How can we help?

Got questions? We got answers.

Getting started

In this section, we address the most common general questions regarding the NFTfi protocol.

NFTfi is the leading liquidity protocol for NFTs.

We allow NFT owners to use the assets (NFTs) they own to access the liquidity they need by receiving secured wETH, DAI, and USDC loans from liquidity providers, peer-to-peer, in a completely trustless manner.

NFT liquidity providers use NFTfi to earn attractive yields or — in the case of loan defaults — to have a chance at obtaining NFTs at a steep discount to their market value.

NFTfi's vision is to build a fully decentralized, permissionless, user-owner public utility, supporting the seamless financialization of NFT based economies through innovative mechanisms and highly user-friendly applications.

NFTfi currently requires the MetaMask digital wallet to connect. You can find and install it here. Then, navigate to nftfi.com and click on any tab and you will be prompted to connect your wallet. You can then navigate to the ‘Account’ tab on the top right where you can edit your account information. If you add an email address to your account, you will be able to receive email notifications.

Your NFTfi account corresponds to the connected MetaMask wallet Ethereum account. To switch, simply switch accounts in Metamask and refresh the page.

We encourage all users to list their Discord ID in their Account profile. We have a bustling community on our Discord server and that is usually where Borrowers and Lenders can find each other, discuss terms, ask further questions, get tips, ask for help in valuations or take part in NFT project/collateral discussions.

The ability to access liquidity against their NFTs without selling the asset gives unprecedented financial flexibility to NFT holders, especially if they have a large percentage of their portfolio locked up in these illiquid assets.

A few examples of what the liquidity obtained via NFTfi can be used for include:

- Serving immediate liquidity needs (e.g. covering margin positions)

- Taking advantage of short-term investment opportunities (e.g. high-yield liquidity mining or NFT flips)

- Taking advantage of long-term investment opportunities (e.g. buying real estate; long-term loans is now supported in NFTfi V2)

- Delaying a planned sale of an NFT for more opportune market conditions

- Delaying a planned sale of an NFT to defer potential capital gains tax

- Financing ‘real life’ needs without having to sell valuable assets

Liquidity providers use their idle capital to earn attractive yield and, in case of Borrower defaults, they have a chance at obtaining NFTs at a steep discount compared to market prices. Strategies vary among liquidity providers.

NFTfi liquidity providers are typically collectors themselves and possess a deep understanding and appreciation of the NFT markets, or a specialized niche within them. Recently, more professionally operating and highly analytical individual and organizational liquidity providers (e.g. lending DAOs) have emerged.

NFTfi is a peer-to-peer platform connecting NFT holders and liquidity providers directly via permissionless smart contract infrastructure. The NFTfi team at no point has access to any asset or is involved in any way in the negotiation of terms between Lenders and Borrowers. Since NFTfi’s first loan in May 2020, we have done over $400m in loan volume spread over more than 40,000 loans, and no borrower has ever had an asset stolen.

The NFTfi V2 smart contract system has been double-audited by two industry-leading firms (Chainsecurity, Halborn).

Here are all Halborn security audit reports:

There are no fees for borrowers and lenders on NFTfi.

Yes, to simplify your loan analysis or tax reporting, you can download loan data in a CSV file: Navigate to your Account and click the Loans tab. Click the “Export in CSV” button, and you will retrieve your loan data.

NFTfi presently supports Wrapped Ethereum (wETH), USD Coin (USDC), and Dai (DAI). You can wrap regular ETH into wETH on Uniswap or many other venues.

NFTfi currently only supports the Ethereum blockchain. That being said, we have an ambitious multi-chain strategy.

Yes, V2 of the NFTfi protocol supports EIP-1271, a standard way for contracts to verify if a provided signature is valid when an account is a smart contract. Our smart contracts and SDK support Gnosis Safe multi-sig, but the dApp is not yet supported.

We recommend you use desktop devices and the Google Chrome browser for the best experience.

P2P (peer-to-peer) and P2Pool (peer-to-pool) are fundamentally different approaches to NFT lending. The advantages of NFTfi are: 1) borrowers get higher LTVs on average (driven mainly by lender competition and diversity; 2) no auto-liquidations hence borrowers always have the option of paying back their loans until loan maturity; they can't be liquidated half-way through as can happen on a P2Pool protocol (a P2P protocol such as NFTfi does not take any protocol risk and does not need to manage liquidity, hence does not need a liquidation mechanism).

Yes, we have a full-featured SDK, enabling developers to easily access our full-feature API and build on top of NFTfi (for instance, lending bots). You can find the SDK in our public repo. It is currently in closed beta, which means you have to request an API key to start using it via this Google form. If you have questions or want to connect to other developers building on NFTfi, join our Discord and go to the #dev-zone channel.

Yes! We have a thriving community of NFTfi Ambassadors, who are active community members that support NFTfi (and soon the NFTfi DAO) in various ways such as: community moderation, outreach and education, content creation, and technical support. They enjoy exclusive perks and play a major role connecting NFTfi to its current and future users.

Check out the Ambassador page for more info and the application form.

Listing is the process of approving specific NFT collections for use as collateral on the NFTfi platform. Users can only borrow and lend against collections that have been listed.

The NFTfi team aims to approve new collections based on a few quantitative and qualitative criteria. We plan to hand over listing decision-making to the NFTfi community sometime during 2023. For now, users can suggest new NFT collections via the following process:

1) Check if the collection matches our current general listing criteria (more or less).

- Floor price > 0.5 ETH

- Historical trading volume > 500 ETH

- Sales in the past 4 weeks > 50

- ERC-721 standard

2) Post your request in this channel and excite at least 10 people from the project's community to support your request with an emoji.

3) Once your request has at least 10 emojis, fill out the listing Google form, which will be reviewed by the team (we list every 4 weeks, with some exceptions).

Please note that we typically don't have the capacity to discuss the status of listing requests. If you follow the above process, you can trust it will be reviewed, and if it meets the criteria (incl. other security checks), it will be listed on the platform.

These are the steps that will need to be followed in order to request projects be listed:

- You need to fill in the listing form. This will automatically add your suggestion to the list that the NFTfi team checks on a weekly basis. If you want to speed up the process, convince a large group of other users requesting the respective listing via the listing form as well :).

- All projects will be added to our watch list, where we track projects to see when they achieve the necessary criteria.

Borrowing

This section addresses the most common questions regarding borrowing activities on NFTfi.

If you own an NFT from a listed collection, you can now list it as collateral on NFTfi. Click the ‘Get a loan’ tab and find the asset you would like to list as collateral. If you have a specific loan amount, duration, and interest rate in mind that you’re looking for, you can specify those desired terms to guide potential Lenders on their offers.

Once listed, your asset will appear in the collateral section, and lenders can make offers against it. A loan would only get executed when you choose to accept a certain lender’s offer. Loan offers automatically expire after 7 days if not accepted and only remain valid as long as the lender’s wallet is sufficiently funded.

Once you accept a loan, your NFT is transferred to the NFTfi escrow smart contract. The smart contract securely holds the NFT until it’s reclaimed by you upon repaying the loan or claimed by the lender in case of failure to repay in time (loan default). Until such time, the technical owner of the NFT is the escrow smart contract, and you will not be able to use the NFT in any way while it is in escrow. We are working on implementing a rights management system that will allow you to use your NFT for specific cases while in escrow!

You can view your current and your past loans under ‘Borrow/Loans’.

We highly recommend you check our borrowing guide before taking out your first loan.

Here are a few important pointers regarding repayments:

- You can repay the loan at any time before it is due, but you still pay the full interest amount.

- You can only repay the loan from the wallet you started the loan with, unless you mint an obligation receipt and thereby transfer your borrower rights to another wallet or someone else (obligation receipts are not yet supported by the dApp - read more here).

- You can only repay the loan in one single repayment, i.e. not partially

- You can request loan renegotiation at any time before the loan is foreclosed by the lender. Read more here.

- Once you default on a loan, it cannot be repaid any longer, even if the Lender has not foreclosed yet.

- Once a Lender has foreclosed the NFT of a defaulted loan, they become the sole owner and the loan can no longer be repaid through the NFTfi platform

- Make sure you have both ETH and wETH in your wallet! You’ll use wETH to repay the loan, but you still want enough ETH to be able to pay for gas.

Once you have repaid the loan in full, including interest, the NFT will be released from the escrow smart contract and returned directly to your wallet. However, if you fail to make payment in full before the due date, the lender will be able to ‘foreclose’ the loan and the NFT will be moved from escrow to the lender's wallet.

Please find below theinstructions for Google Chrome. (if you are using a different browser, please ask the NFTfi community in #general to help you out):

- Navigate to https://app.nftfi.com/ and open the asset page of the (escrowed) loan collateral.

- Open the Chrome browser dev tools (press F12), navigate to the “Network” tab, click “Fetch/XHR” and then refresh the page (press F5).

- You find the “loanId” value in the JSON response of the “/latest” network call.

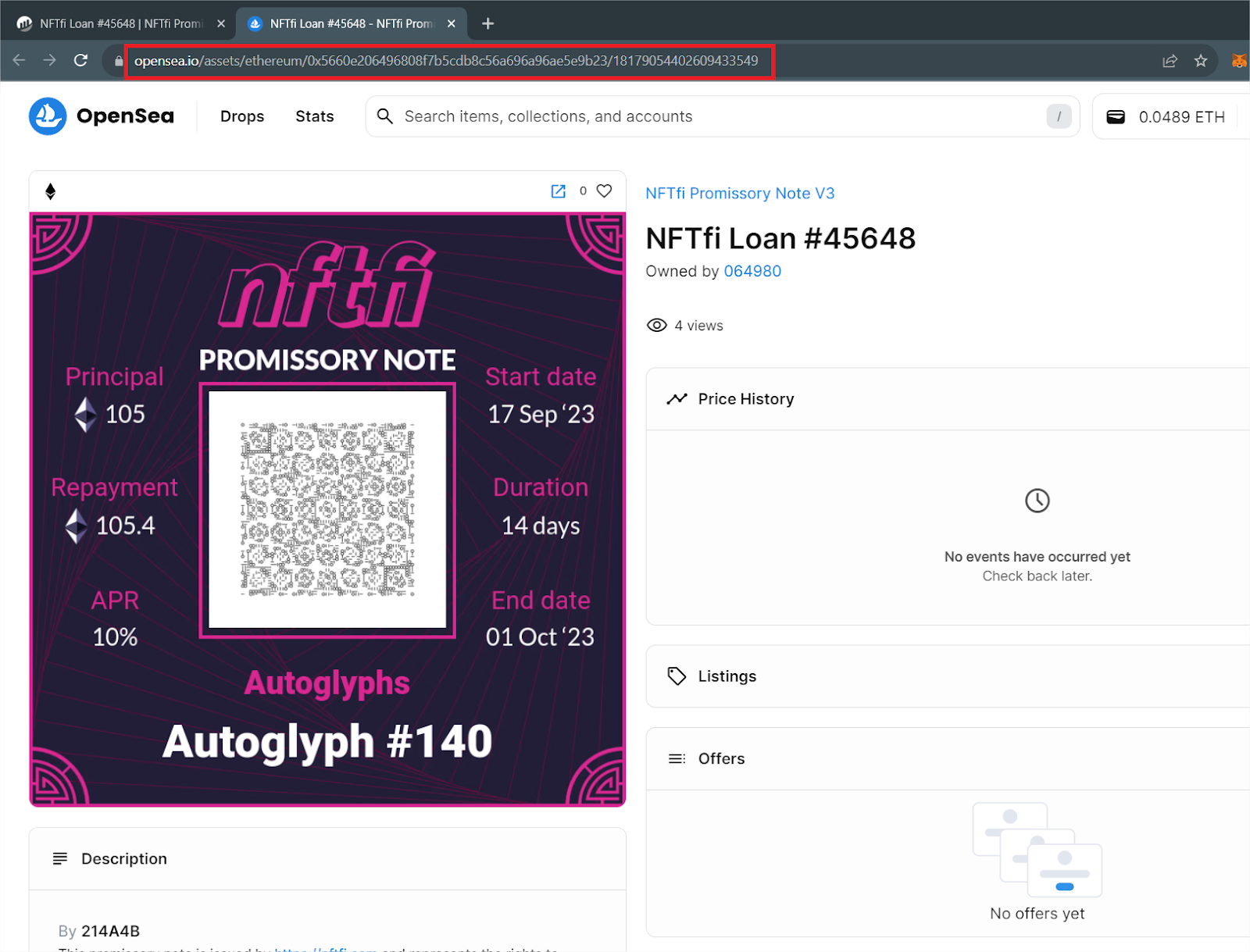

If you need to find the OpenSea URL of the Promissory Note of your loan, please follow these steps:

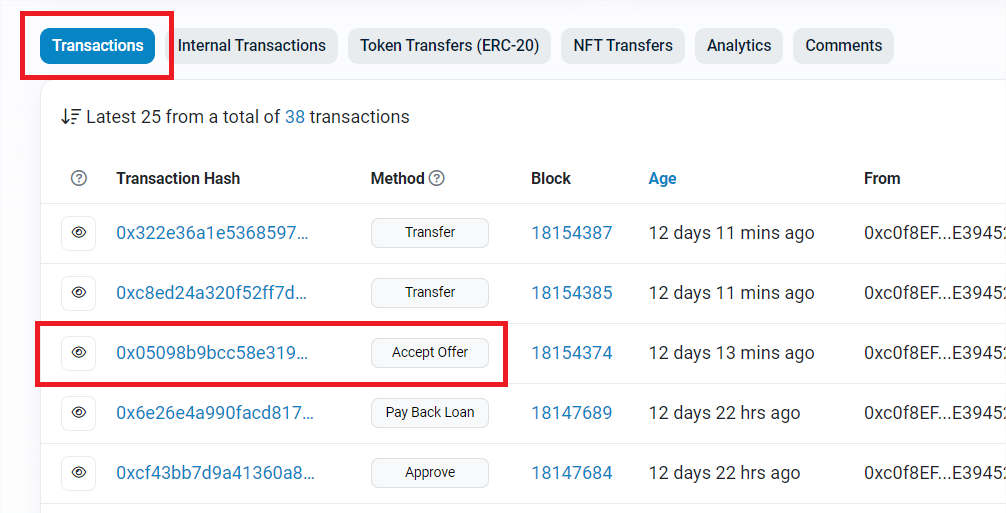

- Open etherscan.io and search for your wallet address (which you used to borrow on NFTfi).

- In the “Transactions” tab, look for the “Accept Offer” transaction of your loan. Click the transaction hash of this loan transaction.

- In the “ERC-721 Tokens Transferred” section, click on the Promissory Note thumbnail to see the details of your loan transaction.

- Now click “View on OpenSea”.

- Once on the OpenSea page, you can see the URL of the Promissory Note for your loan.

In the very unlikely event that the website is down, you can repay your loan via https://repay.nftfi.com/.

If, for some reason, the URL above is not accessible, you can repay your loan via Etherscan.

- Click on this link if your loan is on the V2 contract (fixed loan on an individual NFT) and your loan was made before October 21, 2022: https://etherscan.io/address/0xf896527c49b44aAb3Cf22aE356Fa3AF8E331F280#writeContract

- Click on this link if your loan is on the V2 (fixed loan on an individual NFT) contract and your loan was made between October 21, 2022 and October 12, 2023: https://etherscan.io/address/0x8252Df1d8b29057d1Afe3062bf5a64D503152BC8#writeContract

- Click on this link if your loan is on the V2.3 (fixed loan on an individual NFT) contract and your loan was made after October 12, 2023: https://etherscan.io/address/0xd0a40eB7FD94eE97102BA8e9342243A2b2E22207#writeContract

---

- Click on this link if your loan is on the V1 contract (fixed loan on an individual NFT made before April 3, 2022): https://etherscan.io/address/0x88341d1a8f672d2780c8dc725902aae72f143b0c#writeContract

---

- Click on this link if your loan is on the Standing Collection Offer V2 contract (collection offer loan) and your loan was made before October 12, 2023: https://etherscan.io/address/0xe52cec0e90115abeb3304baa36bc2655731f7934#writeContract

- Click on this link if your loan is on the Standing Collection Offer V2.3 contract (collection offer loan) and your loan was made after October 12, 2023: https://etherscan.io/address/0xD0C6e59B50C32530C627107F50Acc71958C4341F#writeContract

---

- Click on this link if your loan is on the Bundles contract (bundle loan) and your loan was made before October 12, 2023: https://etherscan.io/address/0x8252Df1d8b29057d1Afe3062bf5a64D503152BC8#writeContract

- Click on this link if your loan is on the Bundles contract (bundle loan) and your loan was made after October 12, 2023: https://etherscan.io/address/0xd0a40eB7FD94eE97102BA8e9342243A2b2E22207#writeContract

---

- Connect your wallet and put the loan ID in the ‘payBackLoan’ field.

- You can find the loan ID on Etherscan. When you click on the transaction of your loan, you can see the loan ID of your NFTfi Promissory Note, or you can check it out on OpenSea, where the image of the Promissory Note displays the ID as well.

- The contract will know what you owe, so the next step will be a pop-up from MetaMask, which will ask you to confirm the transaction. This will then take money from your wallet and pay back the loan for you.

Yes, loan renegotiation can be initiated both by the borrower and lender on any active loan that is not yet foreclosed by the lender. To read more about loan renegotiations and how they work, please read this blog post.

Yes, borrowers can extend the maturity of their loan with just a few clicks and without having to repay the previous loan in full.

At any point, a borrower can accept new offers from lenders to extend their active loan or just seize an opportunity for better terms. To extend a loan, borrowers only need to pay (or in the case of a surplus, receive) the difference between the new principal and the old principal plus interest.

To learn more about loan extension and refinancing, please read this blog post.

Refinancing is open to all lenders, including the original lender, while renegotiating is limited to the original lender.

Yes, you can do that with NFTfi bundles. NFTfi bundles allow borrowers to collateralize multiple NFTs more conveniently and renew or roll over multi-collateral loans quicker and cheaper. Bundles also provide more options when negotiating higher-value loans with lenders. At launch, you can bundle up to 236 NFTs into a single bundle. If you want to learn more about NFTfi bundles, please read this blog post.

NFTfi is a peer-to-peer platform and the liquidity terms are agreed upon exclusively and directly between lenders and borrowers. Several factors (as perceived by the two counterparties) typically affect loan terms, including but not limited to:

- Current market conditions

- Quality and longevity of the respective collection

- Rarity of the specific NFT

Here are a few resources that might help you estimate the value of your NFT, and infer sensible loan term ranges:

- Marketplaces such as OpenSea, and websites like Rarity Tools

- Browsing past loans given against similar assets on NFTfi

- Checking collection pages or individual assets to see the average APR and loan principal over the last 30 days

- #loan-requests NFTfi Discord channel

- The #rockefeller Discord channel (accessible for active Lenders only)

Borrowers will pay gas fees for the operations listed below:

- Approving NFTfi to interact with your NFT (once per NFT collection, except for CryptoKitties (CK), where it must be done for each individual cat as CK isn’t fully ERC-721 compliant).

- Approving the NFTfi smart contract to spend (repay) wETH, USDC, or DAI for the first time (this is a one-time transaction)

- Starting a loan

- Repaying a loan

When you begin a loan, your NFT is moved into the NFTfi escrow smart contract. Therefore the de facto owner of the NFT during the duration of the loan is the smart contract. No one (also not the NFTfi team) can access the NFT during that time.

Whether you are able to receive an airdrop during an active loan depends on the airdrop/claim mechanism. In some scenarios the answer is yes, and in others unfortunately no. Here are a few scenarios for your reference (please note, this list is not exhaustive):

- If the airdrop is distributed based on a snapshot that was taken before your loan began (at a time when the NFT was still in your wallet), then your wallet will likely still receive it.

- In yield-bearing NFTs, where the claim/value is accrued "in" the NFT or "connected" to the NFT, the claim will be waiting for you once you have possession of the NFT again.

- If the airdrop occurs in real-time or based on a snapshot that was taken after the loan began, then the escrow smart contract will receive the airdrop, in which case it cannot be retrieved later unfortunately. Although the escrow smart contract includes technical provisions for manual retrieval of airdrops, we are currently unable to provide this service. We are are working on a holistic solution for airdrops via escrowless lending technology.

Yes! If you take out a loan against BAYC / MAYC / BAKC NFTs (or NFT bundles) while they are committed to either the BAYC, MAYC or paired (BAKC) staking pool, they keep accruing $APE rewards. While the NFTs are in the NFTfi escrow smart contract during the loan, you cannot technically uncommit them from the BAYC or MAYC pools (you need to be in possession of the NFT for that). In the case of the paired pool, you technically could uncommit them during a loan if you’re in possession of the paired BAKC, but since the BAKC only gets sent the accrued rewards, and the BAYC/MAYC gets sent all the staked $APE, your staked $APE would be forever lost in the escrow contract (so don’t do it!!). Upon loan repayment, the NFTs transfer back from the escrow smart contract into your wallet, and you are again able to uncommit the NFTs and claim all associated staked $APE and accrued rewards.

Important: If you fail to repay your loan in time for whatever reason, you lose your collateral BAYC / MAYC / BAKC to the lender, and with it, you also lose access to all associated staked $APE and accrued rewards. We therefore highly recommend to uncommit your BAYC / MAYC / BAKC before taking a loan on NFTfi (except, of course, you would be consciously borrowing against a committed asset incl. associated $APE to achieve better loan terms). Please note that the above statement is based on the ApeCoin staking specification available at http://apestake.io/ as of January 6th, 2023. Please inform yourself of any changes in the meantime.

Approvals happen at the NFT contract level. This means that once you have approved or granted NFTfi access to manage an asset, the NFTfi smart contract will have access to all of your assets minted on that contract. The NFTfi smart contract will not have access to manage NFTs minted on other contracts though. For example, if you approve a BAYC and you have multiple apes and also a CryptoPunk, our smart contract will have the ability to manage all of your apes but not your CryptoPunk. Remember - the only way for the contract to move the asset is for you to start a loan on the asset, so this can not happen automatically.

Yes. Borrower rights are tied to an “obligation receipt” NFT, which can be optionally minted and is then sent to the borrower’s wallet. If you move the obligation receipt to another wallet address, you are effectively transferring the borrower’s rights (to repay the loan and receive the collateral back) to that address. To learn more about obligation receipts, read this article.

Lending

This section addresses the most common questions related to lending activities on NFTfi.

Proceed to the ‘Lend’ tab. As a Lender, you can browse all available NFT collateral and make (gas-free) loan offers by proposing a loan amount, duration and interest rate. Once you submit an offer, it will show on the asset's listing page. You can modify or cancel an offer any time before it is accepted. If your loan offer is not accepted it will expire automatically after 7 days. You can currently only make 1 offer on any given NFT at a time.

Once a Borrower accepts your loan offer, the corresponding funds will be automatically deducted from your account. From hereon, as a Lender, you cannot cancel the loan before it expires, it could be repaid early by the Borrower, however.

If a loan is not paid back by the Borrower in time, the asset becomes available for foreclosure by the Lender. If you click on ‘Foreclose’ the NFT will be transferred to your wallet.

Before getting started, we highly recommend you read our lending guide.

You might find this blog article helpful in formulating your personal NFTfi lending strategy: https://nftfi.com/blog/3-lending-strategies-on-nftfi/

Lenders pay gas fees for the operations listed below:

- Approving the NFTfi smart contract to spend wETH, USDC or DAI for the first time (this is a one-time transaction)

- Foreclose an NFT in case of a borrower default

- Canceling an offer on-chain (due to security reasons)

Lenders can use private offers to make a loan offer to potential borrowers for assets that are not publicly listed. Private offers can also be used by friends or parties who know each other but would like to facilitate a loan without listing an asset on NFTfi. To learn more about private offers, please read this blog post.

Lenders can send refinancing offers to active borrowers with assets held in escrow. Lenders can browse existing loans and send refinancing offers to borrowers through the new Loans page.

To learn more about refinancing offers, please read this blog post.

Standing Collection Offers or SCOs allow lenders to submit loan offers that are valid for any currently listed NFT (or that may be listed in the future) from a particular NFT collection. Before, lenders had to place individual loan offers for each individual NFT asset in a collection - now, they can target entire collections (any asset within the collection) with just one offer! There are several risks associated with SCOs, and we advise that you carefully read this blog post before placing any Standing Collection Offers!

The Rockefeller role (red-labeled names) is a special designation claimable by anyone who is currently lending on NFTfi and has an active loan (i.e. holds a Promissory Note). Rockefellers receive special privileges in recognition for promoting liquidity on NFTfi, including access to a lenders-only channel called “🎩-rockefellers” (link)

If you have an active loan — please head over to our dedicate channel #collabland-join (link) and follow the instructions there: you’ll be prompted to connect your wallet. If the system indeed detects an NFTfi Promissory Note (indicating an active loan) it will grant you the Rockefeller role. Only active lenders can claim the role. If you lost the role due to not having any active loans, you can later reclaim it when you do, by repeating the process explained above.

Yes. Lender rights are tied to a “Promissory Note” NFT. The Promissory Note is minted with every new loan and sent to the lender's wallet. If you move the Promissory Note to another wallet address, you are effectively transferring lenders' rights (to receive the loan repayment or loan collateral in case of default) to that address. To learn more about Promissory Notes, read this article.

If your loan offer has an expiry duration of less than 48hrs, it can be revoked in two ways:

- Cancel: offer gets invalidated on the smart contract. Requires a blockchain transaction and costs gas fees. This is the option we recommend for maximum safety.

- Delete: offer gets deleted from the off-chain order book immediately, but remains valid on-chain until it expires. Less secure and not recommended, but avoids gas fees.

If your loan offer has an expiry duration of more than 48hrs, it can only be canceled for security reasons.

NFTfi Rewards

NFTfi Rewards is our new loyalty program which aims to reward loyal users for using the NFTfi platform. Eligible users can earn virtual, non-transferable reward points (e.g., OG Points and Earn Points) for activities such as lending and borrowing.

While all users may technically be able to view and accumulate rewards points within their accounts, the following groups of persons are not eligible to participate in NFTfi Rewards and will not be able to redeem rewards points: U.S. residents, other U.S. persons, UK residents, other UK persons, and residents of Switzerland, Russia, Cuba, Iran, North Korea, Syria, specific regions within Ukraine (Crimea, Donetsk, and Luhansk), Venezuela, or other countries or regions subject to sanctions, embargoes, or other restrictions imposed by the United States government, the United Kingdom, or other applicable international authorities. Additionally, persons appearing on the U.S. Treasury’s Office of Foreign Assets Control (OFAC) Specifically Designated Nationals and Blocked Persons List or the UK Sanctions List, maintained by His Majesty’s Treasury’s Office of Financial Sanctions Implementation (OFSI), are also not eligible to participate in NFTfi Rewards. The eligibility of users is at NFTfi's sole discretion, may take into account regulatory circumstances per jurisdiction, and may change over time without notice. We encourage users to consult with their own legal advisors or tax professionals to understand their eligibility for the NFTfi Rewards program and any potential legal or tax implications that may arise from participating in the program. It is the user's sole responsibility to ensure compliance with applicable laws and regulations in their respective jurisdictions.

Each phase of NFTfi Rewards has date cut-offs determining which loans are eligible to receive reward points. OG Points could be secured by anyone who had repaid loans before the snapshot date, by starting any loan after the snapshot and before June 12th 2023 (3pm CET). Eligible loans in Earn Season 1 include all those repaid after the snapshot date and before the end of Earn Season 1 (November 28th, 2023). Eligible loans in Earn Season 2 include all those repaid before the end of Earn Season 2 (March 26th, 2024)

In addition to the above, eligible loans exclude any loans we deem fraudulent or harmful to the NFTfi Rewards program. We have partnered with a leading analytics firm to detect and exclude, on an ongoing basis, loan patterns which we - at our sole discretion - deem inorganic and harmful to the NFTfi Rewards program (non-eligible lending behavior).

Yes, to put it simply, refinancing means paying off your existing loan and then starting a new one. When you refinance, it's like beginning a new loan, which means you'll generate Earn Points and your loan streak will continue.

Earn Seasons are part of our loyalty program NFTfi Rewards, and allow eligible borrowers and lenders to earn exclusive, non-transferable Earn Points. They have been designed with a clear goal: to reward NFT lovers for borrower-friendly loan terms and a responsible lending market on NFTfi.

Earn Season 1 concluded on November 28th, 2023, immediately followed by Earn Season 2. Earn Season 2 concluded on March 26h, 2024, immediately followed by Earn Season 3, which will run for 3 months. The conclusion of Season 2 marks the start of a journey to decentralize the NFTfi protocol.

Loans initiated during one season but reaching into the next season (including renegotiated or refinanced loans) will earn rewards upon repayment in the new season.

Each Earn Season has a leaderboard and leaderboard multiplier tiers for secured points (=repaid loans). Leaderboard ranks and multiplier tiers are frozen at the end of each season.

OG Points are one type of NFTfi Rewards loyalty points. They were allocated to (reserved for) all NFTfi borrowers and lenders who were part of a successfully repaid loan before the snapshot.

Earn Points are another type of NFTfi Rewards loyalty points. They are accrued during reward seasons by participating in lending activities on the NFTfi platform. The points for each successfully repaid loan are split evenly between the borrower and lender, at approximately a 50/50 ratio.

Both OG Points and Earn Points are non-transferable reward points.

Earn Points aim to incentivize borrower-friendly loan terms and a responsible lending market. Please refer to the announcement blog post for how Earn Points are calculated.

A loan streak on the NFTfi platform represents a series of consecutive calendar months during which a user has an active loan (defaults do not count), either as a borrower or a lender.

A streak continues as long as there is at least one active loan present each calendar month. Loan streaks focus on monthly continuity, not daily. This means that inactive days within a calendar month do not break a streak, only inactive calendar months do. A loan that is active as a result of renegotiation counts towards a loan streak. Loan streaks are further described using visuals in this tweet.

Loan streak multipliers are an additional reward for loyal users. A streak multiplier is a numerical factor amplifying Secured Points based on the length of your unbroken loan streak at the time of a Season’s ending.

Streak Multipliers become visible in the leaderboard at the end of each Season only. They are applied post leaderboard multipliers and do not impact leaderboard ranks, but are applied to users’ final, secured season balances.

Loan streak multipliers and respective streak durations are as follows:

3 months = 1.10x;

6 months = 1.20x;

9 months = 1.35x; and

12 months = 1.50x.

On the NFTfi.com user interface, which connects to the NFTfi protocol, reward points serve as a measure of a user's loyalty. The NFTfi Foundation, now overseeing the NFTfi protocol and its development, plans to hold events from time to time where users who meet specific criteria can redeem these points. For further details, check the NFTfi Foundation's website or their Twitter. Note that there are certain conditions for eligibility.

Please open a ticket in our Discord server (#private-ticket channel) or ask the community.