How NFT lending works

NFTfi allows you to use your NFTs to get a crypto loan - safely, securely, and anonymously. NFT holders can borrow wETH, USDC, and DAI by collateralizing their NFTs in exchange for loans provided by lenders. All loans have fixed terms without any auto-liquidations!

Listing an NFT

Borrowers provide their NFTs (ERC-721 tokens) as security and get loan offers from our lenders. In other words, as a borrower, you need to list your NFTs so potential lenders can see your assets and decide if they want to offer you a loan. You are under no obligation to accept any loan offers you receive.

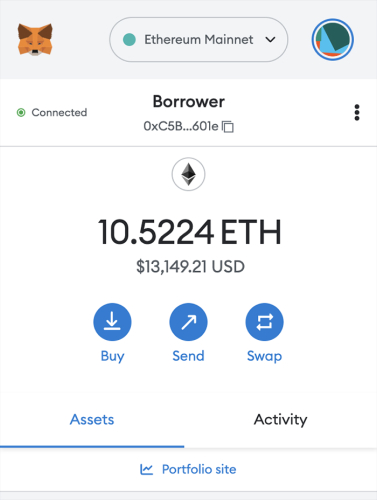

Connect your wallet

To use NFTfi, you need to connect your Ethereum wallet to the NFTfi dApp. Connecting your wallet allows the dApp to see your address (public key) and the NFTs it holds. It does not automatically list your NFTs as collateral. You're in complete control at each step of the way.

Get started >

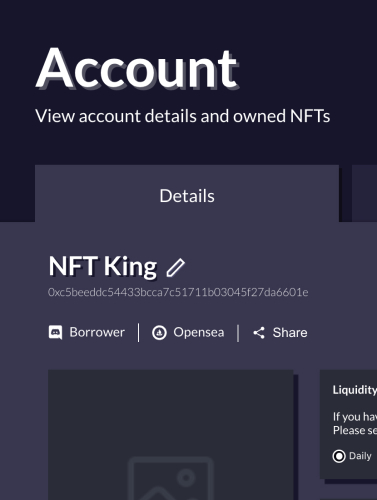

Customize your account

Many users have found it helpful to list their Discord ID in their NFTfi account profile for easier lender/borrower coordination. We have a fantastic community on Discord, where borrowers and lenders connect, form longer-term business relationships, discuss terms and learn from each other. If you provide your email, you will also get system notifications regarding the status of your offers & loans.

Get Started >

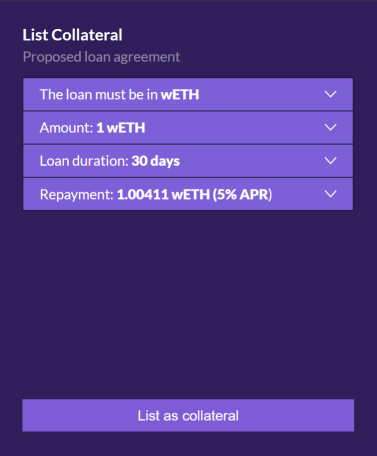

Set desired terms and list your NFT

Click the “Get a loan” tab to find the asset you want to list as collateral. Next, you have the opportunity to specify a preferred loan amount (wETH, DAI, or USDC), interest rate (APR), and duration (days) as guidance for lenders. Click “List as collateral,” sign the message (no gas!), and your NFT will get listed.

Get started >

FAQ

NFTfi currently requires the MetaMask digital wallet to connect. You can find and install it here. Then, navigate to nftfi.com and click on any tab and you will be prompted to connect your wallet. You can then navigate to the ‘Account’ tab on the top right where you can edit your account information. If you add an email address to your account, you will be able to receive email notifications.

Your NFTfi account corresponds to the connected MetaMask wallet Ethereum account. To switch, simply switch accounts in Metamask and refresh the page.

We encourage all users to list their Discord ID in their Account profile. We have a bustling community on our Discord server and that is usually where Borrowers and Lenders can find each other, discuss terms, ask further questions, get tips, ask for help in valuations or take part in NFT project/collateral discussions.

The ability to access liquidity against their NFTs without selling the asset gives unprecedented financial flexibility to NFT holders, especially if they have a large percentage of their portfolio locked up in these illiquid assets.

A few examples of what the liquidity obtained via NFTfi can be used for include:

- Serving immediate liquidity needs (e.g. covering margin positions)

- Taking advantage of short-term investment opportunities (e.g. high-yield liquidity mining or NFT flips)

- Taking advantage of long-term investment opportunities (e.g. buying real estate; long-term loans is now supported in NFTfi V2)

- Delaying a planned sale of an NFT for more opportune market conditions

- Delaying a planned sale of an NFT to defer potential capital gains tax

- Financing ‘real life’ needs without having to sell valuable assets

NFTfi is a peer-to-peer platform connecting NFT holders and liquidity providers directly via permissionless smart contract infrastructure. The NFTfi team at no point has access to any asset or is involved in any way in the negotiation of terms between Lenders and Borrowers. Since NFTfi’s first loan in May 2020, we have done over $400m in loan volume spread over more than 40,000 loans, and no borrower has ever had an asset stolen.

The NFTfi V2 smart contract system has been double-audited by two industry-leading firms (Chainsecurity, Halborn).

Here are all Halborn security audit reports:

There are no fees for borrowers and lenders on NFTfi.

Making offers

Once an NFT has been listed, lenders can make loan offers against them. As a lender, your loan offers are binding, which means you cannot change your mind once the borrower has accepted a loan offer. Once a loan offer is accepted, the loan is automatically executed.

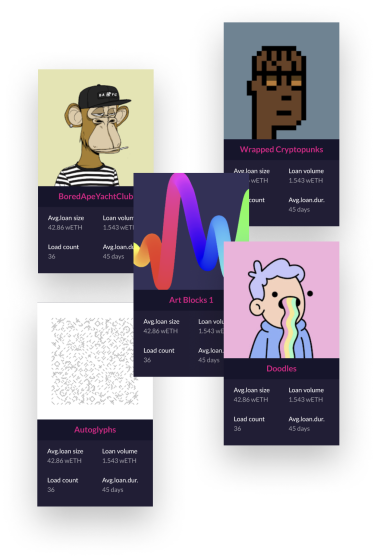

Find an NFT or entire collection to lend against

You can view all available NFT collateral by clicking on the “Lend” tab. Choose the card view for a visual glance through the artworks, or use the list view for powerful sorting capabilities. You can filter by specific collections or by keywords. You can also make collection offers and target entire collections!

Get started >

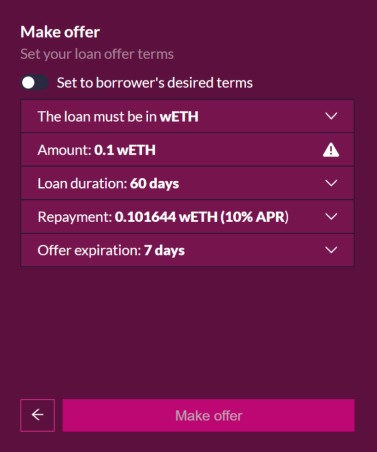

Submit a loan offer or standing collection offer

Once you have found an NFT or collection on which you want to make a loan offer, you can review a list of existing loan offers in case the asset has any active ones. Add your preferred loan amount (wETH, DAI, or USDC), interest rate (APR), and duration (days), and submit your offer (gasless!). You can modify or cancel an offer at any time before the borrower accepts it. If your loan offer is not accepted, it will expire automatically after the period you set.

Get started >

FAQ

You might find this blog article helpful in formulating your personal NFTfi lending strategy: https://nftfi.com/blog/3-lending-strategies-on-nftfi/

Lenders pay gas fees for the operations listed below:

- Approving the NFTfi smart contract to spend wETH, USDC or DAI for the first time (this is a one-time transaction)

- Foreclose an NFT in case of a borrower default

- Canceling an offer on-chain (due to security reasons)

Lenders can use private offers to make a loan offer to potential borrowers for assets that are not publicly listed. Private offers can also be used by friends or parties who know each other but would like to facilitate a loan without listing an asset on NFTfi. To learn more about private offers, please read this blog post.

Standing Collection Offers or SCOs allow lenders to submit loan offers that are valid for any currently listed NFT (or that may be listed in the future) from a particular NFT collection. Before, lenders had to place individual loan offers for each individual NFT asset in a collection - now, they can target entire collections (any asset within the collection) with just one offer! There are several risks associated with SCOs, and we advise that you carefully read this blog post before placing any Standing Collection Offers!

Accepting offers

Quite a few things happen simultaneously in a single transaction once a loan gets executed to keep the NFT and loan amount secure at all times.

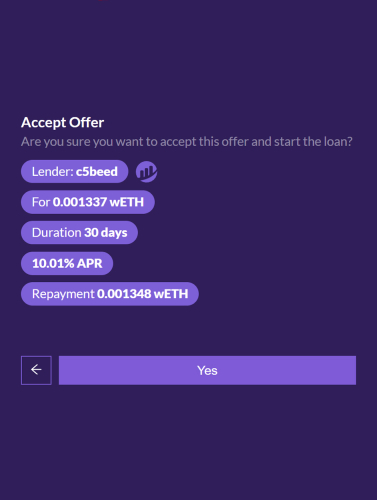

Choose a loan offer

As a borrower, you will be notified as soon as you receive a loan offer on your NFT. If you receive multiple loan offers, you can choose the one you prefer from a list. You might, for instance, prefer a high loan amount with a high-interest rate over a lower loan amount and a lower interest rate, or vice versa.

Get started >

Execute the loan

Once you accept a loan offer, you trigger a transaction that creates a new loan contract, sends the NFT to the secure NFTfi escrow smart contract, transfers the loan amount from the lender to your wallet, and issues a NFTfi promissory note NFT to the lender. Because these happen simultaneously in a single transaction, there is no risk that an NFT will be sent to escrow without the borrower receiving the funds.

Get started >

FAQ

Yes, loan renegotiation can be initiated both by the borrower and lender on any active loan that is not yet foreclosed by the lender. To read more about loan renegotiations and how they work, please read this blog post.

Borrowers will pay gas fees for the operations listed below:

- Approving NFTfi to interact with your NFT (once per NFT collection, except for CryptoKitties (CK), where it must be done for each individual cat as CK isn’t fully ERC-721 compliant).

- Approving the NFTfi smart contract to spend (repay) wETH, USDC, or DAI for the first time (this is a one-time transaction)

- Starting a loan

- Repaying a loan

When you begin a loan, your NFT is moved into the NFTfi escrow smart contract. Therefore the de facto owner of the NFT during the duration of the loan is the smart contract. No one (also not the NFTfi team) can access the NFT during that time.

Whether you are able to receive an airdrop during an active loan depends on the airdrop/claim mechanism. In some scenarios the answer is yes, and in others unfortunately no. Here are a few scenarios for your reference (please note, this list is not exhaustive):

- If the airdrop is distributed based on a snapshot that was taken before your loan began (at a time when the NFT was still in your wallet), then your wallet will likely still receive it.

- In yield-bearing NFTs, where the claim/value is accrued "in" the NFT or "connected" to the NFT, the claim will be waiting for you once you have possession of the NFT again.

- If the airdrop occurs in real-time or based on a snapshot that was taken after the loan began, then the escrow smart contract will receive the airdrop, in which case it cannot be retrieved later unfortunately. Although the escrow smart contract includes technical provisions for manual retrieval of airdrops, we are currently unable to provide this service. We are are working on a holistic solution for airdrops via escrowless lending technology.

NFTfi is a peer-to-peer platform and the liquidity terms are agreed upon exclusively and directly between lenders and borrowers. Several factors (as perceived by the two counterparties) typically affect loan terms, including but not limited to:

- Current market conditions

- Quality and longevity of the respective collection

- Rarity of the specific NFT

Here are a few resources that might help you estimate the value of your NFT, and infer sensible loan term ranges:

- Marketplaces such as OpenSea, and websites like Rarity Tools

- Browsing past loans given against similar assets on NFTfi

- Checking collection pages or individual assets to see the average APR and loan principal over the last 30 days

- #loan-requests NFTfi Discord channel

- The #rockefeller Discord channel (accessible for active Lenders only)

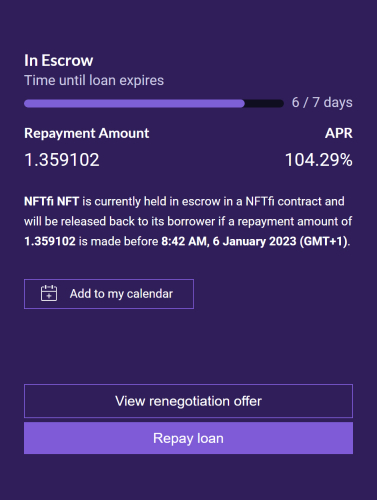

Repaying a loan

Repaying a loan is as secure as starting one. A single transaction transfers the funds from the borrower to the lender and returns the NFT from the escrow smart contract back to the borrower.

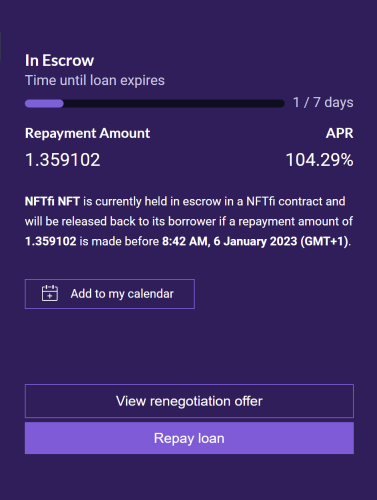

Repay the loan amount with interest

Once a loan has started, both borrowers and lenders can view the days until a loan expires and the repayment amount at any time. As a borrower, you also receive notifications from NFTfi close to the repayment due date. You will always have the entire loan period to return the repayment amount (loan amount plus interest): there are no auto-liquidations on NFTfi, and the lender can not foreclose before the loan due date. Once the borrower initiates the repayment, all of the following happen simultaneously in a single transaction: the loan amount plus interest is transferred out of the borrower’s and into the lender’s wallet (after deducting the platform fee of 5% on the loan interest), the lender’s promissory note is burned, and the NFT collateral is transferred from the escrow smart contract back to the borrower.

Get started >

FAQ

Here are a few important pointers regarding repayments:

- You can repay the loan at any time before it is due, but you still pay the full interest amount.

- You can only repay the loan from the wallet you started the loan with, unless you mint an obligation receipt and thereby transfer your borrower rights to another wallet or someone else (obligation receipts are not yet supported by the dApp - read more here).

- You can only repay the loan in one single repayment, i.e. not partially

- You can request loan renegotiation at any time before the loan is foreclosed by the lender. Read more here.

- Once you default on a loan, it cannot be repaid any longer, even if the Lender has not foreclosed yet.

- Once a Lender has foreclosed the NFT of a defaulted loan, they become the sole owner and the loan can no longer be repaid through the NFTfi platform

- Make sure you have both ETH and wETH in your wallet! You’ll use wETH to repay the loan, but you still want enough ETH to be able to pay for gas.

Once you have repaid the loan in full, including interest, the NFT will be released from the escrow smart contract and returned directly to your wallet. However, if you fail to make payment in full before the due date, the lender will be able to ‘foreclose’ the loan and the NFT will be moved from escrow to the lender's wallet.

Yes, loan renegotiation can be initiated both by the borrower and lender on any active loan that is not yet foreclosed by the lender. To read more about loan renegotiations and how they work, please read this blog post.

In the very unlikely event that the website is down, you can repay your loan via https://repay.nftfi.com/.

If, for some reason, the URL above is not accessible, you can repay your loan via Etherscan.

- Click on this link if your loan is on the V2 contract (fixed loan on an individual NFT) and your loan was made before October 21, 2022: https://etherscan.io/address/0xf896527c49b44aAb3Cf22aE356Fa3AF8E331F280#writeContract

- Click on this link if your loan is on the V2 (fixed loan on an individual NFT) contract and your loan was made between October 21, 2022 and October 12, 2023: https://etherscan.io/address/0x8252Df1d8b29057d1Afe3062bf5a64D503152BC8#writeContract

- Click on this link if your loan is on the V2.3 (fixed loan on an individual NFT) contract and your loan was made after October 12, 2023: https://etherscan.io/address/0xd0a40eB7FD94eE97102BA8e9342243A2b2E22207#writeContract

---

- Click on this link if your loan is on the V1 contract (fixed loan on an individual NFT made before April 3, 2022): https://etherscan.io/address/0x88341d1a8f672d2780c8dc725902aae72f143b0c#writeContract

---

- Click on this link if your loan is on the Standing Collection Offer V2 contract (collection offer loan) and your loan was made before October 12, 2023: https://etherscan.io/address/0xe52cec0e90115abeb3304baa36bc2655731f7934#writeContract

- Click on this link if your loan is on the Standing Collection Offer V2.3 contract (collection offer loan) and your loan was made after October 12, 2023: https://etherscan.io/address/0xD0C6e59B50C32530C627107F50Acc71958C4341F#writeContract

---

- Click on this link if your loan is on the Bundles contract (bundle loan) and your loan was made before October 12, 2023: https://etherscan.io/address/0x8252Df1d8b29057d1Afe3062bf5a64D503152BC8#writeContract

- Click on this link if your loan is on the Bundles contract (bundle loan) and your loan was made after October 12, 2023: https://etherscan.io/address/0xd0a40eB7FD94eE97102BA8e9342243A2b2E22207#writeContract

---

- Connect your wallet and put the loan ID in the ‘payBackLoan’ field.

- You can find the loan ID on Etherscan. When you click on the transaction of your loan, you can see the loan ID of your NFTfi Promissory Note, or you can check it out on OpenSea, where the image of the Promissory Note displays the ID as well.

- The contract will know what you owe, so the next step will be a pop-up from MetaMask, which will ask you to confirm the transaction. This will then take money from your wallet and pay back the loan for you.

Yes. Borrower rights are tied to an “obligation receipt” NFT, which can be optionally minted and is then sent to the borrower’s wallet. If you move the obligation receipt to another wallet address, you are effectively transferring the borrower’s rights (to repay the loan and receive the collateral back) to that address. To learn more about obligation receipts, read this article.

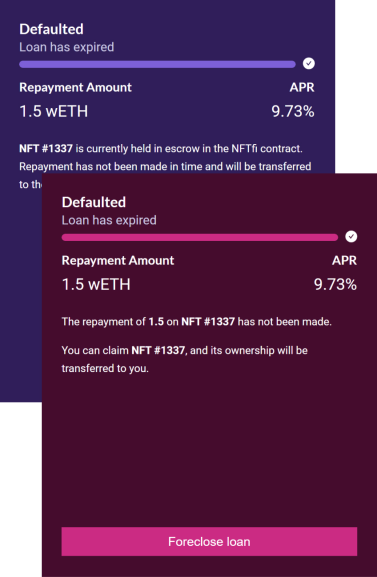

Foreclosure

Not everything in life goes as planned and sometimes loans may not be repaid. In this case, the lender can foreclose on the loan.

Foreclosing an overdue loan

If a loan is not repaid in total and on time, the loan becomes overdue, and the lender has the option to foreclose on the loan. Only overdue loans can be foreclosed. To foreclose a loan, the lender clicks on “Foreclose loan,” which triggers a transaction to transfer the NFT collateral out of the escrow smart contract and into the lender’s wallet. The lender’s promissory note is burned, and the borrower gets to keep the loan amount.

Get started >