KILLABEARS: horrifyingly lovable collateral on NFTfi

March 20, 2023 ・ 4 min read

If you’re not vibing in the Killaverse, you’re doing it wrong. This next-gen immersive entertainment world has consistently reached new heights in 2023, all while delivering for the community, delighting fans and defying a turbulent market.

At the heart of it all? The Killabears of course. An elite crew of 3,333 bears with serious main character energy, crafted by master illustrator Memo Angeles. Often described as “horrifyingly lovable”, it turns out some bears have a side hustle - maximizing liquidity opportunities via NFTfi.

So what exactly have these bears been up to (besides keeping their feet warm with those cozy new KillaSocks)?

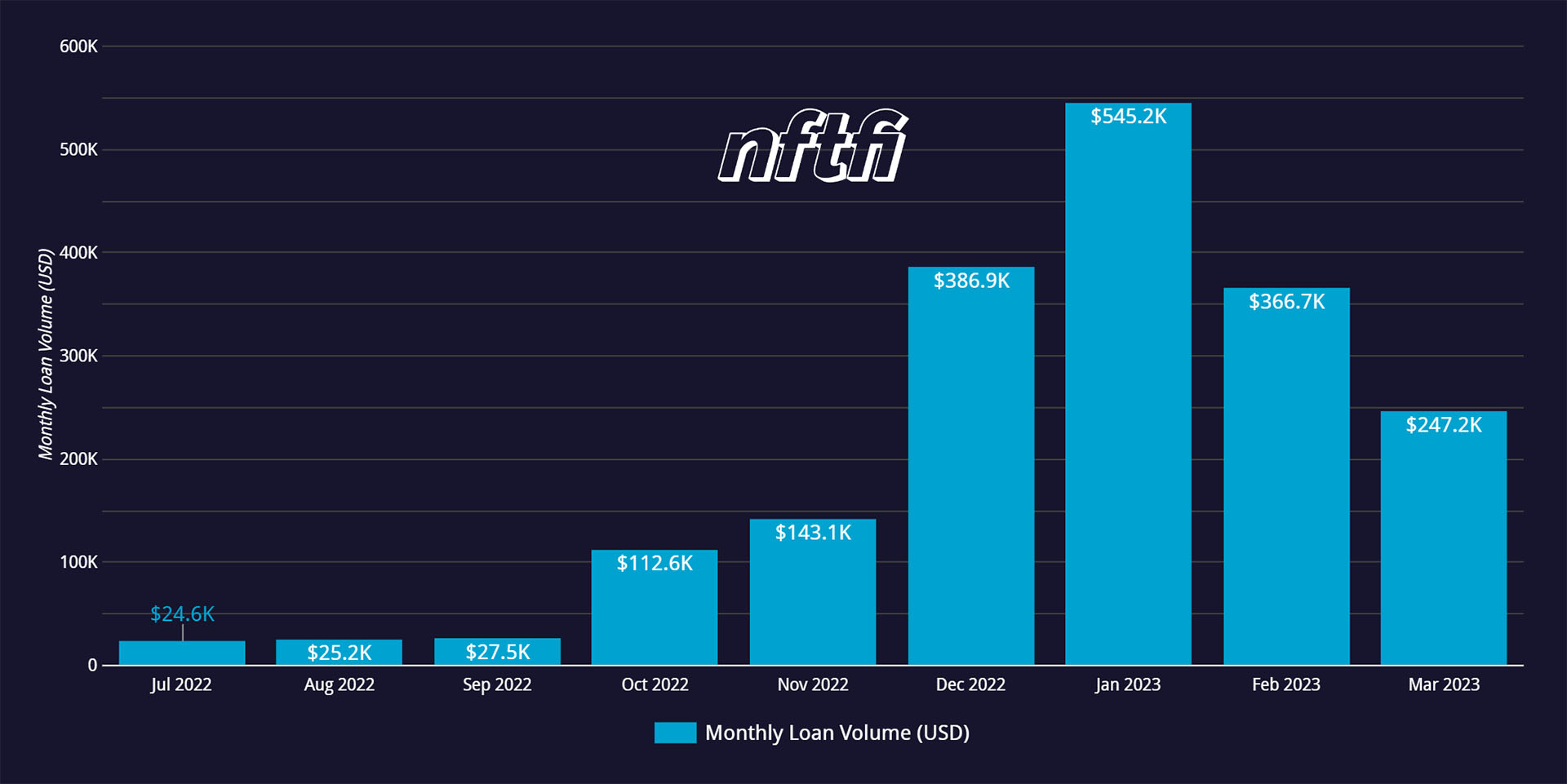

Killabears loan volume is gaining momentum

NFTfi first welcomed Killabears in July 2022 and saw immediate adoption by the community with over $20k loan volume in the first month, although this was just the beginning. As the chart above shows, activity began to skyrocket in December and has remained above $300k a month since then. One borrower even took out a 20k USD loan on his KILLABEAR #1632 - the highest loan to date!

It’s no coincidence that the Killabears’ floor price has made similar moves. It’s only natural that as a collection’s valuation and community conviction rises, so does the desire to diamond-hand. And that’s where NFTfi comes in: as the top NFT lending protocol in the space, NFTfi enables holders to access liquidity without selling their precious bears.

On the borrower side, there are a million reasons why you might need temporary liquidity, from spotting opportunities in the NFT market to IRL commitments. Meanwhile, on the lender side, the benefits are clear for Killabears holders and fans alike, as you can earn interest (in ETH, DAI and USDC) while lending against assets you are long-term bullish on, all in a secure, trustless environment.

Borrowing against Killabears is getting cheaper

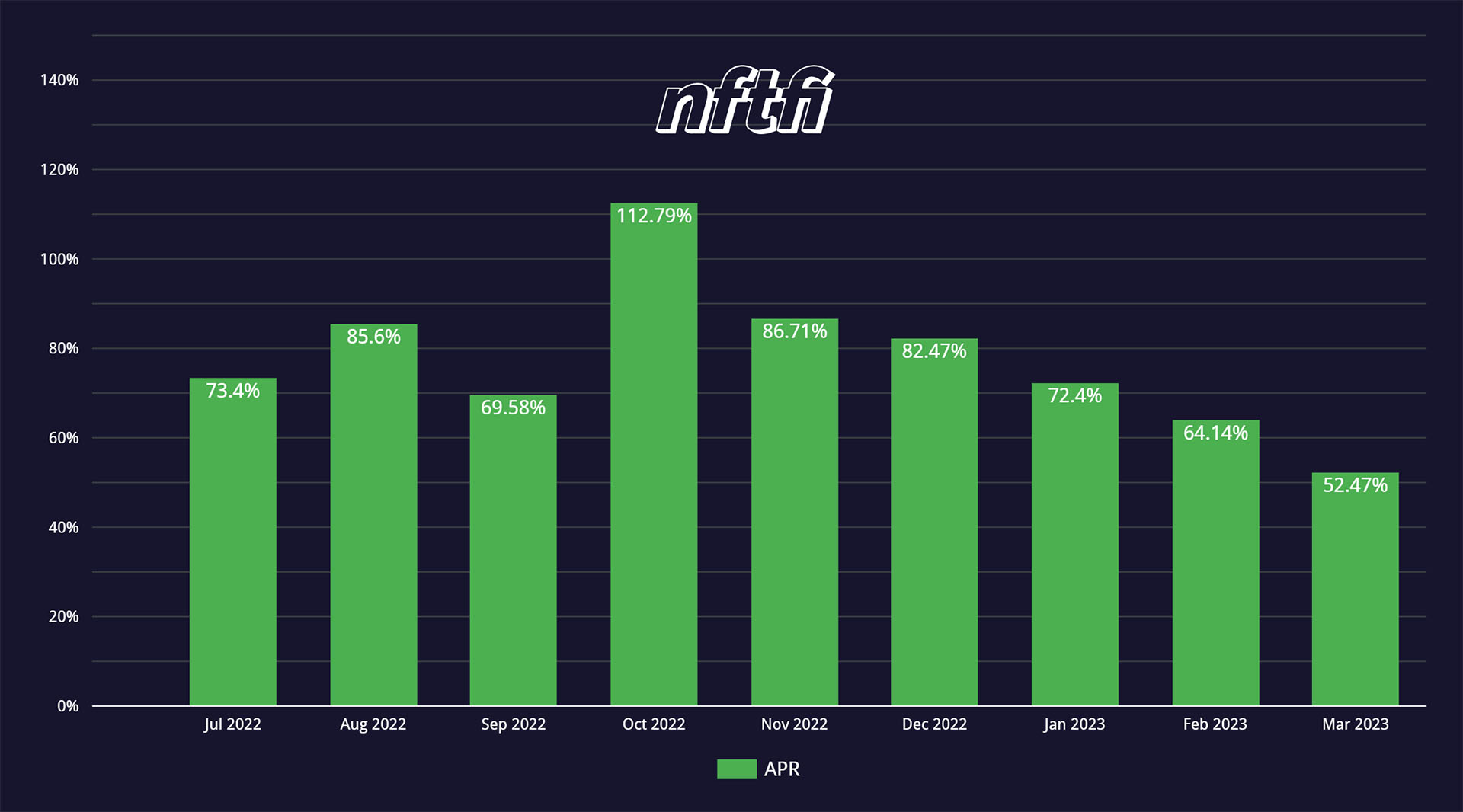

So, what kind of interest rates can you expect? NFTfi enables lenders and borrowers to set custom loan terms that suit them and their unique assets. In February 2023, however, the average APR for Killabears loans was 64.14% and the average loan length was 23 days. So, if you took out a loan of 1 ETH under those conditions, you would have likely had to repay 3.65% or 0.0365 ETH in interest.

In fact, as the chart below demonstrates, the annual percentage rate (APR) has been steadily decreasing month on month since October, which means it has never been cheaper to take out a loan against your Killabear! Please note that APR is an annualized amount so the true loan cost for the average loan on Killabears is very low.

The loan stats are impressive, but we wanted to hear the real stories and use cases behind them, so we reached out to OG users to learn more. Long-term Killabears lender MrDerber told us:

“I always choose the strongest projects and communities to lend against, so for me it was an obvious play to offer liquidity to Killabears early on. I trust NFTfi since it has been around the longest and I feel safe using it. They were also the first to support Killabears!”

We also got the alpha from an anon borrower on his strategic accumulation plays:

“I use NFTfi so I can raise liquidity without selling my Killabears assets, and I even use that liquidity to invest more in the ecosystem. I recently took out loans in order to buy more Killabits, which I thought were undervalued at the time, and I had a liquidity event coming in a few days later. This was the perfect way to quickly access capital to redeploy into the same project without waiting.”

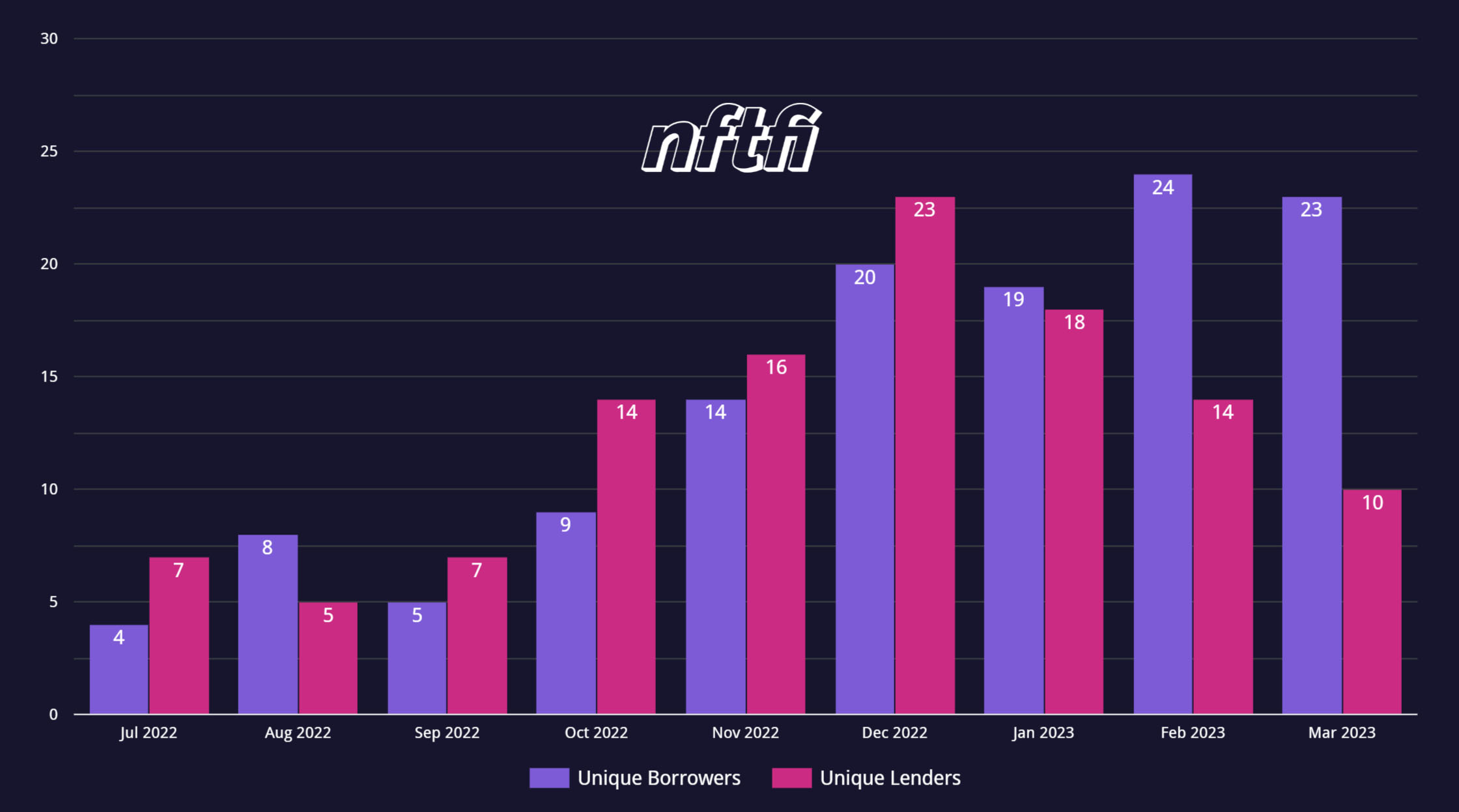

Sounds like Killabears are thriving on NFTfi. But in real terms, how many unique lenders and borrowers are there? According to the chart below, 64 and 54 respectively. But there are 3,333 bears?! In other words, you’re still early 😎

Want to learn more?

You can check out NFTfi’s beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter and chat with experienced users by joining our thriving Discord community where you can connect with lenders and borrowers. While we value a personal touch and building relationships at NFTfi, all transactions are totally trustless, ensuring your assets are secure at all times.

To stay up to date with the latest developments in the fast-growing Killaverse, follow the Killabears Twitter and join the Discord. If you missed a step along the way or are hungry for a lore-refresh, the full story can be enjoyed here.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >