Start placing Standing Collection Offers (SCOs)!

November 14, 2022 ・ 5 min read

What are Standing Collection Offers (SCOs)?

Our new SCO feature is a new loan offer type, allowing lenders to submit loan offers that are valid for any currently listed NFT or, in the future, to be listed NFT of a particular NFT collection. Before, lenders had to place individual loan offers for each individual NFT asset in a collection — now, they can target entire collections (any asset within the collection) with just one offer!

SCOs are standing loan offers in the sense that they remain valid and can be accepted by multiple borrowers until 1) they expire (the lender can set the expiry time manually), 2) the wallet which made the SCO runs out of money, or 3) the lender revokes the offer.

Alongside introducing collection offers, we are also adding a new Collections page, where you will find all listed collections and their basic loan stats.

Collections page — Card view & List view

How do SCOs work?

Here is an example of how SCOs work on NFTfi. Lender X makes a standing collection offer on the CryptoPunks collection and sets a 7-day expiry duration. Any borrower who has listed a CryptoPunk as collateral will see Lender X’s collection offer. Any borrower who newly lists a CryptoPunk as collateral will also (immediately after listing it) see Lender X’s collection offer. For 7 days, Lender X’s account will keep giving out an unlimited number of loan offers (and enter into loan agreements) automatically unless Lender X’s wallet runs out of funds or Lender X cancels the collection offer. After 7 days, the collection offer expires, and the collection offer disappears for all borrowers who have listed CryptoPunks.

Benefits for borrowers

Borrowers are expected to enjoy a much reduced waiting time to access liquidity and will have more offers to choose from. Those borrowers newly connecting their wallets to NFTfi with assets that have valid SCOs, will enjoy instant offers.

If you are new to borrowing on NFTfi, you can learn more here.

Benefits for lenders

Lenders can execute collection-wide lending strategies with minimal overhead and achieve high capital efficiency: if Lender X has X USD in capital he wants to lend against a specific collection, he can place an SCO and will give out loans automatically unless the offer expires, is revoked, or the wallet runs out of money. We expect the SCO feature to be used mainly by professional lenders to achieve higher capital efficiency with a lower admin overhead.

If you want to start lending for the first time, read this guide first.

Important risks!

Collection offers are a powerful tool and put a lender’s wallet on “auto-pilot.” Lenders must do their own collection due diligence and understand the scope of their planned SCOs before they are placed. We strongly suggest using separate wallets/funding for your SCO lending strategies. Please note the following:

- SCOs automatically bid on ALL collections of a particular smart contract: For instance, if you put an SCO on “Art Blocks 2” on NFTfi, that offer is valid for many collections with vastly different collateral values, e.g., for Fidenzas (around 100 ETH floor at the time of writing), Dreams by Joshua Bagley (around 2 ETH floor at the time of writing) and all other Art Blocks 2 collections. The SCO feature is not designed for these “meta collections.” Understand the scope of your SCO and don’t get rekt.

- SCOs don’t detect “OpenSea flagged” assets: SCOs automatically bid on ALL collections of a particular smart contract. This means you could end up with loan collateral that is flagged as contested on OpenSea or has otherwise problematic provenance. If you use the SCO feature, you knowingly accept that you might end up with such assets.

Please note that due to the above risks, NFTfi accepts no responsibility for any losses related to wrongly placed / misinformed SCOs! Asset information in our UI (floor prices, OS link, asset pictures) may not be up to date at all times due to different reasons.

How to place a collection offer on NFTfi?

There are two options to access collection offers. When on the asset page, click the collection name, which will take you to the collection page. Or, you can click Lend in the main menu and select “Collection offers.” Click on the desired collection, and you will be redirected to the collection page.

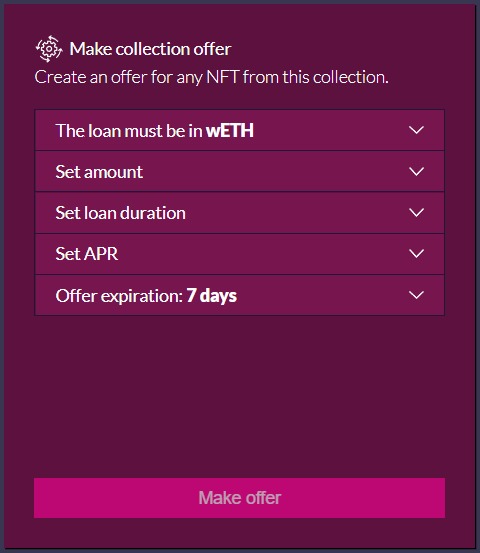

Once on the collection page, you can make a collection offer by selecting loan terms on the right, just like you would with an individual loan offer. Once satisfied with the loan terms, click the “Make offer” button, and that’s it! Your collection offer is now live, and if an asset from that particular collection becomes available under your loan terms, the borrower may initiate the loan!

With collection offers, you can also set an offer expiration date.

As mentioned above, we suggest that lenders use separate wallets with adequate funds for different collections, as you might be giving out loans to multiple assets at the same time.

Follow us on Twitter and join our awesome Discord community if you need help with SCOs, or want to connect with other NFT Finance enthusiasts.

Discord | Twitter | Join the Ambassador program

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >