Earn Season 1: Rewarding NFT lovers for responsible NFT loans

May 15, 2023 ・ 6 min read

Note: The core mechanics of NFTfi Rewards described in this article apply to all future seasons until further notice. For any season-specific updates, please refer to the latest announcements.

Healthy credit markets are fundamental to the growth of the NFT space overall.

With this in mind, Earn Season 1 has been designed with a clear goal: to reward NFT lovers for borrower-friendly loan terms and a responsible lending market on NFTfi.

We are confident that the implemented reward structure will contribute to a healthy, non-predatory lending environment. At the same time we acknowledge that reward systems are complex and often produce unintended side effects. We will be monitoring the health of the market actively and plan to make any adjustments necessary to ensure a fair, borrower-friendly lending environment that contributes positively to the overall NFT ecosystem. Any changes to the reward structure will only apply to loans started after the change.

How Earn Points work

Eligible borrowers and lenders can earn points for repaid loans (more on eligibility later).

Upon taking out a new loan, you see the associated Earn Points under “unsecured points” in your NFTfi Rewards cockpit. If the loan gets repaid, these points turn into “secured points”.

Rewarding borrower-friendly terms and a responsible lending market

Earn Points aim to incentivize borrower-friendly loan terms and a responsible lending market. Borrower-friendly loans feature competitive APRs and LTVs, but what’s a responsible lending market?

We believe that in a responsible lending market, lenders manage credit risk carefully and borrowers receive loans that they can reasonably be expected to repay, preventing excessive debt-levels and over-indebtedness.

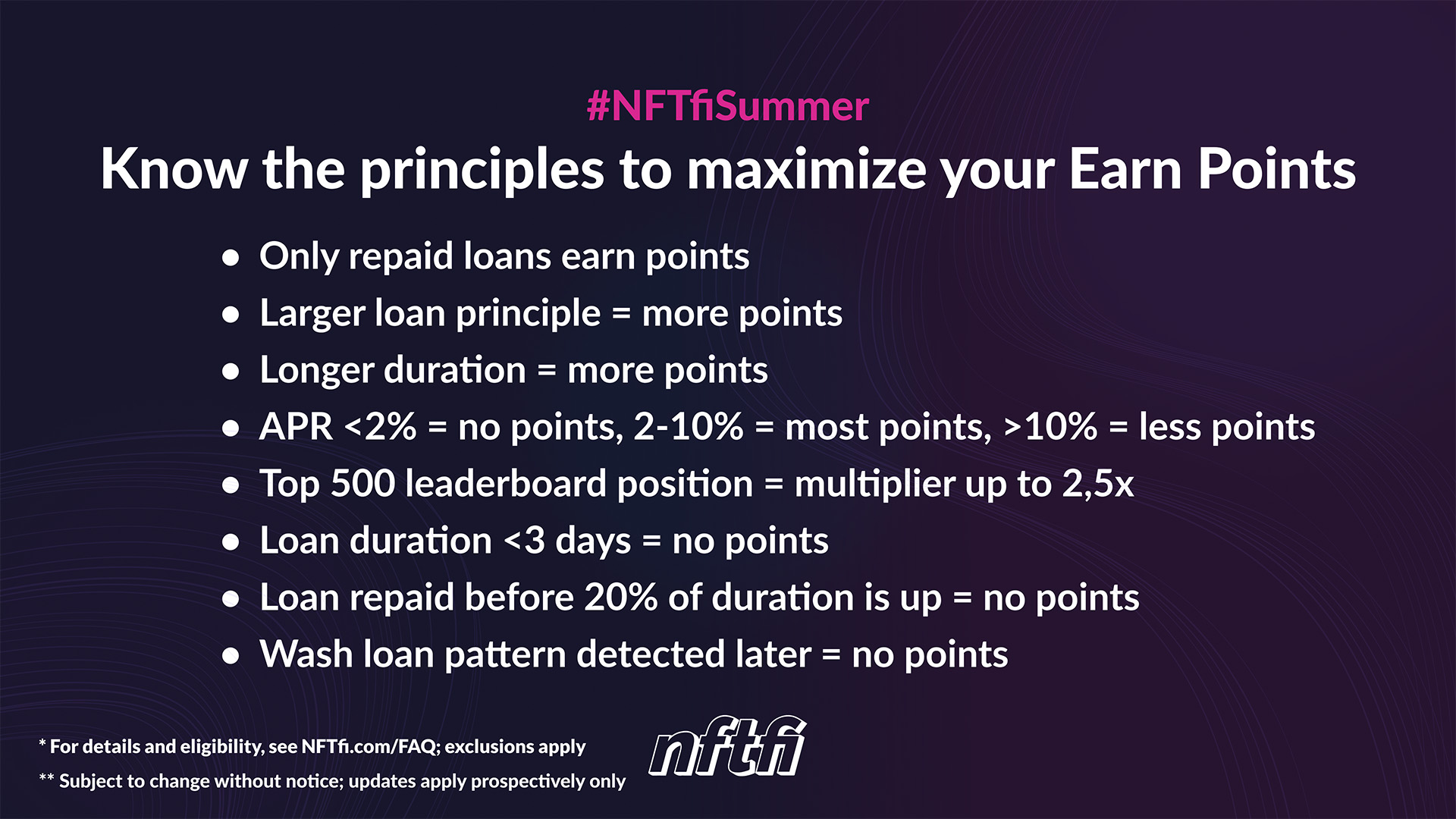

Here are the key calculation principles of Earn Season 1 and how they strive to support borrower-friendly loan terms and a responsible lending market:

Only repaid loans earn points: Aims at motivating lenders to carefully manage default risk via conservative LTVs, and borrowers to not take out excessive debt they might not be able to repay.

Larger and longer loans earn more points: Aims at motivating lenders to provide borrowers with flexible access to various loan sizes and loan durations. While loan size and loan duration are directly proportional to the points earned, their effect on the final number of points per loan is lesser than that of the APR (see below).

Lower interest rate (APR) loans earn most points: Aims at motivating lenders to provide borrower-friendly interest rates and risk-adequate LTVs as a consequence. APR is the most important factor for determining the final number of points per loan.

- Loans with APR <2%: no points to reduce wash lending risk.

- Loans with APR between 2% and 10%: max points. A lower APR within that range does not earn more points.

- Loans with APR > 10%: reward points diminish at a moderate rate.

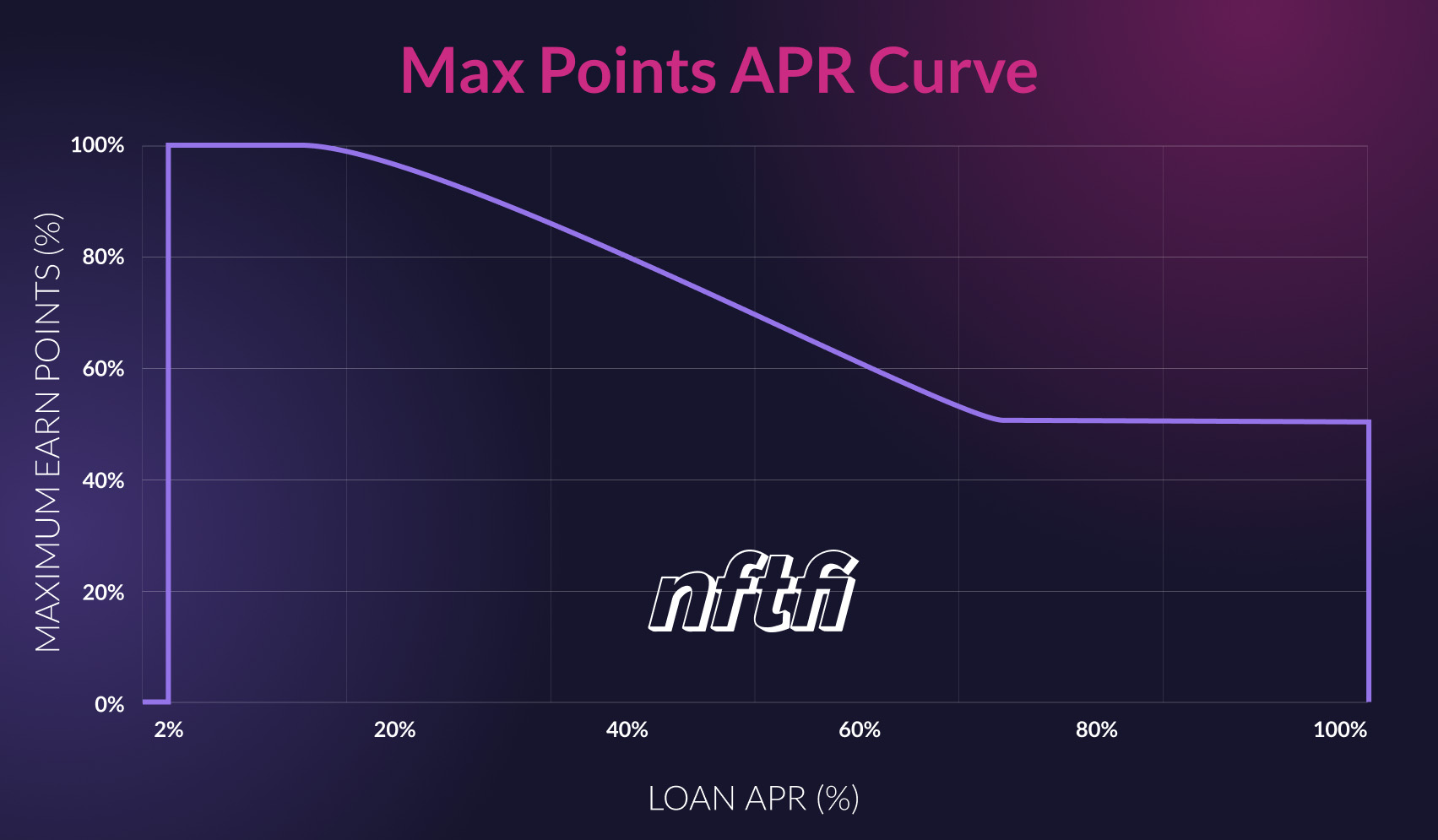

Max Point APR Curve (updated on July 5, 2023): The maximum points a given loan can receive drops off slowly and plateaus at 50% of max points for loans between 70-100% APR. Loans with APRs over 100% do not earn points.

Learn more about the APR in our latest Earn Season 1: APR Incentive Update.

Rewarding real users, not washlenders

Over the last 3 years we have built a community of the smartest collectors and lenders in the NFT space. This community is at the heart of our success and it is critical for us to reward our actual current and future users, not wash lenders (those generating fake lending volume with their own or related accounts to “farm” points).

How Earn Season 1 disincentivizes wash loans:

- No points for <2% APR loans: Reduces the profitability of wash lending.

- No points for <3 day loan durations: Avoids short duration wash loans.

- No points for <20% loan duration utilization (example: if a 30 day loan is paid back in less than 6 days, it does not earn points): Avoids early repayment wash loans longer than 3 days.

- No points for related wallets: Our analytics partner Zash will detect and exclude various simple and more sophisticated wash lending patterns periodically.

Exactly how Earn Points are calculated is not public, but here are the above principles summarized:

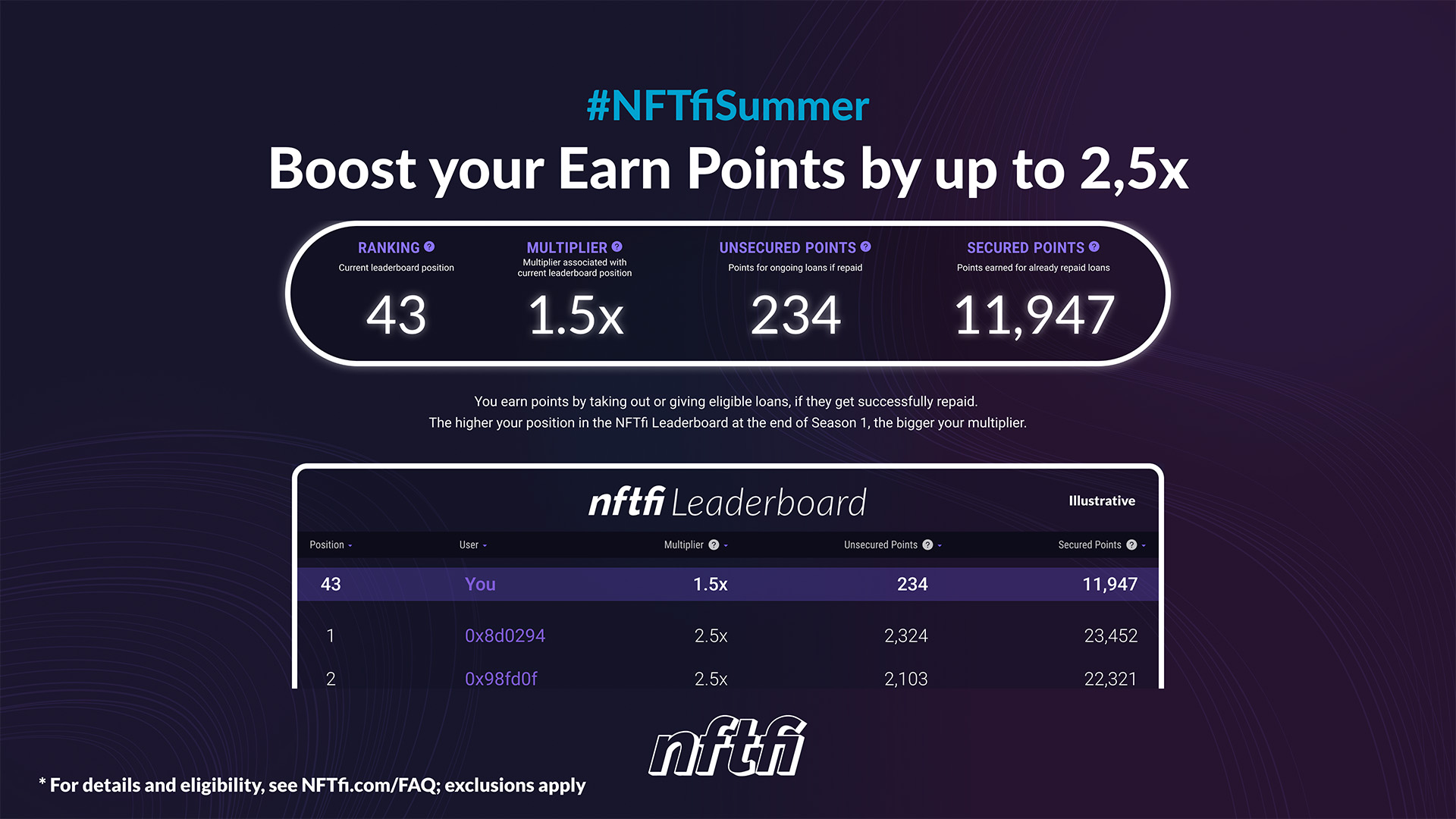

NFTfi Leaderboard

The NFTfi Leaderboard shows unsecured Earn Points (upon starting a loan) and secured Earn Points (upon repayment). The 500 wallets with most secured points by the end of Season 1 will get a multiplier of max 2,5 on their final balance.

Season 1 will run for at least 3 months. Eligible loans still ongoing at the end of Earn Season 1 can still receive Season 1 rewards incl. leaderboard multipliers.

This is not an offer of tokens or securities. Currently, reward points are not redeemable and simply show the loyalty level of a user. However, they are planned to become redeemable for benefits at a later point in time for eligible persons. U.S. residents, other U.S. persons, UK residents, other UK persons, and residents of countries or regions subject to sanctions, embargoes, or other restrictions imposed by the United States government or other applicable international authorities as well as persons subject to sanctions imposed by applicable international authorities are not eligible persons, and their points will not be redeemable. The eligibility of non-U.S. persons is at NFTfi's sole discretion and may take into account regulatory circumstances per jurisdiction. NFTfi makes no guarantees or promises regarding the issuance of any blockchain tokens. The timeline for a token issuance, whether or not an issuance occurs, and the conversion rate between reward points and tokens are all at NFTfi's sole discretion.

Much more to come

We have many surprises planned for all you NFT lovers out there. Earn Season 1 is only the beginning of a long and exciting #NFTfiSummer.

For now, check the Earn Points cockpit and enjoy collecting points while lending and borrowing on NFTfi.

This blog post is for informational purposes only and should not be construed as financial or investment advice. Investments in loans carry inherent risks, and the value of NFTs can be highly volatile. Users should carefully consider their risk tolerance and investment objectives before taking out loans. Refer to the NFTfi Rewards FAQ and the NFTfi Terms and Conditions for more details before participating in the loyalty program.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >