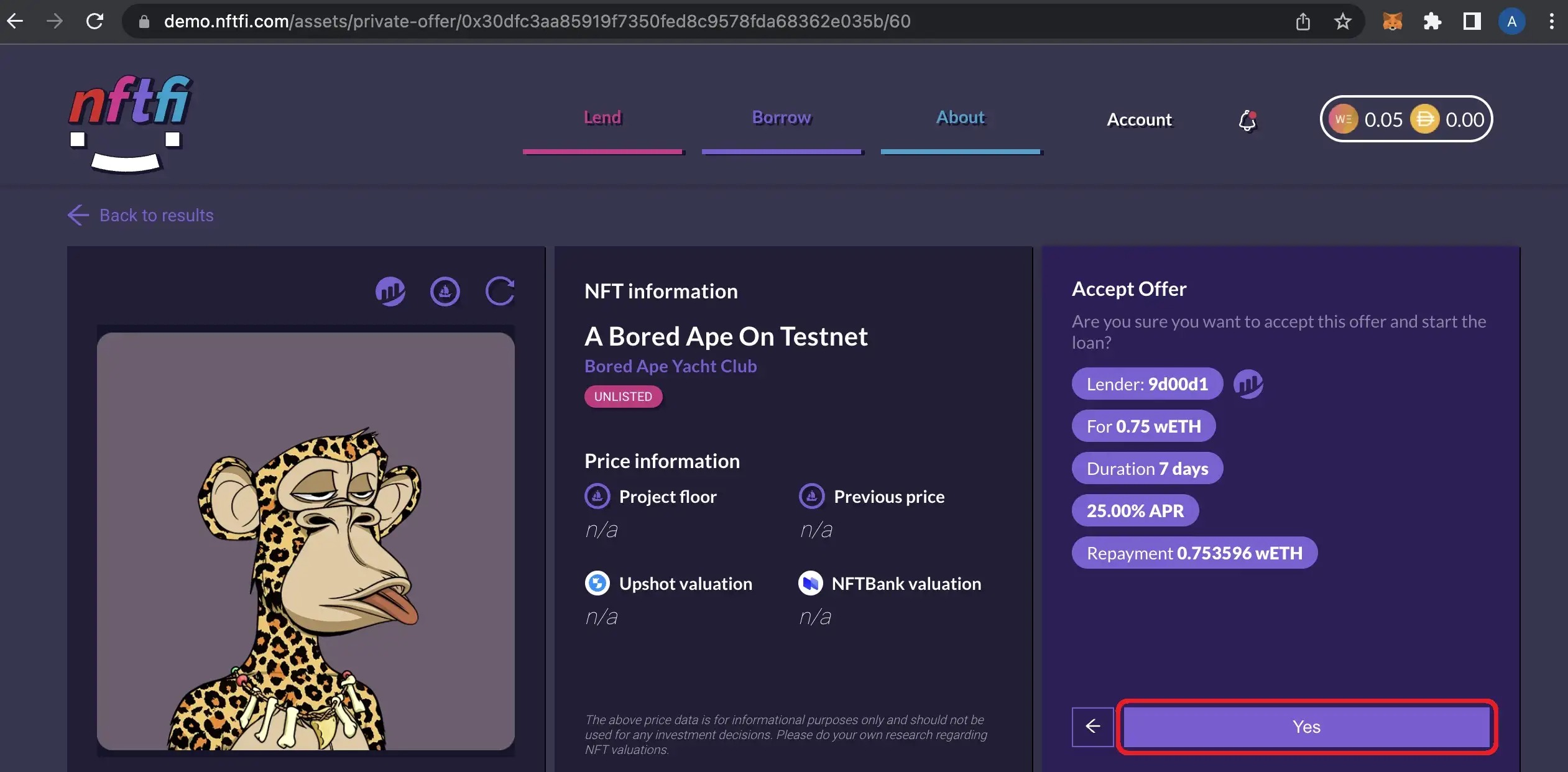

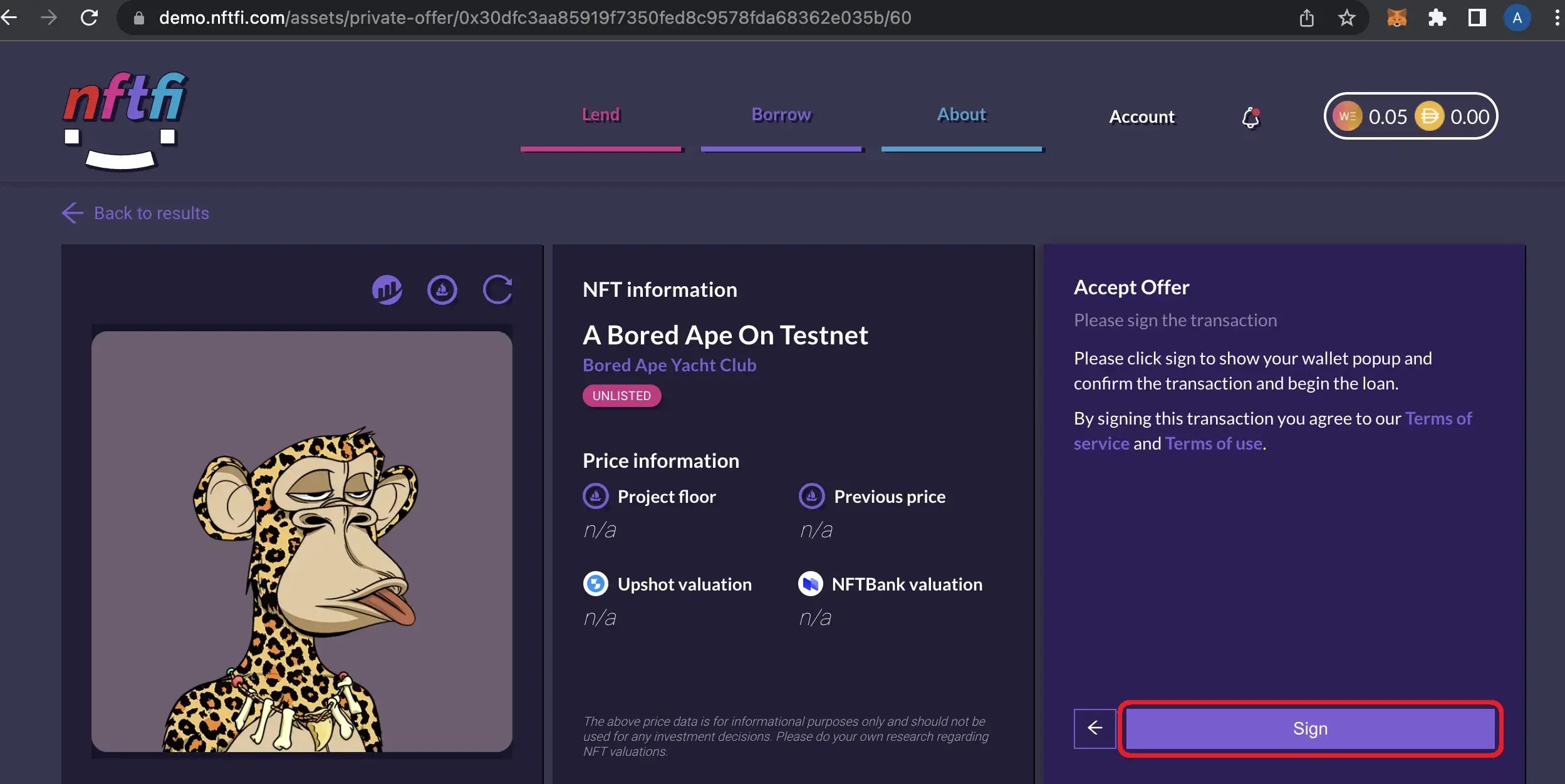

As a borrower, you will receive a private offer link (the lender should send you the link) that takes you to the asset page. Connect your wallet that holds this asset, and you will see offer terms. Before accepting, you can view the lender’s history via Etherscan.

You can accept the offer and receive this loan like any other loan on NFTfi.

Click “Yes.”

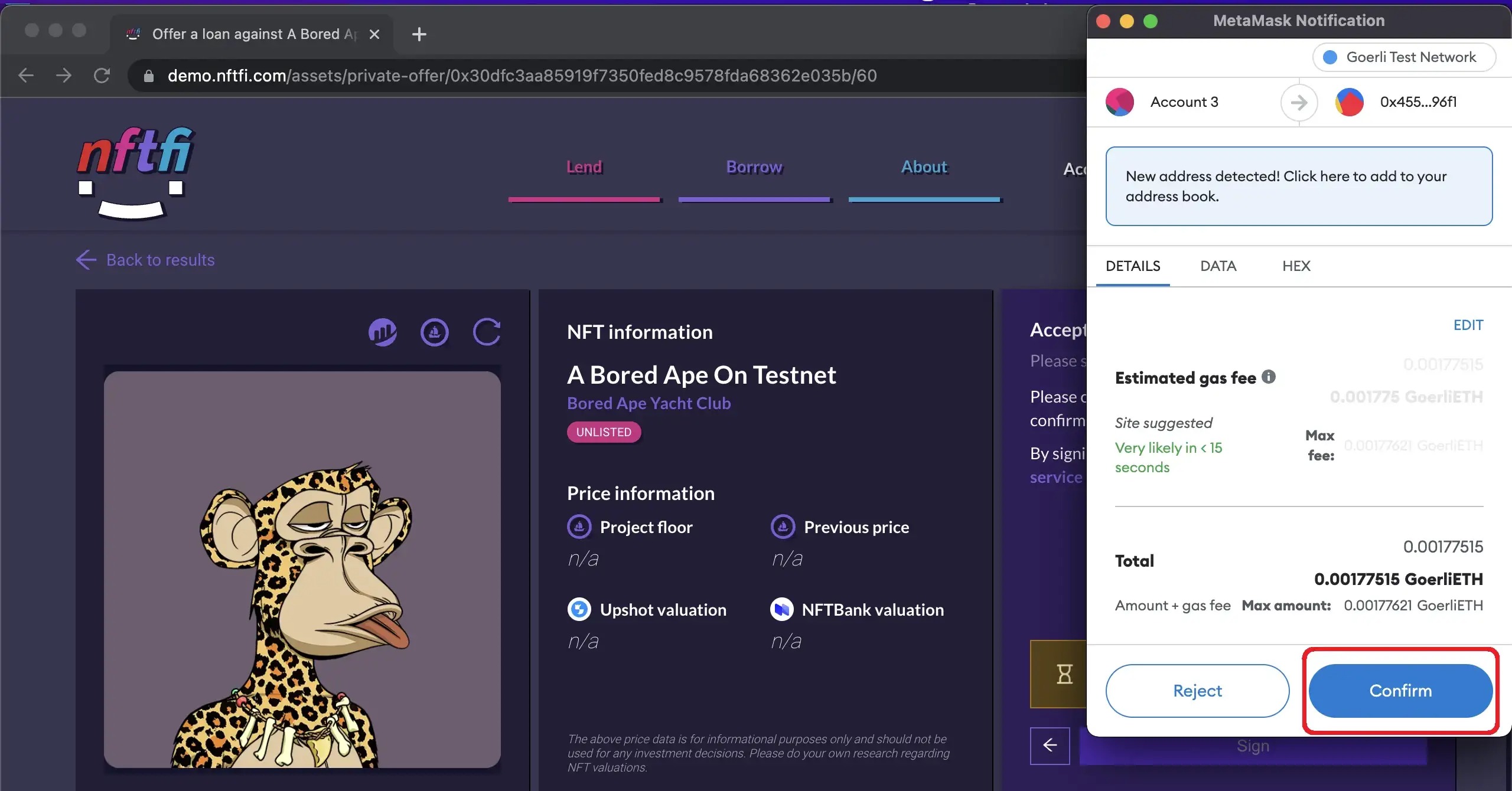

Sign the transaction (please note that you will need to pay gas in ETH for this).

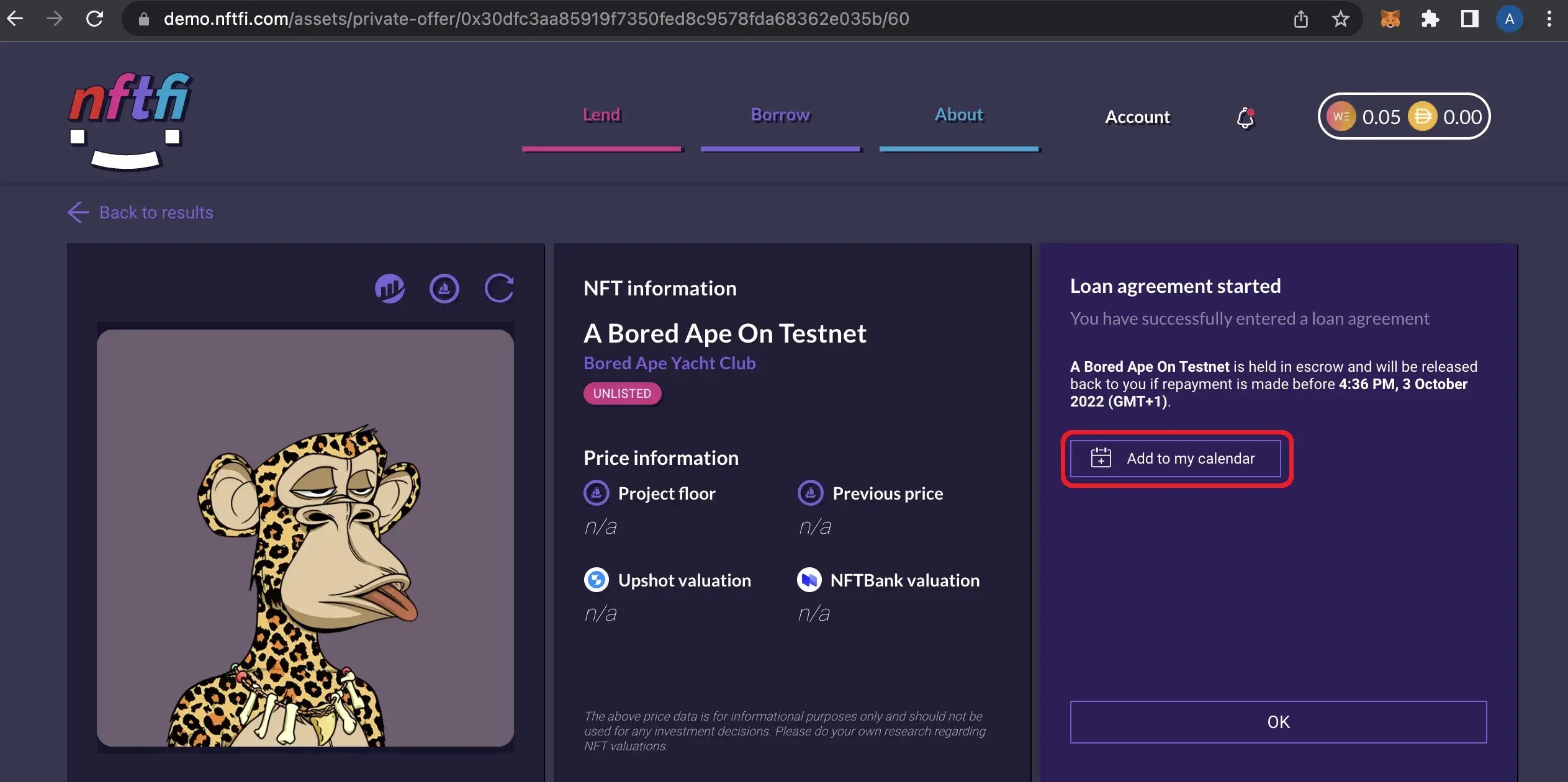

Once the offer is accepted (and confirmed), the loan will be executed just like any other loan on NFTfi.

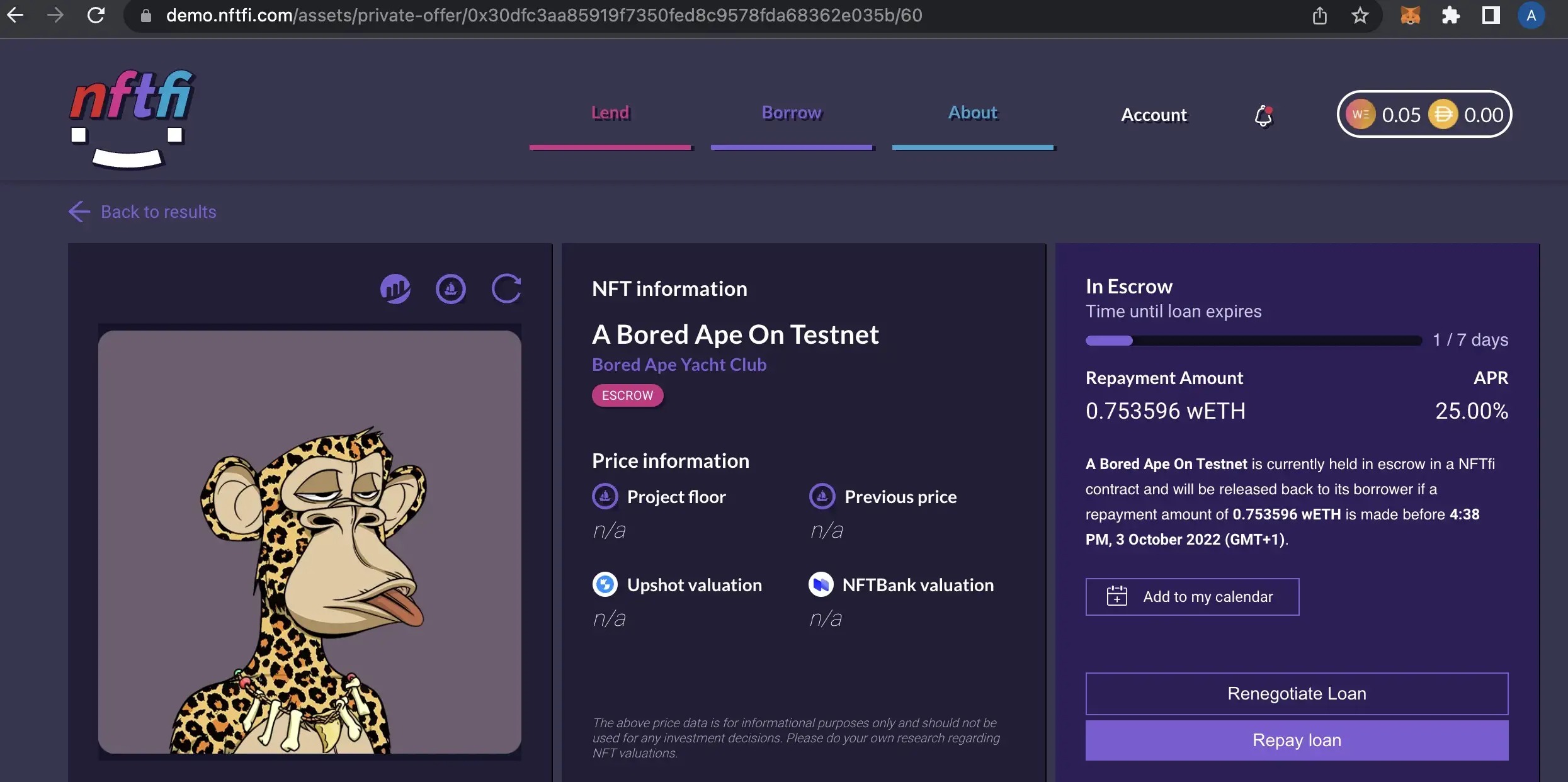

You can click “Add to my calendar” to receive the notification before your loan due date & time! To learn more about calendar notifications, read this blog post.

You can also renegotiate your loan, to learn more about loan renegotiations, click here.

You can always check the status of your loan if you navigate to Borrow in the main menu and then select Loans.

If you are new to borrowing on NFTfi, you can learn more here.

Follow us on Twitter and join our awesome Discord community if you need more help or want to connect with other NFT finance pros.

nftfi.com | Discord | Twitter | Join the Ambassador program

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >