NFTfi x Creepz: the long-term liquidity lizards 🦎

March 13, 2023 ・ 4 min read

A portal has opened 🌀

What does it mean? Where does it lead?

Three things are certain: OVERLORD has ripped up the playbook, the revolution is underway and Creepz, the lovable, lore-steeped lizards, are here to stay.

Creepz x NFTfi: The story begins

For NFTfi, welcoming Creepz onto the platform back in March 2022 and enabling all lizards to lend and borrow ETH, DAI and USDC against their NFTs was a no-brainer. Why? For starters, OVERLORD’s vision is simply unrivaled.

Co-founders Joe and Dom are shaking up the entertainment, gaming, media and fashion industries, leveraging their extensive web2 and web3 experience to make it happen. Their sights are set on onboarding hundreds of millions of users into the OVERLORD ecosystem, and February 2023 saw partnerships confirmed with Spotify [read more] and the #1 global entertainment agency WME [read more].

The beneficiaries of these major moves? Creepz, of course. As lizards own their IP, they are proud co-owners of this new world, although we’ll all benefit from OVERLORD raising entertainment standards 📈.

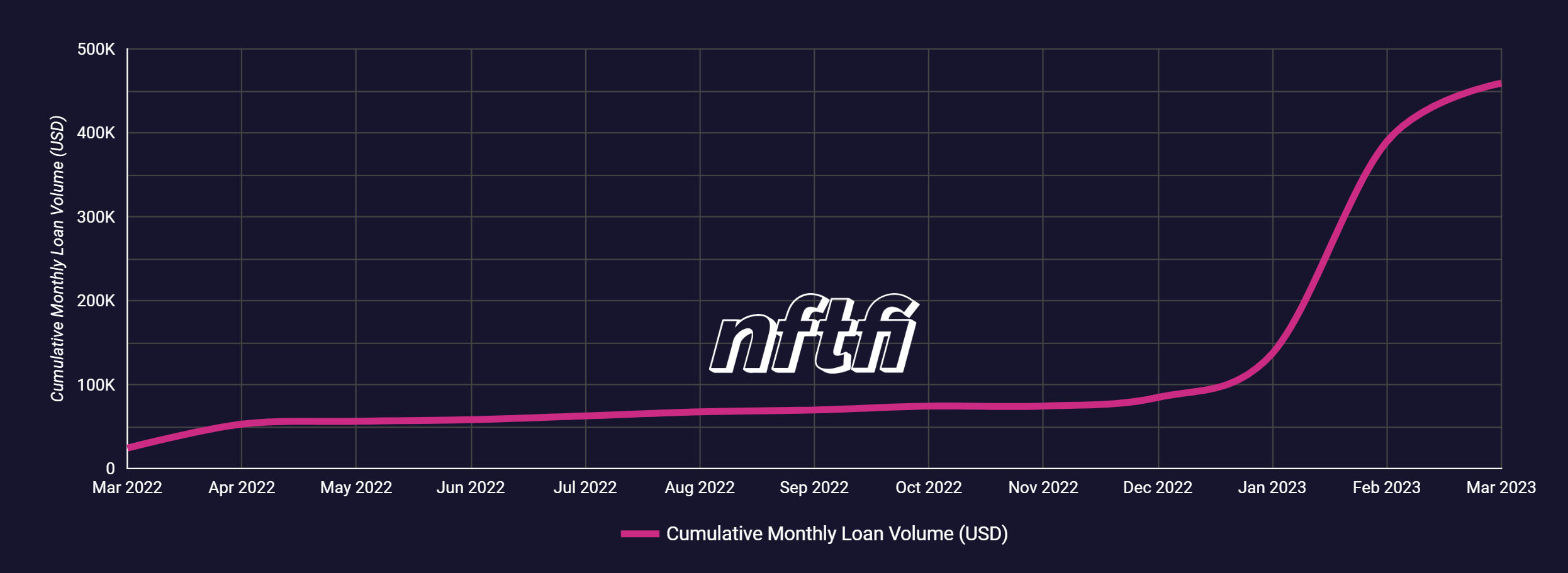

At NFTfi, we’re here to help all of you long-term lizards unlock liquidity and put it to work, whether that’s maximizing market opportunities, re-investing in the Creepz ecosystem, or taking care of things IRL. So far, it’s been up only. The chart below represents the cumulative loan volume (in USD) for Creepz, showing how the collection really started to take off in December, with a significant jump in loan activity in January.

How are Creepz making the most of NFTfi?

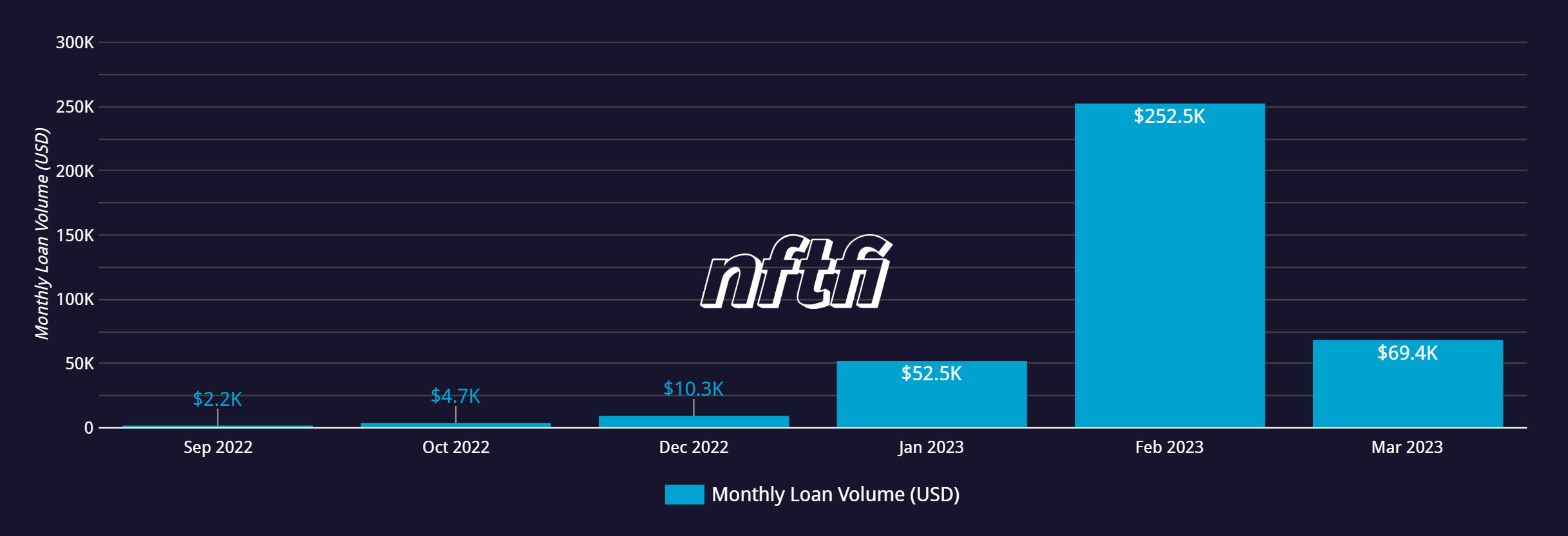

Since the start of January, Creepz borrowers and lenders have amassed a whopping $374,400 total loan volume as shown in the chart below. How many of these Creepz loans were repaid? 98.97% ✅

Not bad, Creepz!

Despite the stats, borrowing or lending for the first time might seem daunting, so we checked in with some key Creepz community members about their NFTfi journeys. Here’s what Chesus.eth had to say:

“The great thing about NFTfi is the ability for community members in any listed project to keep their PFP and gain liquidity. As a member of a strong community like Overlord, my PFP is my brand and personal IP. Sometimes life gives us an easy path but other times a grenade is thrown in the way. Personal things come up or even an opportunity to get another NFT falls in your lap. Within minutes you can find a loan that fits your needs and the money is in your wallet.

Security in Web3 is talked about everyday but action is rarely taken. With NFTfi, security is a top priority for both the lender and the borrower. You can have a personal conversation with a lender and build the rapport needed to secure a loan in the discord but the transaction is completed on the site. No links to click, random emails, or OTC deals. It’s truly a trusted process that allows both parties to build a relationship that is not just a one time transaction. The lenders I work with are slowly becoming friends and I’m grateful for that.”

This commitment to security makes NFTfi the most trusted lending protocol in the space, as well as offering unparalleled flexibility. You might want to lend/borrow against a specific Creep, or use our collection offers feature. We also recently released bundles, enabling you to take out a loan against multiple NFTs across different collections in a simple, gas-efficient manner.

What’s next?

The revolution is only just getting started. This is true for both OVERLORD and the NFT Finance space. As NFTs mature and become fundamental infrastructure across web2 and web3, early adopters can benefit from NFTfi’s trustless, hurdle-free lending and borrowing environment.

As part of our mission to demystify NFT lending, NFTfi Ambassador and long-term Creepz lender Kevin and Creepz OGs Chesus.eth & Kenny Powerz, hosts of the popular Wen Radio show, shared their experiences and some lending alpha with the community in a recent episode. Listen here!

Still have questions? We have plenty of resources to help!

You can check out NFTfi’s beginner-friendly guides to both Lending and Borrowing, stay up to date by following our Twitter and chat with experienced users by joining our thriving Discord community.

For Creepz updates, follow their Twitter + the OVERLORD Twitter, website and Discord. And last but not least, the thriving community-led media platform Overlord News!

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >