The Rise of Long-Term NFT-Backed Loans: Lending Trends and Borrower Behaviors on NFTfi

October 26, 2023 ・ 7 min read

Introduction

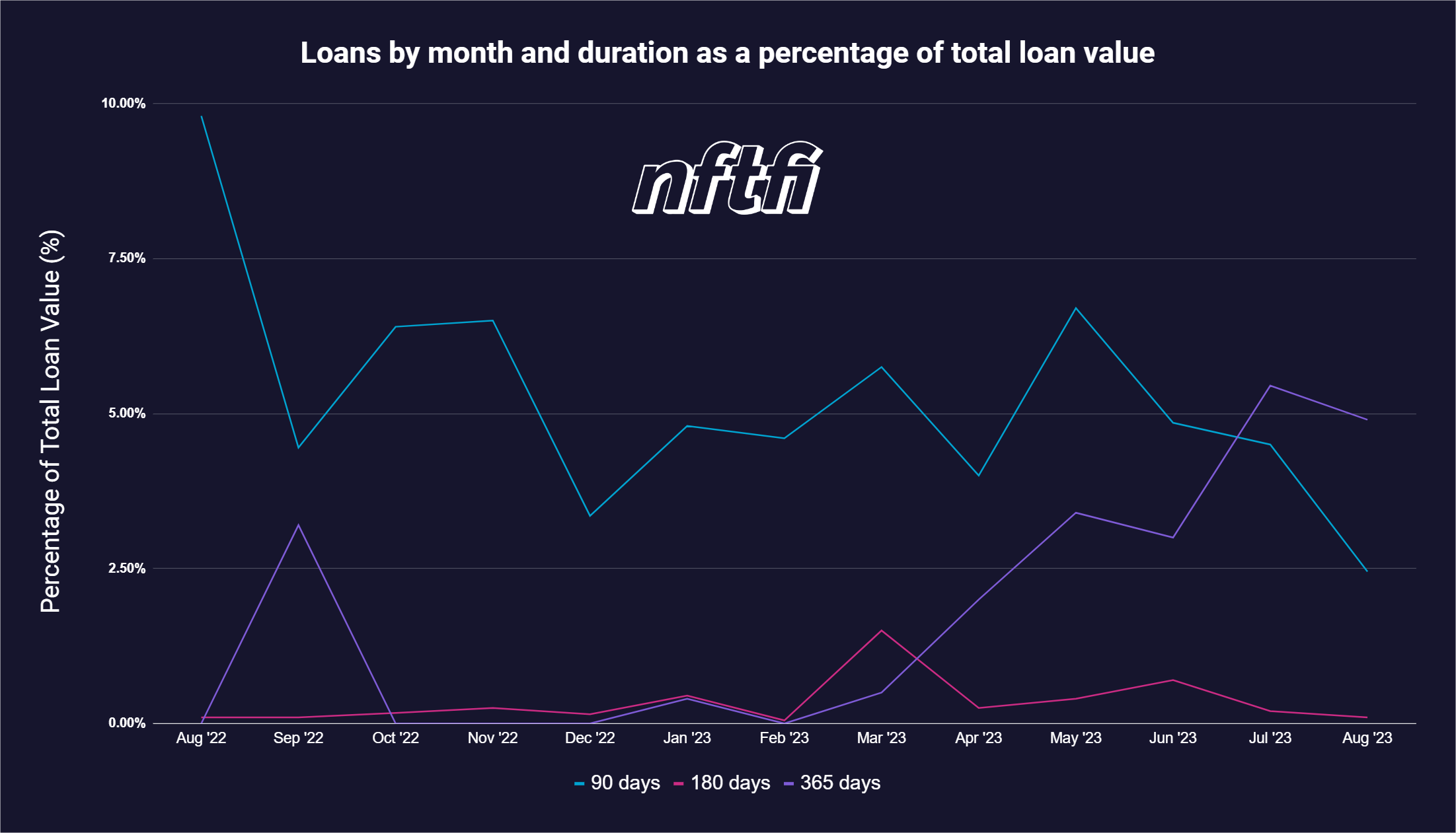

In the dynamic world of Web3, a notable shift is emerging on NFTfi – a preference for long-term loans. Since the first quarter of 2023, NFTfi has seen a steady uptick in 365-day loans, and loans of 180 days or more now make up ~5% of monthly loan originations on NFTfi.

We think this trend in user behavior signifies a deeper, evolving understanding of value, with key collections emerging as premium collateral. Assets such as Autoglyphs, CryptoPunks, and Chromie Squiggles share a common thread of strong historical significance, and have defined technical standards and categories within the NFT art vertical. Notably, these collections have exhibited remarkable resilience, consistently withstanding drastic declines in floor price even when other blue chip NFTs faced significant downturns. These characteristics underscore their emerging status as premium collateral, and have made them a preferred collateral choice for long-term loans.

Lenders seem increasingly content engaging in these loans, earning interest through lending, and having the opportunity to acquire these premium collateral assets at a discounted rate should a loan default occur. On the flip side, borrowers putting up the collateral assets seem more inclined to secure longer-term loans as the nature of longer loan durations provides them with more financial flexibility but raises the question of what borrowers do with their loans once received.

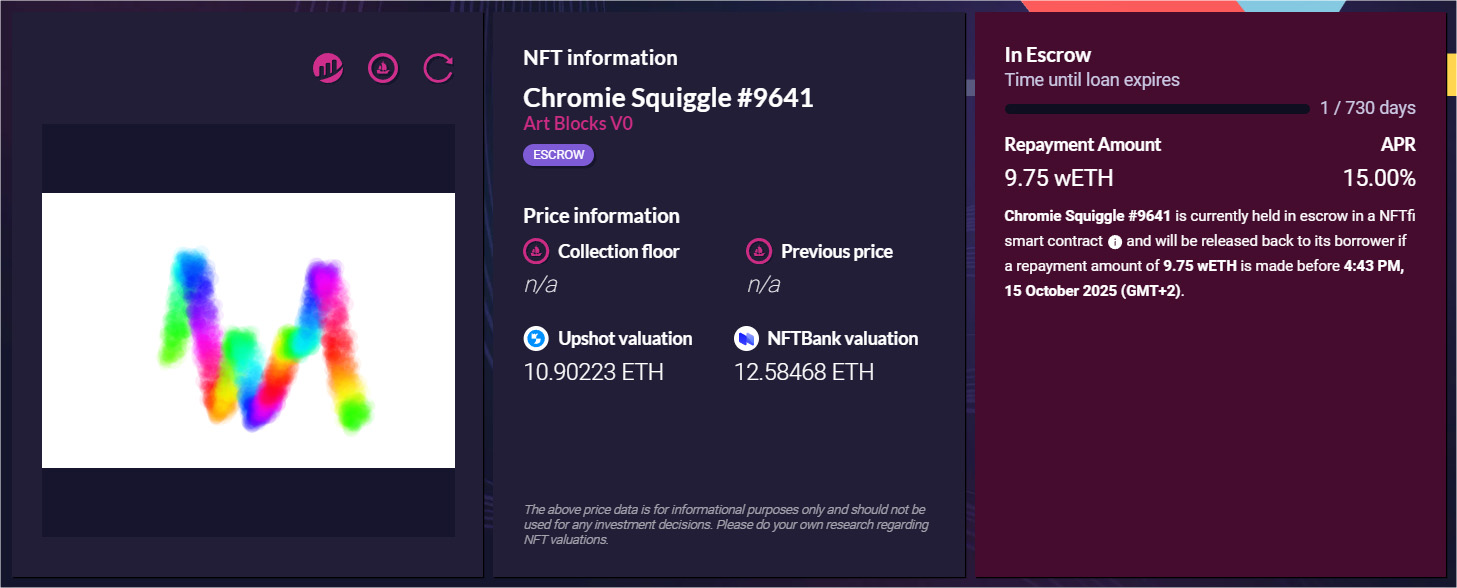

Our latest protocol upgrade also enabled 5-year loan durations, and multiple Chromie Squiggles have already been collateralized in 2-year loans.

In this article, we present a categorization of borrower activities and look at some on-chain examples of recent long-term loans to examine user behaviors and loan spending.

Categorization of NFT-backed loan spending

Based on discussions with borrowers and on-chain data, we observe four main categories of borrower spending: On-Chain Spending, Off-Chain Spending, Loan Repayments, and Yield Opportunities. Borrowers often don’t stick to just one of these categories. With long-term loans, borrowers have more flexibility to pursue a combination of strategies to create value. It isn’t uncommon for a borrower to use a long-term loan to repay other loans, buy some art, and swap some of the remaining captialto stablecoins and take those off-chain.

On-Chain Spending

This includes the purchase of NFTs or other crypto assets with borrowed capital. Often, these borrowers are aiming to take advantage of short and medium-term investment / speculation opportunities, increasing the capital efficiency of their overall portfolio.

Off-Chain Spending

Off-chain spending involves moving funds to centralized exchanges. Although it can’t be certain that these funds will be taken off-chain, anecdotally, many people do use NFT loans for off-chain expenses. This allows them to spend their funds in places that don't accept cryptocurrency or to cover expenses that can't be paid on-chain, such as buying property.

Loan Repayments

A significant use of borrowed funds is to refinance/repay other outstanding on-chain loans. This can be a strategic move for borrowers, especially if they can secure a new loan with a lower interest rate than their existing debts. This allows them to reduce their monthly payments, shorten the loan term, or just consolidate other loans. It's often a way of managing and optimizing their debt portfolio, ensuring they're not paying more in interest than necessary.

Yield Opportunities

Borrowers sometimes use their loans to engage in yield farming, providing liquidity, or even actively lending against NFT collateral that offers a higher APR than what they are paying to borrow. The idea is to earn a return on these investments higher than the interest they pay on their loan.

Who is taking out long term loans?

We look at three on-chain examples of these borrower spending patterns. We have the on-chain spender, the off-chain spender, and the yield seeker. Across these three examples, we’ll see spending categories overlap.

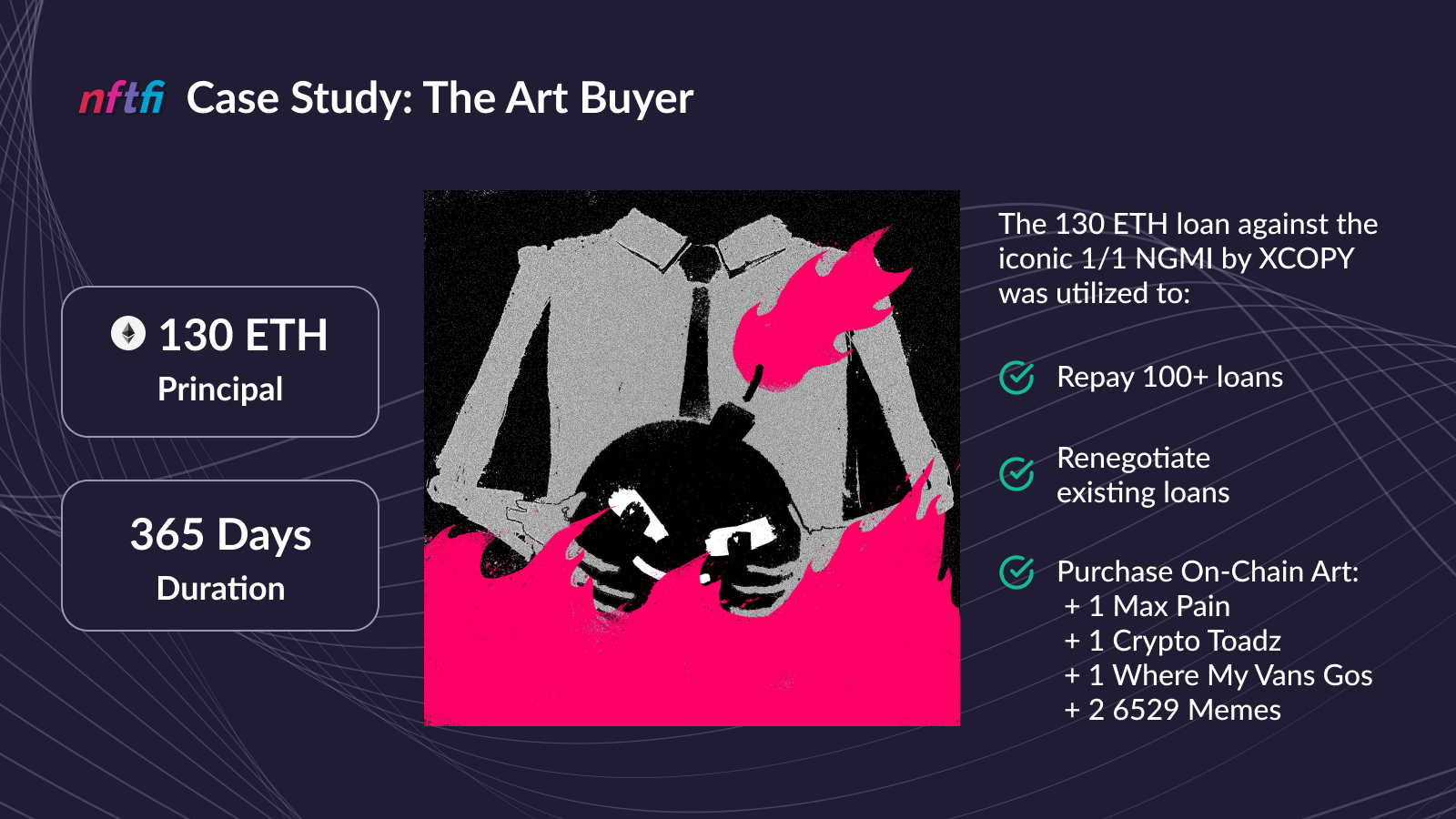

The Art Buyer

Recently, a notable 130 ETH, 365-day loan against an XCOPY 1/1, NGMI, was secured on NFTfi. Currently, NGMI is estimated to be valued in excess of 200 ETH. The borrower then utilizes the loan to repay over 100 loans, renegotiate several existing loans on NFTfi, and goes on an on-chain art buying spree purchasing 1 Max Pain, 1 Cryptoadz, 1 Where My Vans Go, and two 6529 memes here and here.

This is a clear example of using the more predictable, long-term, high-value loan to manage liquidity for repaying short-term loans, and presumably more long-term art purchases.

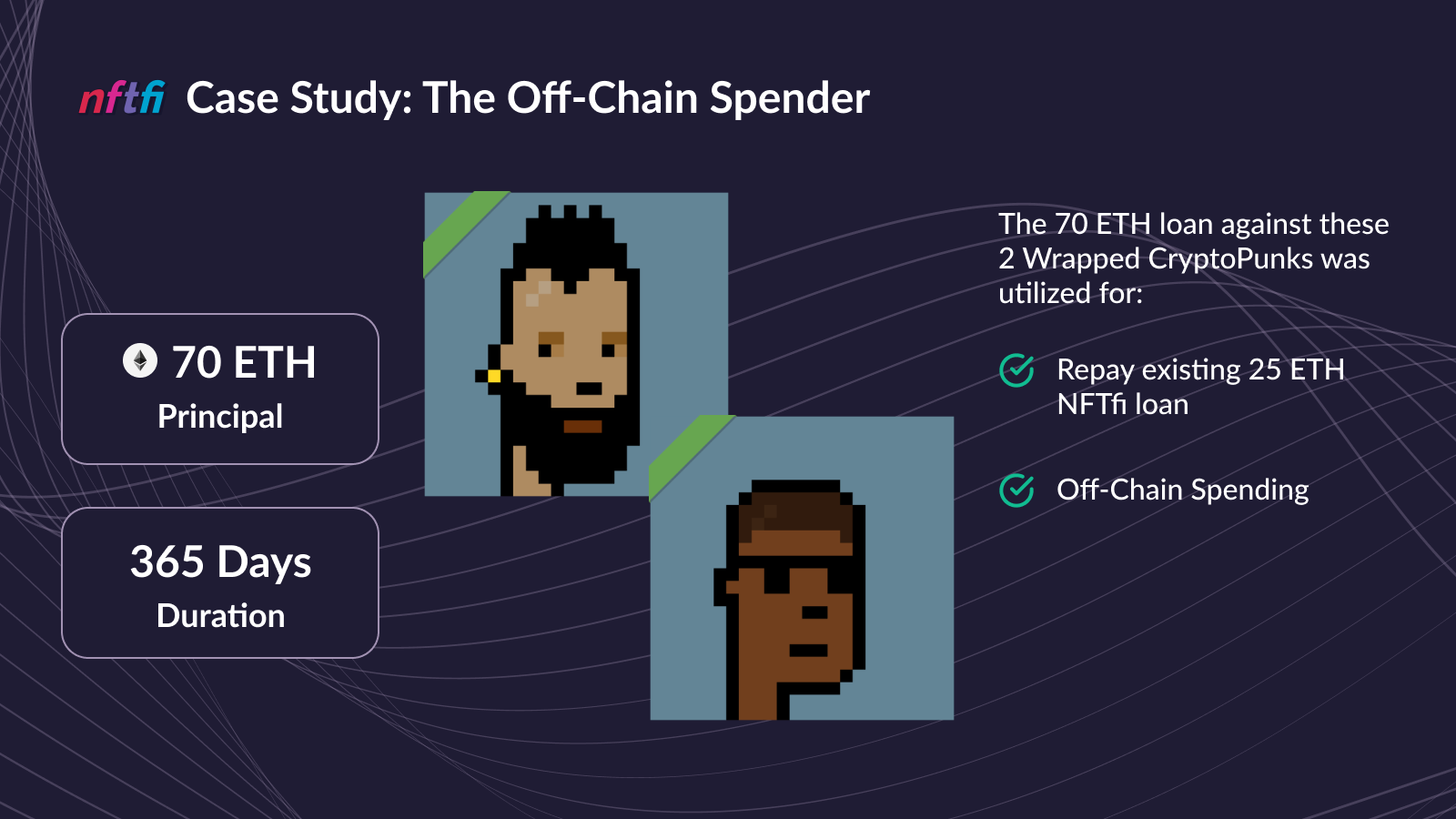

The Off-Chain Spender

“Through NFTfi, I was able to attain my real estate goals.” - Tony Herrera, NFTfi borrower

Another user Tony Herrera, who has previously used NFTfi to aggressively borrow against Crypto Punks to secure 2 commercial properties and 1 residential property, recently took out 2 long-term loans securing 70 ETH, 365-day loan against 2 Crypto Punks. Crypto Punks currently have a value of 46 ETH. With these loans, Herrera goes on to repay another loan on NFTfi for 25 ETH. From there, he swaps the remaining ETH for USDC and distributes the USDC to various address including taking $70,000 off-chain to Coinbase. Perhaps for another property?

Like the on-chain spender, Herrera was able to leverage his loan to manage liquidity for short-term loans. However, unlike the on-chain spender, Herrera does send capital to a centralized exchange presumably to leverage capital off-chain given how this borrower has used NFTfi previously.

The Yield Seeker

Another borrower, locked in a 100 ETH, 90-day loan against an Autoglyph on NFTfi. While this is a shorter loan term than the ones previously reviewed, it is still a great example of what can be done with liquidity in the medium term. The floor for Autoglyphs currently sits around 205 ETH. The borrower, swapped half of their loan- 50 ETH in total, into $RLB, the protocol token for Rollbit. From there, they went on to deposit their newly acquired $RLB tokens and ETH into a Uniswap v3 liquidity position, to take advantage of a yield opportunity from one of the most popular trading pairs in recent months.

This shows an excellent example of a medium-term loan being used for a medium-term opportunity. The borrower knew what they wanted the loan for, had an idea of the timeframe of the opportunity, and took an intelligent decision to use DeFi tools to earn yield on a high volume altcoin, which benefits from a strong uptrend. In this case, if the borrower defaults, the lender is able to secure an Autoglyph at a 105 ETH discount.

Conclusion

It’s clear that borrowers have many reasons to take loans against their NFTs, from spending on real-life expenses by taking their funds off-chain, chasing higher yields in other areas of DeFi, to just wanting to collect more art.

The emergence of long-term loans, particularly those of around 365-day duration, gives borrowers the flexibility to manage their assets more efficiently, without the concerns of needing to have funds available in the short term to repay the loan. Many of the longer-term borrowers are also heavy users of NFT lending protocols and use these longer loans to manage their repayments of other loans and ensure their capital isn’t all tied up in illiquid assets.

As users look to protocols to secure long-term loans, NFTfi is a natural choice as the pioneer in permissionless peer-to-peer NFT lending, with the most battle-tested contracts and over $492 million in cumulative borrow volume. As long-term loan trends continue to grow, NFTfi will be at the forefront, supporting borrowers and lenders with their goals.

If you're just discovering NFTfi, watch the video below for a quick overview and check our beginner’s guide to borrowing.

Stay up to date by following our Twitter, and chat with experienced users by joining our thriving Discord community.

A big thank you to @cr1st0f69 and @jenndefer for their contributions to this article!

This article is for educational and informational purposes only and should not be considered financial advice. Conduct your own research and due diligence before making any investment or financial decisions, such as when considering novel products including NFT loans.

October 08, 2024

NFTfi Aggregator: Your NFT Lending Command Center Is Live

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

October 08, 2024

NFTfi V3 is here! Flexible Loans and More

NFTfi V3 is the best version of your favorite NFT lending protocol. The highlight of this protocol upgrade is the introduction of Flexible Loans. Now, borrowers can choose a new loan type called “Flexible Loan.” Under flexible loans, they only repay the prorated interest instead of the full interest, as they did before. In other words, borrowers will have the option to pay only for the interest they use.

Learn more >

July 30, 2024

Improved Underfunded Offers

We have significantly enhanced the loan offer functionality on NFTfi, allowing lenders to make offers even when they do not have sufficient funds in their wallets. This improvement helps lenders boost their capital efficiency and save time, especially when refinancing a loan.

Learn more >