The Advent of NFT Finance #4: The Traditional Art and Collectibles Market

June 02, 2022 ・ 19 min read

The fourth in a series of articles exploring the systemic impact of NFT Finance on the mass adoption of NFTs — within the Art & Collectibles vertical and beyond. A research collaboration with CADLabs.

By Giulio Trichilo and Jonathan Gabler

INTRODUCTION

In this article, we provide a breakdown of how the Traditional Art & Collectibles (Trad A&C) market works. We establish key similarities (and some differences) with the NFT A&C market, setting us up for the final two articles in the series that will deep dive into how Financialization works in Trad A&C followed by a thorough analysis of our end goal: the development and potential of NFT Finance.

We begin by examining the structure of the Trad A&C market, considering fungibility, liquidity and price discovery. We then break down the participant ecosystem, the fundamental differences between primary and secondary market issuances in Trad A&C and Traditional Finance (TradFi) markets, and the nature of price formation at auction houses and galleries. We then consider how to conceive of market making in an A&C context, the role of ‘institutional trust’ in mitigating risk, and, crucially, how value creation arises. To answer the latter question, we expand on the ‘subscription’ framework for valuation introduced in Article 1 in far greater depth, exploring the roles of key market participants and the importance of scarcity — which takes on novel twists in an NFT A&C context.

CATEGORIZING THE TRAD A&C MARKET

The market for Trad A&C is not a financial market. In Article 3, our overview of TradFi, we defined financial markets as venues which facilitate the sale and purchase of any security or financial instrument [1]. High value art pieces and categories of collectibles do not ascribe to the definition of security nor of financial instrument. They are more properly termed ‘Non-Financial’ or ‘Real’ assets, which fall under the category of alternative investments.

However, the market for Trad A&C does not inherently serve a purpose in terms of facilitating the functioning of the real economy — this is not a veiled critique of the sector, rather a fundamental observation that the nature and purpose of an asset will reflect how markets formed around its trade function. Rather than comprising any evident utilities, the main characteristics typically attributed to art markets are: “high-risk investments, illiquid, opaque, unregulated, high transaction costs, at the mercy of erratic public taste and featuring short-lived trends” [2].

THE STRUCTURE OF THE TRAD A&C MARKET

Does Trad A&C’s position as neither vital to the real economy nor qualifying as a financial market mean its markets have no structure? Certainly not. Much like capital markets that we looked at in Article 3, the Trad A&C market can be subdivided into primary markets, where the initial issuance of a particular asset takes place, and secondary markets where assets sold once can be re-sold. In Article 3, we defined ‘market microstructure’ as the working processes of markets that in turn affect determinants of transaction costs, price discovery, trading behavior, and other particulars. While it is almost unheard of to speak of ‘market microstructure’ in this context, complex modes of price discovery, for example, are definitely present — primarily in the form of auction-based and binary price formation mechanisms. This is mediated by auction houses and galleries respectively, as touched upon in Article 1 and revisited in more detail in the body of this article.

However, very much unlike capital markets, where millions of people and firms participate in buying and selling financial securities, or the commodities market where measures of raw or primary products are exchanged using standardized contracts [3], Trad A&C market activity is characterized by the interactions of a limited array of private collectors, museums as well as large corporations and institutions [4]. The key takeaway here is that the high volumes and subsequent high liquidity seen in many markets for securities are driven by the fact that the assets traded are, in the overwhelming majority of cases, fungible assets whose inherent purpose is linked to the functioning of the real economy, with such levels of participation and standardization having led to the creation of, and arguably the need for, high-performance market making.

The fungibility of an asset is in and of itself not always a sufficient condition for a market formed around it to be liquid, however, when the asset is inherently non-fungible, such as a painting in the real world, as well as most NFT A&C collections seen today, liquidity is harder to achieve. Since Trad A&C as well as most NFT A&C can be classified as passion assets (or HODL assets), the interactions between the demand and supply sides are less frequent. At the aggregate level, this implies that the institutions responsible for the upkeep of infrastructure which maintains price formation mechanisms in place do not need to be as sophisticated as an electronic order book used in a CEX or even the Automated Market Makers (AMMs) used in DeFi’s DEXes.

In general, price discovery of passion assets is based not only on the availability of the demand and the supply sides, but also on a work’s appraised valuation, its price history, and its predicted future value. This is the case for both Trad & NFT A&C, where a lack of market liquidity increases the impact of speculation on the price discovery process in comparison to traditional fungible assets like stocks, or ERC-20 tokens.

In broad strokes, the Trad A&C market is a relatively illiquid market primarily for non-fungible assets. It can be subdivided into primary markets and secondary markets, alongside an asset creation process which informs valuation even outside of market structure. The lines between primary and secondary issuance are blurred as the same entities, typically galleries and auction houses, are responsible for the primary forms of intermediation, clearance and settlement. At these venues, price formation is twofold: binary price setting (buy or don’t) in the case of art galleries, and auction-based [5] [6] in the case of auction houses. Given the market’s inherent illiquidity, there is a need for centralized ‘expert opinion’ actors, namely appraisal services, to provide interim expected valuations of non-fungible assets which are currently outside market boundaries. Valuations thus obtained are inherently speculative but nonetheless become an input to future price formation once the appraised asset re-enters circulation and transactional availability.

In the following sections, we will break down how the Trad A&C market works in finer detail, looking in turn at the participant ecosystem, primary and secondary market issuance (and how this differs from the TradFi examples we covered in Article 3), price formation and market making in galleries and auction houses, and finally subscription: a useful model for understanding value creation in the Trad A&C market.

THE PARTICIPANT ECOSYSTEM IN TRAD A&C

The primary set of participants in the Trad A&C market is [7] [8]:

PRIMARY AND SECONDARY MARKETS

While making a distinction between primary and secondary markets is crucial to understanding both TradFi and Trad A&C markets, they do not work in exactly the same way. The main differences between the subdivision of primary and secondary market issuance in Trad A&C as opposed to capital markets are as follows:

In capital markets, the primary issuance of standardized fungible assets such as shares in a company is synonymous with the creation of the assets themselves — publicly traded shares are created upon the company itself going public, and do not require a production process — they are spun into existence based on the company’s valuation. In stark contrast to this, an artistic or collectible non-fungible piece typically requires nontrivial amounts of time and effort to produce [7] [8](this is also true for generative NFT art), a process which is completely independent of its functionality as an asset.

These particularities of issuance mean that in practice, there is no set structure for the ‘primary market’ and the term is therefore more useful at an individual asset level rather than for attempting to define operations at an aggregate level. Further complicating matters, the same participants are often involved as buyers and sellers at both primary and secondary market levels [8].

Therefore, whether the market is ‘primary’ or ‘secondary’ is actually determined at the individual asset level more so than at the aggregate level — it is not structural in nature.

Now that we have established the key participants in Trad A&C and broken down primary and secondary issuance, we can move on to how price formation works in practice. We give an overview of both galleries and auction houses, as these are the most important venues for primary and secondary market action, demand generation, and — primarily in the case of the latter — liquidity provision.

We limit the discussion to market participants operating within legal ecosystems and do not consider the impact of counterfeit risk and black market price history on subsequent ‘legitimate’ price formation, although these undercurrents undoubtedly exist in Trad A&C.

Auction Houses

Auction houses, as the name implies, use auctions as their price formation mechanism. An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest seller [6]. Within the context of the auction, the process informs the price discovery of listed assets.

Auctions can differ in the number and type of participants: primarily buyers and sellers. A buyer pays to acquire a certain good or service, while a seller offers goods or services for money or barter exchange. There can be single or multiple buyers and single or multiple sellers in an auction [5].

If a non-fungible asset is being auctioned for the first time (is on the ‘primary market’) and is then never re-auctioned, then price discovery only exists at the micro-level, with the bidding history and final bid price being the only available pieces of price related information (which may not even be made public). If a non-fungible asset is re-auctioned repeatedly, then price discovery exists at the micro-level and at the macro-level as a result of all conclusive price points reached with each auction.

Galleries

Typically, galleries are where most of the primary market issuance of artworks occurs. Galleries operate using a binary price formation model, i.e., purchase at a preset price or do not. While this may initially not really feel like a ‘price discovery process’ at all, it’s easy to forget that most day-to-day transactions in our experience — from the supermarket to any online shop to even SaaS subscriptions — happen this way. As such, price discovery can be construed as ‘willingness to pay’, which is a useful data point to have present — at the aggregate level for fungible assets and at the individual level for non-fungible assets.¹

Galleries act on both the demand side and supply side with regards to the procurement and sale of non-fungible assets [9]. When galleries are acting on the supply side (which is the majority of the time), the typical demand side is made up of retail or institutional collectors (e.g. HNWIs and museums). When galleries are acting on the demand side, they may be buying from artists directly or buying artworks at auction or from other galleries with the intention of reselling to their own network of buyers at a later date or motivated by the need to maintain their affiliated artists’ prices and the appearance of demand.

The relationship between liquidity in the Trad A&C market and galleries is difficult to pin down, given the latter’s use of a binary price formation mechanism. Furthermore, and by contrast to auction houses, gallery prices are often only available by request and sales data is not readily publicly available.

One approach for gauging liquidity would be to analyze sales made by both auction houses and galleries for a particular artist, taking into account price points and frequency. Then, the frequency of sales becomes a good proxy for the liquidity of that artist’s market. It is worth noting that within an artist’s output, of course, there will be some collections or series or artworks with higher demand and value — a process we will contextualize in the final section on how valuation through ‘subscription’ works [7] [8].

Since auction houses provide the main mechanisms for market liquidity and their prices are publicly listed, auction houses’ price-setting mechanisms limit the impact of galleries’ ability to set prices in a binary way — above all when it comes to secondary markets, the main area in which liquidity matters.

Market Making

Now what of market makers? As outlined in Article 3, in capital markets for standardized fungible assets, market makers are large institutions with significant capital and inventory of a given asset, and profit from the bid-ask spread (one could extend this definition to include AMMs like uniswap, with ‘capital’ and ‘inventory’ for the asset being the two components of a liquidity pool and with profit being protocol revenue in terms of explicit fees). Market making is inherently a lot harder when dealing with non-fungible assets — as there is no notion of ‘inventory’ for something provably unique.

However, we can still try and map the idea of inventory onto Trad A&C and NFT A&C, as when it comes to a particular series by an artist, or collectibles such as rare coins and figurines or generative NFT A&C — where each item in the collection is non-fungible but they ascribe to similar characteristics or are permutations of a base model, these may be ‘fungible in price’ [10]. This means that from a demand/buyer perspective, all pieces within that collection have a certain value and they may therefore be indifferent to which non-fungible piece within the collection they purchase. In this scenario, ‘market making’ might be feasible in terms of holding capital and inventory, whether profitable, however, is a different discussion.

VALUE CREATION IN TRAD A&C: SUBSCRIPTION

All of the structural elements considered so far will now enable us to break down the fundamental question of how value is created. Understanding value creation is essential to conceiving of the overall Trad A&C market as this process ultimately informs price discovery, particularly in the absence of the clear primary and secondary market structures that exist for other assets. To do so we will outline a process known as ‘subscription’ [7].

We restrict the focus of our discussion to non-fungible artworks and collectibles in the Trad A&C market, as the relationship between art and artist is better established and in our view more akin to that seen in NFT A&C. By contrast, for categories of collectibles such as video game collectibles or rare coins, the entity responsible for production is either an established corporation or is unknown / non-existent, as opposed to an individual (even anonymous) artist aiming to raise their profile.

The concept of subscription was introduced by Arts Council England in M.H. McIntyre, 2004, and is defined as “the process by which art is filtered and legitimized”. The need for this unusual and unofficial multi-party process is due in part to the lack of Trad A&C industry regulation and the fact that anything could be declared ‘art’, meaning artists must engage with their peers and other industry participants for recognition. The closest you can get to the concept of regulated activity, like you would encounter in financial markets, is ‘institutional trust’. A guarantee of authenticity from reputable institutions like Sotheby’s or Christie’s instantly grants an asset legitimacy and prestige. This guarantee ultimately serves in lowering the asset’s risk profile [8] and increases its desirability.

Within the subscription process, artists and their intermediaries alike strive for artworks to gain popularity and achieve progression — for example, an artwork being purchased by a prestigious museum or resulting in consistently higher secondary market prices. How does this progression work in practice? Networks of Trad A&C market participants and associated professionals advocate and endorse the work of certain artists through various means such as critical appraisal, inclusion in exhibitions, and the price formation process itself.

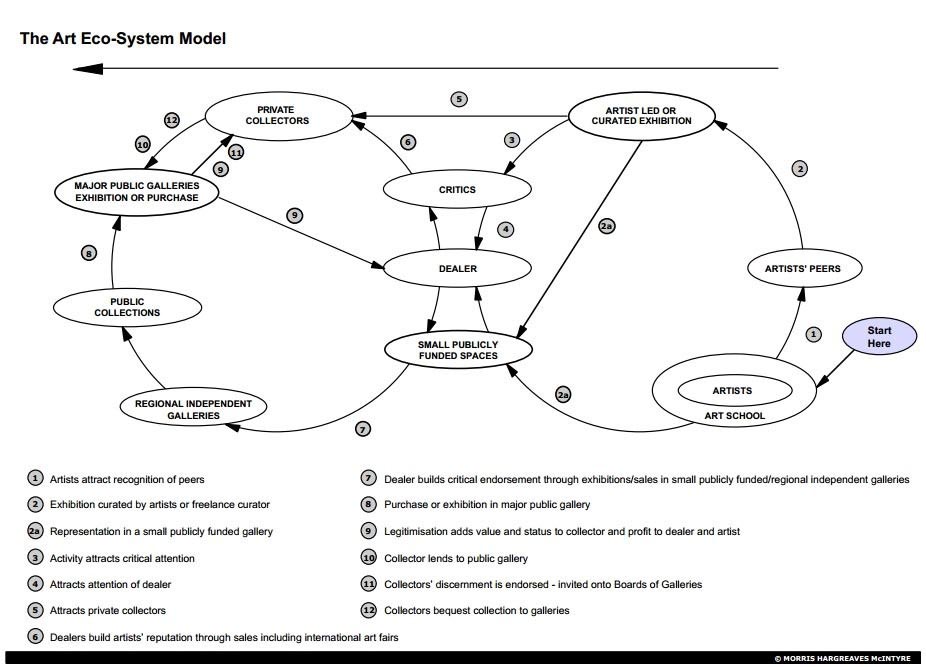

The art ecosystem model below illustrates the participants who determine artists’ trajectories as they accrue endorsements or subscription, and how they traditionally operate in relation to one another, although the exact order of interactions can shift:

Within this framework, “the value of an artist’s work increases in direct proportion to the subscription it attracts and sustains” [7]. This process is reflected by the artist or collectible issuer’s implicit ‘standing’ in the ecosystem, which is then publicized by intermediary parties such as dealers to the demand side. [reference] suggests “artists who aspire to move through the subscription system are encouraged to rely on dealers to maximize the degree of subscription that they can achieve and sustain. Placing work within significant collections is an important aspect of this activity”.

A simple parallel which exists between Trad and NFT A&C here is in ‘placing work within significant collections’: the traditional ‘collection’ can be replaced by a broader entity such as the blockchain on which a given generative collection itself is minted — Ethereum NFTs are ‘premiumized’ simply by virtue of the minting cost (gas fees) and associated network security. On a more localized level, you could also compare how Trad A&C artworks accrue in value when they are added to a notable collector’s collection, to the increased interest in NFTs that enter certain whales’ wallets — whether the whale publicizes their purchase or whether that wallet is one that is widely tracked by other collectors in the industry.

The subscription framework also dictates that organic scarcity (i.e. non-fungibility) of existing work produced by an artist is a “precondition for achieving high levels of subscription and consequent value, as well as a necessary outcome”. [reference] continues, “As value comes to reflect high levels of subscription, that value has to be maintained through a strict control of supply and demand. Managing the subscription process necessitates directly restricting the amount of work for sale, and the number of people who are able to possess work by the artist”. In other words, tradeable collections must not become inflationary in number, as the dilution of each work negatively affects subscription. In NFT A&C collection terms, these considerations have a novel twist found in the factors of a collection such as minting capacity, generative rarity, rights attribution, and broader Web3 utility. We’ll return to discuss this in more depth in Article 6, along with important parallels between the role played by the traditionally individual figure of an artist and an NFT collection’s community.

Now that we have established how subscription works and who the key players are, we will look at how this system interacts with liquidity in Trad A&C. Let’s consider an established artist with artworks from multiple collections available via secondary markets. We now know that the demand for non-fungible pieces created by this artist was likely built up via subscription, as they progressively built their reputation by being recognised for creating ‘avant-garde’ or somehow ‘market-leading’ work. Artworks of this caliber are in high demand and the length of time they will be available for sale or auction will be shorter compared to less established artists. The available pieces are therefore more liquid and will likely appreciate in price as a result of the increasing demand and frequency of sales. Liquidity risk in this scenario is dependent upon the current supply side (or holders’) collective tradeoff between ownership of the assets as an investment or as entities with non-financial, emotional returns.

It is worth noting that in both Trad and NFT A&C, there may be a further distinction between liquidity at the creator level and at the asset level. This is not the case with fungible assets, where, for example, stating that a company’s stock is liquid and that the company itself is liquid is referentially equivalent. The fact that this distinction arises is due to the non-fungible nature of A&C and the interplay that arises between ‘artist and artwork’ or ‘creator and collection’: an additional facet of determining value in both Trad & NFT A&C markets.

CONCLUSION

In this section, we have argued that organically limited collections of non-fungible passion assets, with particular reference to artistic pieces, have a direct correlation between subscription and demand, with the producer of the asset or collection and personally associated intermediaries playing a role in its ability to circulate in secondary markets. Scarce pieces by well known artists in high demand will be liquid despite not being fungible by the very nature of demand and supply — if a holder of such a non-fungible asset decides to auction it or otherwise put it for sale, its notoriety will ensure buyers are found, essentially ‘filling’ the sell order faster. If this process is frequent enough, the non-fungible asset may be considered liquid.

While we have established how liquidity interacts with subscription, a number of important questions remain. How can the Trad and NFT A&C markets expand? How can collectors who hold passion assets which are intrinsically valuable according to scarcity and subscription metrics continue to participate and profit in the market without selling those assets? How can the demand side with available capital gain access to these prized assets? A potential answer to these questions lies in a key property of non-fungible passion assets — they may be used in the generation of value flows if parties are in agreement with the asset’s valuation. In the following article, we will explore how value creation and market expansion can be tied to lending structures as we take readers on a deep dive into the Financialization of A&C assets.

To get notified once we publish the next article in this series, follow this Medium Publication or leave your email address on NFTfi.com.

FOOTNOTES

¹ The branch of economic theory dealing with auction types and participants’ behavior in auctions is called auction theory, whose treatment is outside the scope of this article.

² Although to aid their cash flow, galleries more commonly take artworks on ‘consignment’ — giving them the right to sell and transfer ownership to a new buyer without pre-purchasing the artwork from the artist

REFERENCES

[1] Corporate Finance Institute. (2020, May 3). Market. https://corporatefinanceinstitute.com/resources/knowledge/economics/market/

[2] Picinati Di Torcello, A. (2012). Why should art be considered as an asset class? Deloitte.

[3] Commodity Market. (2021, October 30). Investopedia. Retrieved 2022, from https://www.investopedia.com/terms/c/commodity-market.asp

[4] Wikipedia contributors. (2022a, January 14). Art market. Wikipedia. Retrieved 2022, from https://en.wikipedia.org/wiki/Art_market

[5] Auction House. (2021, July 21). Investopedia. Retrieved 2022, from https://www.investopedia.com/terms/a/auction-house.asp

[6] Wikipedia contributors. (2022c, April 30). Auction. Wikipedia. Retrieved 2022, from https://en.wikipedia.org/wiki/Auction

[7] McIntyre, M. H. (2004, October). Taste Buds: How to cultivate the art market. Arts Council England.

[8] Torrelles, E. A. F. (2015). CRITERIA FOR INVESTING IN THE MARKET FOR THE VISUAL ARTS. Negotium, 10(30). https://redib.org/Record/oai_articulo1102343-criterios-para-invertir-en-el-mercado-de-las-artes-visuales

[9] Gallerist. (2020, December 22). Investopedia. Retrieved 2022, from https://www.investopedia.com/terms/g/gallerist.asp

[10] Sax, G. (2022, March 19). Exploring NFT Price Distribution Across Collections. Medium. Retrieved 2022, from https://medium.com/@goblinsax/exploring-nft-price-distribution-across-collections-782193240f2c

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >