Rektguy Community Ahead of the Curve with NFT-Collateralized Loans

February 21, 2023 ・ 4 min read

There are now countless DeFi protocols such as MakerDAO and Aave that allow permissionless loans, whereby cryptocurrency assets can be used as collateral. They’ve become extremely popular, with those two projects alone exceeding $12.5B in collateralized assets as of the time of writing.

However, certain savvy individuals and communities are now realizing that the same is possible when it comes to NFTs. And with the total market capitalization of NFTs historically exceeding the value of DeFi, these early adopters may be extremely well-positioned as adoption only continues to rise.

One such community is rektguy, who has become a surprising success story in the world of NFTs. They began as the latest project of established artist OSF and were quickly embraced by many, even earning recognition from Snoop Dogg. The artwork features a hooded skeleton drinking, representing those who have been “rekt”, referring to those hit hard by crypto losses.

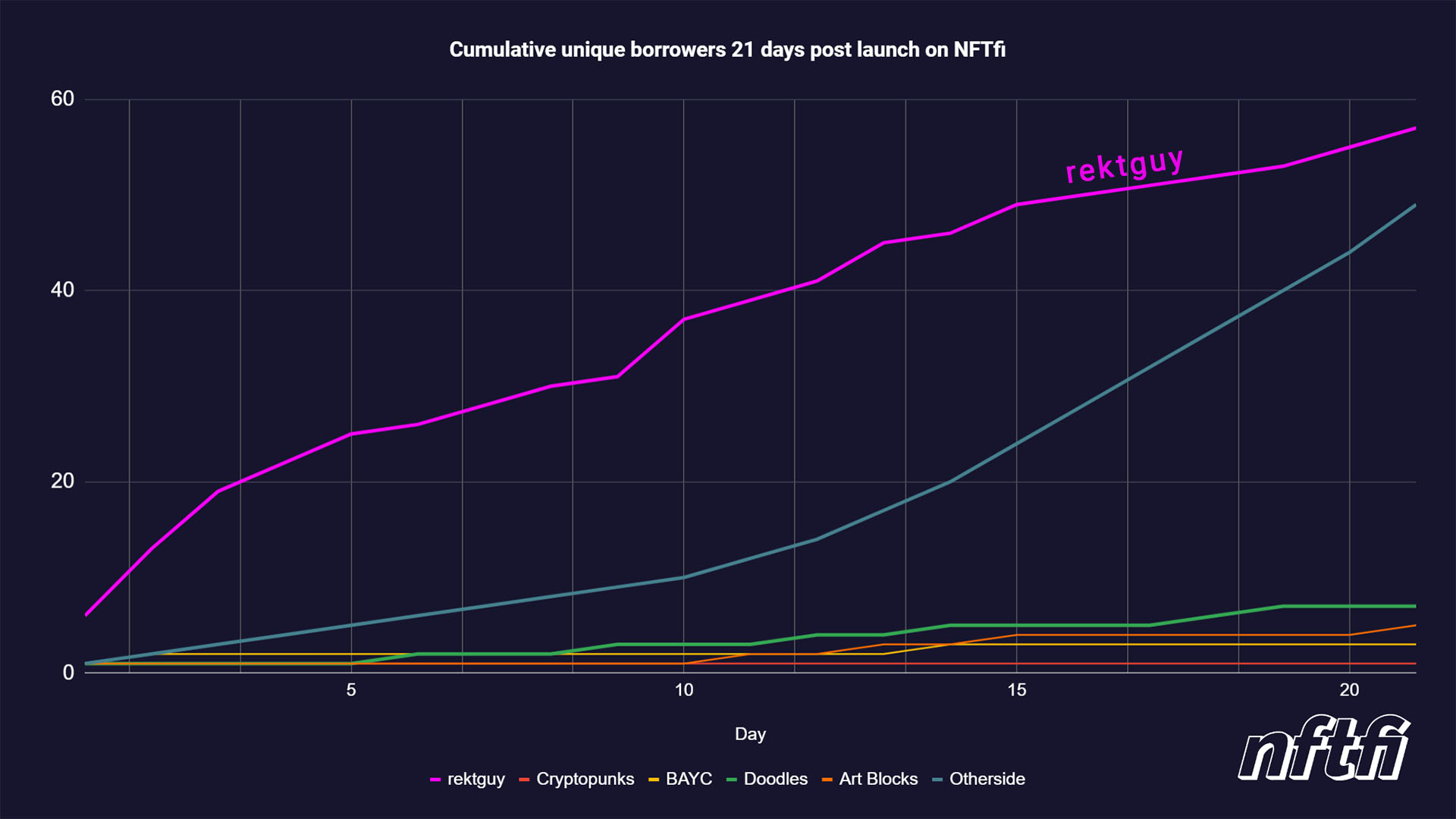

Ironically, rektguy has just become the fastest-ever adopted new project on the NFTfi platform! Below we’ll be highlighting how community members are turning to NFT loans to unlock liquidity from their assets. They are still a nascent project, but definitely one we are excited about and recommend keeping a close eye on.

Rektguy: The Fastest Growing Launch of NFTfi

The rektguy community has quickly captured mainstream attention while simultaneously breaking records on NFTfi as well as the fastest-ever adopted new project on the platform: in the first three weeks post launch, 57 users took out over 300 rektguy-collateralized loans, unlocking over 650,000 USD in liquidity for holders.

Why have NFT loans become so popular in the rektguy community?

“Liquidity is a major problem for NFTs, especially during volatile periods,” said rektguy community member TogL.

“NFTfi allows our community members to unlock liquidity from their rektguy NFTs whenever needed. It just gives us financial flexibility that we otherwise would not have. Rather than having to sell off assets at low prices during dire times, we can now access that capital whenever needed - while keeping the upside exposure. This is huge.” - TogL

While NFT loans have a variety of use cases, we generally see borrowers use NFTfi to achieve one or two primary goals: either they use NFT loans as a put option to protect against downside risk, or they use them to “lever up” their existing holdings for additional exposure.

The former is a true bear market use case and entails taking out high-LTV loans to gain optionality at the point of loan expiry: pay back if the collateral value is above the loan principal, and default if it dropped below the loan principal, and keep the money.

In the latter case (using loans to lever up), a borrower would, for instance, take out an NFT loan to participate in an upcoming mint, or simply buy another NFT on the secondary market to gain additional upside exposure. Note that leverage increases profit potential but also the risk of losses, and manage your risk carefully.

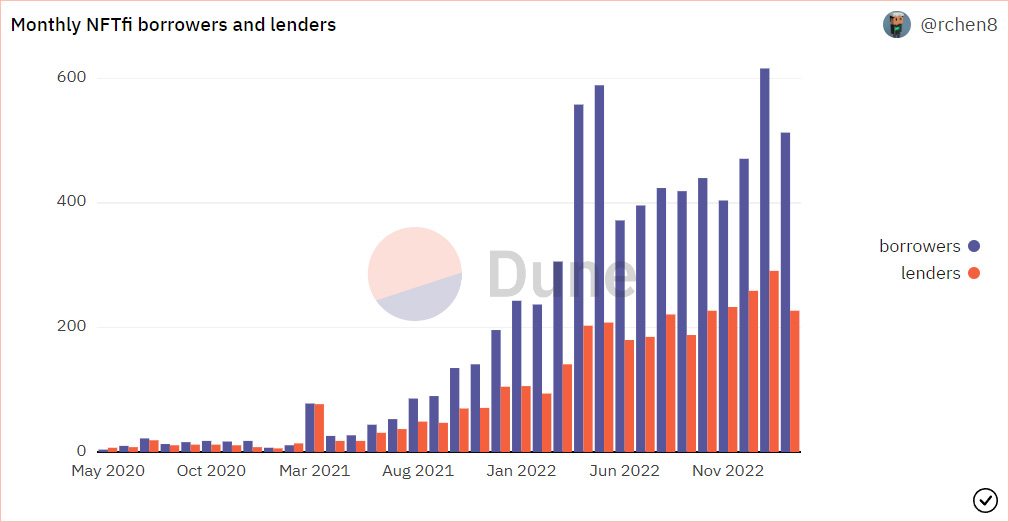

NFTfi lenders, on the other hand, have the perspective of earning higher-than-average interest. The average rektguy loan APR is ~60% as of mid-February 2023, lower than many other new collections - another very positive sign for the rektguy community. The rising interest of lenders in rektguy is in line with the general NFTfi user trend: #up-only.

Moving Forward

The rising popularity of NFT lending is not surprising - the value proposition for holders of illiquid assets (and their communities) is crystal clear, and the trajectory of credit markets around new asset classes is well documented in other markets.

So it’s, in our view, not a question of whether adoption will grow dramatically, but only how quickly. Many rektguy holders are early adopters of lending liquidity, and many other communities are and will be following suit. We wish them an exciting future as a project, and will be watching and supporting their journey.

You can learn more about rektguy on their website or follow them on Twitter.

To learn more about NFTfi, join our thriving Discord community, or check our Twitter.

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products such as NFT loans.

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >