NFTfi V3 is here! Flexible Loans and More

October 08, 2024 ・ 3 min read

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

But that's not all. The protocol upgrade also improves the user experience. We can summarize these improvements in three keywords: Flexibility, Efficiency, and Control.

We’ve been cooking.

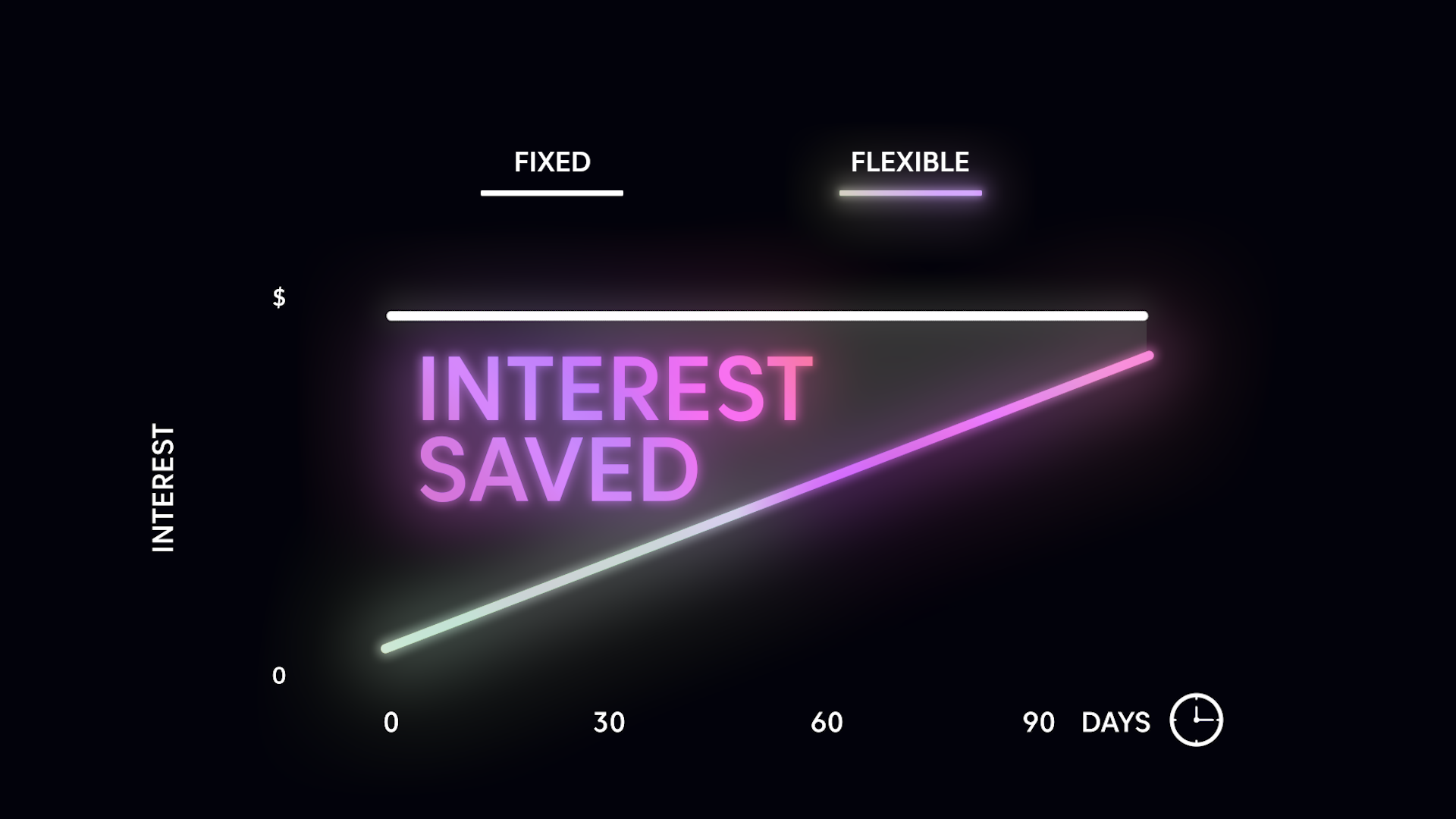

Flexibility: With Flexible Loans, Borrowers Only Pay the Interest They Use.

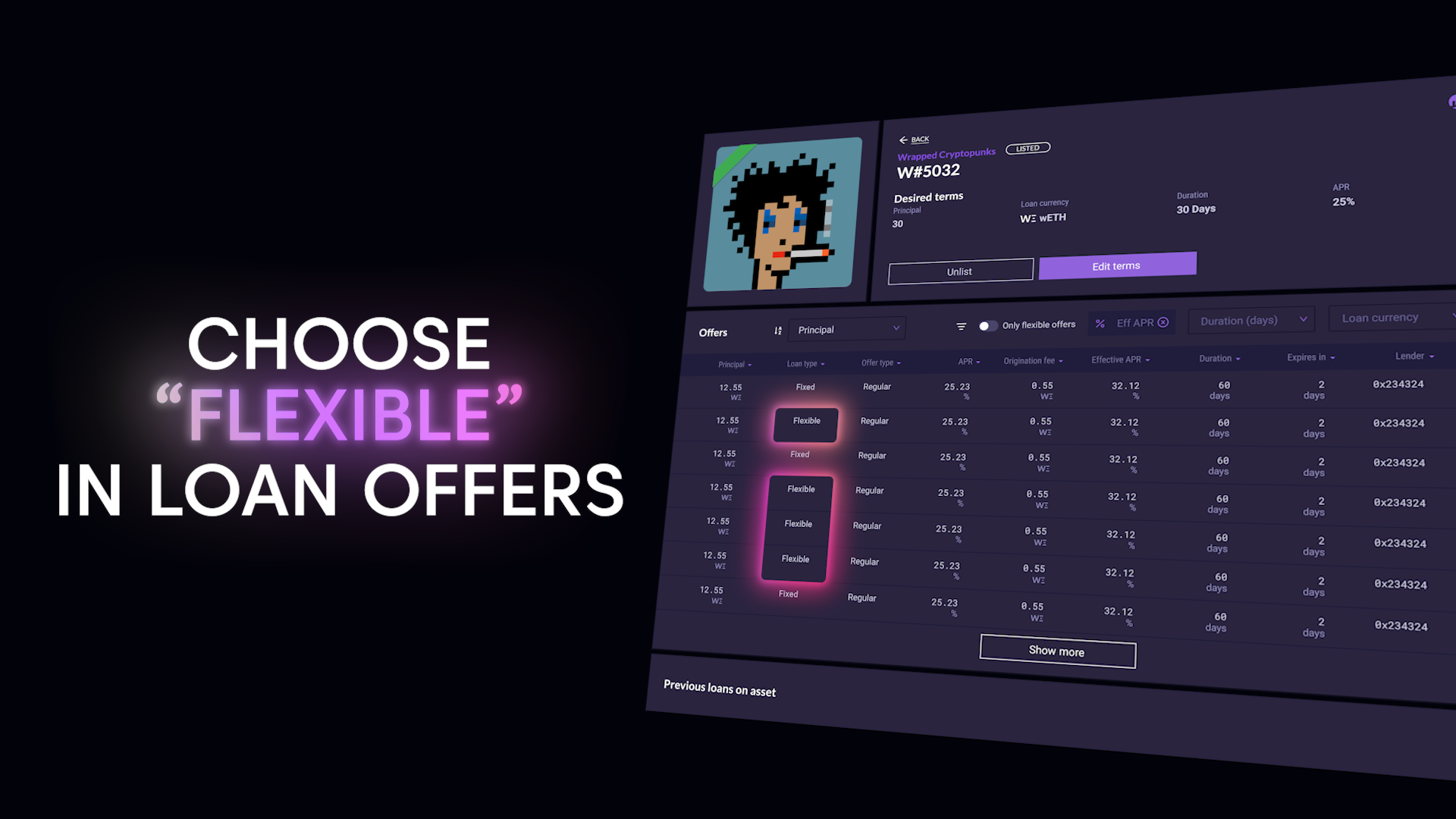

At the heart of NFTfi V3 is the introduction of Flexible Loans. Flexible Loans are a new type of loan that requires borrowers to pay only the interest accrued at the time of closing or refinancing a loan—in other words, borrowers pay for what they use. Fixed Loans, which require full payment of the interest, are still available on NFTfi. Borrowers and lenders can now choose between these options when agreeing on the terms and competing for the best terms.

With Flexible Loans, a new suite of loan terms is introduced:

- [New] Fixed Loan or Flexible Loan: When evaluating offers, borrowers can opt for fixed interest (Fixed Loan) or just prorated interest (Flexible Loan) payments.

- [New] Origination Fees: Optional fees paid upfront by the borrower to start the loan, applicable to both fixed and flexible loans. It will allow lenders to put an effective floor on the interest they receive if their Flexible Loan is refinanced or repaid earlier, for instance.

- [New] Effective APR: In cases where origination fees are included in the loan, they will be factored into the total effective interest calculation.

Efficiency: With Lower Gas Fees, NFTfi Has Never Been More Efficient.

The protocol upgrade has reduced the number of operations in NFTfi smart contracts, resulting in lower overall gas costs. Users will experience a 6% decrease when accepting offers (collection or fixed), an 11% decrease when repaying, a 5% decrease when refinancing, and a significant 30% decrease when renegotiating an overdue loan. For lenders, the cost of foreclosing an overdue loan has also decreased by 6%.

Control: With More Loan Parameters, Lenders and Borrowers Can Unlock Better Deals.

Only borrowers can trigger a loan refinancing on NFTfi. This means that an active loan cannot be refinanced to another lender without the borrower's approval. Besides, on NFTfi, lenders can experiment with more lending strategies and parameters, including fixed or flexible interest and with or without origination fees. For instance, one might prefer a fixed interest rate without an origination fee, while another may opt for flexible interest with origination fees.

With NFTfi V3 and the introduction of Flexible Loans, rolling over loans has never been cheaper and more frictionless for borrowers while offering multiple ways for lenders to generate a return. We believe this design is the best to create a thriving decentralized lending market for NFTs.

If you have any other suggestions or features you would like to see on NFTfi, head to: https://feedback.nftfi.com/

First time learning about NFTfi?

If you're just discovering NFTfi, watch the video below for a quick overview and check our beginner’s guide to borrowing.

Stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >

January 31, 2024

Discover Refinancing: A Faster and More Efficient Way to Extend Loans

NFTfi is introducing its refinancing feature. Instantly renew an existing loan and bypass the burden of upfront repayment.

Learn more >