The NFTfi Promissory Note: tokenizing loans as NFTs (ERC721)

February 02, 2021 ・ 5 min read

Before we dive into promissory notes, let’s recap the basics of how the NFTfi platform works.

NFTfi is a platform for P2P loans that use one of your NFTs as collateral for the transaction. We hold the NFT in escrow while the loan is active, so lenders know for sure that they will either get their money back with interest (if that is what was agreed to) or receive the NFT in exchange. For the nitty gritty on how the platform works, check out our Introduction and FAQ article.

But to understand how NFTfi may open up brave new possibilities that will lead the NFT niche into worlds such as trade financing, one must understand its most important core element.

NFTfi Promissory Note

So you’re browsing NFTfi and find a user who is asking for a loan against one of their NFTs as collateral. The terms of the loan appeal to you, as does the NFT itself, and you decide to make an offer with the exact terms they requested. A few moments later, they accept. What is happening behind the scenes?

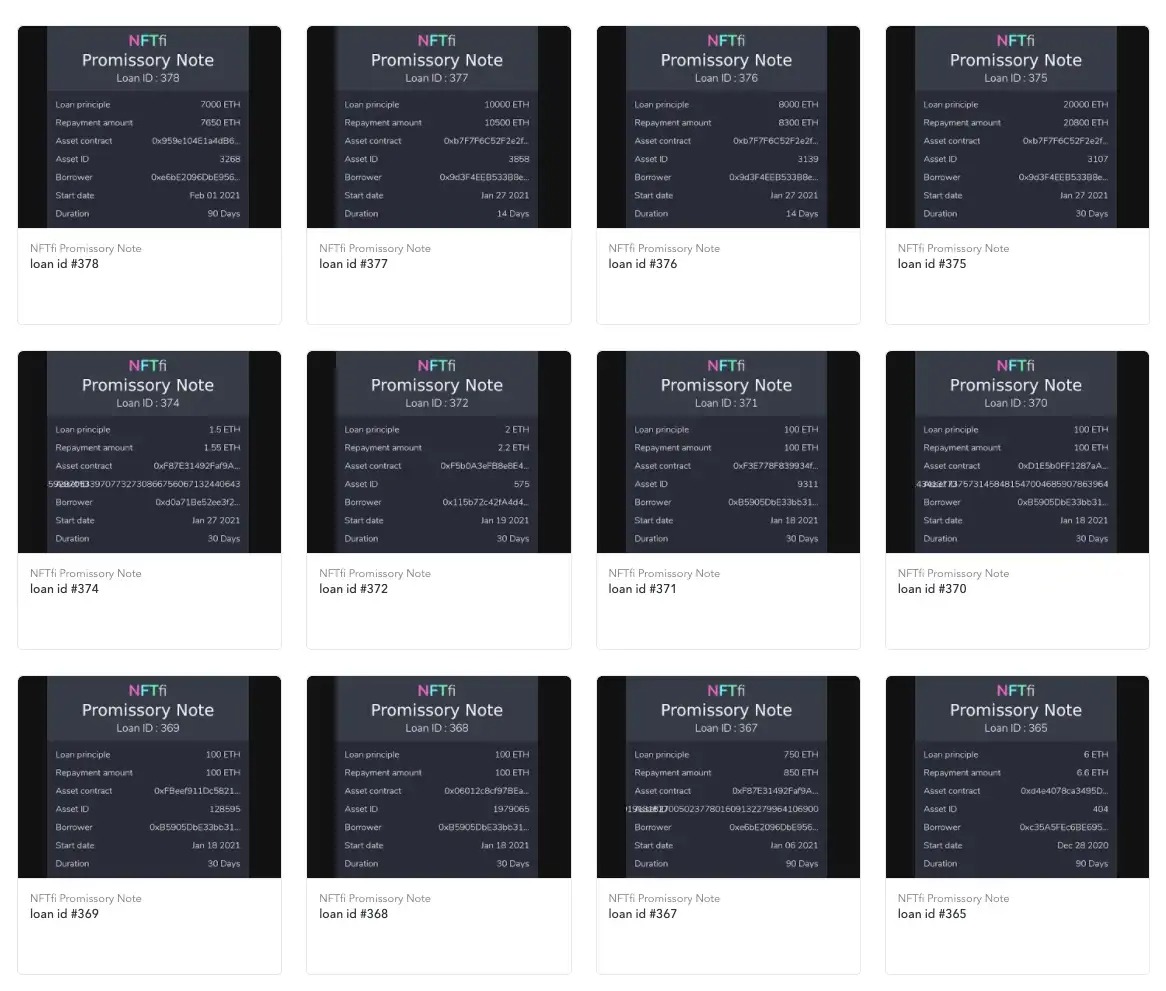

When the borrower accepts your loan offer the NFTfi smart contract mints an ERC721 NFT into your account. We call this token a NFTfi Promissory Note. You can see what those Promissory Notes look like on Opensea.

The image of the Promissory Note displays essential information about the transaction

These are tangible representations of your loan, much like a real fiat promissory note. If the loan term expires before the borrower repays the loan+interest, the holder of the Promissory Note can foreclose the loan. On foreclosure the lender receives the NFT that was provided as collateral.

The person to receive the Promissory Note is always the lender in the transaction. When the NFTfi smartcontract recognizes that the loan term has expired and that the borrower has ‘defaulted’ (this just means that the borrower did not repay the loan+interest in time), the holder of that specific Promissory Note will see in their NFTfi panel that they now have the option to foreclose the loan, which means receive the NFT that was provided as collateral.

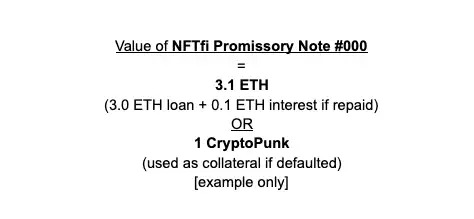

Therefore the holder of a NFTfi Promissory Note is always entitled to one of two things at the end of the loan’s term and those represent its minimal intrinsic value.

Rewards and Trade Financing in the NFT Ecosystem

Here is where things get interesting! Even though the lender is the one who receives the Promissory Note NFT — it’s still an ERC721 NFT in every way! That means that you can do many cool things with it. For example, at present whoever holds at least one Promissory Note at any given moment can claim the Rockefeller role in our Discord server. Rockefellers have access to an exclusive #lenders channel and will also be entitled to special privileges, drops, rewards and more!

But even more interesting is that you can buy, sell and trade the Promissory Notes amongst each other. This opens the door to the world of trade financing. Imagine this scenario:

Loans with 90-day terms are provided against NFTs that are relatively low value. If the value of the NFTs changes significantly during the loan term a market opens up for trading the loans themselves (i.e. the NFTfi Promissory Notes).

If the holder of the Promissory Note needs liquidity they can exit their position by selling the note. If the value of the NFT increased they might be able to sell the note at a premium. In this scenario the buyer of the note will receive the loan+interest at the very least. If, on the other hand, the borrower defaults the holder of the note will receive the higher value NFT.

If the value of the NFT decreases, the holder might want to sell the loan at a discount so they can exit their position and reduce risk.

Other examples of potential use cases:

- Take a loan using the NFTfi Promissory Note as collateral (a loan against a loan)

- Create an index of loans/credit

- Collect debt

Summary

NFT-based defi is on the cutting edge of the blockchain (and finance!) ecosystems. It is very exciting and our plan is for NFTfi to evolve alongside it while also pushing it to new frontiers.

The key takeaways from this article, however, should be understanding what the NFTfi Promissory Note token is and what it does. It is an ERC721 NFT that represents the loan you gave and it also grants the right/ability to collect either the loan+interest or the NFT from the smart-contract at the end of the loan term.

The value of a NFT Promissory Note at any time, at the bare minimum, is either the loan+interest OR an NFT (depending on if the borrower defaults or not by the end of the term).

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >