The great NFT x DeFi experiment: Part 1

August 30, 2020 ・ 8 min read

Hello folks,

I sat yesterday and contemplated that all my high-end NFTs are basically sitting as unproductive principal in the midst of a DeFi boom. I don’t want to sell them, but they are not doing any work for me either. We are not yet at a stage where NFTs are directly accepted as collateral on DeFi platforms like Maker, Compound or Aave, so instead I decided on a simple experiment:

Q: Can I take out a loan, invest the funds, pay the loan back and profit?

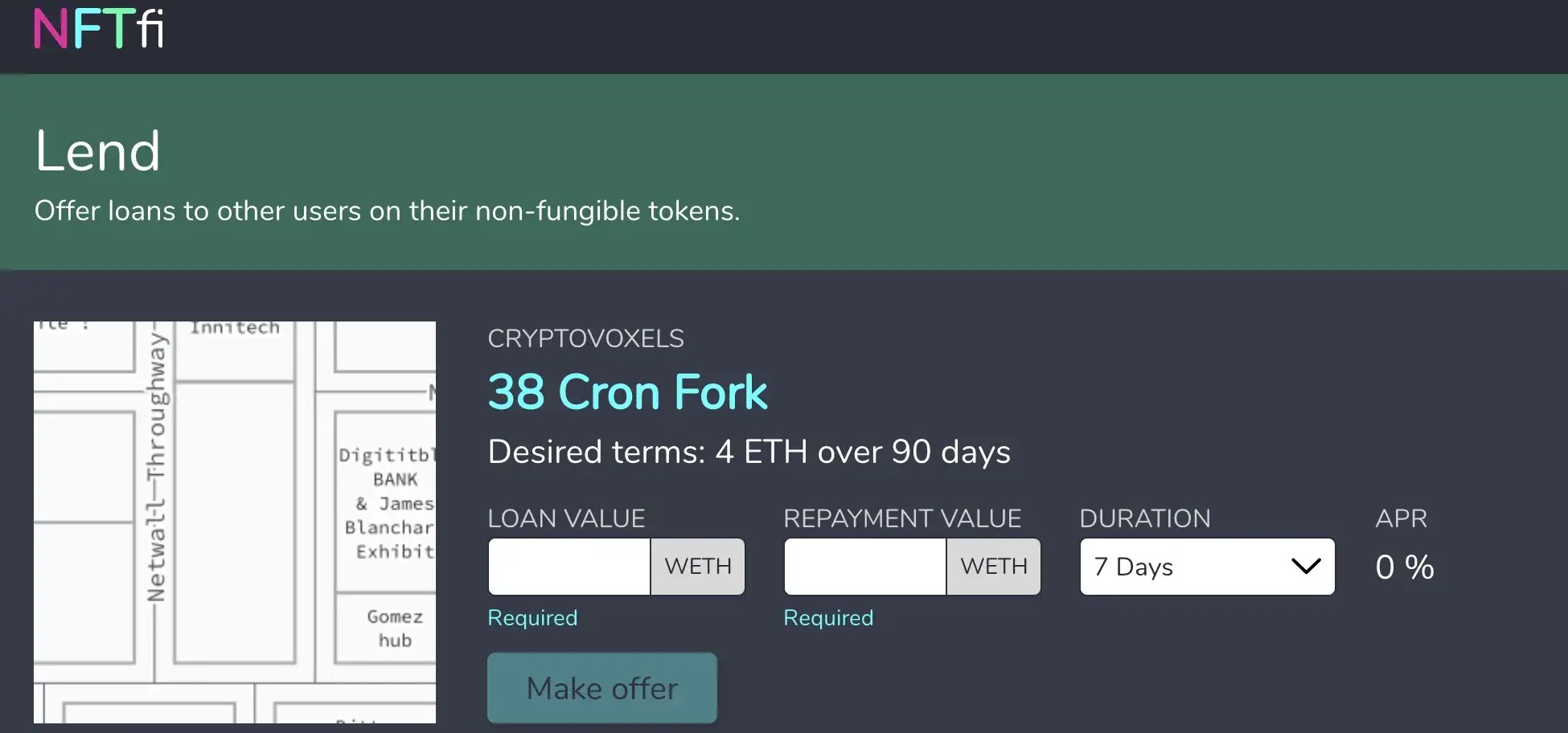

To start with I listed a top Frankfurt Cryptovoxels plot for a loan on NFTfi:

Got a loan!

I was quick to get a first loan offer (6 mins) from Nifty Fund, a new fund dedicated to providing loans on NFTfi (which is SUPER cool and awesome). While the interest rate was maybe not the most attractive I could possibly get, it was a good amount of ETH and the 90 days duration that I had requested.

So, I decided to see that as part of the challenge. If I could return this, then any more preferable loan terms would simply make the experiment easier to achieve. The loan also cost me 0.06 ETH to take out as gas prices are currently pretty hectic, but again, I felt that just added to the experiment. So, all in all my budget is:

- Loan repayment: 5.2 ETH (4 ETH +1.2 ETH loan fee)

- Tx fee: 0.06 ETH to take out loan

- Expected Tx fee to pay back = 0.05

So, over the 90 days, I have to return 5.31 ETH (132.75% of my 4 ETH loan).

Challenge accepted!

Now, how do I prosper?

Broadly I considered three strategies that I believed could work:

i) Buy 4 small cap DeFi coins, hodl for 90 days and sell with profit. Cross my fingers and hope for a moonshot amongst them. This was attractive as it requires very little work (beyond identifying the tokens to buy).

ii) Continuously swing trade small cap DeFi coins on a DEX like Uniswap for profit. This requires more work, but also offers more active control.

iii) Try to earn pool fees or yield farm to make up for the loan fee and profit. This could be Uniswap, Balancer, yCurve or any of the other tools available.

The first strategy was appealing, but also highly risky. Given the current gas prices, I also knew upfront I couldn’t afford to be indecisive, as cumulative transactions would easily eat up any profits. In the end I decided on a combo:

- Try to do a few profitable swing trades to make up some of the ground and get a bit more ETH stacked (ii)

- Then reduce risk and effort by pooling on Uniswap to earn pool fees, while hopefully still indirectly benefiting from the price increase of a token (iii).

Part 1: Swing trading on Uniswap

I’d been monitoring $FSW for a few days as I have a small bag already, and I decided it could be a great candidate for some swing trading. It fluctuates a lot, it has got a market cap that is still low (17.5m USD) and high liquidity on Uniswap with price swings that are significant.

My first 4 ETH bought me 3202.818 FSW:

I sold that a few hours later for 4.43 ETH (minus gas fees for both transactions) and made up 34% of the total mileage on my first trade. Great start, but also lucky.

Due to the success I decided to focus on FSW and sBree exclusively, as monitoring only two coins is easier and more manageable. Plan was to get in on any bigger dips, and sell consequently when in profit.

Here’s a list of all my trades:

- 4 ETH to 3202.8 Falcon (0.024 gas)

- 3.202.8 Falcon to 4.48 ETH (0.026 gas)

- 4 ETH to 3111.6 Falcon (0.026 gas)

- 3111.6 Falcon to 4.16 ETH (0.031 gas)

- 4 ETH to 61.47 sBree (0.031 gas)

- 61.47 sBree to 4.16 ETH (0.031 gas)

- 4 ETH to 61.10 sBree (0.034 gas)

- 61.10 sBree for 4.17 ETH (0.034 gas)

- 4 ETH to 3110 Falcon (0.029 gas)

- 3110 Falcon to 4.56 ETH (0.034 gas)

At the end of day one my 4 ETH loan had already become 5.13 ETH, only 0.18 ETH left to recoup before I am in profit. I had pretty made it to break even in less than a day from swing trading a few DeFi coins on Uniswap. Admittedly I had a very good day, I only got stuck in sBree for 4 hours before it crawled back up.

However, I also knew my luck could turn at any point and gas prices kept going up too, so I decided to quit while things looked good. I’d made up a lot of ground, so no more reason to take excessive risk with my principal.

Time to wait for a good entry and farm some Uniswap pool fees for the win!

Part 2: Uniswap pooling

For the second part I opted for Uniswap pooling to earn trading fees. The trick here is to find a coin that has a high trading volume against a relatively small liquidity pool (ideally 3–4x daily ratio) as you earn your fees from the % share of the pool you own on each transaction.

I decided to go for FSW here too, as it has a good trading volume (it is only listed on Uniswap at present), and I firmly think it can appreciate against ETH in the coming 90 days, but also earn me some solid fees along the way. To join a pool, you have to put an equal amount of the pair you want to pool and then Uniswap maintains a 50/50 balance automatically (Balancer is a great alternative for more creative options).

I was going to try to time an entry into FSW again and then Uniswap pool it to earn fees while I wait for appreciation against ETH. This will leave me with less FSW and more ETH (due to the 50/50 ratio), but since I have to pay back my NFTfi loan in ETH that’s preferable. The balancing reduces my upside from holding FSW, but also reduces downside and will earn me fees on an ongoing basis. Given I was already way closer to profit than I thought I would be at this point, this seemed like the best option going forward.

I managed to trade 2.53 ETH for 2159.63 FSW (2.56 ETH incl. 0.032 fees) on the next dip. Luckily FSW dropped a bit more right after I purchased it, so I could get away with the following transaction to add to the pool:

I had spent another 0.07 on the transactions (this really was a bad day to experiment), but I managed to land myself in a pool with 0.07 ETH remaining in cash for the final accounting.

This is a snapshot of the pool a second ago. As you can see my ETH balance has dropped a bit, but my FSW stack has gone up. I’ve earned my first fees.

Now, what can I expect over the 90 days? The maths is actually pretty simple:

Pool share 0.15% x 24.782 USD fees in the last 24h = 37.17 USD per 24h

In reality, every transaction pays 0.3% in fees to the pool, and you earn a % of the 0.3% fee equivalent to your current share of the pool. Every transaction counts and compounds. This also means that as trading volumes go up and down daily, and people add and withdraw liquidity from the pool (changing your % share of the total pool) the earnings will fluctuate too. But let’s do some basic back-of-the-napkin maths:

90 day loan x $37.173 per day = $3345.57

Assuming ETH stays at $435 it will equal 7.69 ETH (on top of the principal) by the time the loan is due to be paid back. Now, that is if everything stays stable during the 90 days. Naturally, it won’t of course, but I hope I picked a good token and a good pool. Time to lean back with the afternoon coffee (much like a real farmer), look out over my digital fields and watch the seedlings grow…

Needless to say, I’ll keep you all posted on the progress in our next post.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >