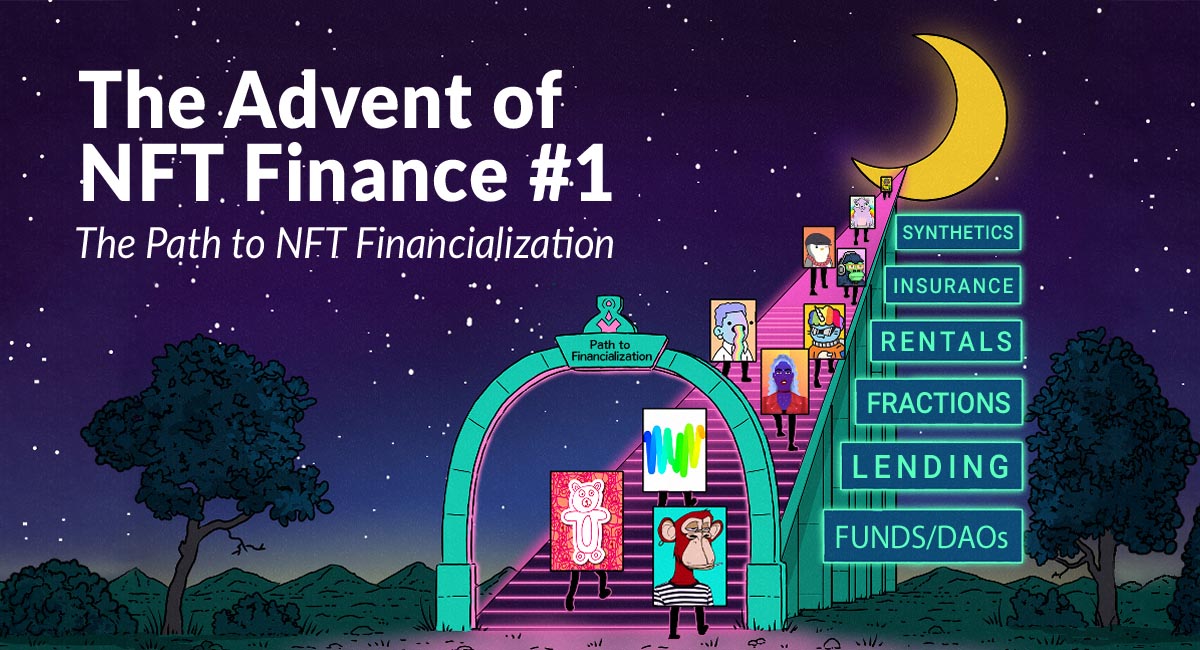

The Advent of NFT Finance #1: The Path to NFT Financialization

February 10, 2022 ・ 17 min read

The first in a series of articles of articles exploring the systemic impact of NFT Finance on the mass adoption of NFTs — within the Art & Collectibles vertical and beyond. A research collaboration with CADLabs.

By Giulio Trichilo and Jonathan Gabler

INTRODUCTION

By volume, NFTs are currently estimated to be a $40B market [1]. In Q1 of 2021, trading volume was up 13,118% versus Q1 of 2020 [2]. In Q3, this same year-on-year statistic stood at 26,719%, with $6B in volume on Ethereum alone [3]. Clearly, there has been phenomenal growth in the NFT space, but why?

NFTs are blockchain’s answer to provable, scarce, digital ownership. Until now, the lack of demonstrable, traceable ownership in Web2 has ingrained infinite reproducibility as one of the internet’s characterizing features up until the present day. If there was one funny dog meme, there were already a million; now, enter NFTs — a crucial missing piece in the scarcity-driven digital value creation puzzle.

Where does the NFT space currently stand? Many well-established NFT Blue chip projects have been launched on Ethereum, including CryptoPunks, BAYC, Autoglyphs, and specific ArtBlocks Collections like Ringers and Fidenzas. While metaverse land was a focal point for NFT investor attention later in 2021, with significant traction in projects like Axie, Decentraland, and Sandbox, the rest of NFT history has largely been about Art and Collectibles (A&C)[1, 2], financially and socially. The involvement of prestigious auction houses like Sotheby’s and Christie’s attests to this.

On March 11th of 2021, Beeple’s “Everyday: The First 5,000 Days” was sold for $69M at Christie’s [4], a landmark moment in the brief history of NFTs. However, such prices are not representative of the entire NFT market. In fact, a recent study from the Alan Turing Institute on NFT valuations revealed that: “only 1% of NFTs sell for more than $1,500, and 75% sell for $15 or less” [5]. Some have questioned these market discrepancies and suggested NFTs could be a speculative bubble. We would argue in response that the wrong questions are being asked and there is a widespread failure to distinguish between NFTs as a technology and the economic vertical that has established itself as the main driver of NFT hype so far: A&C.

In our view, NFTs have the potential to become a ubiquitous internet primitive. We envision a world where all economic verticals will make extensive use of NFTs. In this series of articles, we aim to establish this point while presenting our thesis for the NFT space’s next frontier — NFT Finance. We define NFT Finance as the Web3 vertical comprising the infrastructure and set of markets for NFT-based financial products and services.

BEYOND A&C: NFTs CAN REPRESENT ANYTHING NON-FUNGIBLE

The premise of NFT technology is that anything non-fungible can be uniquely and unquestionably represented. This includes A&C, real estate, legal contracts, IP rights, and supply chains. Any economic activity that deals with distinct units may benefit from existing on a blockchain as an NFT.

At the moment, NFTs conform to two main EIP specifications in mainstream use: ERC-721 and ERC-1155. An NFT is a token with an ID that makes it digitally unique or digitally scarce in a blockchain ecosystem. Every single token in an NFT spec comes with its own ID. This ID is the main differentiator between NFTs and fungible tokens. However, as with fungible tokens, an NFT owner can be an Externally Owned Account (EOA) wallet — usually a person — or a smart contract. NFTs also have a field for a link to (potentially) off-chain metadata.

As new use cases gain market relevance, it is likely a multitude of new standards for NFTs will be developed. However, the conceptual underpinnings are here to stay and could become fundamental to the operations of many industries. Economic verticals which leverage blockchain infrastructure to represent non-fungible economic units stand to benefit from efficiency gains and ecosystem synergies (financial or otherwise) if markets for those same economic units exist on the same infrastructure. Real estate, IP rights, and supply chain management are just a few examples of economic verticals which are well-suited to NFT adoption, given that non-fungible items are at the core of their economic functionality.

While the role of NFTs is to date not yet systemic even within the blockchain ecosystem, the adoption of NFTs as digital primitives in additional economic verticals is likely to put the technology front and center.

THE ROAD TOWARDS BROADER NFT ADOPTION: BENEFITS AND VALUE CREATION

Blockchain technology can increase an economic vertical’s efficiency. This can take the form of transparency, visibility, accountability, and ascertaining provenance.

With decentralization, direct (non-intermediary) interfacing with the end user or client becomes possible too. This has been best recognized by conventional players in A&C such as Sotheby’s. They now have a space in Decentraland [6], and hold live auctions in Ethereum. Popular narratives in both ‘Finance 2.0’ with DeFi and ‘Art 2.0’ with NFTs take from these themes and leverage their implementations.

Blockchain has another important paradigm at heart — composability. This set the stage for the so-called ‘DeFi Summer of 2020’ — the Cambrian explosion of protocol interoperability. Through greatly increased levels of TVL, the biggest protocols of the time cemented themselves as systemic in a ‘we’re here to stay’ show of hands. While composability has not yet infiltrated the NFT space to the same degree, it is poised to do so from many angles. Each of these angles should unlock value for the space, financially or otherwise. From a ‘social composability’ angle, projects like POAP [7] have already begun leveraging NFTs as a way of demonstrating membership of a community and proving participation.

However, we believe that the main angle for unlocking value in the NFT space lies in what we’re calling ‘NFT Finance’. As previously defined, NFT Finance comprises the Web3 infrastructure and set of markets for NFT-based financial products and services, such as NFT-backed loans. Value creation for the NFT space stems from the interplay between these financial markets and the underlying NFT economies.

NFTs can and will encompass more economic verticals than A&C. However, to maximize the opportunities for value creation, it is crucial to have a thorough understanding of how traditional A&C (TradA&C) markets work. Having conducted extensive research, we can conclude that there are broad infrastructural similarities between traditional and NFT-native ‘variants’ of these markets. We will discuss this in the next section, and in greater depth in the following articles in this series.

THE WEB3 NFT ECONOMY CURRENTLY MOST CLOSELY RESEMBLES TRADITIONAL A&C MARKETS

The closest ‘real world’ economic vertical to the Web3 NFT Economy today is TradA&C. In TradA&C markets, ‘Financialization’ or ‘Specialty Finance’ are the key to new value flows. Assets and capital which are otherwise stagnant now have infrastructure to become active engendering the creation of new markets. Through assimilation, NFT Finance can unlock those same value flows for the A&C NFT vertical.

Unlocking mass participation for the NFT space can happen through NFT Finance. Since the entire market infrastructure is blockchain-based, the potential scale of this integration, adoption and value creation is unprecedented.

As A. Picinati Di Torcello [9] puts it, TradA&C markets are seen by many as “high-risk, illiquid, opaque, unregulated, high transaction costs, at the mercy of erratic public taste and short-lived trends, and virtually ‘unhedgeable’”. Yet, the total estimated size of A&C stands at USD 1.7T [10, 11].

In the following sections we will provide a high-level overview of the traditional A&C market structure and break down the terms ‘Financialization’ and ‘NFT finance’. Each of these topics will be treated in much greater detail in later articles.

SUPPLY AND DEMAND, ASSET CIRCULATION, LIQUIDITY AND VALUATION

In TradA&C markets, supply and demand meet at auction houses, pawn shops, or galleries. What we call the ‘price formation’ model, the model for the process by which prices are set, is usually defined at auction or through a binary model. Auction houses use the former model and galleries use the binary model (buy / don’t buy).

A&C are non-fungible (semi-fungible at best) and markets for these assets are traditionally illiquid. Liquidity itself is a function of market demand. Asset circulation in the A&C ecosystem is determined by several factors. A key role is played by the asset issuer’s acquaintance with the principal market intermediaries and price formation venues. The market presence and visibility of the actors on the buying and selling sides are also key. Liquidity, resultant of demand, is driven by the fame of the artist or collectible issuer, past performance (price data), insider information, and speculation. For those familiar with liquidity being quoted in terms of depth or breadth of a bid-ask spread on an order-book based exchange, or the size of token pairs in an AMM, this definition may sound unfamiliar and rudimentary.

Mathematical and statistical models which can describe the liquidity of a particular piece or particular collection from a given artist or collectible issuer based on non-price factors and asymmetric information are virtually non-existent. This said, the valuation of A&C is, when possible, market-based, and when not, it becomes the domain of expert appraisal services.

In the NFT space, “Mapping the NFT revolution” by the Alan Turing Institute [12], quoted earlier, has taken an important first step towards greater transparency. As a premise, this noteworthy analysis was possible mainly because of the full (noise free) data availability which a public blockchain like Ethereum can provide. An attempt was made at characterizing the market’s topology through the lens of statistical network analysis, as well as to model NFT valuation.

Topologically, it was found that tight clusters formed around specific NFT niches, attesting to ‘ecosystem presence’ being an important factor in valuation. As far as valuation itself is concerned, visual characteristics, sales history, and the popular influence of some traders are found to account for up to 70% of the overall explanatory power in employed models. As we’ll argue in our TradA&C deep-dive article later in this series, this result strongly attests to there being a parallel between traditional and NFT A&C valuation.

UNLOCKING MAINSTREAM PARTICIPATION — THE NEED FOR FINANCIALIZATION

So, how can we unlock mainstream participation in an opaque and illiquid market? A&C are scarce and non-fungible by their very nature, so it is not possible to ‘make the market liquid’ with a one-off intervention. It is possible, however, through Financialization: building an infrastructure of new, bespoke financial products that serve to release liquidity at all levels of the industry, create new markets in relation to that asset class and encourage further investment in it.

These new financial instruments, whether financial primitives or more complex ‘money legos’, can directly unlock novel value flows for current and new market participants alike.

Financialization is a rather recent phenomenon in TradA&C markets as well, and is sometimes also termed Specialty Finance. It consists of the creation of financial instruments ‘based’ on A&C (and the establishment of markets for those instruments). These instruments can be broadly classified into types: debt-like: pertaining to fixed-income instruments such as art-collateralized loans; equity-like: for example asset fractionalization and other means of fungible part-ownership; and aggregation-like: a broad category comprising art funds and other products where art-based portfolios are created, traded and managed on behalf of investor groups.

Who participates in TradA&C financial markets? As we will go on to explore in later articles, the target investors for traditional financialized A&C products are a very restricted niche of high-net-worth individuals. This lack of broader participation puts estimates of the market size at not over $30B [10] — a tiny footprint in a USD 1.7T market.

So, can we expect the Financialization phenomenon to move into NFT A&C markets, and how widely will the corresponding instruments find user and investor adoption?

Novel NFT Finance products can mimic traditional financial instruments such as the loan-type products found today in most money market protocols. They can also consist of entirely new Web3 financial primitives, such as NFT AMM’s. We are still far from having a definitive ontology for these products, but we expect them to fit into the 3 Financialization categories defined above. Below, we set out how the expanding spectrum of NFT finance products can be distributed within those categories:

- Debt-like: the creation of any fixed income primitive or money lego resulting in a cash flow based on NFTs. e.g. a p2p loan where a blue chip NFT is used as collateral

- Equity-like: the creation of any primitive or money lego enabling ownership of fungible items (loosely) backed by non-fungibles. e.g. fractionalized tokenization of NFTs via ERC-20s

- Aggregation-like: the creation of investment vehicles, aggregators, or market making utilities which enable individuals to become market participants solely on the basis of upfront capital, with no industry or technical knowledge required. An index fund which tracks NFTs, as well as an NFT AMM are both examples of ‘items’ in this category

We are already seeing project teams offering NFT-based financial products across all three Financialization types: debt-like NFT-backed lending projects such as NFTfi’s platform are fast emerging in different (e.g. centralized and decentralized, peer-to-peer and peer-to-contract) shapes; equity-like securitization solutions such as NFTX, and aggregation-like DAO fund structures and market making infrastructures have been merging at a rapid pace.

NFT Finance has the potential to progress much faster, and develop appeal for a much wider audience, than the traditional Financialization of A&C. This is due to the nature of DeFi composability which is unique to blockchain infrastructure — as are NFTs themselves. This common infrastructural medium enables direct synergies between NFT markets and NFT finance. We argue that this synergy will allow economic verticals leveraging NFTs to accrue importance and interoperability with the broader financial ecosystem — in other words, become a true asset class.

NFT FINANCE FOR SCALE AND LIQUIDITY IN A&C — BECOMING A ‘TRUE’ ASSET CLASS

To determine the societal relevance of a technology, it is common to refer to usage metrics, adoption curves, and social footprint as gauges. In financial terms, however, the systemic importance of an asset class can be ranked on a scale from fringe or integral. A ‘fringe’ asset class is one which is typically characterized by non-fungibility, lack of liquidity, difficulty in valuation, and improper direct use of assets as financial assets. Keep in mind, all of Crypto was considered ‘fringe’ (despite fungibility) back in 2013.

A typical definition of an asset class is ‘a grouping of investments that exhibit similar characteristics’ [13]. It is hard to argue that A&C are not assets outright. They are, after all, valuable and used as investments. However, it is important to keep in mind that a set of assets is not automatically an asset class. While one may be tempted to jump at defining A&C as an ‘asset class’, there is a level at which this ‘grouping of assets’ is considered so ‘fringe’ that for practically applicable purposes, the definition fails to bring with it the implication of economic benefit and opportunity that usually accompany asset classes.

So when does a set of assets become an asset class in the proper sense? There is no absolute definition, however if the market for the asset class is highly liquid and benefits from ‘mainstream’ participation in terms of volume, diversity and function of actors, the asset class can be deemed integral. Also, if financial circularity is involved in terms of the existence of supporting financial products, then the economic landscape becomes complete.

It is in this regard that NFT Finance is necessary to turn an NFT vertical, starting with A&C, into something closer to a ‘true’ asset class.

A consequence of NFTs ‘taking over the world’ is that the verticals leveraging the technology should become more tightly integrated with the global financial landscape, as such, it’s important to identify to what extent this evolution is underway.

TRAD A&C AND THE ASSET CLASS QUESTION

Traditional A&C and associated investment services (Financialization) fall under the class of ‘illiquid alternatives’ and are gaining the attention of wealth management services and family offices [9, 14]. This universe of assets should be considered an asset class as argued in Picinati Di Torcello (2012) [9]. However, ‘mainstream’ participation, with global markets as a reference point, is not present. We argue in favor of mainstream participation as a necessary condition for NFT A&C to become a ‘true’ asset class, similarly to how in traditional markets the consensus is that illiquid alternatives are by definition asset classes, but are not of systemic importance.

As Cynthia Sachs, CEO of Athena Art Finance, argues in Frank, R. (CNBC, 2021) [14], for A&C to be an ‘asset class’ there must be an underlying credit market. At a glance, a well frequented credit market implies the participation of investors and holders, creating value flows. To use our terminology, this is a type of Financialization. At a mature stage of Financialization, the products offered may be both fungible and non-fungible in nature. On the equity-like side, you have fractionalized art. On the debt-like side you have art-secured loan products. In the OTC realm any bespoke non-fungible product goes — such as a particular loan on a particular piece.

IS THE EXISTENCE OF NFT FINANCE ENOUGH FOR NFT A&C TO BECOME A ‘TRUE’ ASSET CLASS?

Many would argue that it was the Financialization of real estate which started in the late 90’s that allowed it to scale, opening the market up to financially-driven players. This involved the securitization of loans and the creation of various mortgage-based products and derivatives. Real estate is now considered an asset class outright.

While the NFT market is still at an early stage, we believe it is not too far-fetched to say that the interplay between the market and an appropriately and responsibly constructed NFT Finance space could be vital to scaling NFTs — at the very least A&C NFTs.

If an economic vertical or market niche is to scale and become mainstream it needs to benefit from participation and network effects. In the case of financial products this participation and network effects manifest in trading. Hence, indicators like trading volume, volatility, and gauges of liquidity — indicators of market health — also indicate how affluent and integral the asset class is.

In other words, we can say that NFT Finance adds utility. Generally, utility contributes to liquidity. In a market which is traditionally illiquid because non-fungible assets are what’s traded, Financialization ‘adds utility’, helping the space reach asset class status. More activity in NFT Finance fuels activity in markets for NFTs themselves, and vice versa. We discuss this “NFT Finance Liquidity Loop” in depth in upcoming articles.

CONCLUSION

NFT Finance is a complementary vertical which we believe is necessary to make the A&C NFT vertical mainstream. It can play a crucial role in endowing NFTs in this vertical with the necessary elements for the space to be universally recognized as an asset class. In the financial sense first, and even more broadly as an internet primitive — with the benefit extending to other verticals within the scope of NFT tokenization, like gaming, music or real estate.

We are excited about the potential of NFT Finance. We are sharing our thoughts in this article series in the hope that it may add a useful artifact to the general discourse about the ontology and direction of our industry.

To get notified once we publish the next article in this series, leave us your email address at NFTfi.com.

We would like to thank the following reviewers for their invaluable feedback: Dr. Josh Rosenthal, Dmitriy Berenzon, Peter Pan, Christopher Heymann, Derek Edward Schloss, Stephen McKeon , Alexander Lange, Emma Cui.

REFERENCES

[1] The NFT Market Report. (2021). The Chainalysis 2021 NFT Market Report. https://go.chainalysis.com/nft-market-report.html

[2] NonFungible.com. (2021a, March). NON-FUNGIBLE TOKENS QUARTERLY REPORT Q1 2021. https://nonfungible.com/subscribe/nft-report-q1-2021

[3] Q3 2021 NFT Quarterly Report. (2021). NonFungible.com. https://nonfungible.com/nft-report-q3-2021

[4] Damiani, J. (2021, March 12). Beeple’s ‘The First 5000 Days’ Sold To Metakovan, Founder Of Metapurse, For $69,346,250. Forbes. https://www.forbes.com/sites/jessedamiani/2021/03/12/beeples-the-first-5000-days-sold-to-metakovan-founder-of-metapurse-for-69346250/

[5] Non-fungible tokens: Can we predict the price they’ll sell for? (2021). The Alan Turing Institute. Retrieved 2021, from https://www.turing.ac.uk/blog/non-fungible-tokens-can-we-predict-price-theyll-sell

[6] Decentraland. (2021, June 4). Sotheby’s opens a virtual gallery in Decentraland. Retrieved 2021, from https://decentraland.org/blog/announcements/sotheby-s-opens-a-virtual-gallery-in-decentraland/

[7] P. (2021b). POAP — Homepage. POAP. https://poap.xyz/

[8] NonFungible.com. (2021b, June). NON-FUNGIBLE TOKENS QUARTERLY REPORT Q2 2021. https://nonfungible.com/subscribe/nft-report-q2-2021

[9] Picinati Di Torcello, A. (2012). Why should art be considered as an asset class? Deloitte. https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/artandfinance/lu-art-asset-class-122012.pdf

[10] Deloitte. (2019). Art & Finance Report 2019 (№6). https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/artandfinance/lu-art-and-finance-report-2019.pdf

[11] Masterworks. (2020, November). Understanding Art as an Investment [Slides]. PDF. https://assets.ctfassets.net/u7fuap5iqsvx/Yl5AJQD1mtKDMbs9V9GjP/02d2cc5af96cb48fb741814f3ab7b667/Masterworks_Art_as_an_Investment__November_2020_.pdf

[12] Alan Turing Institute. (2021, October). Mapping the NFT revolution: market trends, trade networks, and visual features (№20902). Nature. https://doi.org/10.1038/s41598-021-00053-8

[13] What Is an Asset Class? (2022, January 10). Investopedia. https://www.investopedia.com/terms/a/assetclasses.asp

[14] Frank, R. (2021, February 25). The wealthy are borrowing billions against their art collections and lenders are reselling the debt. CNBC. Retrieved 2021, from https://www.cnbc.com/2021/02/25/the-wealthy-are-borrowing-billions-against-their-art-collections-.html

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >