The great NFT x DeFi experiment: Part 3

September 11, 2020 ・ 4 min read

Welcome back to the grand experiment… Week 3.

If you missed the first parts, you may want to start here.

New week, new dreams. The first thing I did was rush into a 4 ETH position on DXD. That was a terrible idea!

4 ETH = 4.82 DXD

Then ETH dropped like a stone and I got stuck as it pulled DXD down with it. It took several days for the ratio to pop back up to 4.06 ETH again briefly, allowing me to get right back out again as I didn’t trust the market. Nasdaq looked bloody. And good I did, because the price dropped again right after…

People have been making crazy gains on Tron and new copycat “shit coins” this week, but I deemed the risk to be way too high, given I don’t have time to follow it and respond accordingly. Secondly, I was in profit already on the experiment, so no need to take excessive risks… So. Many. Rugpulls!

I decided I needed a more passive strategy. Time to go back to Uniswap pooling. By Thursday I managed to snatch some DXD at an amazing price!

3.86 ETH = 5.463 DXD (+0.01 fees)

That left 2 ETH and enough ETH for the Tx fees needed.

Time for some DXD pooling and hodl’ing. #IrresponsiblyBullish on DXD still.

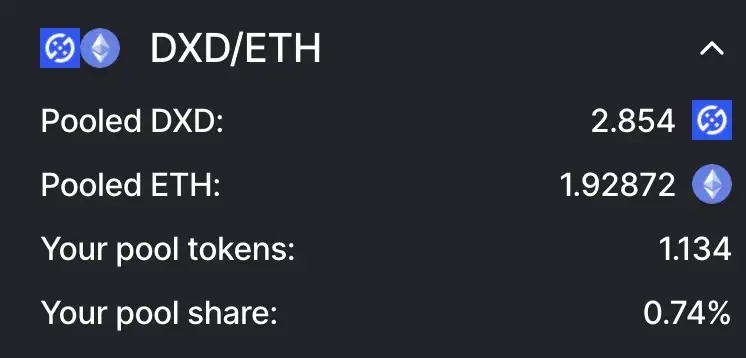

I pooled my 2 ETH + 2.71 DXD and leaned back. Still holding 2.75 DXD too.

Time to farm passively!

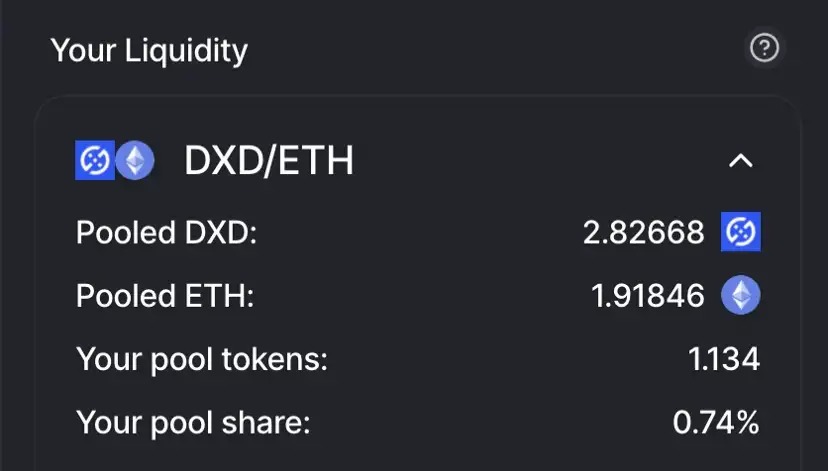

DXD dropped more just after I added to the pool. First screenshot I got.

As you can the see my ETH balance dropped a bit more right after I added, but as we discussed the 50/50 split just means my DXD stack has gone up. And it also means I earned the first sweet gains from people trading and paying 0.3% to me and the other liquidity pool providers.

Now, what can I expect over the 78 days? Well, it will go up and down, that much is a given… but here’s a snapshot of the maths as it looks like presently.

Pool share 0.74% x $838 pool fees earned in the last 24h = or $6.20 per 24h

In other words around 0.02 ETH per day (or 0.5% daily). Not too shabby!

Assuming 78 days x 0.02 per day = 1.56 ETH total on my 4 ETH pool (39%)

However, I am also secretly betting on the fact that I have put DXD and ETH into the pool at a time when DXD was very low and that I’ll get a chance to pull out more favourably. You can of course suffer similar losses!

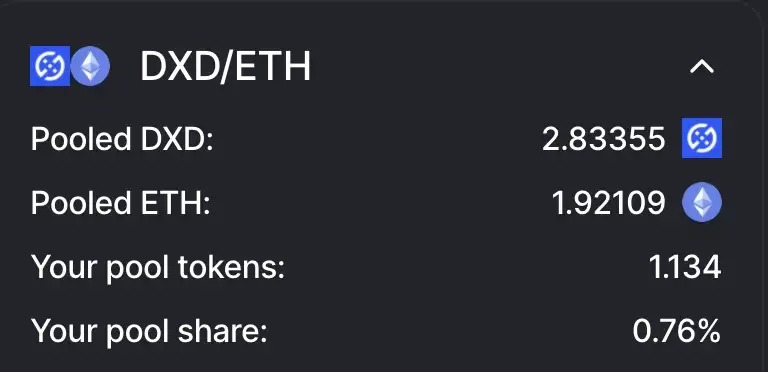

Here’s an update after the first 24 hours:

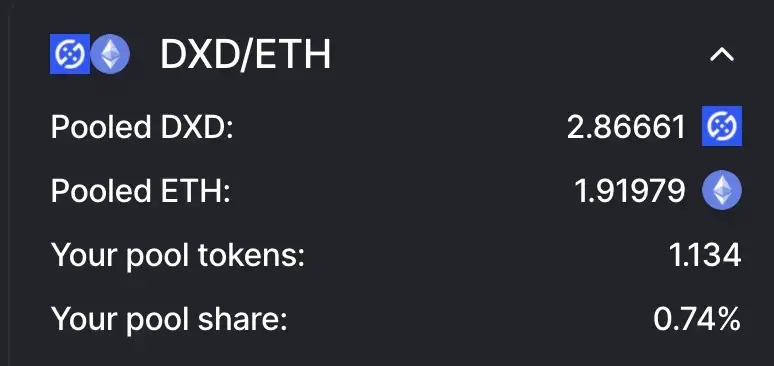

And again 24 hours later:

As you can see the price of DXD has been pretty stable so far, although it did have some pretty significant dips in between.

So far I am pleased, and I look forward to some weeks with less stress, passive earnings accumulating and no more fees paid to other people for moving stuff around between different things. DXD is super solid, no risk of a rug pull here!

Status at the end of the week as I am writing this is:

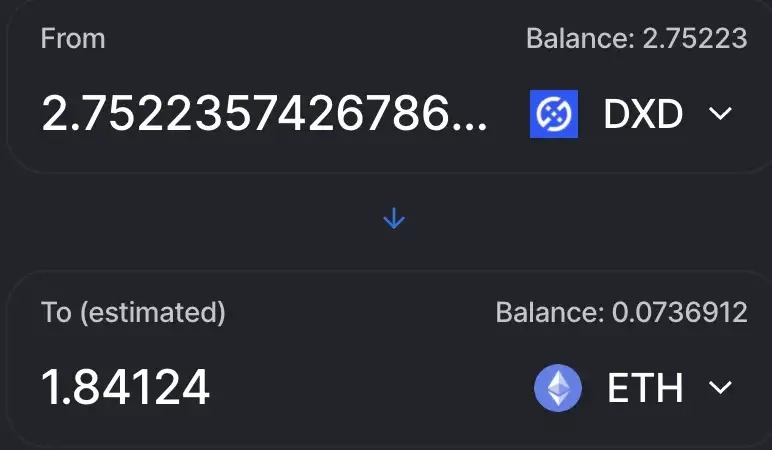

So all in all, if I was to cash out right now, the equation would be;

Pool: 1.928 ETH x 2 = 3.856 ETH

Account: 1.84 ETH (2.75 DXD) + 0.073 ETH

Total: 5.769 ETH (so a bit down on last week, but still in profit by 0.45 ETH)

Overall I am quite happy with that though, given I am in my hodl position now and it looked a LOT worse at many stages during this week.

In case you missed the announcement yesterday, we’re also super excited that you can now wrap Cryptopunks via ARK.gallery and list them on NFTfi as collateral for a DeFi loan.

Disclaimer

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >