Improved Underfunded Offers

July 30, 2024 ・ 4 min read

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan. Borrowers will now have access to deeper and more consistent liquidity.

What Are Underfunded Offers? Underfunded offers are loan offers visible only to lenders. These offers are made when a lender does not have sufficient wallet balance to cover the loan principal. Underfunded offers remain invisible to borrowers until the lender's wallet balance is sufficient to cover the loan principal. This can occur after a repayment or a transfer of funds.

Benefits of Underfunded Offers: Underfunded offers provide more flexibility for lenders in managing liquidity and wallets, boosting capital efficiency. This effectively creates a backlog of new offers waiting for funds to be activated, adding depth to the order book. It also fosters new conversations between borrowers and lenders, allowing lenders to prepare offers while waiting for a repayment.

Unlocking Less Capital-Intensive Refinancing: Another benefit of underfunded offers is a more capital-efficient refinancing process. Previously, lenders needed the full loan principal amount in their wallets when making a refinancing offer. Now, lenders only need the difference between the repayment amount and the new loan principal. The order book will recognize the ability to roll over the loan and make the offer active. This applies only to lenders refinancing their active loans, not when refinancing loans from other lenders.

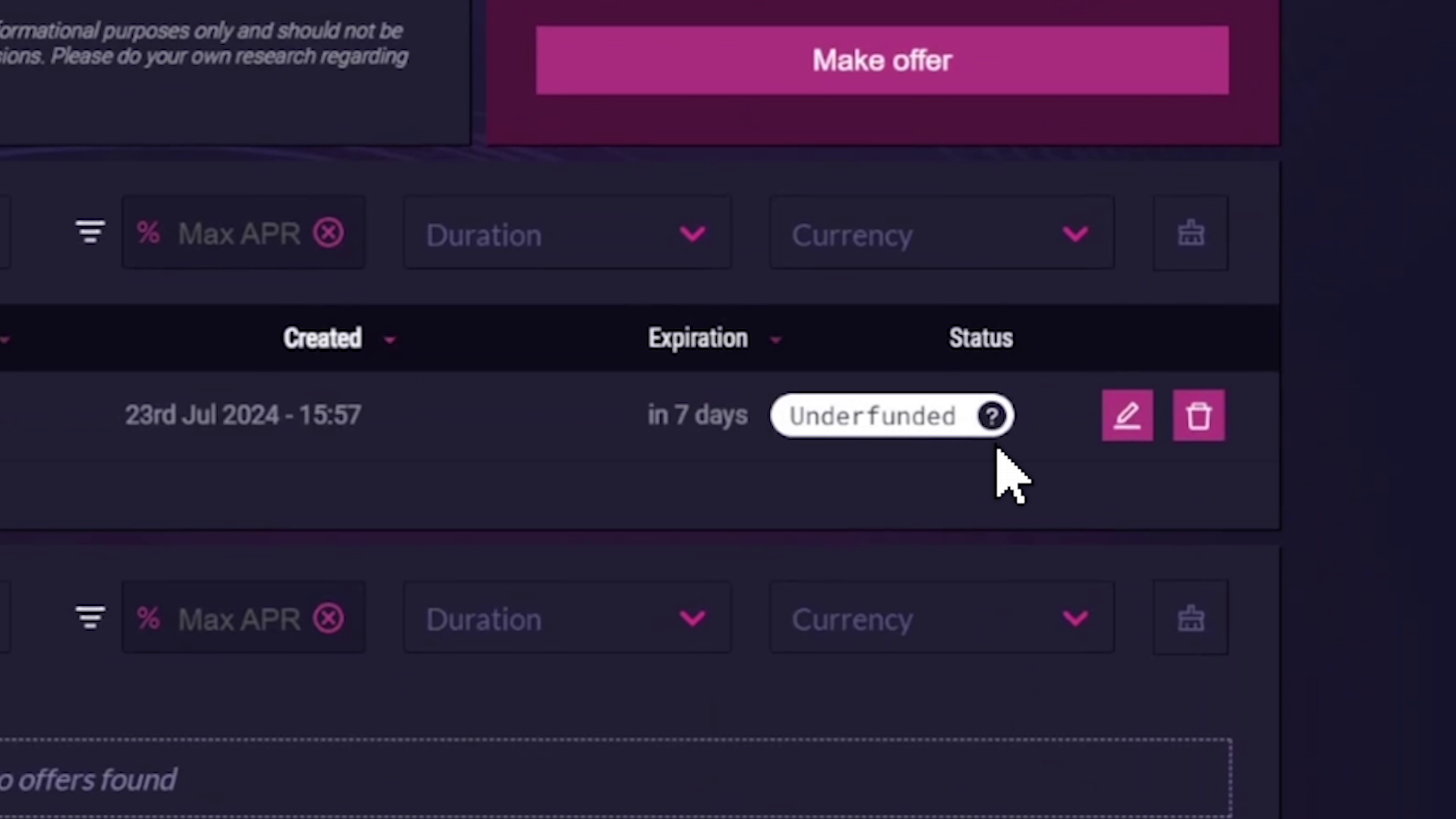

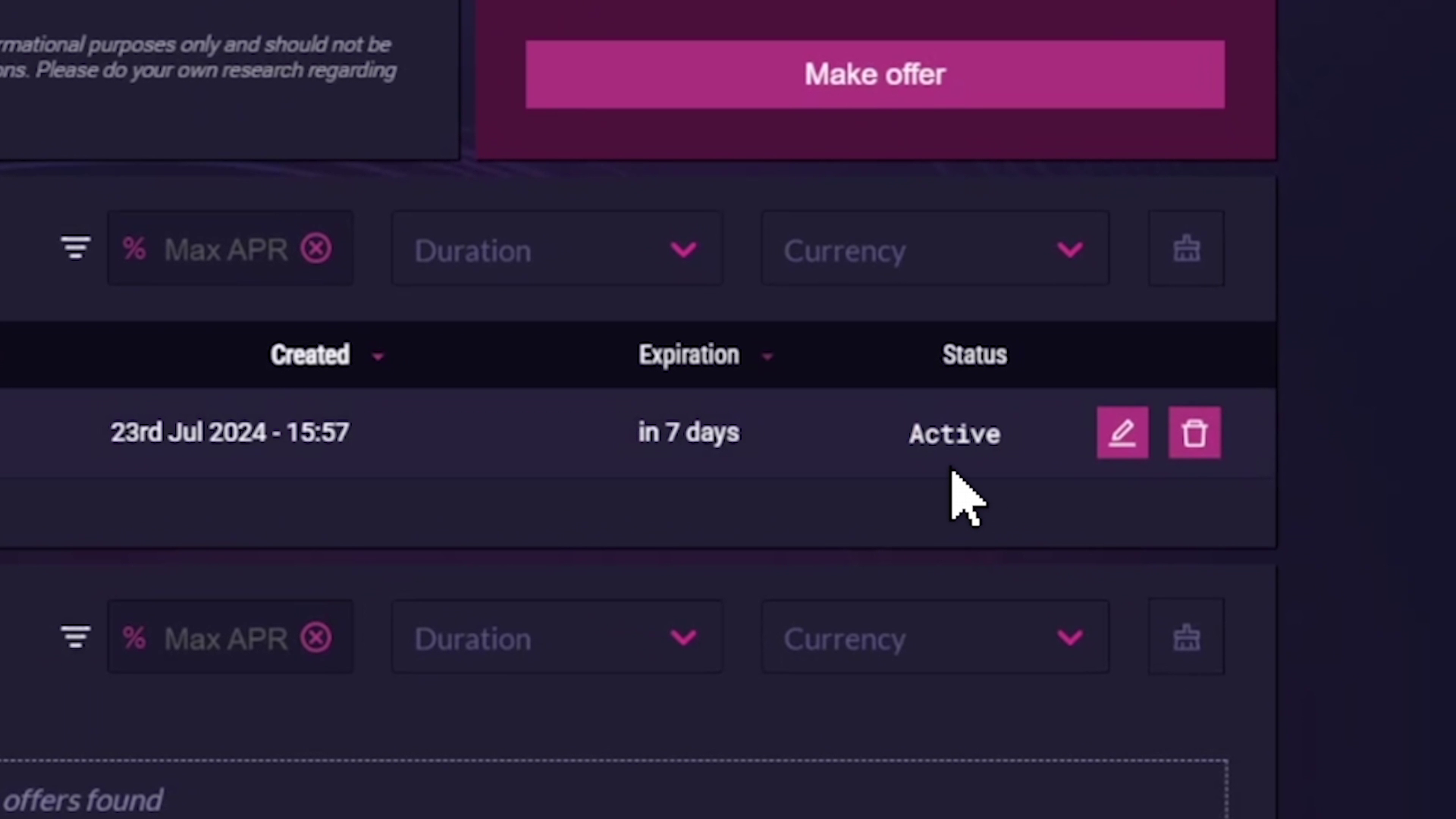

How Underfunded Offers Become Active: Underfunded offers become active and visible to borrowers once the lender’s wallet has adequate funds. NFTfi automatically updates the status of the offer from underfunded to active when the lender's wallet is sufficiently funded.

Managing Underfunded Offers: Lenders should manage underfunded offers similarly to active offers. Underfunded and active offers can be found, edited, or canceled in the “Offers Sent” section of the NFTfi dApp or on the asset page where the offer was made.

Making Underfunded Offers: To make an underfunded offer, follow these steps:

- Go to the "Give a Loan" section of the NFTfi dApp.

- Browse, search, and filter for an asset you’d like to make an offer to.

- Set an amount below the wallet balance.

- The offer will appear only for you in the asset section and in your “Offers Sent” section tagged as underfunded.

You can edit or cancel underfunded or active offers in the “Offers Sent” section of the dApp or on the asset page where the offer was made.

Refinancing Using Underfunded Offers: To refinance using underfunded offers, follow the classic refinancing flow in your active loan section:

- Select an active loan in the “Current Loans” section of the “Loans Given” section.

- Make a refinancing offer with only the capital needed to cover the difference between the old and new principal amounts.

- The system will recognize the rollover capability and make the offer active.

Important Notes:

- Refinancing offers should be in the same loan currency.

- Refinancing using underfunded offers should be between the same lender and borrower.

- There can be only a maximum of 5 active or underfunded offers per currency on an NFT.

First time learning about NFTfi?

If you're just discovering NFTfi, watch the video below for a quick overview and check our beginner’s guide to borrowing.

Stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

January 31, 2024

Discover Refinancing: A Faster and More Efficient Way to Extend Loans

NFTfi is introducing its refinancing feature. Instantly renew an existing loan and bypass the burden of upfront repayment.

Learn more >